This version of the form is not currently in use and is provided for reference only. Download this version of

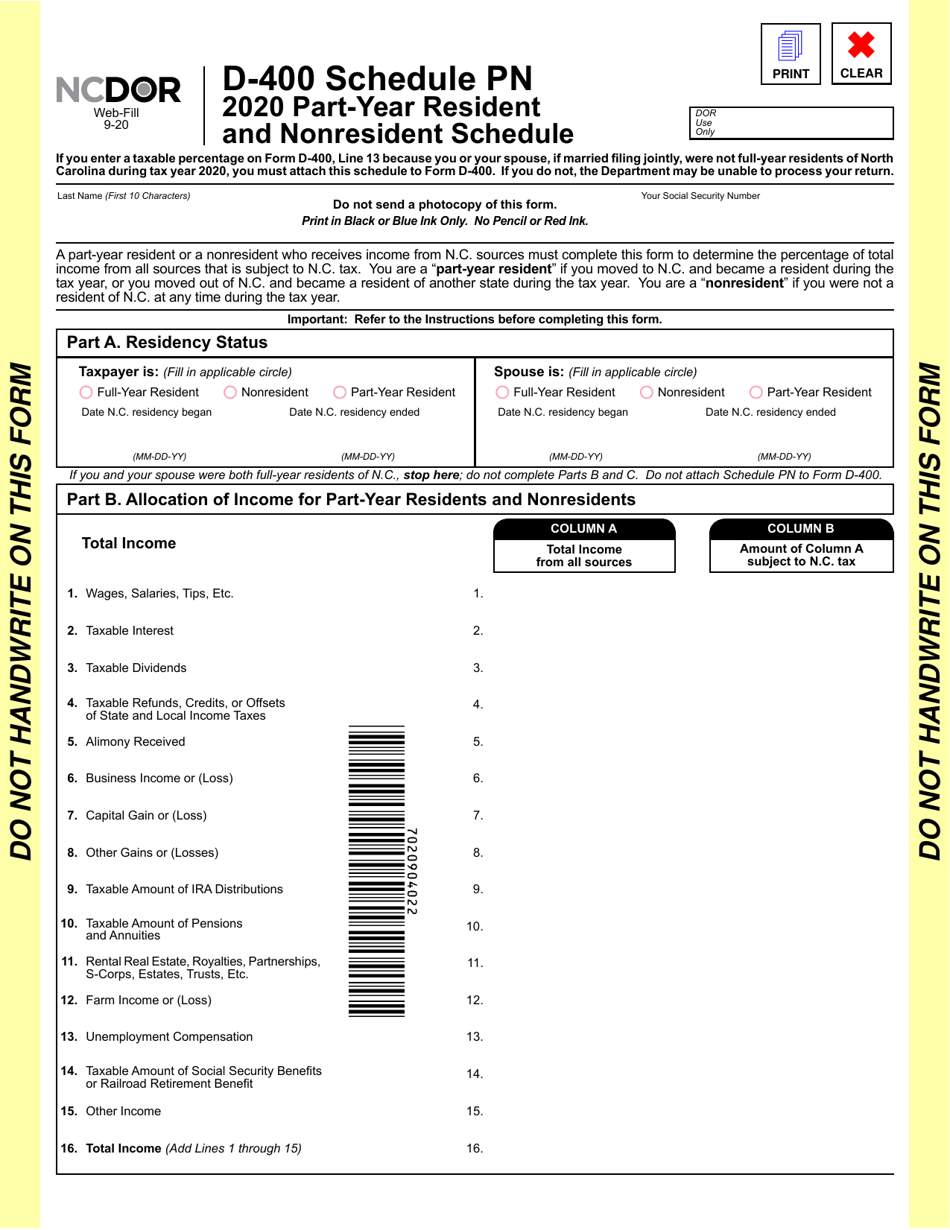

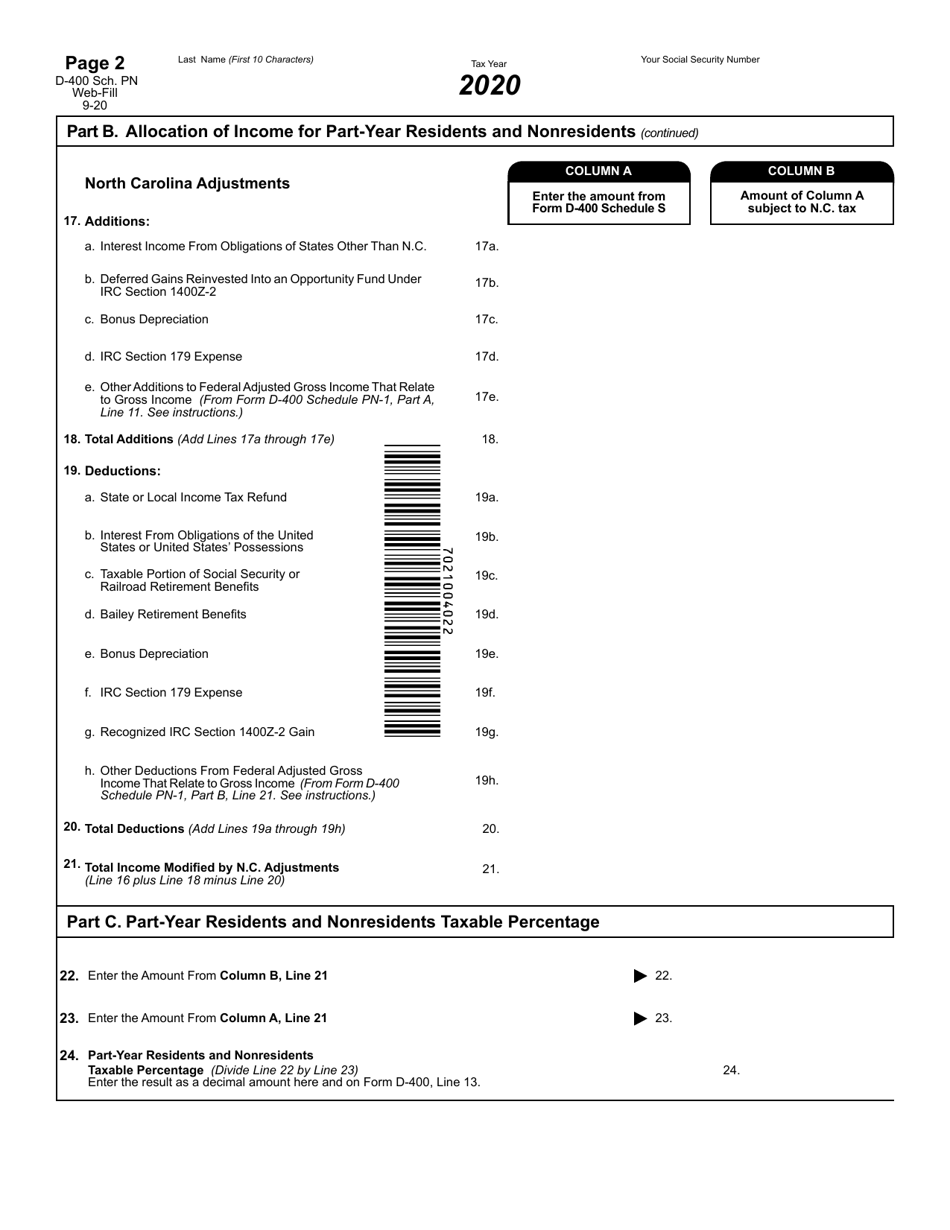

Form D-400 Schedule PN

for the current year.

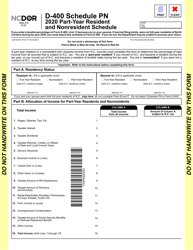

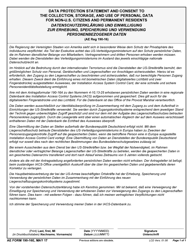

Form D-400 Schedule PN Part-Year Resident and Nonresident Schedule - North Carolina

What Is Form D-400 Schedule PN?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.The document is a supplement to Form D-400, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D-400?

A: Form D-400 is a tax form used by residents of North Carolina to report their income and calculate their state taxes.

Q: What is Schedule PN?

A: Schedule PN is a part-year resident and nonresident schedule that is attached to Form D-400. It is used to determine the portion of income that is subject to North Carolina taxes for individuals who were not residents of the state for the entire year.

Q: Who needs to file Schedule PN?

A: Part-year residents and nonresidents of North Carolina who earned income in the state during the tax year need to file Schedule PN along with Form D-400.

Q: What information is required on Schedule PN?

A: Schedule PN requires information about the taxpayer's residency status, income earned in North Carolina, and any applicable deductions and credits.

Q: When is the deadline to file Form D-400 Schedule PN?

A: The deadline to file Form D-400 and Schedule PN is typically April 15th, but it may be extended in certain circumstances.

Q: Are there any penalties for filing Form D-400 Schedule PN late?

A: Yes, if you file your Form D-400 and Schedule PN late, you may be subject to penalties and interest on any unpaid taxes owed.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

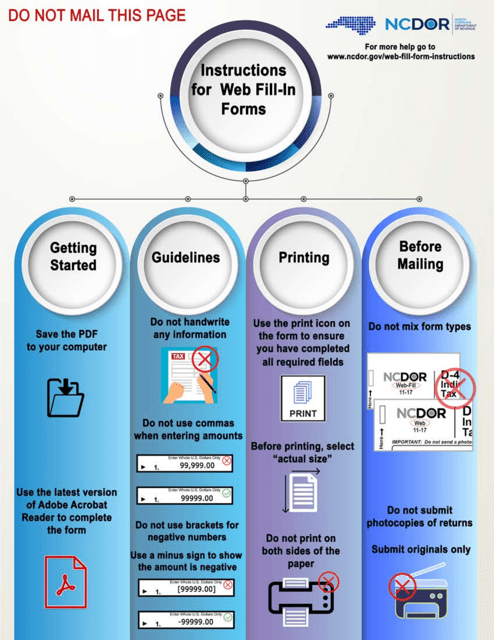

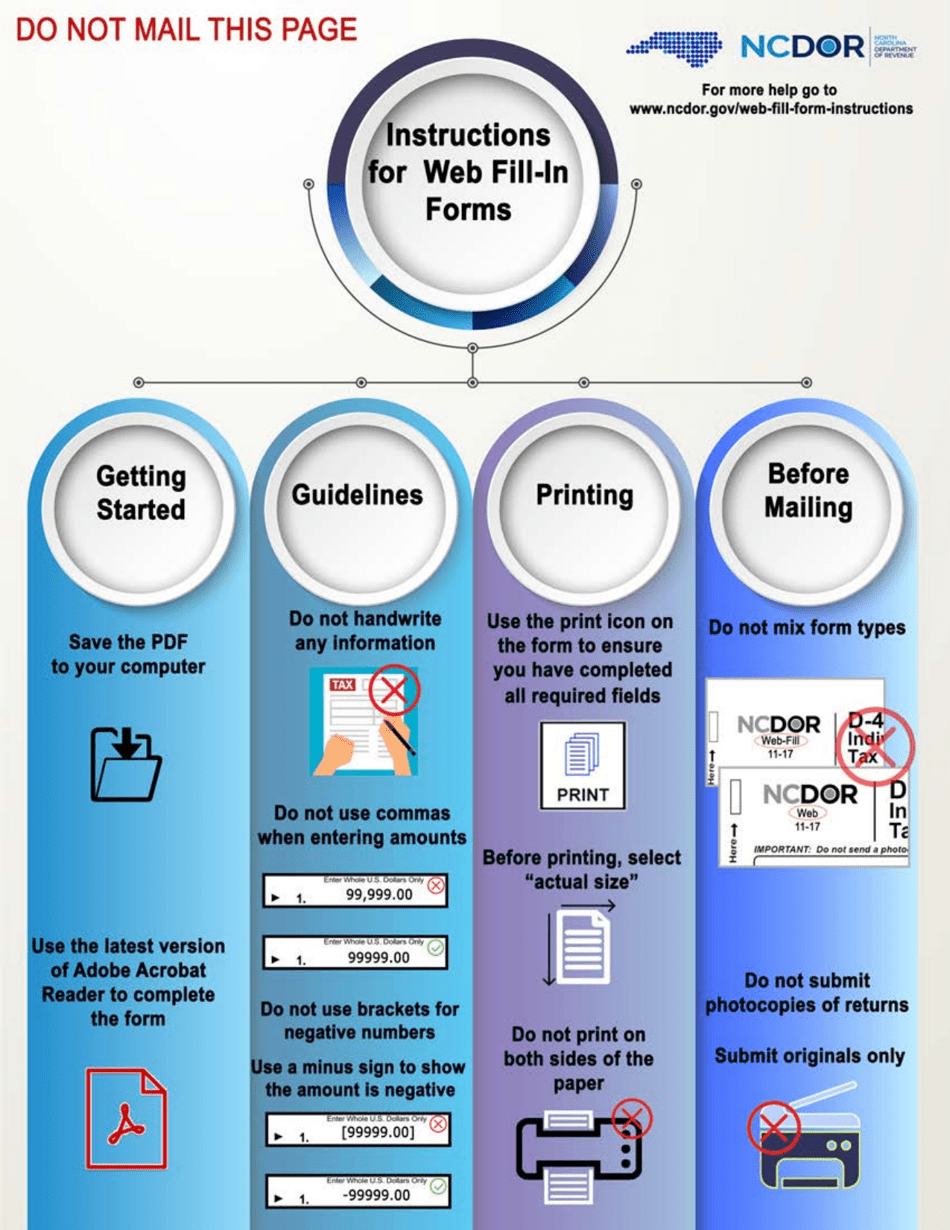

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 Schedule PN by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.