This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-400 Schedule PN-1

for the current year.

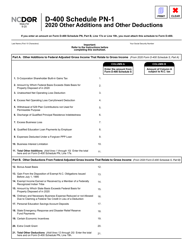

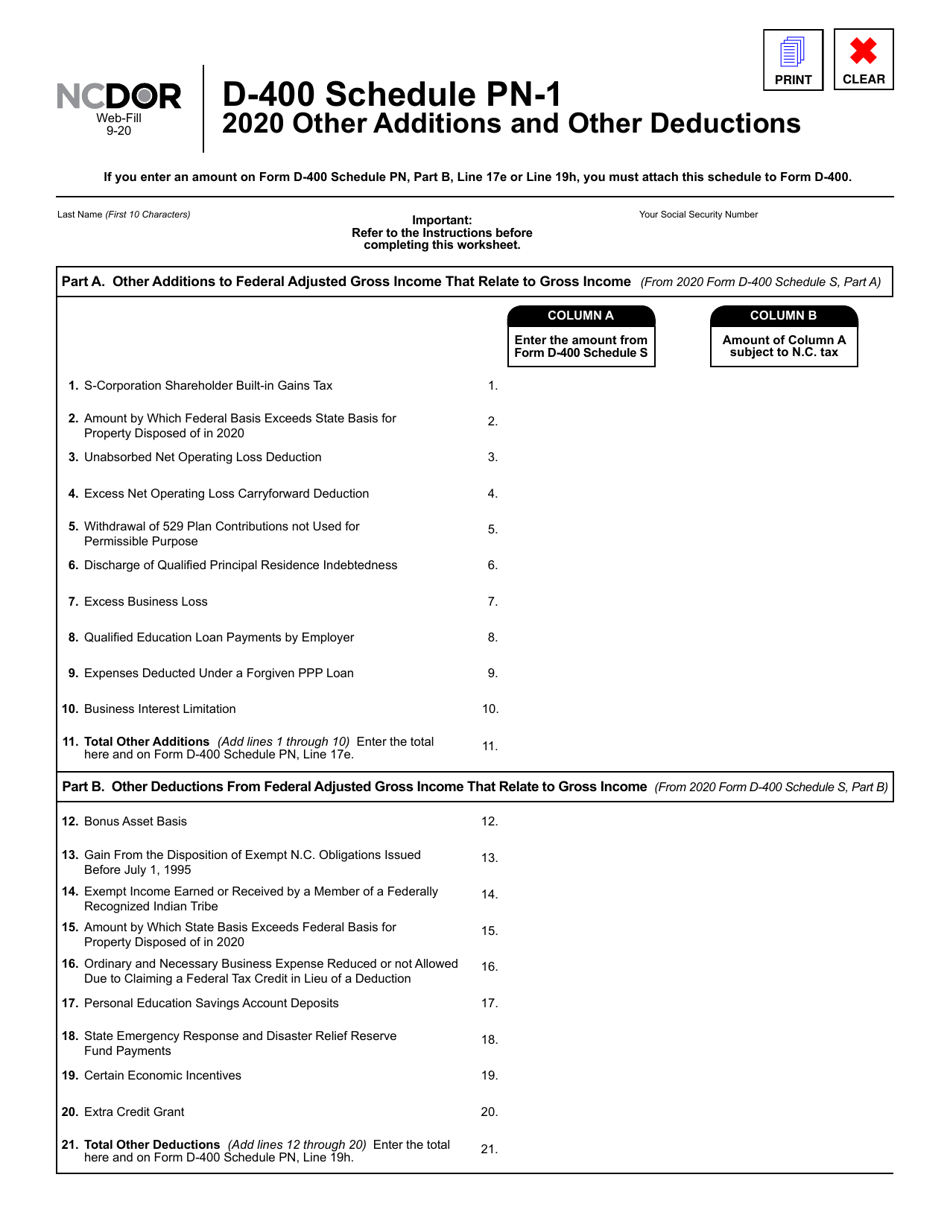

Form D-400 Schedule PN-1 Other Additions and Other Deductions - North Carolina

What Is Form D-400 Schedule PN-1?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.The document is a supplement to Form D-400, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D-400 Schedule PN-1?

A: Form D-400 Schedule PN-1 is a tax form used in North Carolina to report other additions and other deductions on your state income tax return.

Q: What are other additions?

A: Other additions are additional income that is not reported elsewhere on your tax return. Examples include gambling winnings, rental income, and alimony received.

Q: What are other deductions?

A: Other deductions are expenses that can be subtracted from your income to reduce your taxable income. Examples include student loan interest, moving expenses, and educator expenses.

Q: Do I need to fill out Form D-400 Schedule PN-1?

A: You only need to fill out Form D-400 Schedule PN-1 if you have other additions or other deductions to report on your North Carolina state income tax return.

Q: Can I e-file Form D-400 Schedule PN-1?

A: Yes, you can e-file Form D-400 Schedule PN-1 if you are filing your North Carolina state income tax return electronically.

Q: When is the deadline to file Form D-400 Schedule PN-1?

A: The deadline to file Form D-400 Schedule PN-1 is the same as the deadline to file your North Carolina state income tax return, which is usually April 15th.

Q: Can I claim other additions or other deductions on my federal tax return?

A: No, Form D-400 Schedule PN-1 is specific to the North Carolina state income tax return. Other additions and other deductions should be reported on your state return only.

Form Details:

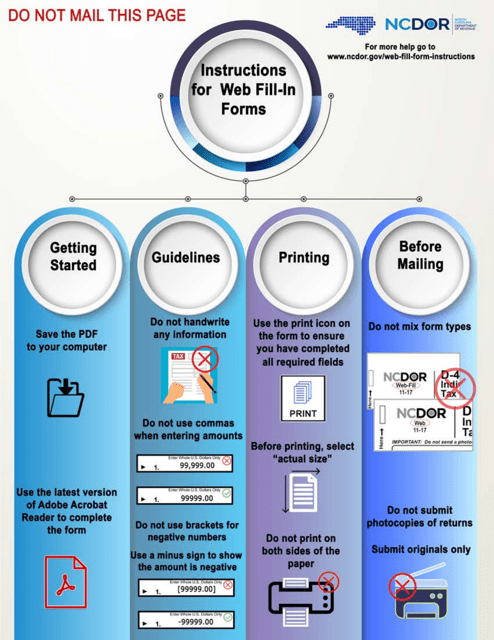

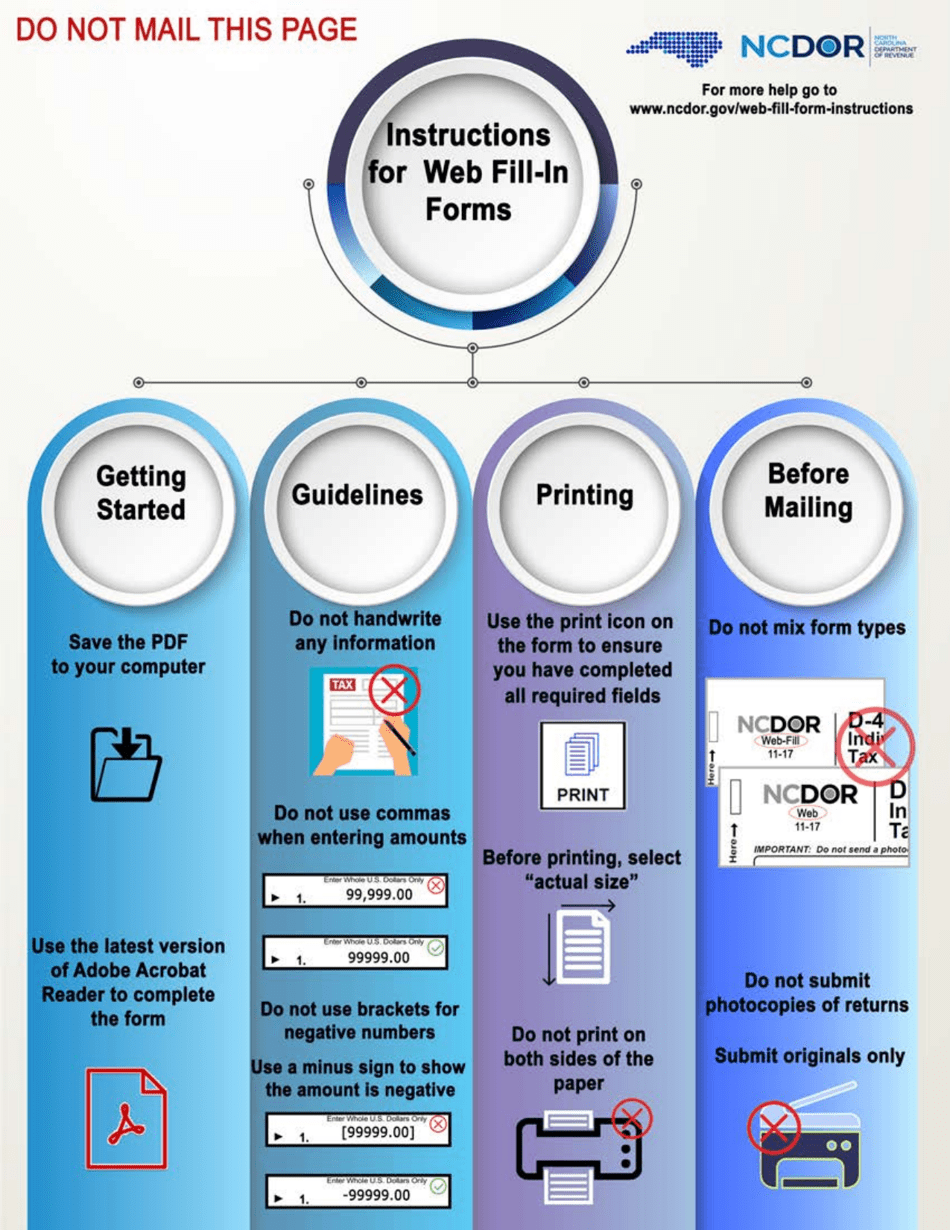

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 Schedule PN-1 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.