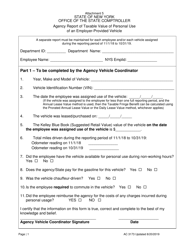

This version of the form is not currently in use and is provided for reference only. Download this version of

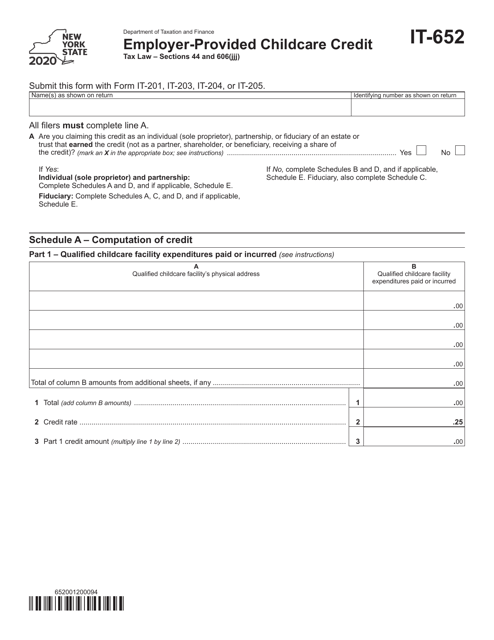

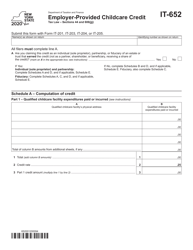

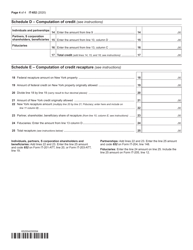

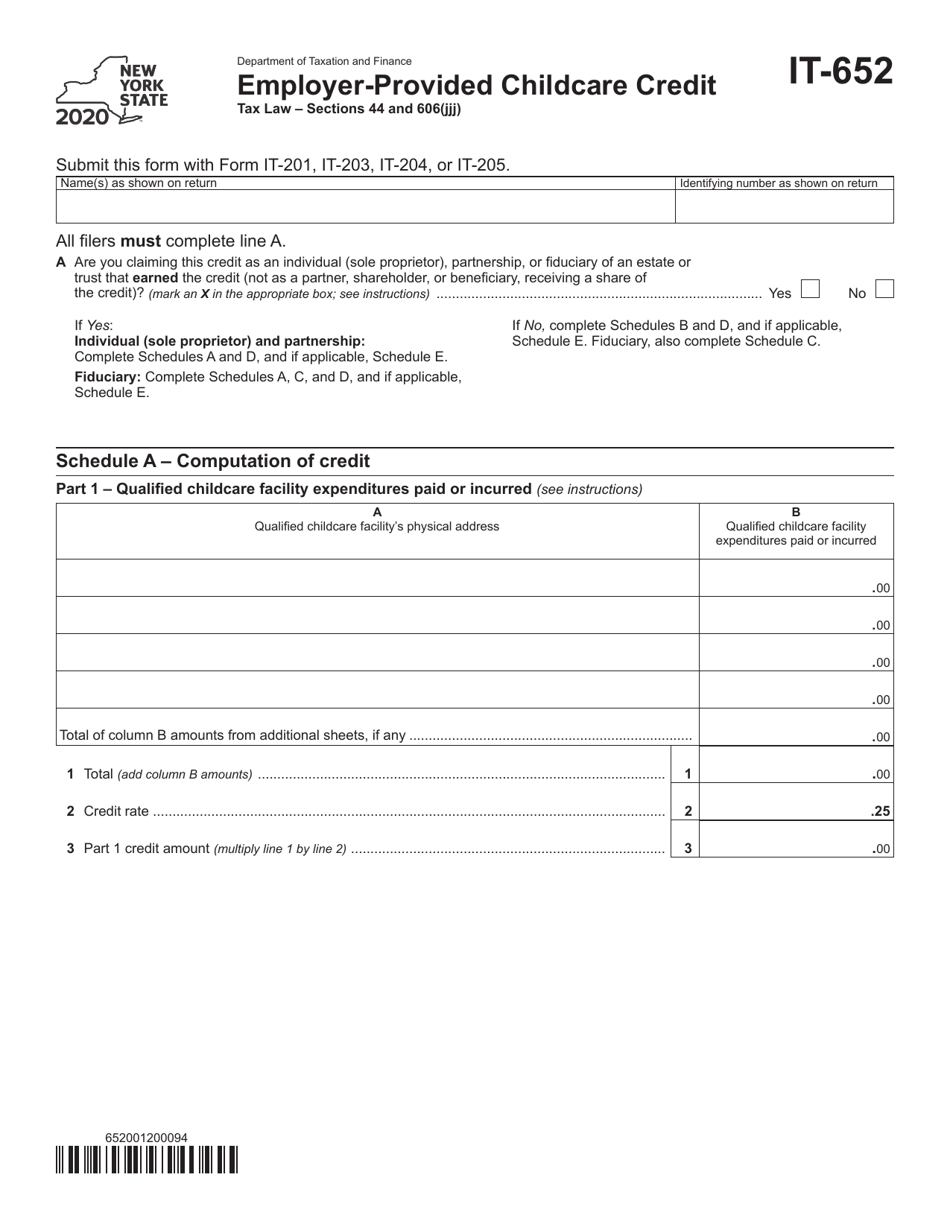

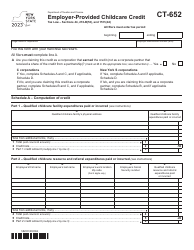

Form IT-652

for the current year.

Form IT-652 Employer-Provided Childcare Credit - New York

What Is Form IT-652?

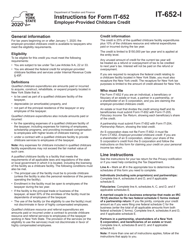

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-652?

A: Form IT-652 is the Employer-Provided Childcare Credit form specific to New York.

Q: Who is eligible for the Employer-Provided Childcare Credit in New York?

A: Employers who provide childcare benefits to their employees may be eligible for this credit.

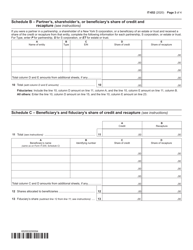

Q: What are the requirements for claiming the Employer-Provided Childcare Credit in New York?

A: Employers must meet specific criteria and submit the necessary documentation to claim this credit.

Q: How much is the Employer-Provided Childcare Credit in New York?

A: The credit amount may vary depending on the number of employees and the total eligible expenses.

Q: How do I file Form IT-652 in New York?

A: Employers should include this form when filing their New York state income tax return.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-652 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.