This version of the form is not currently in use and is provided for reference only. Download this version of

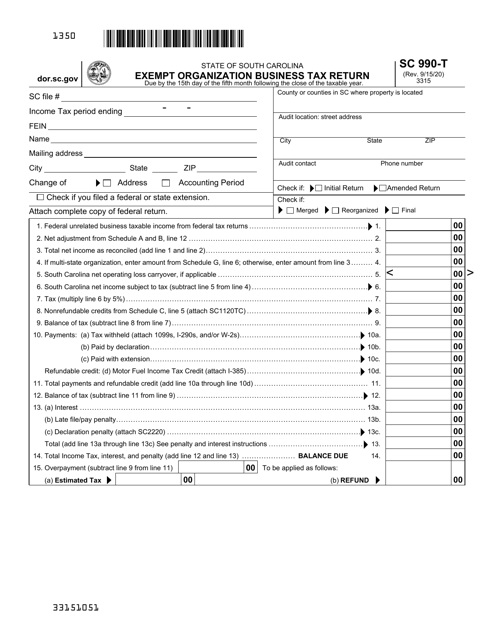

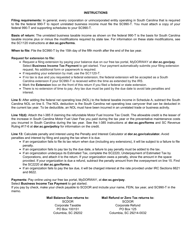

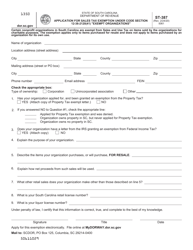

Form SC990-T

for the current year.

Form SC990-T Exempt Organization Business Tax Return - South Carolina

What Is Form SC990-T?

This is a legal form that was released by the South Carolina Department of Revenue - a government authority operating within South Carolina. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

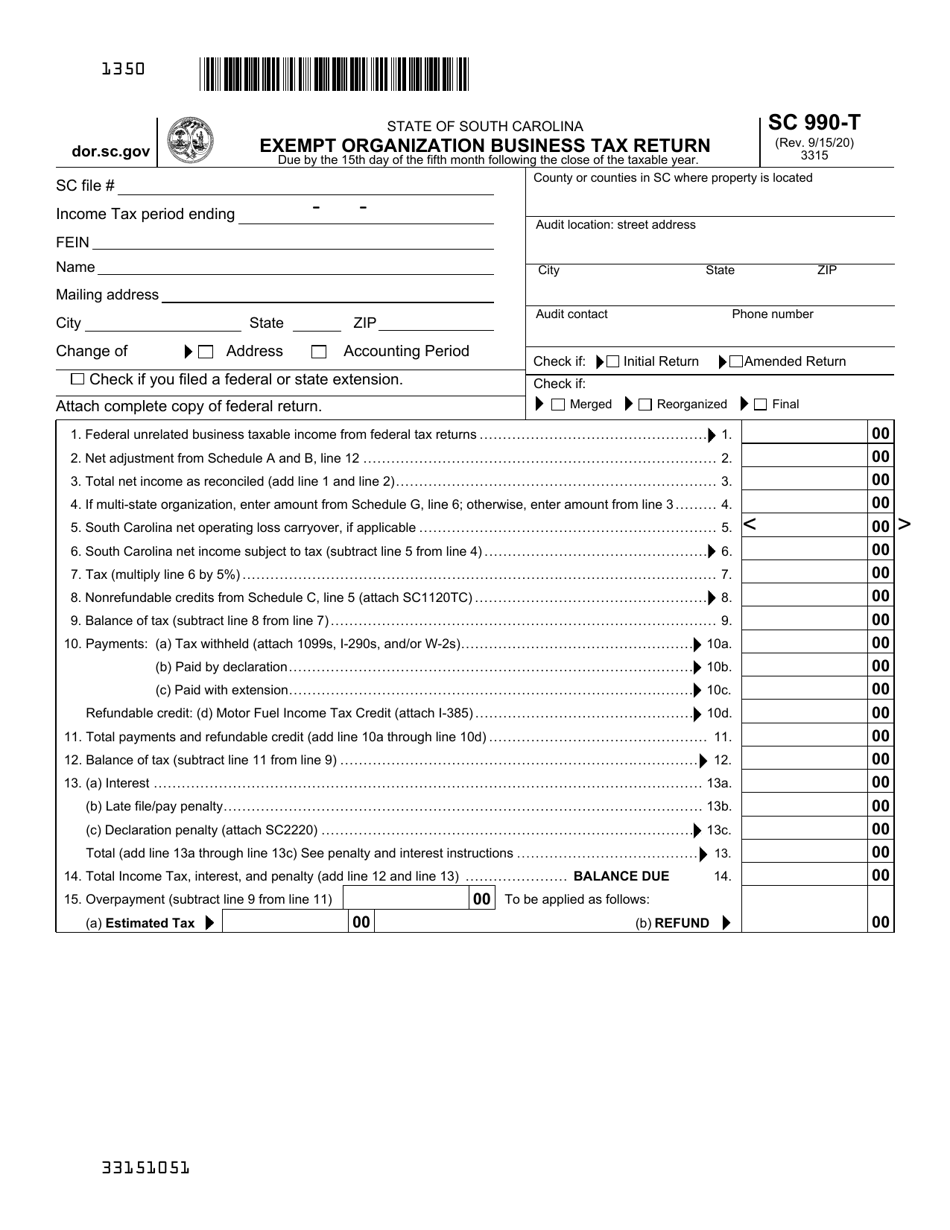

Q: What is Form SC990-T?

A: Form SC990-T is the Exempt OrganizationBusiness Tax Return for South Carolina.

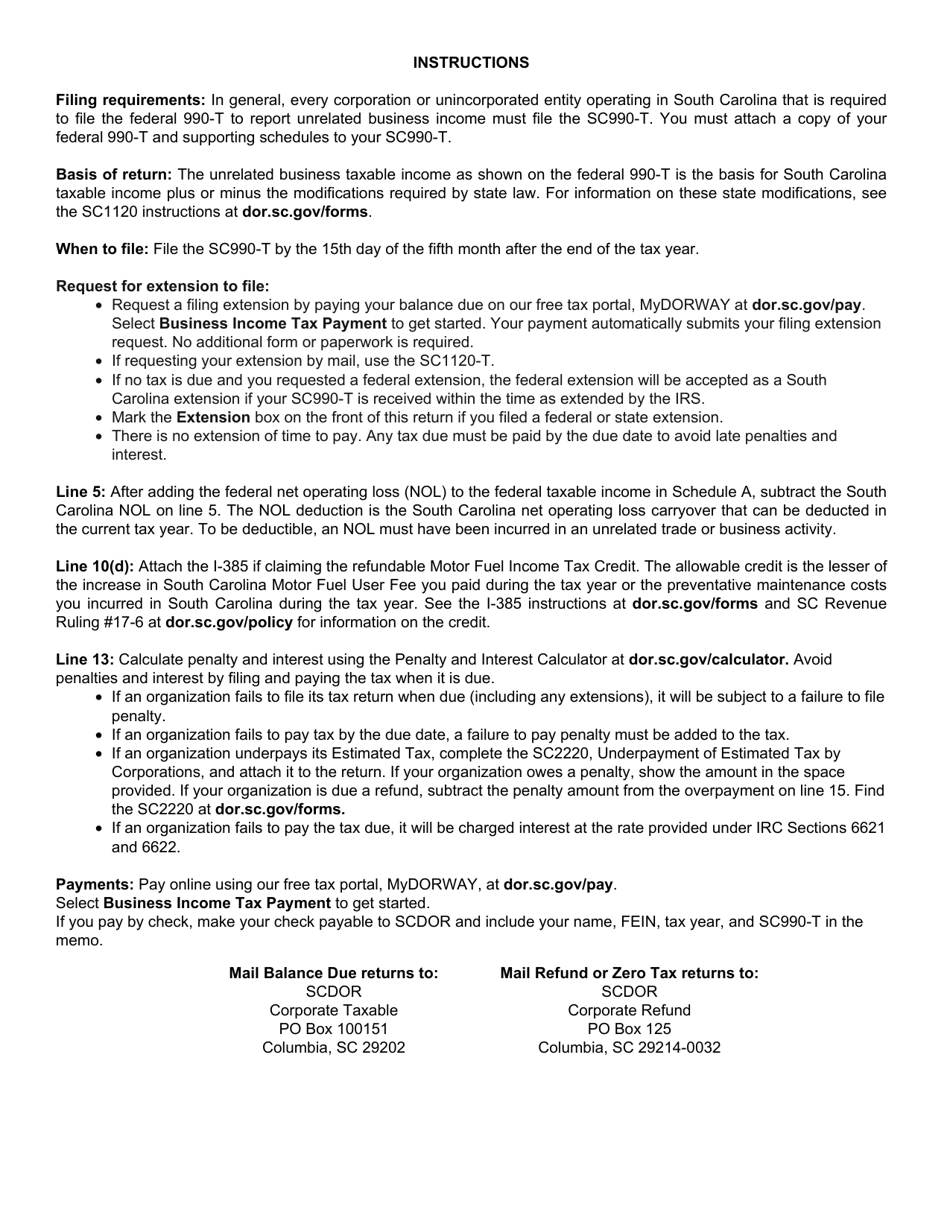

Q: Who needs to file Form SC990-T?

A: Exempt organizations in South Carolina that engage in unrelated business activities and have a taxable income of $100 or more must file Form SC990-T.

Q: What is considered unrelated business activity?

A: Unrelated business activity refers to income-generating activities that are not substantially related to the tax-exempt organization's purpose.

Q: What is the deadline for filing Form SC990-T?

A: Form SC990-T must be filed annually by the 15th day of the fifth month after the close of the organization's fiscal year.

Q: Are there any penalties for late filing?

A: Yes, late filing or failing to file Form SC990-T may result in penalties imposed by the South Carolina Department of Revenue.

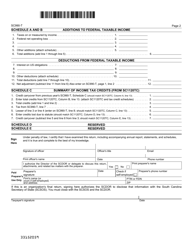

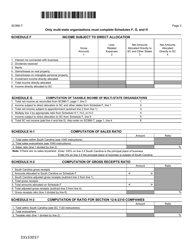

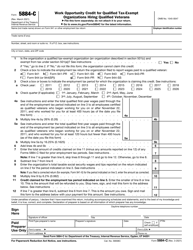

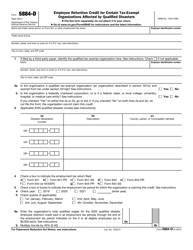

Q: Are there any additional forms or schedules that need to be filed with Form SC990-T?

A: Yes, depending on the organization's specific circumstances, additional schedules and forms may need to be filed along with Form SC990-T.

Q: Does Form SC990-T apply to both nonprofit and for-profit organizations?

A: No, Form SC990-T is specifically for tax-exempt organizations in South Carolina.

Q: Is Form SC990-T the same as the federal tax return for exempt organizations?

A: No, Form SC990-T is the South Carolina state-specific tax return for exempt organizations and is separate from the federal tax return.

Form Details:

- Released on September 15, 2020;

- The latest edition provided by the South Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SC990-T by clicking the link below or browse more documents and templates provided by the South Carolina Department of Revenue.