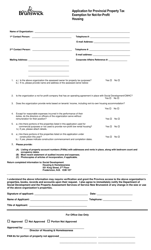

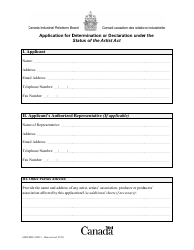

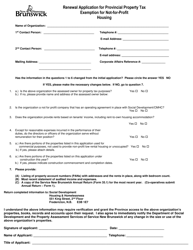

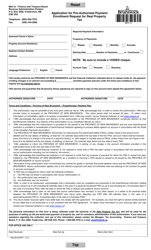

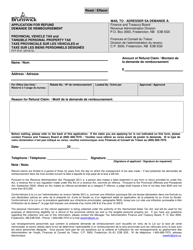

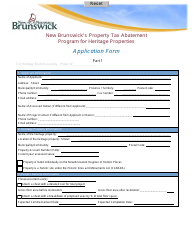

Application / Declaration for Property Tax Deferral Program for Seniors - New Brunswick, Canada

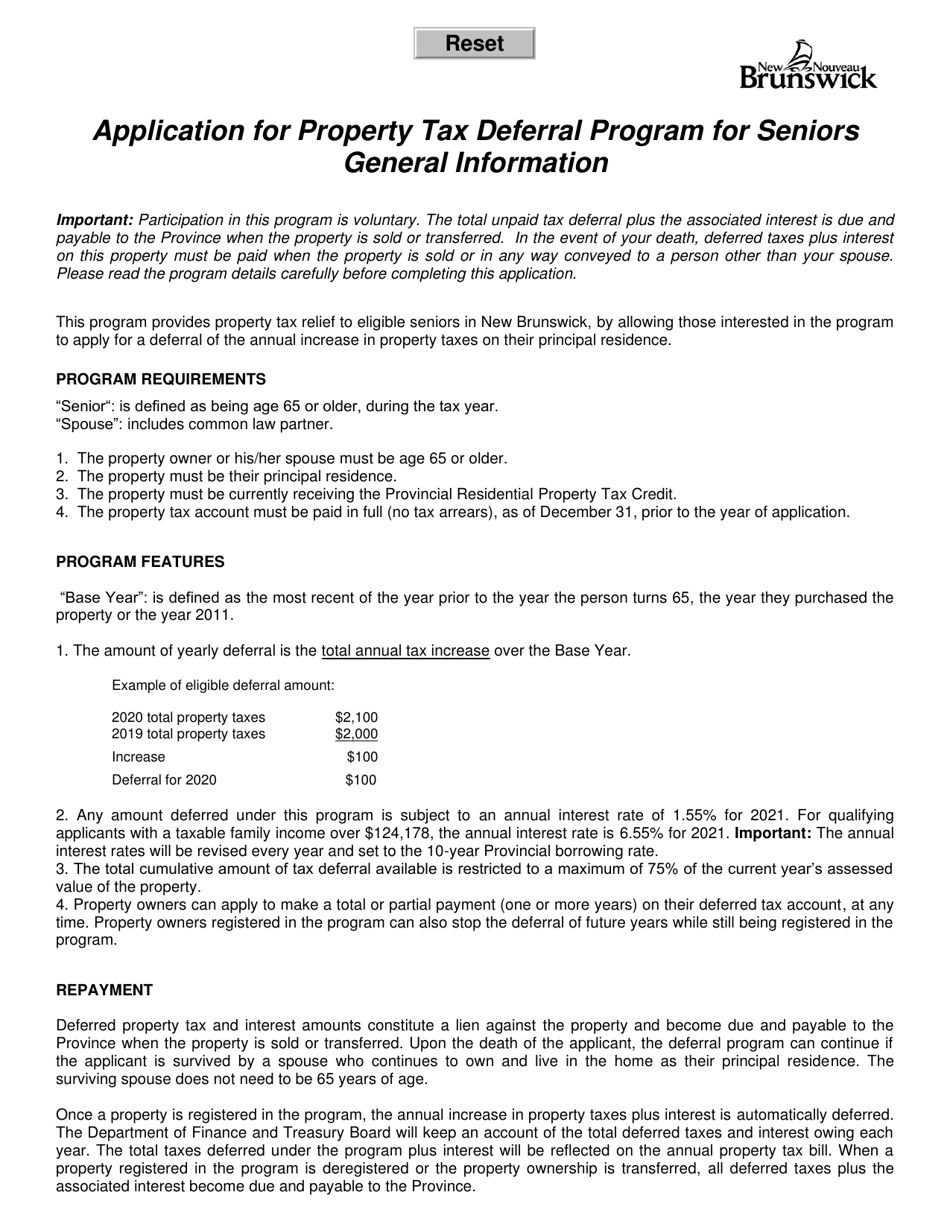

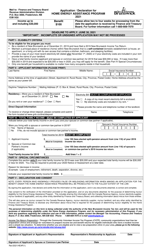

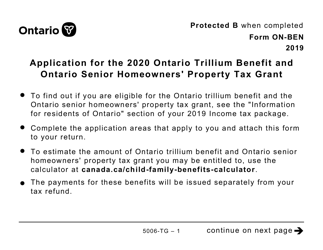

The Application/Declaration for Property Tax Deferral Program for Seniors in New Brunswick, Canada is used to apply for a program that allows eligible seniors to defer the payment of property taxes. The program helps seniors who may have difficulty paying their property taxes to manage their finances and stay in their homes.

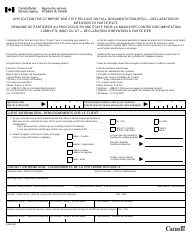

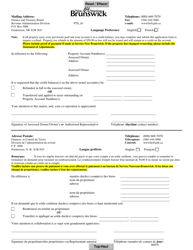

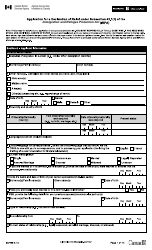

In New Brunswick, Canada, the property owner themselves or their authorized representative files the application or declaration for the Property Tax Deferral Program for Seniors.

FAQ

Q: What is the Property Tax Deferral Program for Seniors in New Brunswick?

A: The Property Tax Deferral Program for Seniors is a program in New Brunswick, Canada that allows eligible senior homeowners to defer payment of their property taxes.

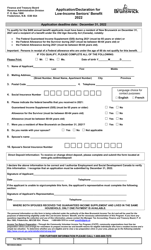

Q: Who is eligible for the Property Tax Deferral Program for Seniors?

A: To be eligible for the program, you must be at least 65 years old and own a home in New Brunswick.

Q: What are the benefits of the Property Tax Deferral Program for Seniors?

A: The program allows eligible seniors to defer payment of their property taxes, providing them with financial relief.

Q: How does the Property Tax Deferral Program for Seniors work?

A: Under the program, the government will pay your property taxes on your behalf, and you will repay the amount deferred with interest when you sell your home or upon your death.

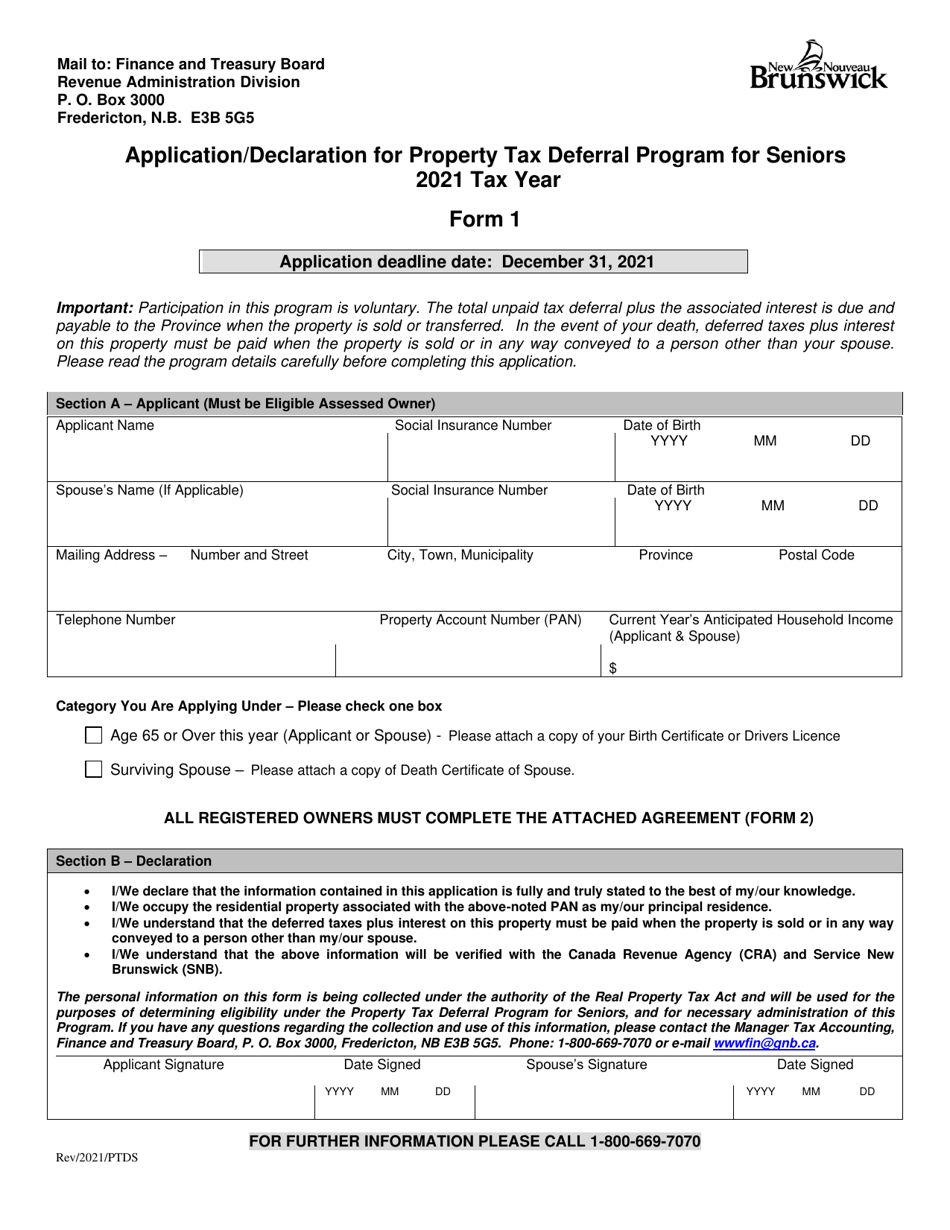

Q: How can I apply for the Property Tax Deferral Program for Seniors?

A: To apply for the program, you need to fill out an application form available from Service New Brunswick.

Q: Are there any income or residency requirements for the program?

A: Yes, there are income and residency requirements that you must meet to be eligible for the program. The specific requirements can be found on the application form.

Q: Is the Property Tax Deferral Program for Seniors available in all municipalities in New Brunswick?

A: No, the program is not available in all municipalities. You should check with your local municipality to see if they participate in the program.

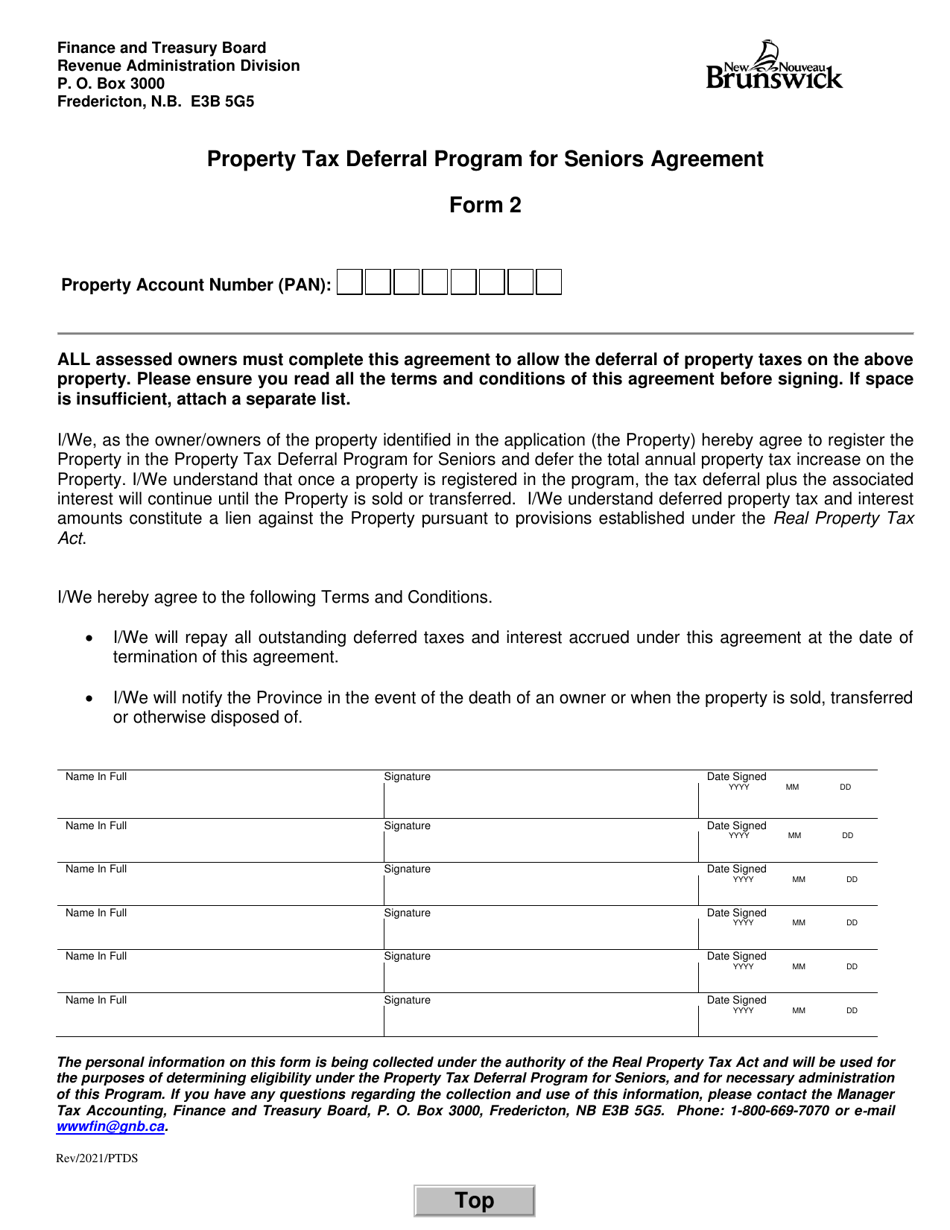

Q: What happens if I sell my home before repaying the deferred taxes?

A: If you sell your home before repaying the deferred taxes, the amount owed will be taken from the proceeds of the sale.

Q: What happens if I pass away before repaying the deferred taxes?

A: If you pass away before repaying the deferred taxes, the amount owed will be taken from your estate before it is distributed to your heirs.