This version of the form is not currently in use and is provided for reference only. Download this version of

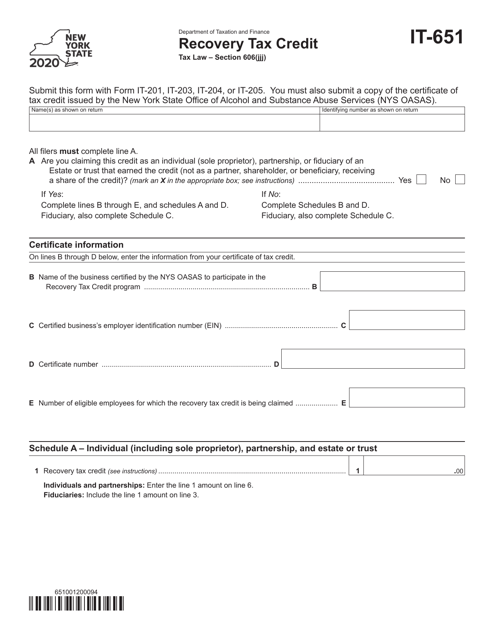

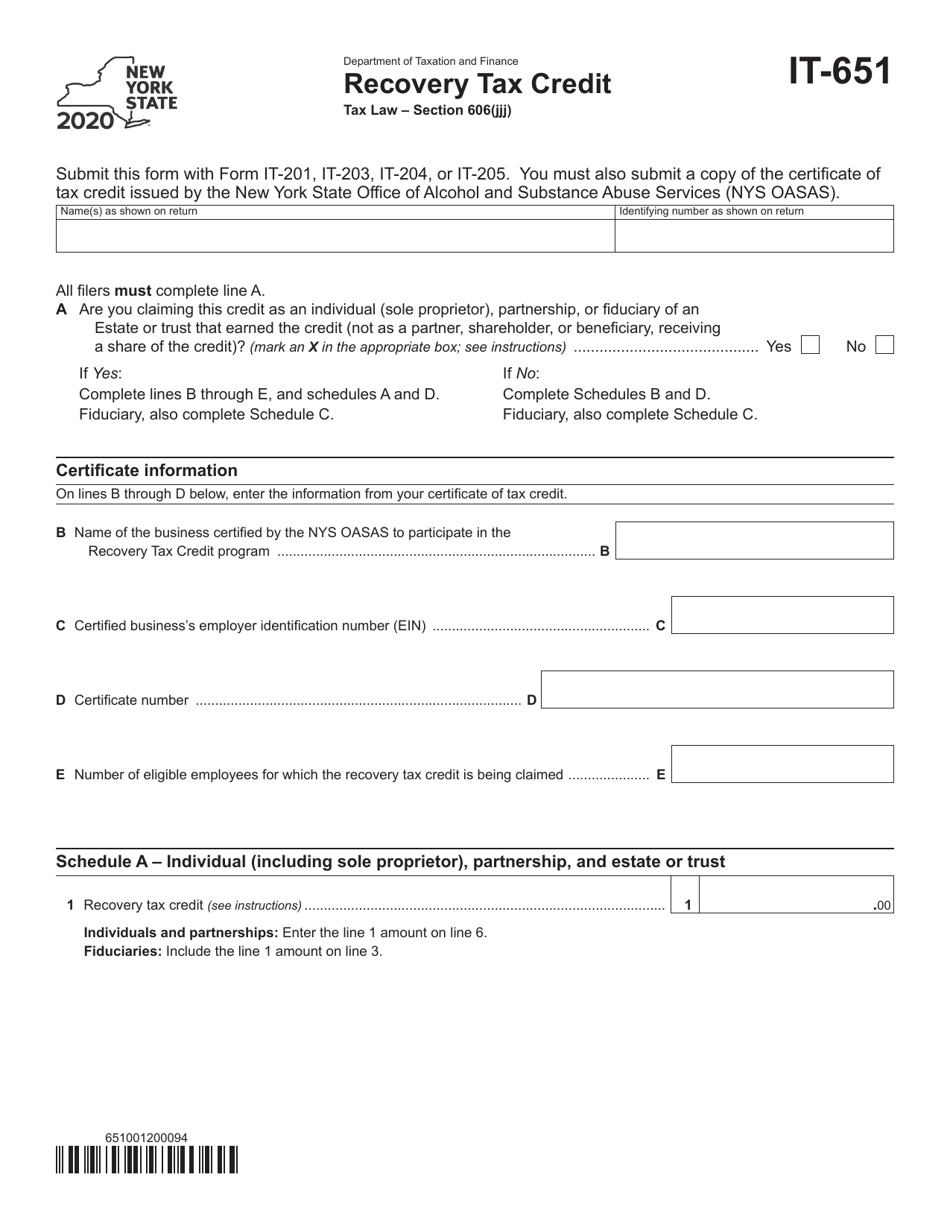

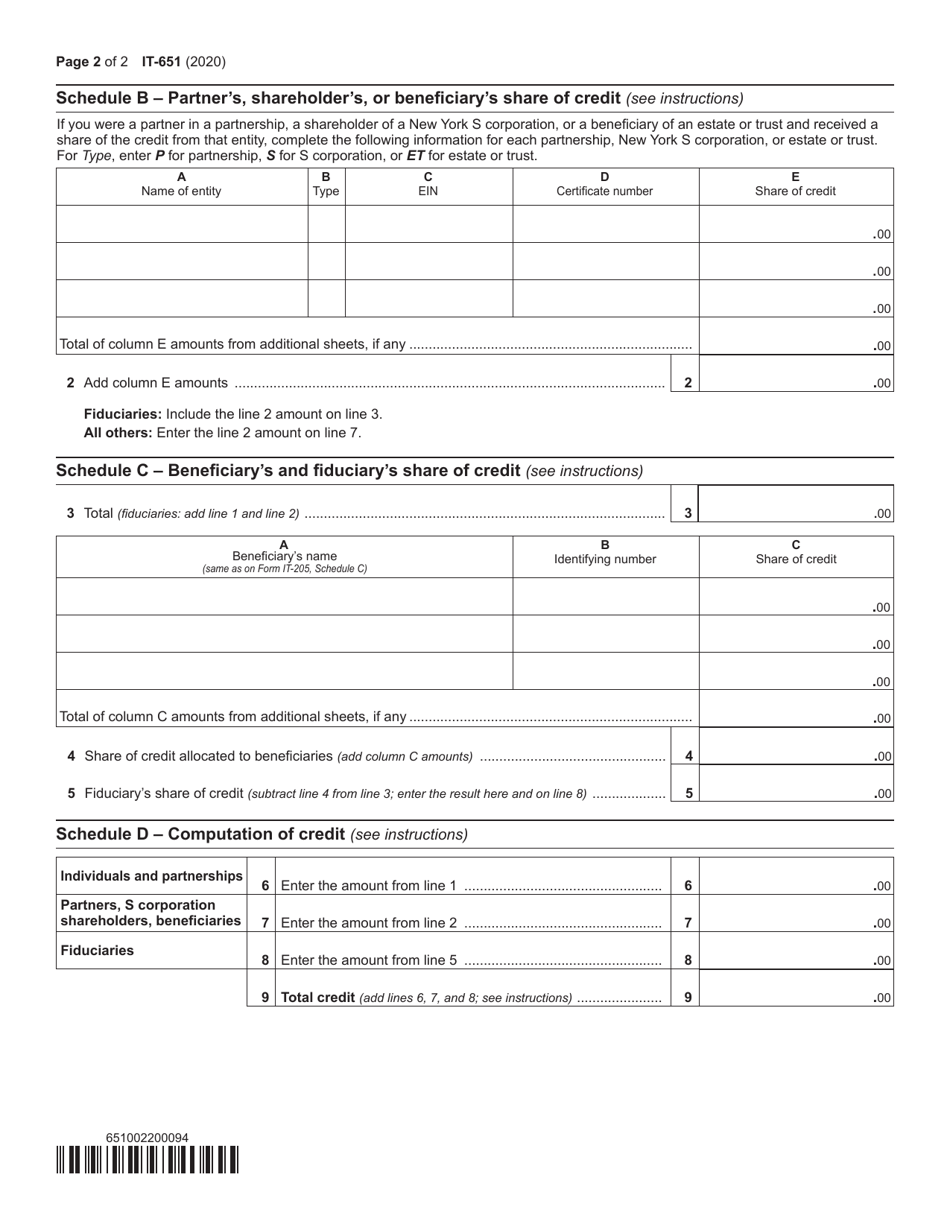

Form IT-651

for the current year.

Form IT-651 Recovery Tax Credit - New York

What Is Form IT-651?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-651?

A: Form IT-651 is a tax form used to claim the Recovery Tax Credit in the state of New York.

Q: What is the Recovery Tax Credit?

A: The Recovery Tax Credit is a tax credit available to New York residents who experienced certain financial hardship during the COVID-19 pandemic.

Q: Who is eligible to claim the Recovery Tax Credit?

A: New York residents who meet certain income and eligibility criteria may be eligible to claim the Recovery Tax Credit.

Q: What expenses can be claimed for the Recovery Tax Credit?

A: Expenses such as rent, mortgage payments, utility bills, and childcare expenses incurred due to financial hardship during the COVID-19 pandemic can be claimed for the Recovery Tax Credit.

Q: What documentation is required to claim the Recovery Tax Credit?

A: Documentation such as receipts, invoices, and proof of financial hardship may be required to support your claim for the Recovery Tax Credit.

Q: When is the deadline to file Form IT-651?

A: The deadline to file Form IT-651 and claim the Recovery Tax Credit may vary each year, so it is important to check the official guidelines and deadlines set by the New York State Department of Taxation and Finance.

Q: Can I claim the Recovery Tax Credit if I already received other pandemic-related assistance?

A: You may still be eligible to claim the Recovery Tax Credit even if you received other pandemic-related assistance, but it is important to review the eligibility requirements and guidelines provided by the New York State Department of Taxation and Finance.

Q: Are there any limitations on the amount of the Recovery Tax Credit?

A: Yes, there may be limitations on the amount of the Recovery Tax Credit you can claim, and this will be determined based on your individual circumstances and the guidelines provided by the New York State Department of Taxation and Finance.

Q: What should I do if I need help filling out Form IT-651?

A: If you need assistance with filling out Form IT-651 or have specific questions about the Recovery Tax Credit, you can contact the New York State Department of Taxation and Finance for guidance and support.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-651 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.