This version of the form is not currently in use and is provided for reference only. Download this version of

Form D-400 Schedule A

for the current year.

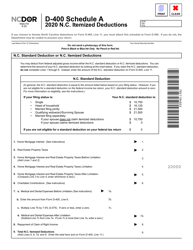

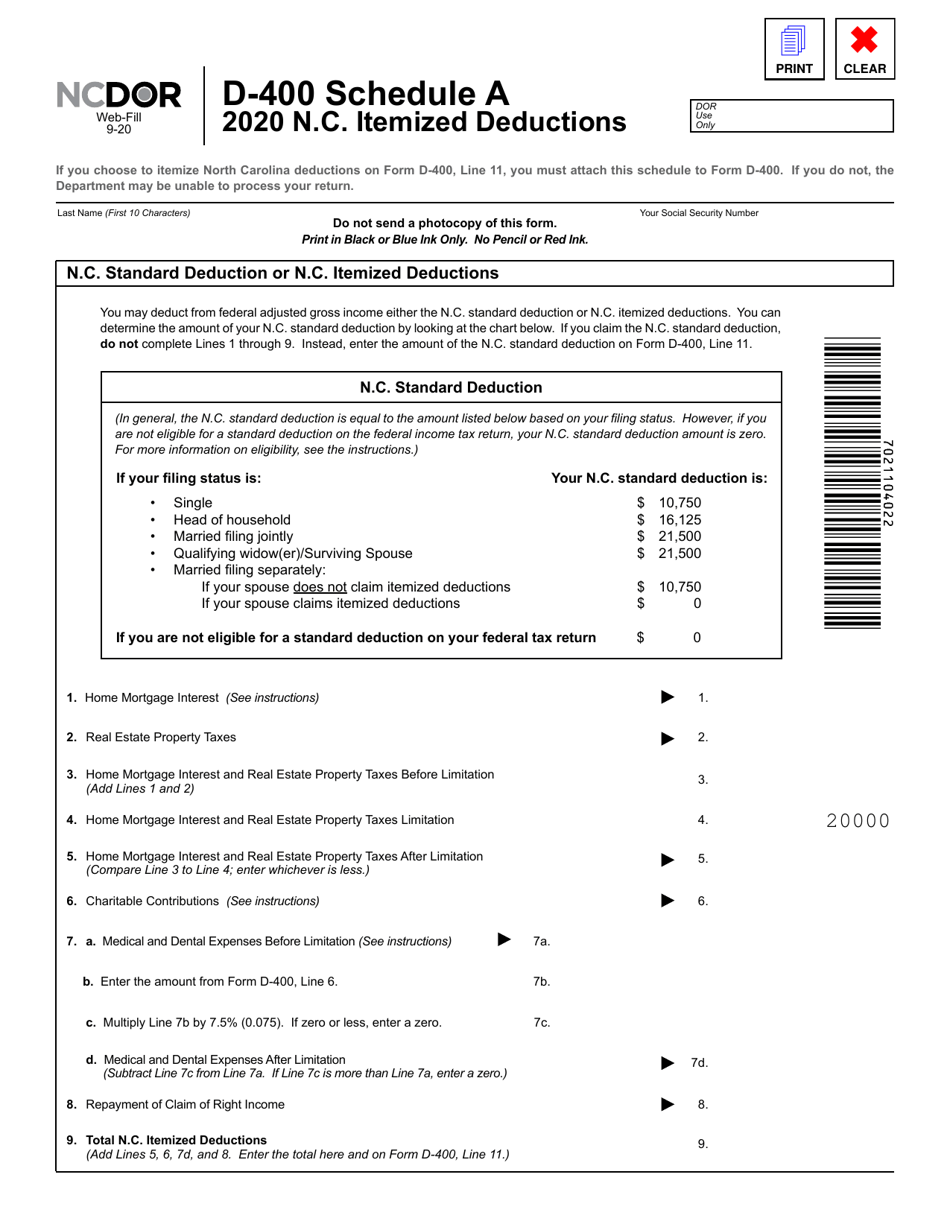

Form D-400 Schedule A North Carolina Itemized Deductions - North Carolina

What Is Form D-400 Schedule A?

This is a legal form that was released by the North Carolina Department of Revenue - a government authority operating within North Carolina.The document is a supplement to Form D-400, Individual Income Tax Return. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form D-400 Schedule A?

A: Form D-400 Schedule A is a tax form used in North Carolina to claim itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that can be subtracted from your taxable income, potentially reducing the amount of tax you owe.

Q: Who needs to file Form D-400 Schedule A?

A: If you want to claim itemized deductions on your North Carolina state tax return, you will need to file Form D-400 Schedule A.

Q: What expenses can be claimed as itemized deductions?

A: Common itemized deductions include medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain job-related expenses.

Q: Do I have to choose between itemized deductions and standard deduction?

A: Yes, you have to choose between claiming itemized deductions or taking the standard deduction. You should choose the method that gives you the highest tax benefit.

Q: Is Form D-400 Schedule A the same as federal Schedule A?

A: No, Form D-400 Schedule A is specific to North Carolina state taxes and may have different requirements and limitations compared to the federal Schedule A.

Q: When is the deadline to file Form D-400 Schedule A?

A: The deadline to file Form D-400 Schedule A is the same as the deadline for your North Carolina state tax return, which is usually April 15th, unless it falls on a weekend or holiday.

Q: Do I need to include Form D-400 Schedule A with my federal tax return?

A: No, Form D-400 Schedule A is only for North Carolina state taxes. You do not need to include it with your federal tax return.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the North Carolina Department of Revenue;

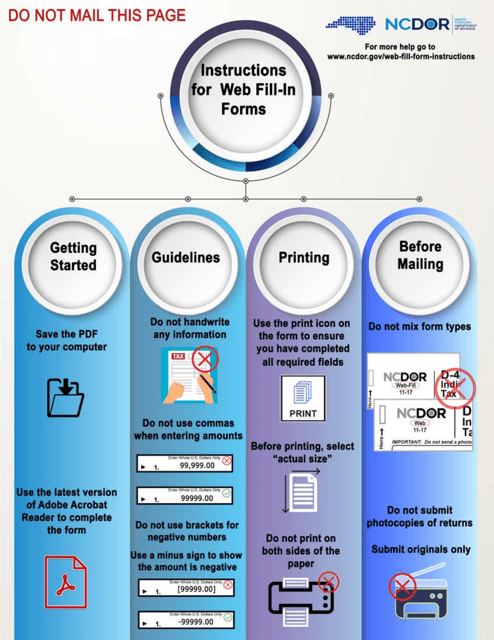

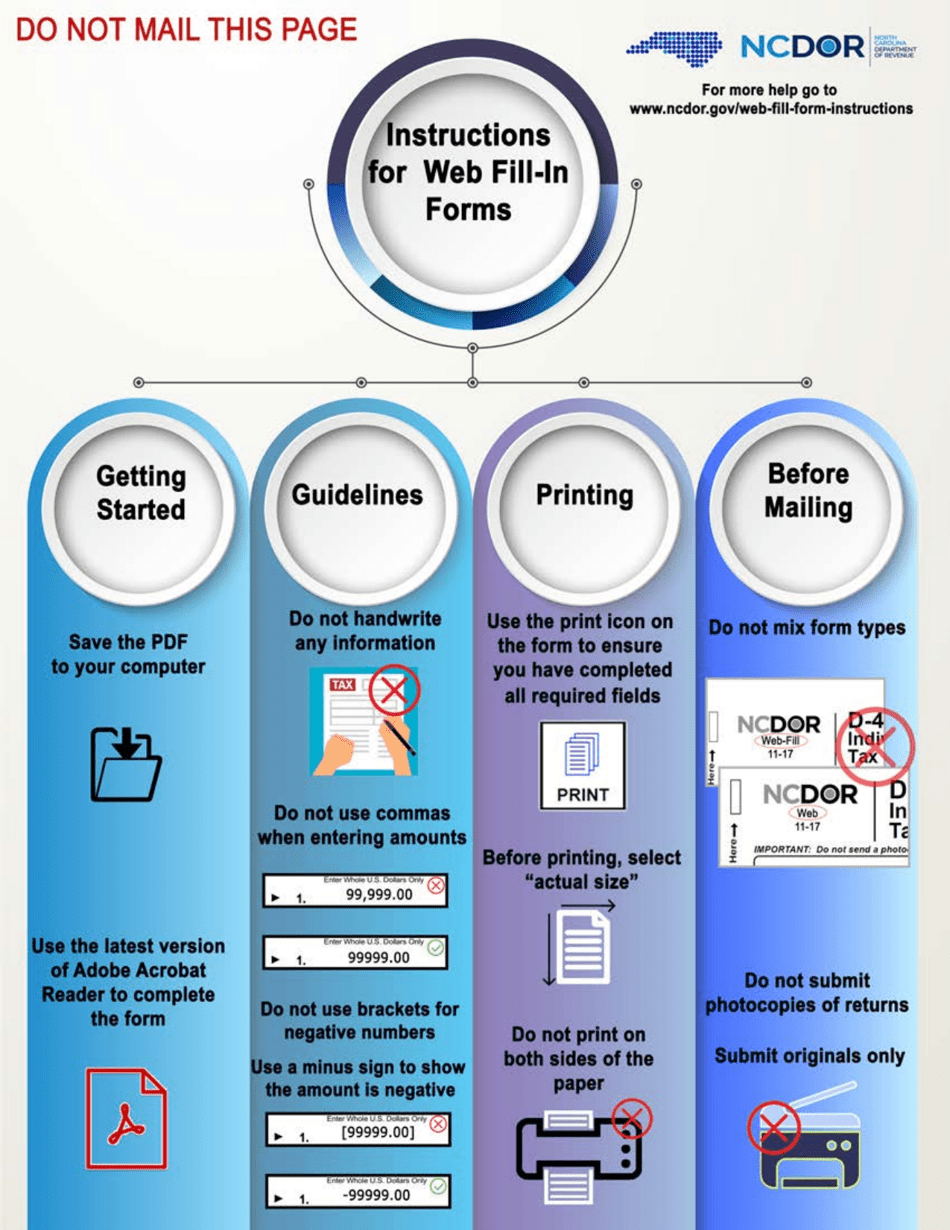

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-400 Schedule A by clicking the link below or browse more documents and templates provided by the North Carolina Department of Revenue.