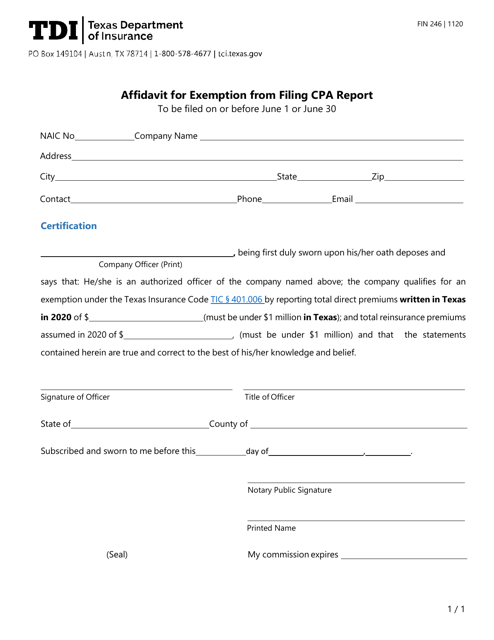

This version of the form is not currently in use and is provided for reference only. Download this version of

Form FIN246

for the current year.

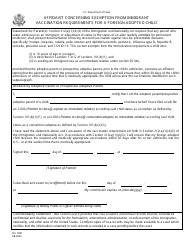

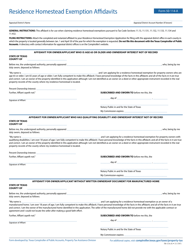

Form FIN246 Affidavit for Exemption From Filing CPA Report - Texas

What Is Form FIN246?

This is a legal form that was released by the Texas Department of Insurance - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FIN246?

A: Form FIN246 is an affidavit for exemption from filing a Certified Public Accountant (CPA) report in Texas.

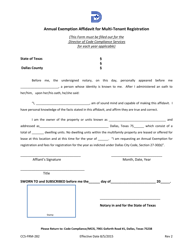

Q: When is Form FIN246 used?

A: Form FIN246 is used when an entity wants to claim an exemption from the requirement of filing a CPA report in Texas.

Q: What does the affidavit entail?

A: The affidavit requires the entity to provide specific details and information about its financial condition and compliance with relevant laws and regulations.

Q: Who is eligible to file Form FIN246?

A: Entities that meet certain criteria specified by Texas regulatory authorities may be eligible to file Form FIN246.

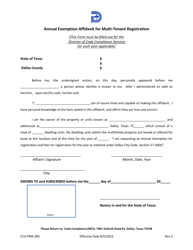

Q: Are there any filing fees associated with Form FIN246?

A: The filing fees, if any, associated with Form FIN246 may vary and should be confirmed with the relevant regulatory authority.

Q: What happens after filing Form FIN246?

A: After filing Form FIN246, the Texas regulatory authority will review the affidavit and determine whether the entity qualifies for exemption or if further action is required.

Q: Is it necessary to consult with a CPA or legal professional before filing Form FIN246?

A: It is recommended to consult with a CPA or legal professional to ensure compliance with all applicable laws and regulations before filing Form FIN246.

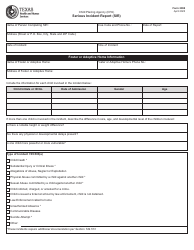

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Texas Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FIN246 by clicking the link below or browse more documents and templates provided by the Texas Department of Insurance.