This version of the form is not currently in use and is provided for reference only. Download this version of

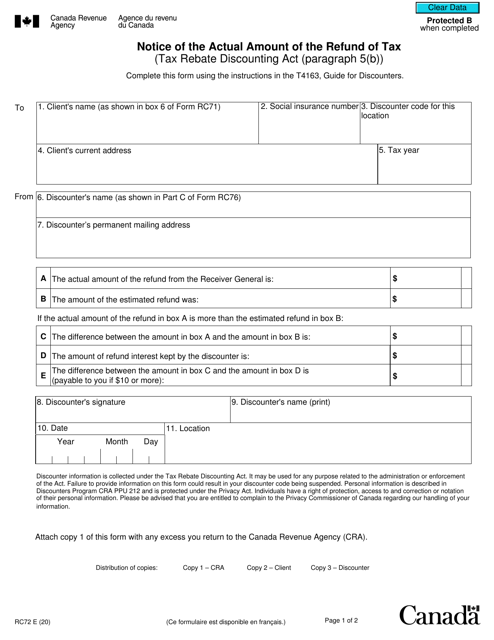

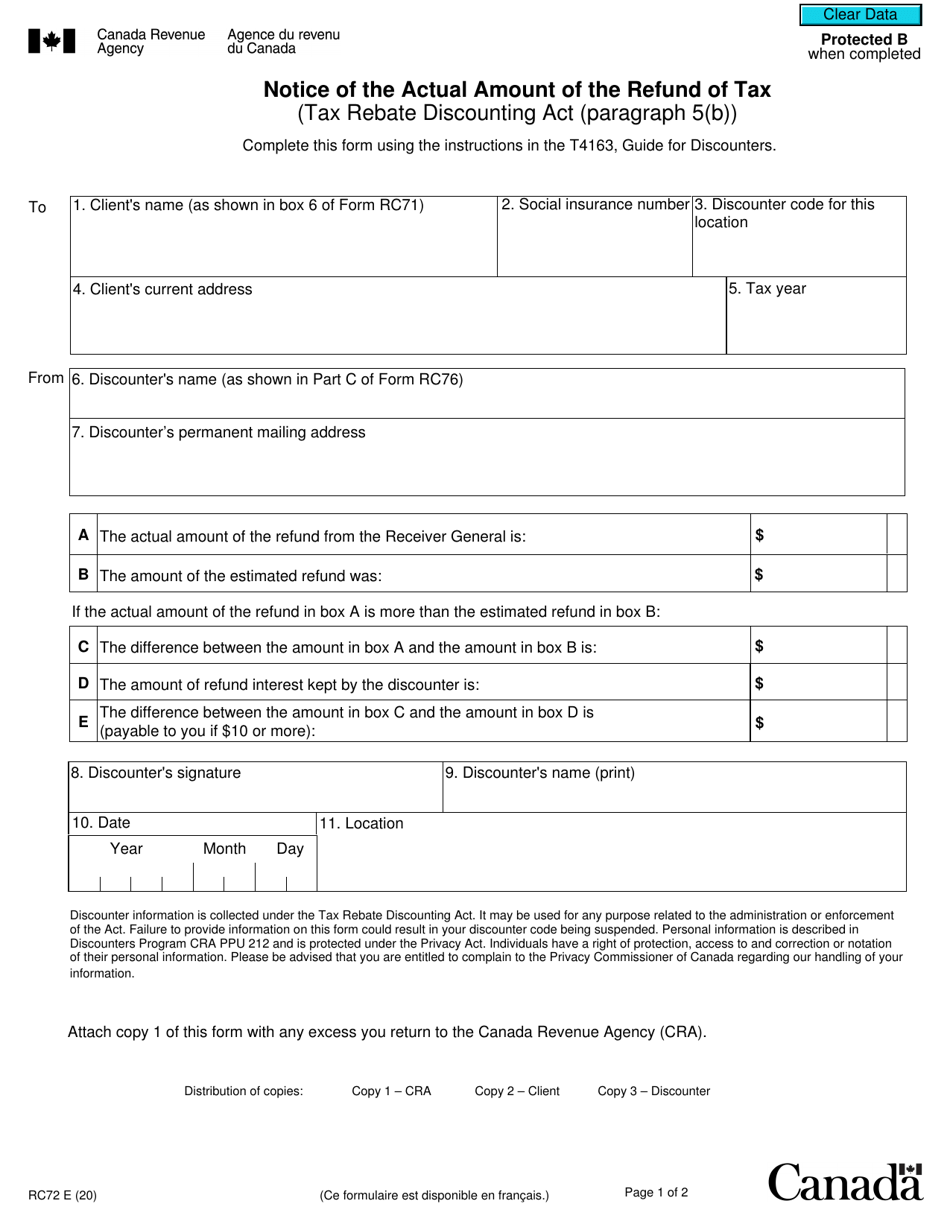

Form RC72

for the current year.

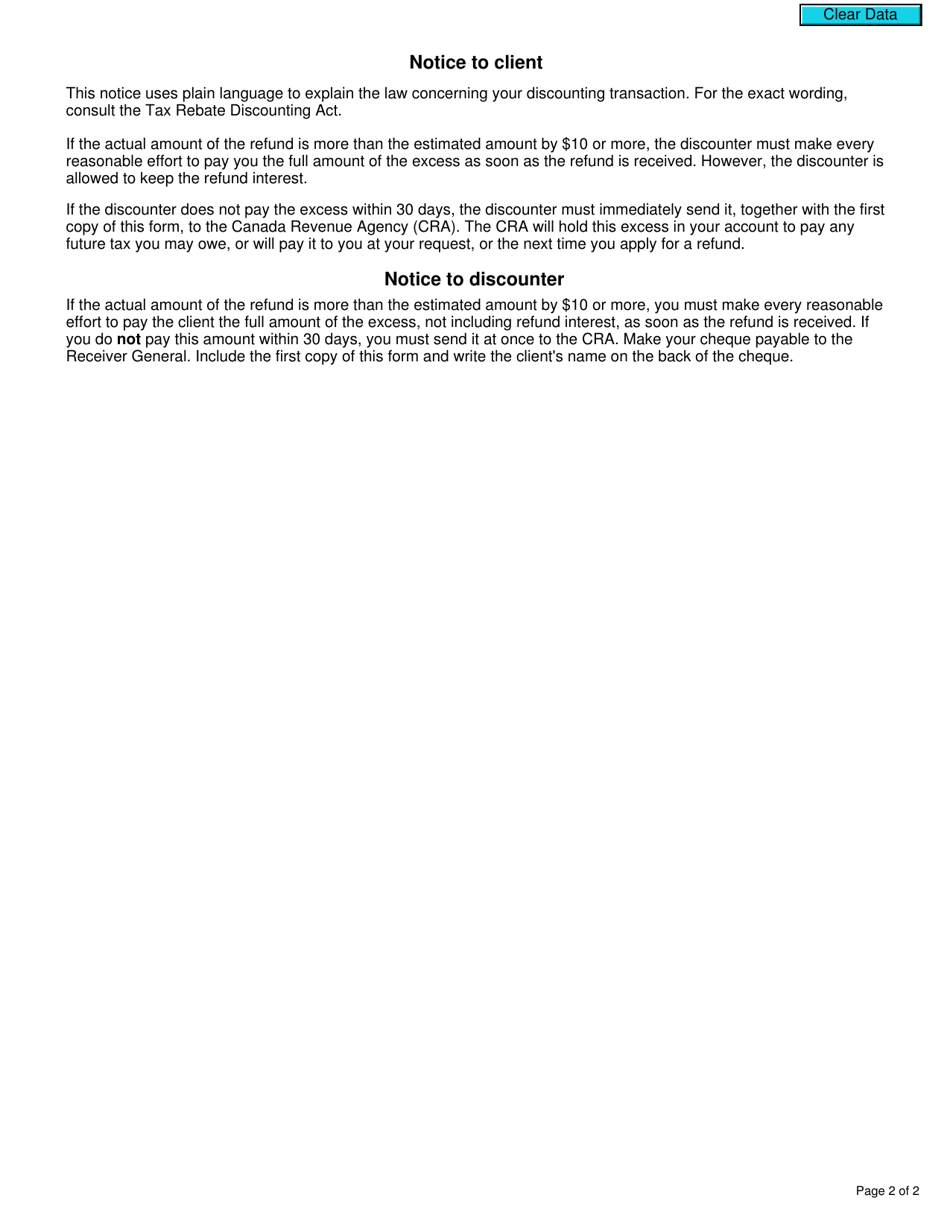

Form RC72 Notice of the Actual Amount of the Refund of Tax - Canada

Form RC72 Notice of the Actual Amount of the Refund of Tax - Canada is used to notify individuals about the final amount of their tax refund from the Canadian government.

The Form RC72 Notice of the Actual Amount of the Refund of Tax in Canada is filed by the Canada Revenue Agency (CRA).

FAQ

Q: What is Form RC72?

A: Form RC72 is a notice from the Canada Revenue Agency (CRA) that provides information about the actual amount of your tax refund.

Q: How do I receive Form RC72?

A: Form RC72 is typically issued by the CRA after they have processed your tax return and determined the amount of your refund.

Q: What information does Form RC72 contain?

A: Form RC72 contains details about the actual amount of your tax refund, including any adjustments or credits that may have been applied.

Q: What should I do with Form RC72?

A: You should review the information provided on Form RC72 and compare it to your own records. If you agree with the amount of the refund, no further action is needed. If you have any questions or believe there is an error, you should contact the CRA.

Q: Can I request a copy of Form RC72?

A: Yes, if you have misplaced or not received Form RC72, you can request a copy from the CRA.

Q: Is Form RC72 only used for tax refunds?

A: Yes, Form RC72 is specifically used to communicate the actual amount of a tax refund. Other forms may be used for different purposes, such as tax assessments or reassessments.