This version of the form is not currently in use and is provided for reference only. Download this version of

Form IE (RV-F1406701)

for the current year.

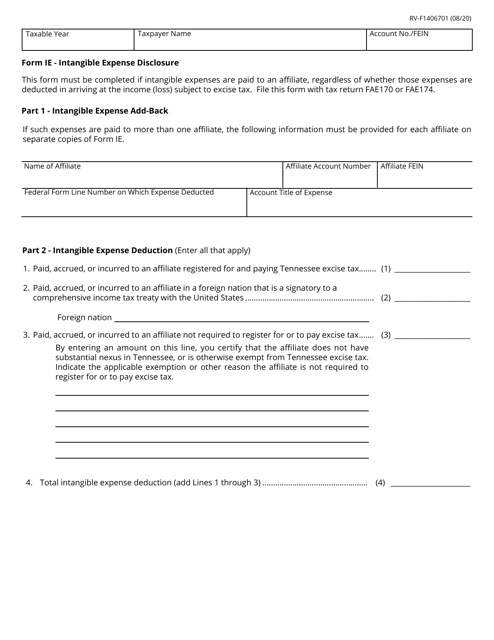

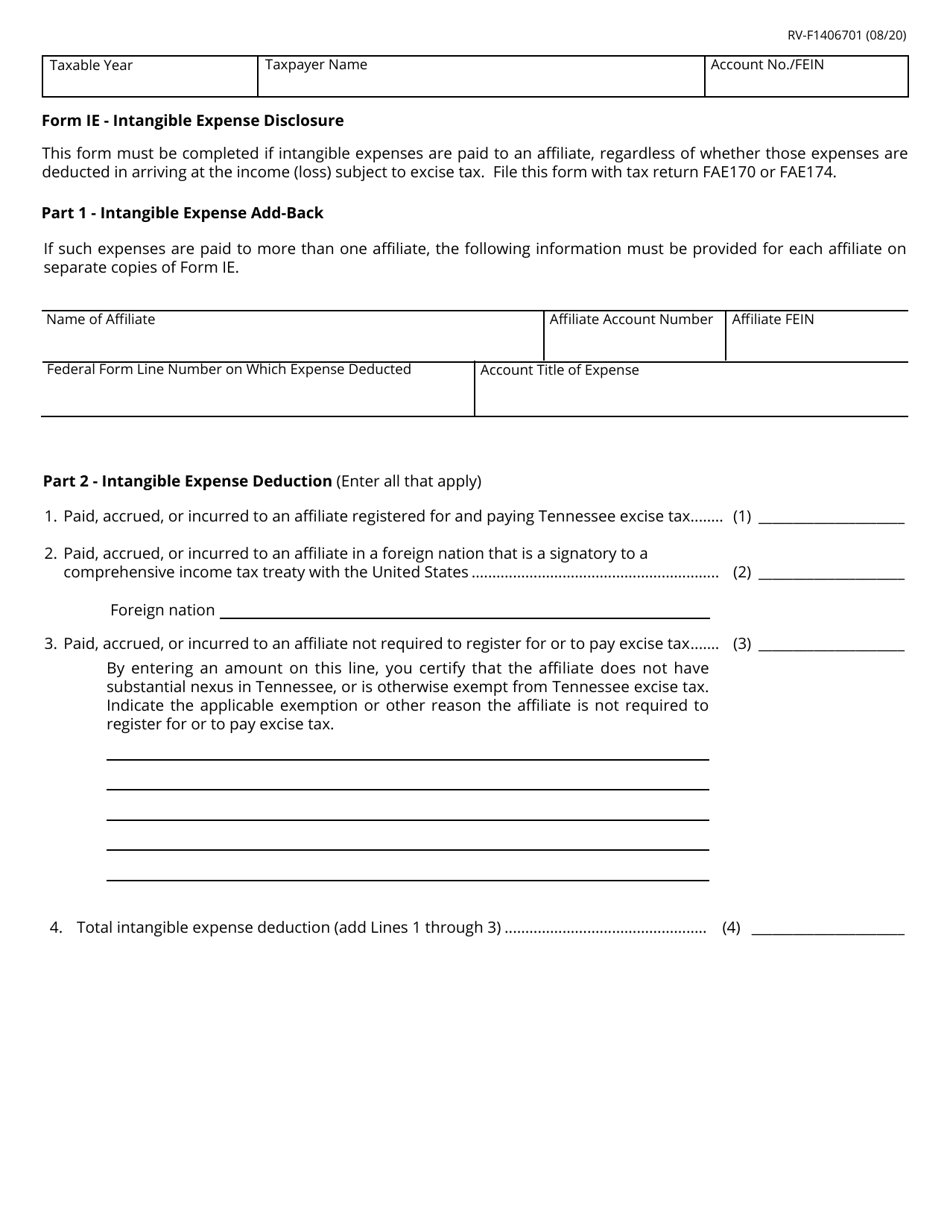

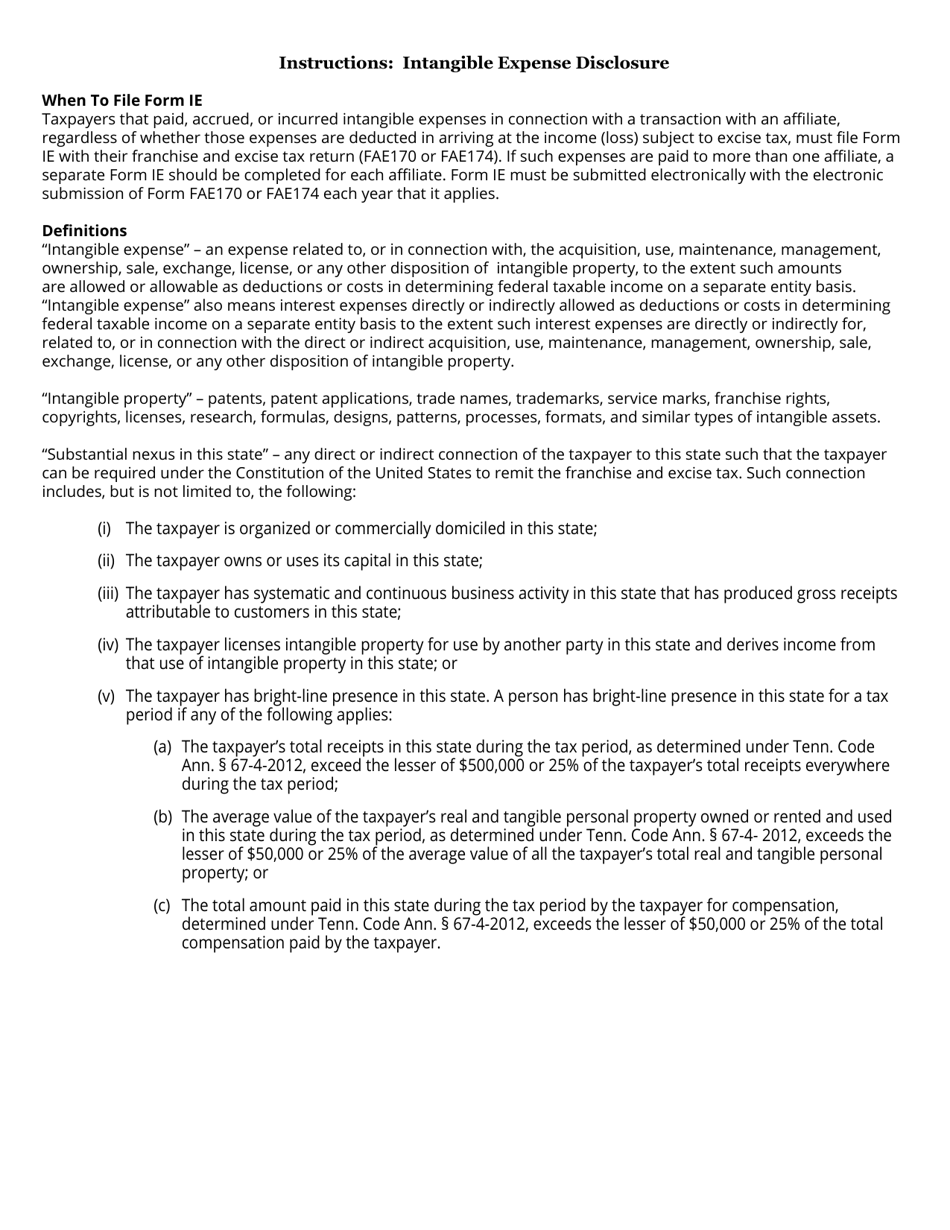

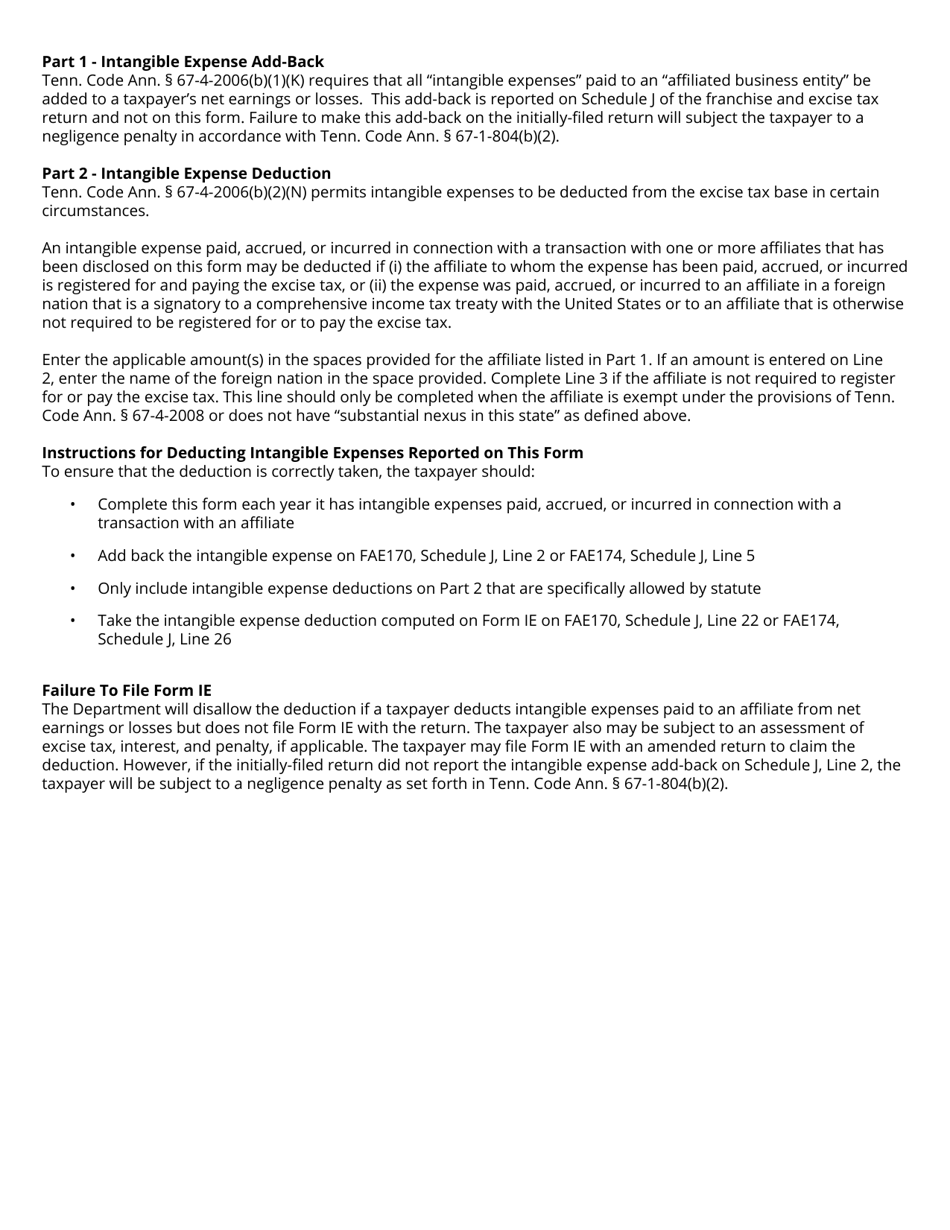

Form IE (RV-F1406701) Intangible Expense Disclosure - Tennessee

What Is Form IE (RV-F1406701)?

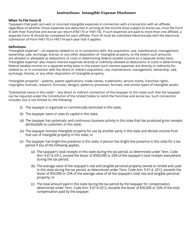

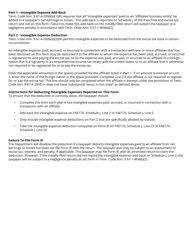

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IE (RV-F1406701)?

A: Form IE (RV-F1406701) is an Intangible Expense Disclosure form.

Q: What is the purpose of form IE (RV-F1406701)?

A: The purpose of form IE (RV-F1406701) is to disclose intangible expenses in the state of Tennessee.

Q: Who needs to file form IE (RV-F1406701)?

A: Businesses operating in Tennessee that have intangible expenses need to file form IE (RV-F1406701).

Q: When is form IE (RV-F1406701) due?

A: Form IE (RV-F1406701) is due by the 15th day of the fourth month following the close of the tax year.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IE (RV-F1406701) by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.