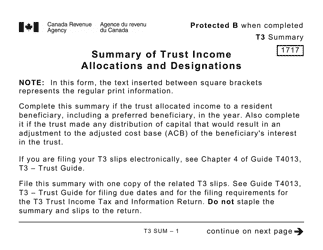

This version of the form is not currently in use and is provided for reference only. Download this version of

Form T3RET

for the current year.

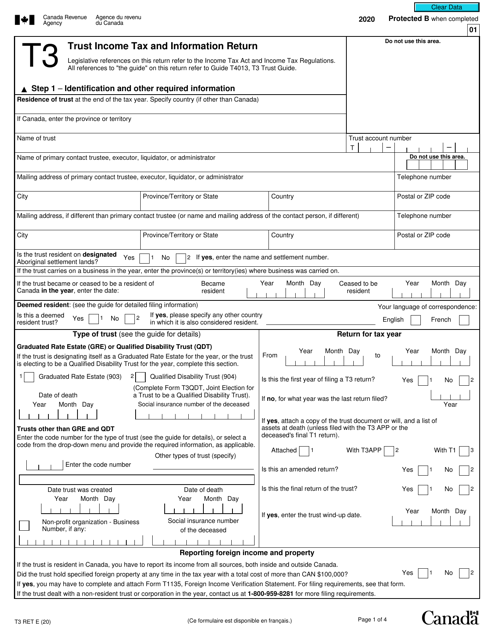

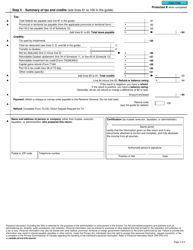

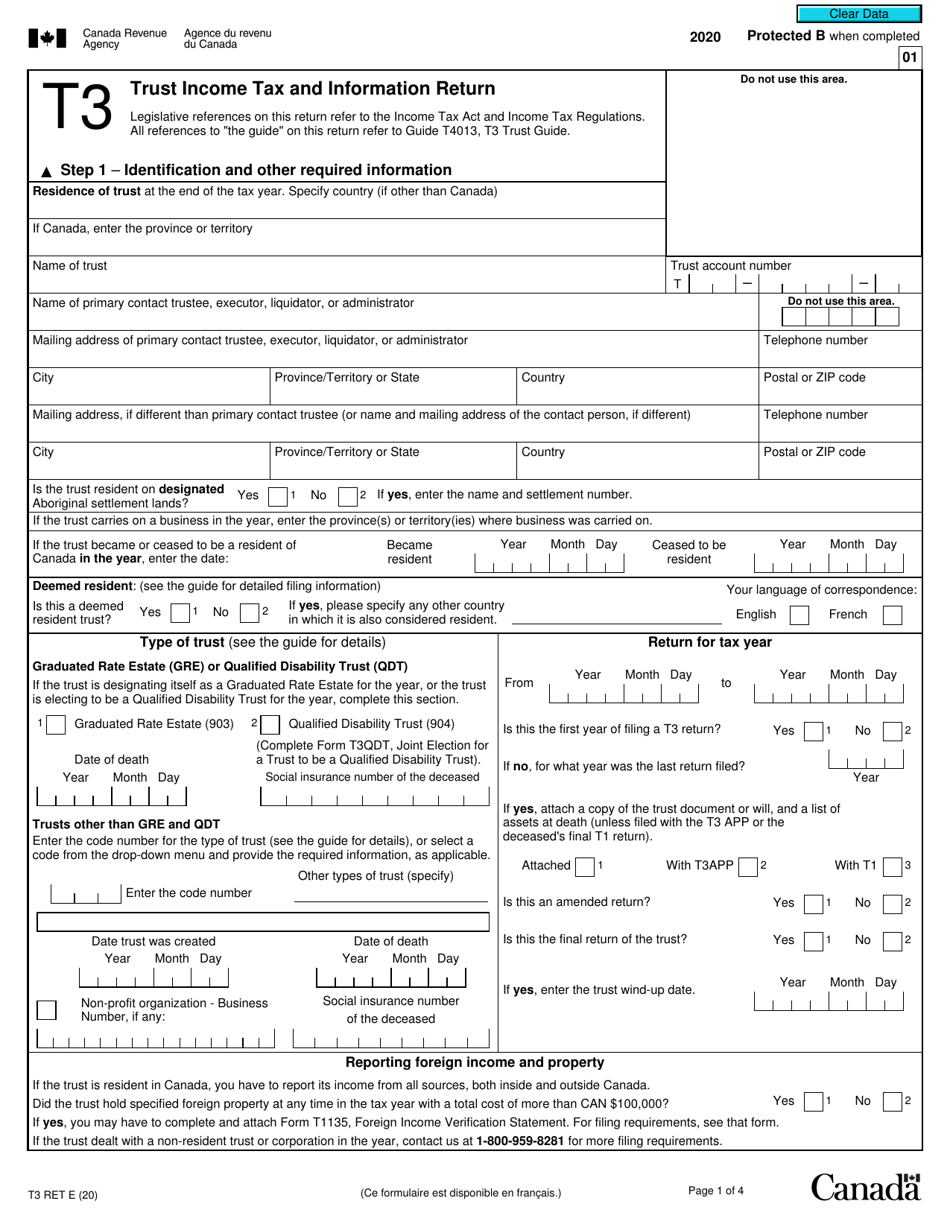

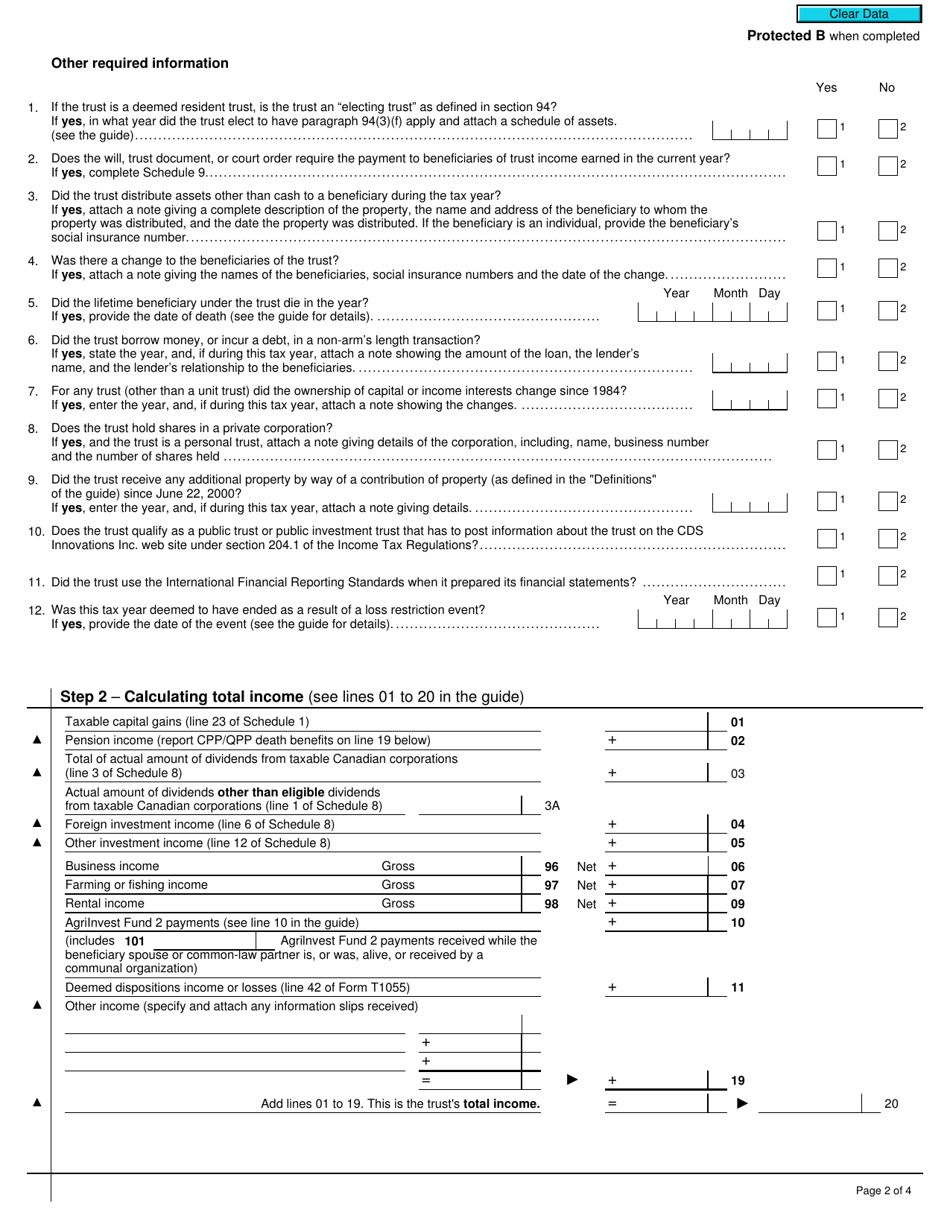

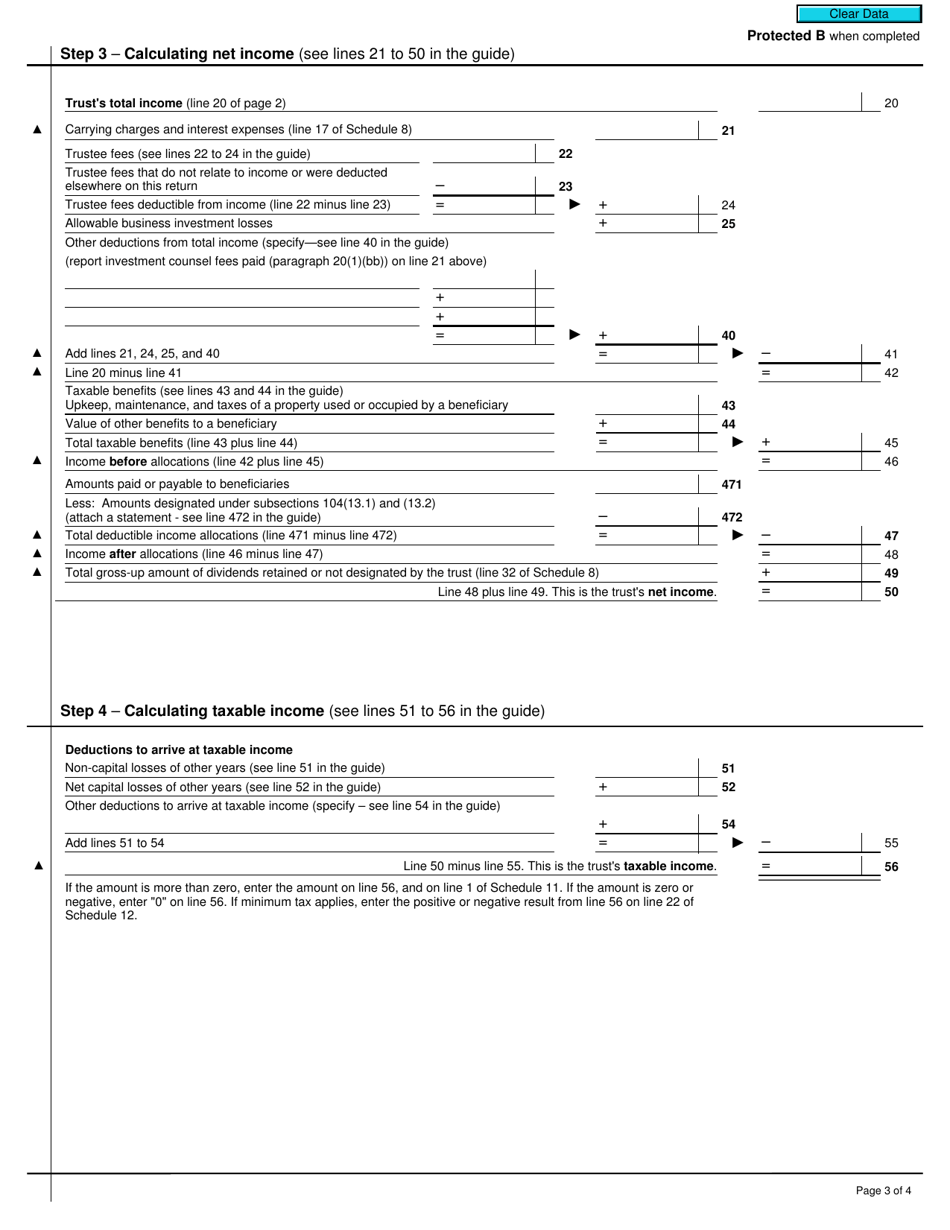

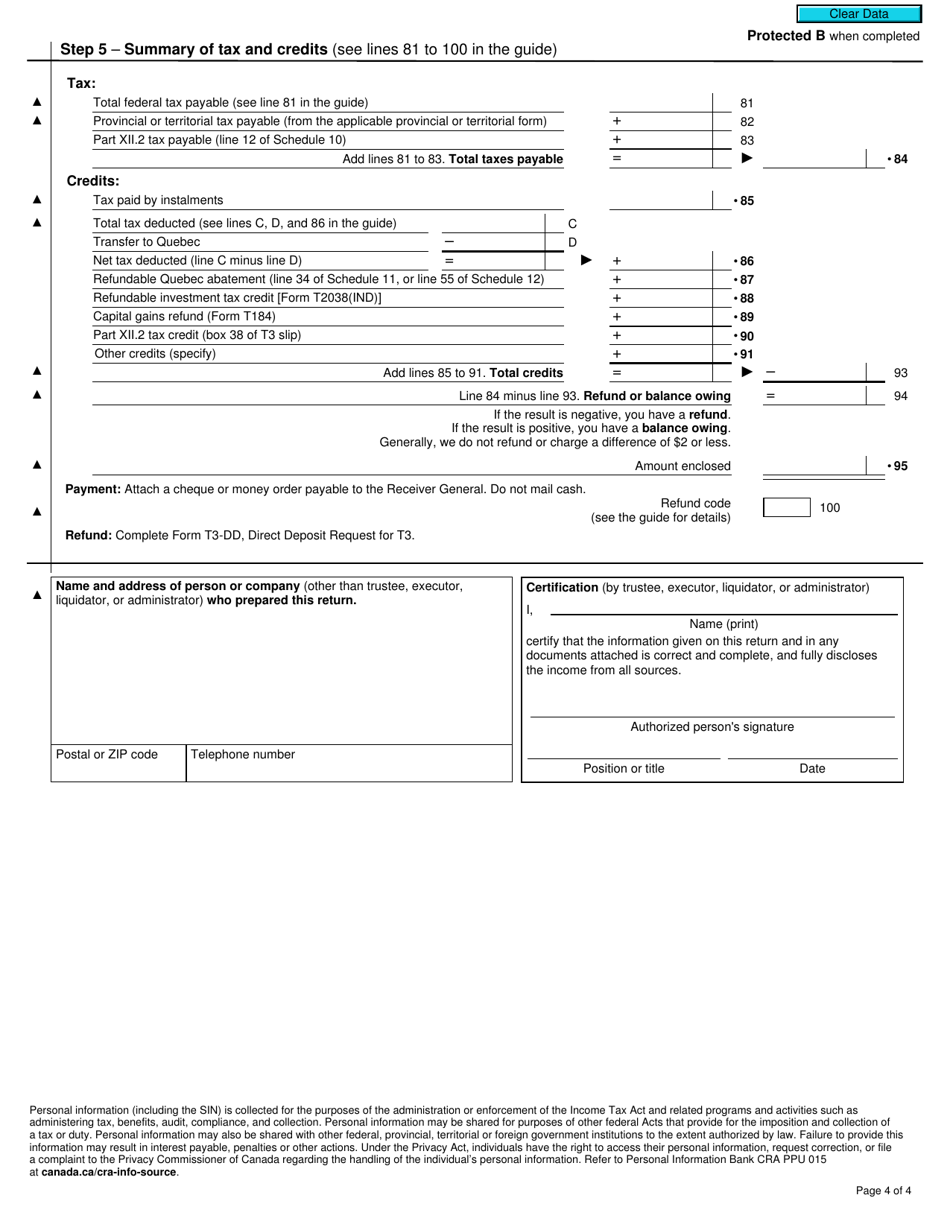

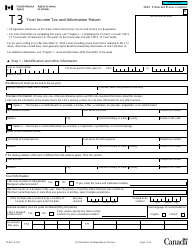

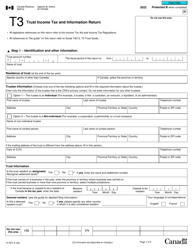

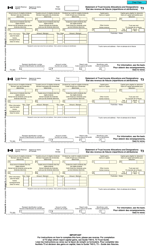

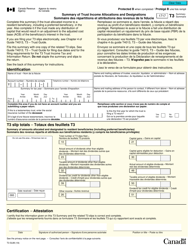

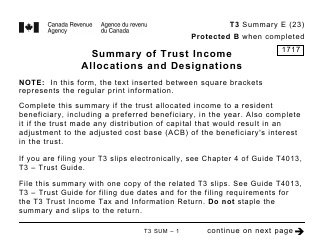

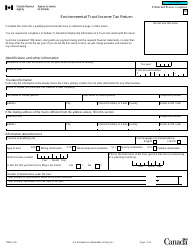

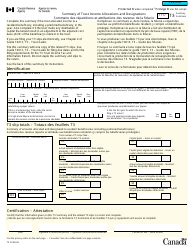

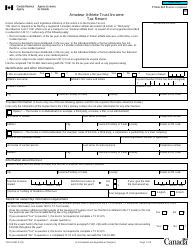

Form T3RET T3 Trust Income Tax and Information Return - Canada

Form T3RET T3 Trust Income Tax and Information Return is used by trusts in Canada to report their income, calculate their tax liability, and provide information about the trust's beneficiaries, activities, and investments. It is filed annually with the Canada Revenue Agency (CRA).

The executor or trustee of the trust files Form T3RET T3 Trust Income Tax and Information Return in Canada.

FAQ

Q: What is Form T3RET?

A: Form T3RET is the T3 Trust Income Tax and Information Return in Canada.

Q: Who needs to file Form T3RET?

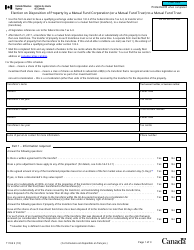

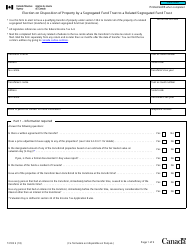

A: Trusts in Canada that have income or capital gains, or that have disposed of taxable Canadian property, are required to file Form T3RET.

Q: When is Form T3RET due?

A: Form T3RET is due within 90 days after the end of the trust's taxation year.

Q: Are there any penalties for late filing of Form T3RET?

A: Yes, there are penalties for late filing of Form T3RET. It is important to file the form on time to avoid any penalties.

Q: Is there a fee to file Form T3RET?

A: No, there is no fee to file Form T3RET.

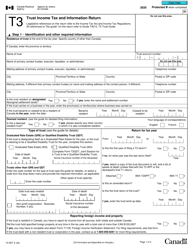

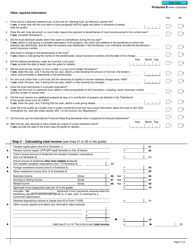

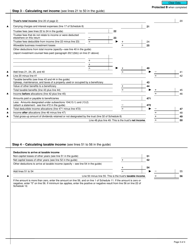

Q: What information is required on Form T3RET?

A: Form T3RET requires information about the trust, its income, expenses, and any capital gains or losses.

Q: Do I need to include supporting documents with Form T3RET?

A: Yes, you may need to include supporting documents depending on the information being reported on Form T3RET. Make sure to keep copies of all supporting documents for your records.

Q: Can I get an extension to file Form T3RET?

A: Yes, you can request an extension to file Form T3RET by contacting the CRA before the deadline.

Q: What are some common errors to avoid when filing Form T3RET?

A: Some common errors to avoid when filing Form T3RET include missing or incorrect information, miscalculations, and not including all necessary supporting documents.