This version of the form is not currently in use and is provided for reference only. Download this version of

Form GAS-1301

for the current year.

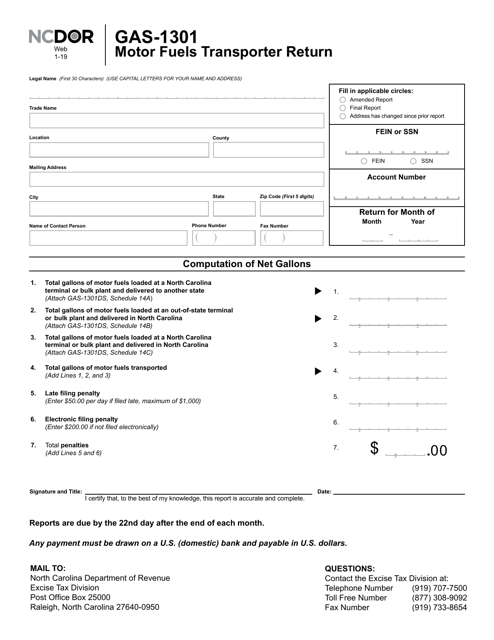

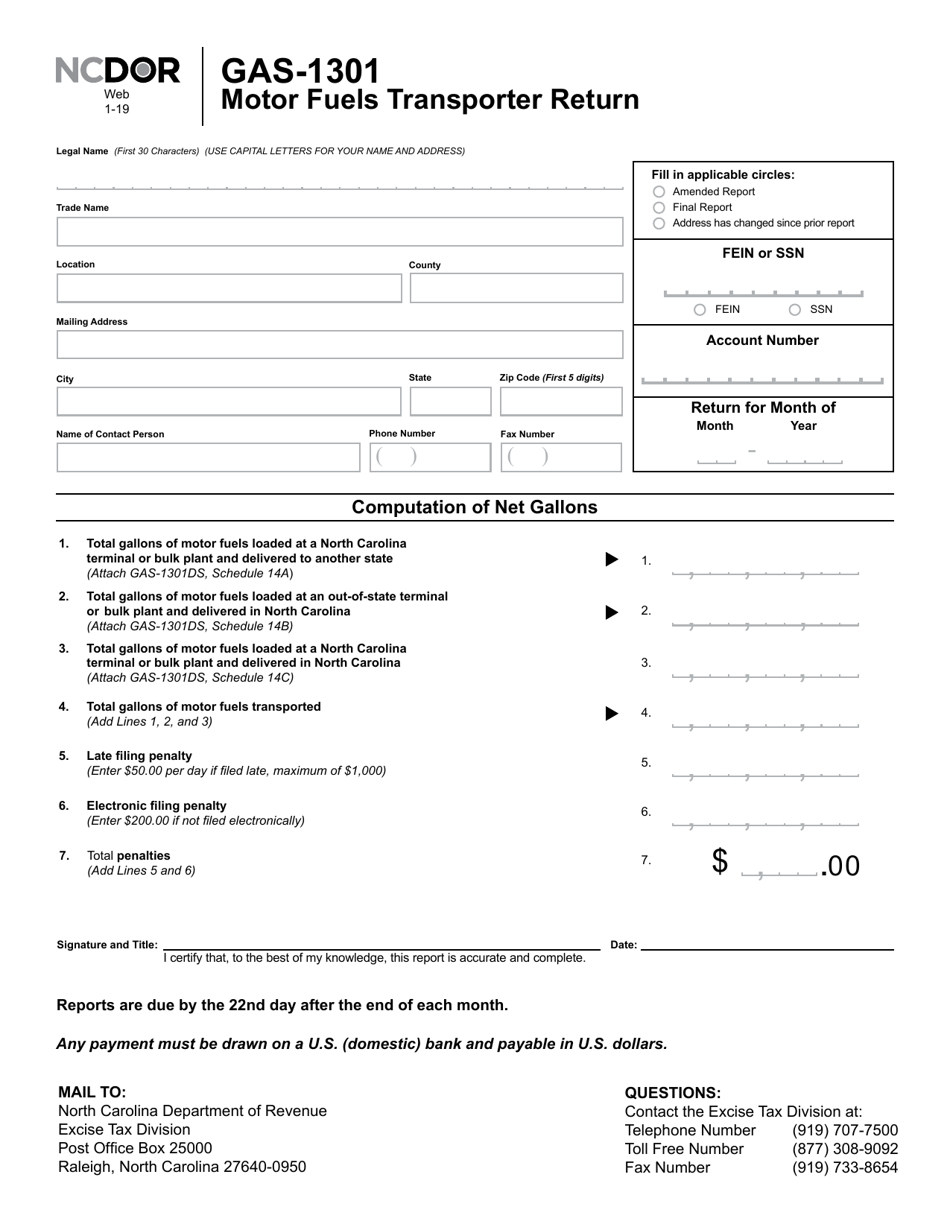

Form GAS-1301 Motor Fuels Transporter Return - North Carolina

What Is Form GAS-1301?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the GAS-1301 form?

A: The GAS-1301 form is the Motor Fuels Transporter Return form for North Carolina.

Q: Who needs to file the GAS-1301 form?

A: Motor fuel transporters in North Carolina need to file the GAS-1301 form.

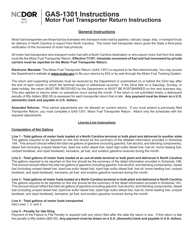

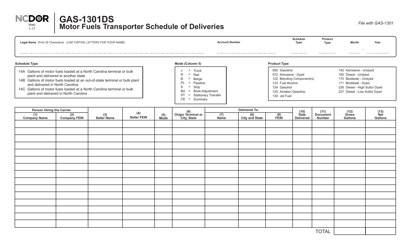

Q: What information is required on the GAS-1301 form?

A: The GAS-1301 form requires information such as the transporter's name, address, and EIN, details of fuel gallons transported, and any taxes due.

Q: When is the deadline for filing the GAS-1301 form?

A: The GAS-1301 form must be filed monthly, with the due date falling on the 25th day of the following month.

Q: Is there a penalty for late filing of the GAS-1301 form?

A: Yes, there may be penalties for late filing or non-compliance with the Motor Fuels Transporter laws in North Carolina.

Q: Are there any exemptions from filing the GAS-1301 form?

A: Certain motor fuel transporters may be eligible for exemptions from filing the GAS-1301 form. It is advisable to consult the North Carolina Department of Revenue for specific exemptions and requirements.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1301 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.