This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-400

for the current year.

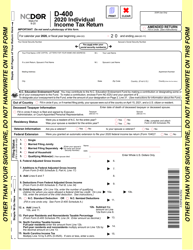

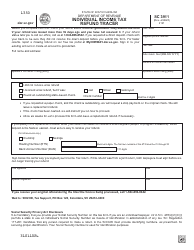

Form D-400 Individual Income Tax Return - North Carolina

What Is Form D-400?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina. Check the official instructions before completing and submitting the form.

FAQ

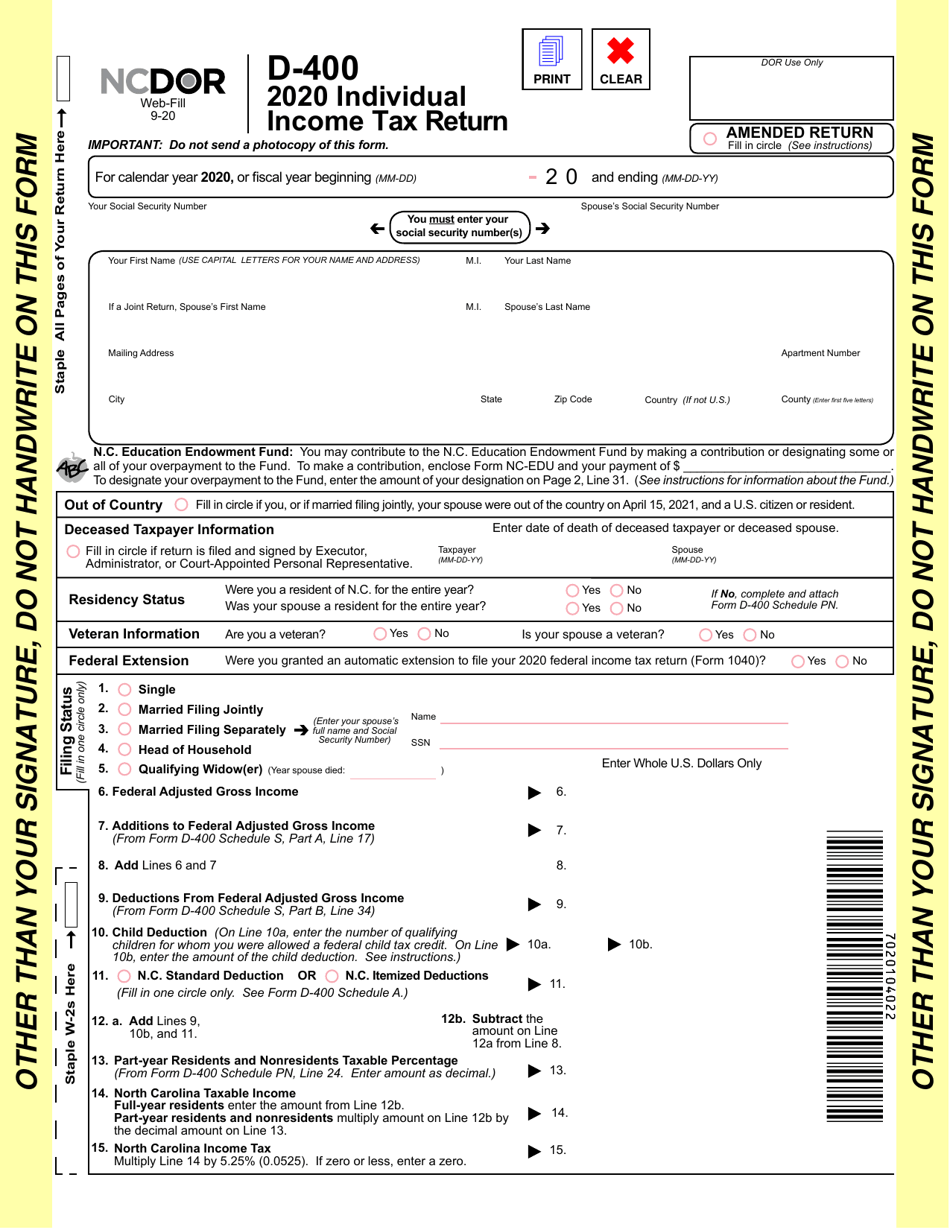

Q: What is Form D-400?

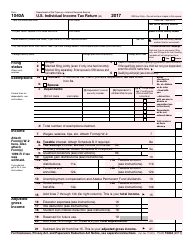

A: Form D-400 is the North Carolina Individual Income Tax Return.

Q: Who should file Form D-400?

A: Any individual who is a resident of North Carolina or has income from North Carolina sources should file Form D-400.

Q: What is the purpose of Form D-400?

A: Form D-400 is used to report an individual's income, deductions, credits, and determine the amount of tax they owe or refund they are entitled to.

Q: When is Form D-400 due?

A: Form D-400 is due on or before April 15th of each year.

Q: Can I file Form D-400 electronically?

A: Yes, North Carolina allows taxpayers to file Form D-400 electronically.

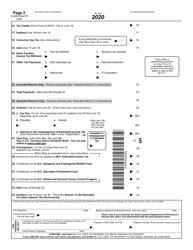

Q: Do I need to attach any other forms or documents to Form D-400?

A: It depends on your individual situation. You may need to attach supporting documents such as W-2s, 1099s, or schedules if applicable.

Q: What if I can't file my Form D-400 by the due date?

A: If you can't file your Form D-400 by the due date, you can request an extension of time to file, but you still must pay any tax due by the original due date.

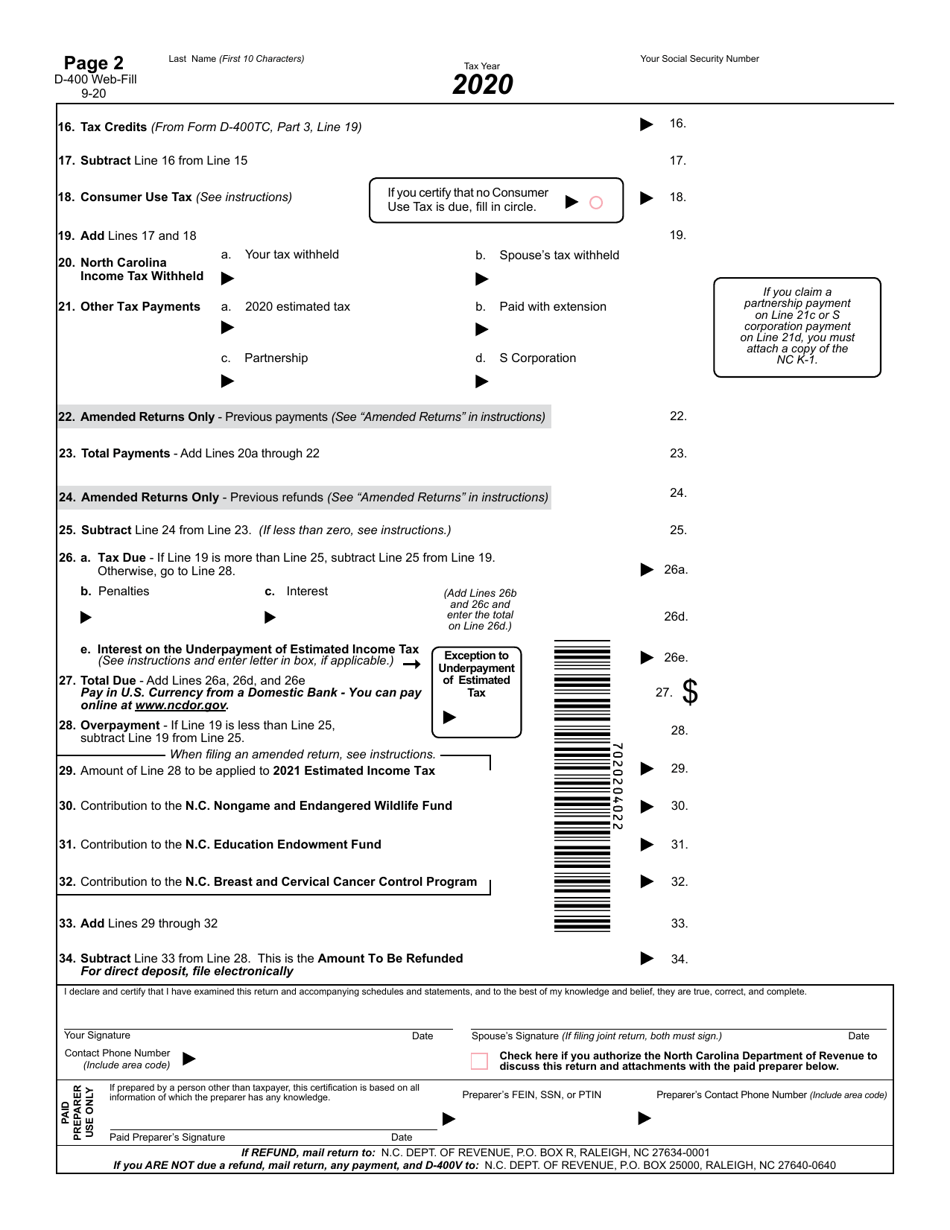

Q: How do I pay the tax I owe on Form D-400?

A: You can pay the tax you owe on Form D-400 by mailing a check or money order with your return, or you can make an electronic payment.

Q: What if I overpaid my tax? Can I get a refund?

A: If you overpaid your tax, you can claim a refund on Form D-400. You can choose to have the refund directly deposited into your bank account or receive a paper check.

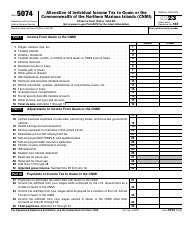

Q: Are there any deductions or credits available on Form D-400?

A: Yes, there are various deductions and credits available on Form D-400, such as the standard deduction, itemized deductions, child tax credit, and dependent care credit.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

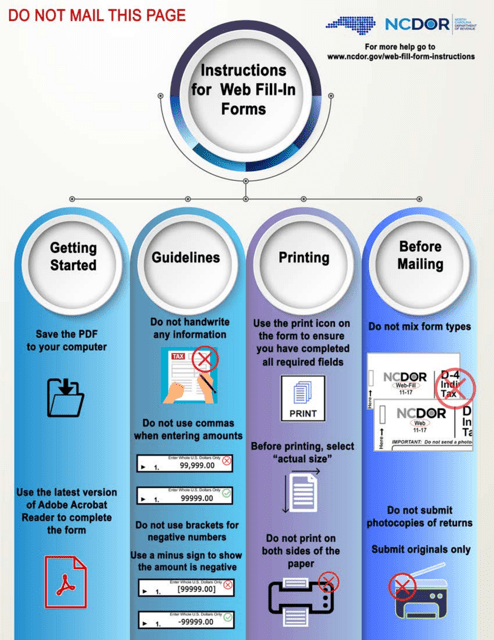

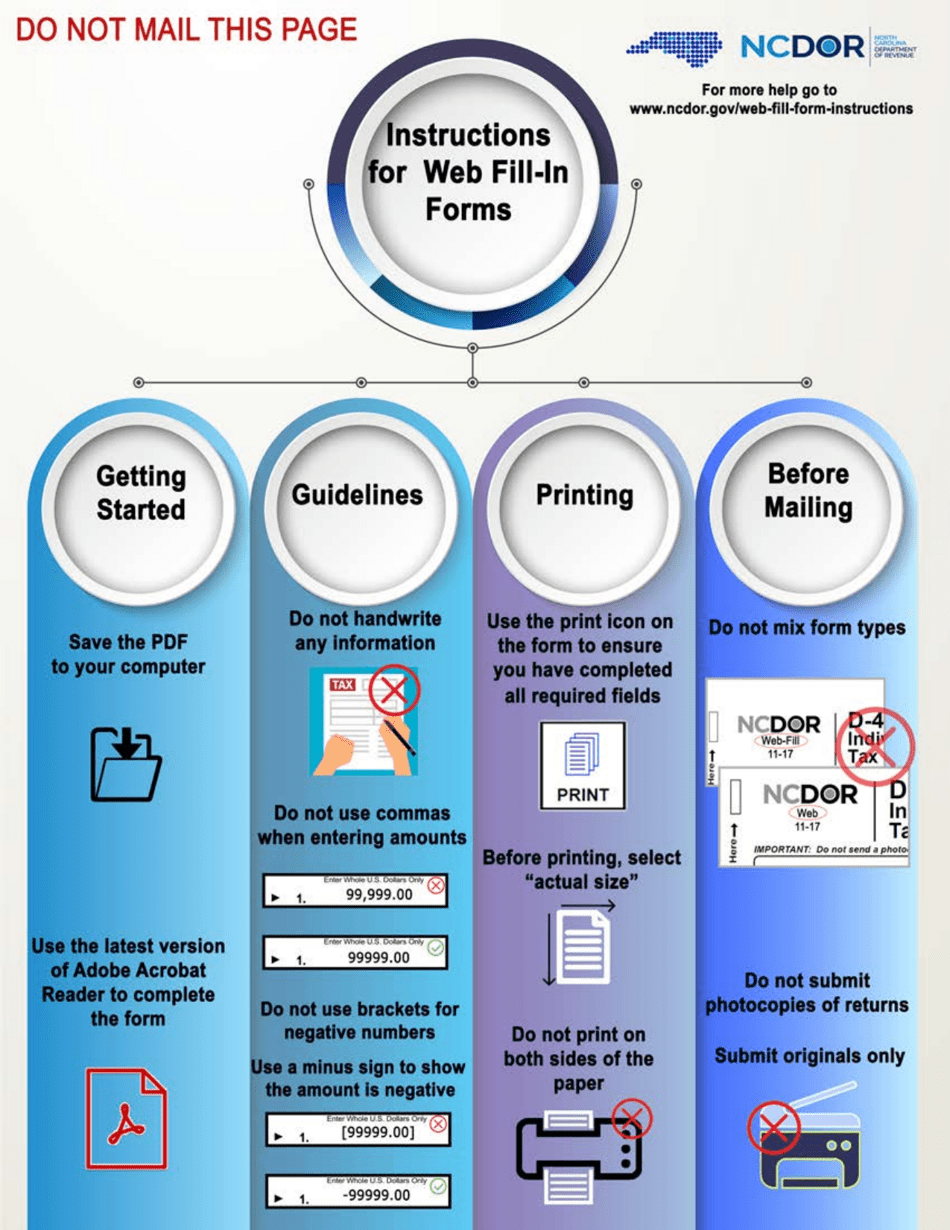

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.