This version of the form is not currently in use and is provided for reference only. Download this version of

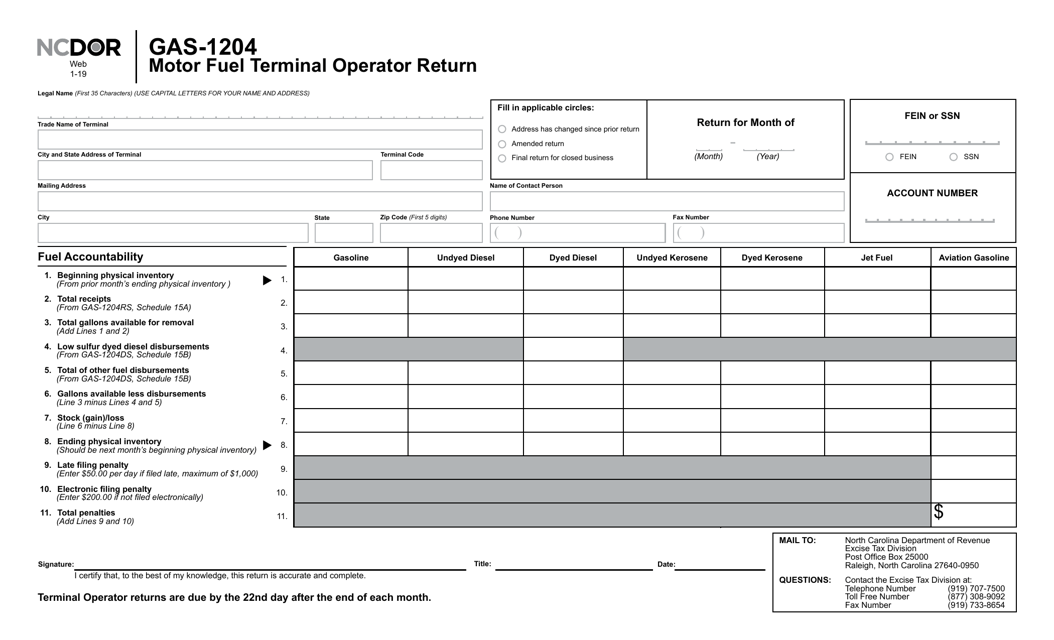

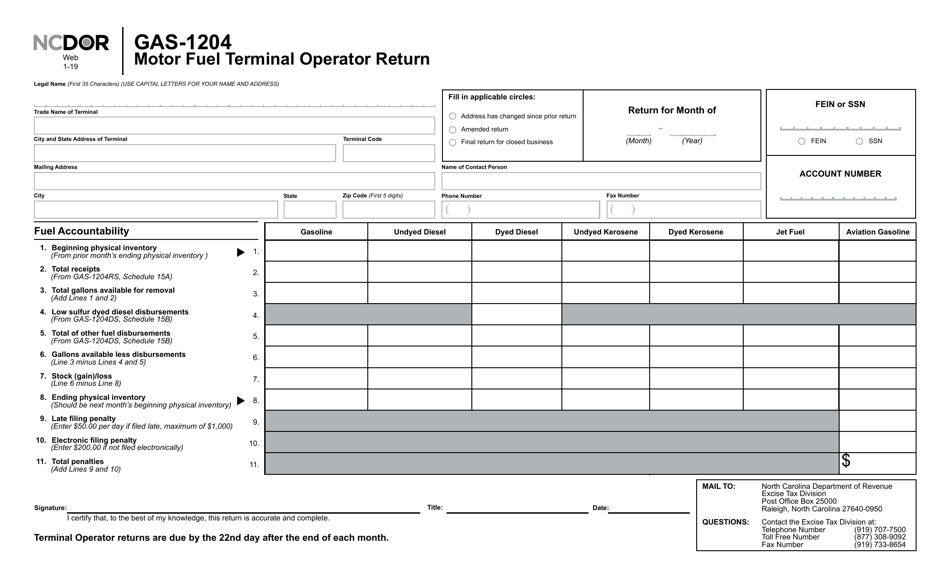

Form GAS-1204

for the current year.

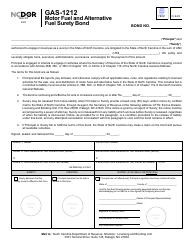

Form GAS-1204 Motor Fuel Terminal Operator Return - North Carolina

What Is Form GAS-1204?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form GAS-1204?

A: Form GAS-1204 is the Motor Fuel Terminal Operator Return for North Carolina.

Q: Who is required to file Form GAS-1204?

A: Motor Fuel Terminal Operators in the state of North Carolina are required to file Form GAS-1204.

Q: What is the purpose of Form GAS-1204?

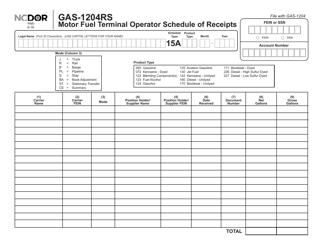

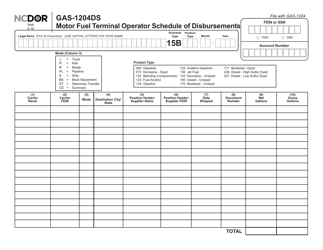

A: The purpose of Form GAS-1204 is to report the motor fuel gallons received, gallons removed, inventory at beginning and end of month, and other related information.

Q: When is Form GAS-1204 due?

A: Form GAS-1204 is due on or before the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for not filing Form GAS-1204 on time?

A: Yes, there are penalties for not filing Form GAS-1204 on time. Penalties and interest will accrue on any unpaid taxes.

Q: Is Form GAS-1204 only for motor fuel terminal operators in North Carolina?

A: Yes, Form GAS-1204 is specifically for motor fuel terminal operators in North Carolina.

Q: What other documentation might be required when filing Form GAS-1204?

A: When filing Form GAS-1204, you may also need to provide supporting documentation such as schedules, invoices, and other relevant records.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GAS-1204 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.