This version of the form is not currently in use and is provided for reference only. Download this version of

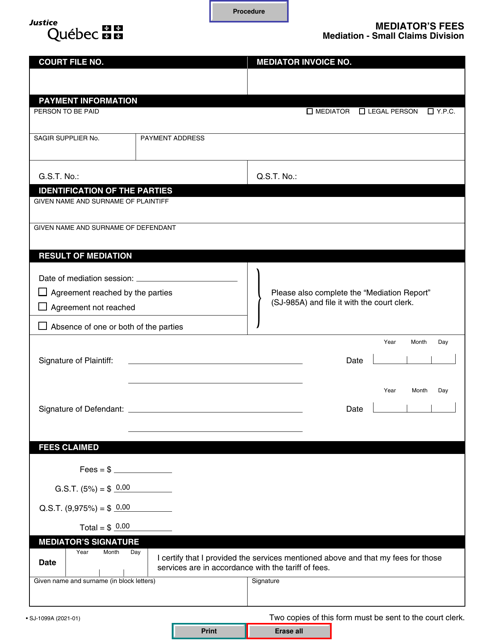

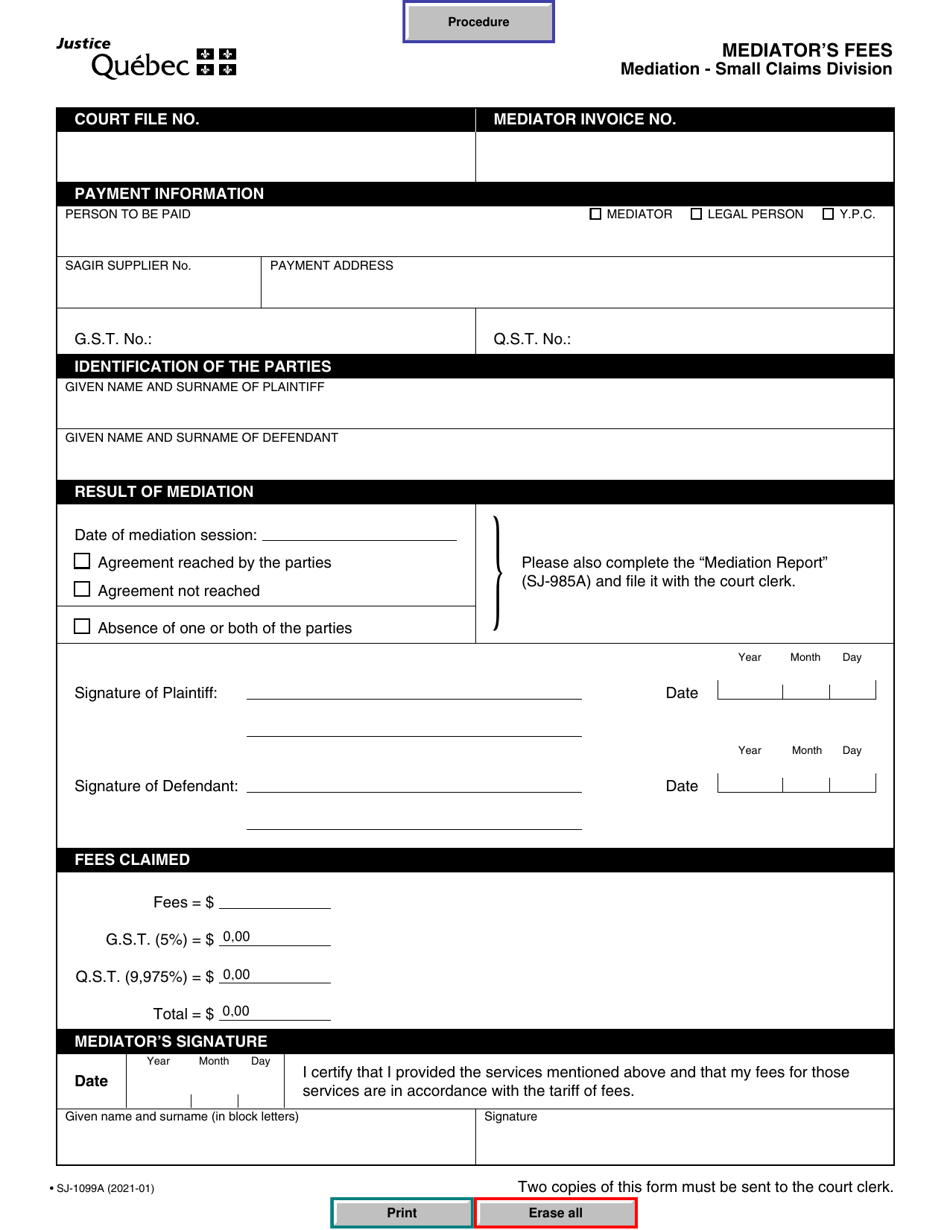

Form SJ-1099A

for the current year.

Form SJ-1099A Mediator's Fees - Quebec, Canada

Form SJ-1099A Mediator's Fees in Quebec, Canada is used to report the fees paid to a mediator for services rendered during a dispute resolution process. This form is typically filed by individuals or organizations involved in a legal or civil dispute in Quebec.

In Quebec, Canada, it is the responsibility of the mediator to file the Form SJ-1099A for their fees.

FAQ

Q: What is Form SJ-1099A?

A: Form SJ-1099A is a document used to report the fees paid to a mediator in Quebec, Canada.

Q: Who needs to file Form SJ-1099A?

A: Parties who have engaged the services of a mediator and paid fees to them in Quebec, Canada need to file Form SJ-1099A.

Q: When is Form SJ-1099A due?

A: Form SJ-1099A is usually due by the end of February each year.

Q: How should I fill out Form SJ-1099A?

A: You should provide your personal information, including your name, address, and social insurance number, as well as the details of the mediator and the fees paid.

Q: Are there any penalties for not filing Form SJ-1099A?

A: Yes, there can be penalties for late or incorrect filing of Form SJ-1099A. It is important to comply with the filing requirements.

Q: Is Form SJ-1099A applicable only in Quebec, Canada?

A: Yes, Form SJ-1099A is specific to Quebec, Canada and is used to report mediator's fees in that region.

Q: Do I need to attach any supporting documents with Form SJ-1099A?

A: No, Form SJ-1099A generally does not require any supporting documents to be attached.

Q: Can I deduct mediator's fees on my tax return?

A: The deductibility of mediator's fees varies depending on individual circumstances. It is best to consult with a tax professional or refer to the tax guidelines provided by the tax authorities in Quebec, Canada.