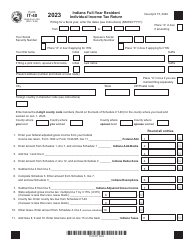

This version of the form is not currently in use and is provided for reference only. Download this version of

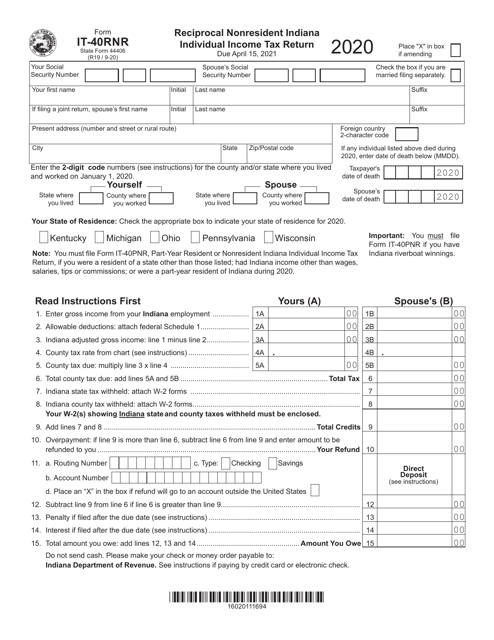

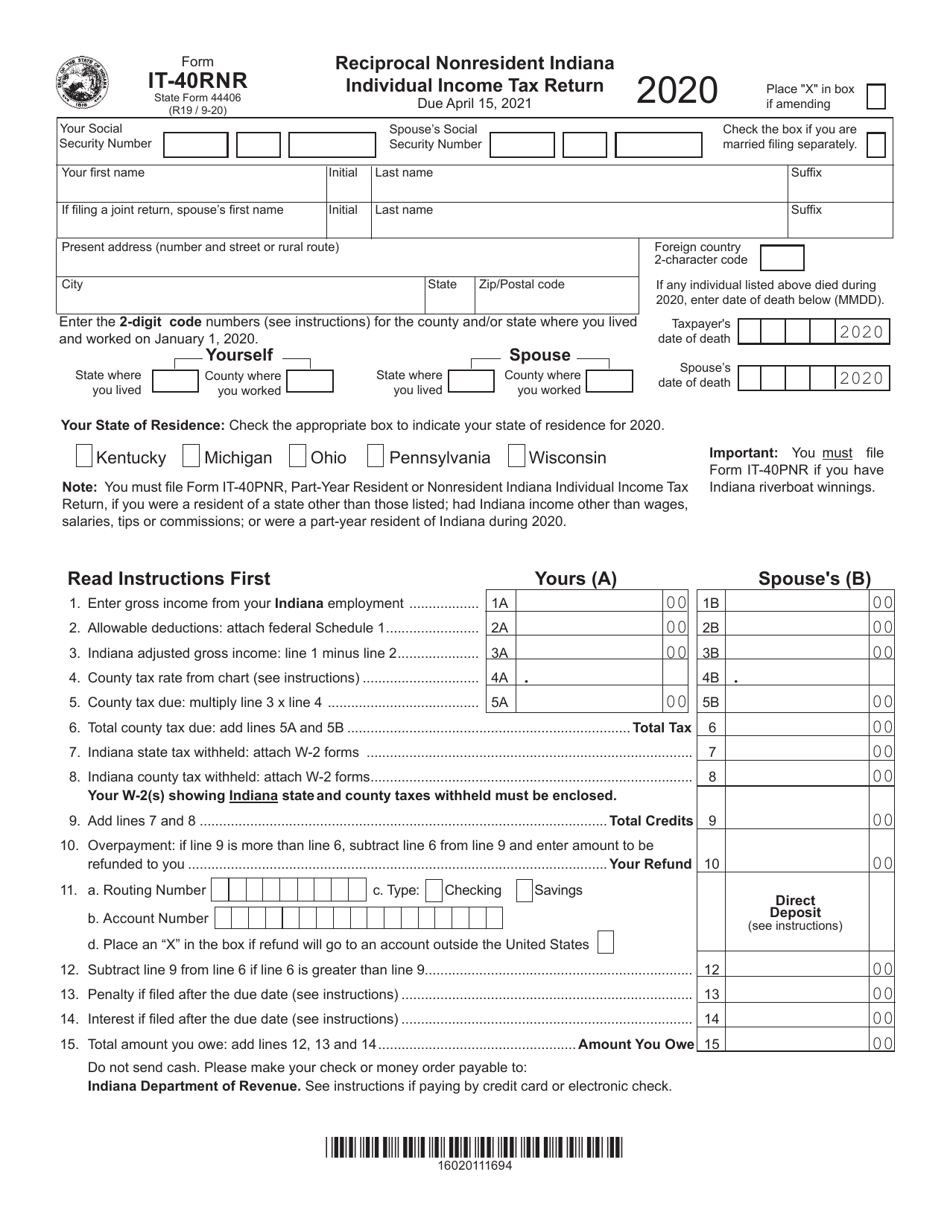

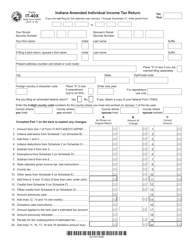

Form IT-40RNR (State Form 44406)

for the current year.

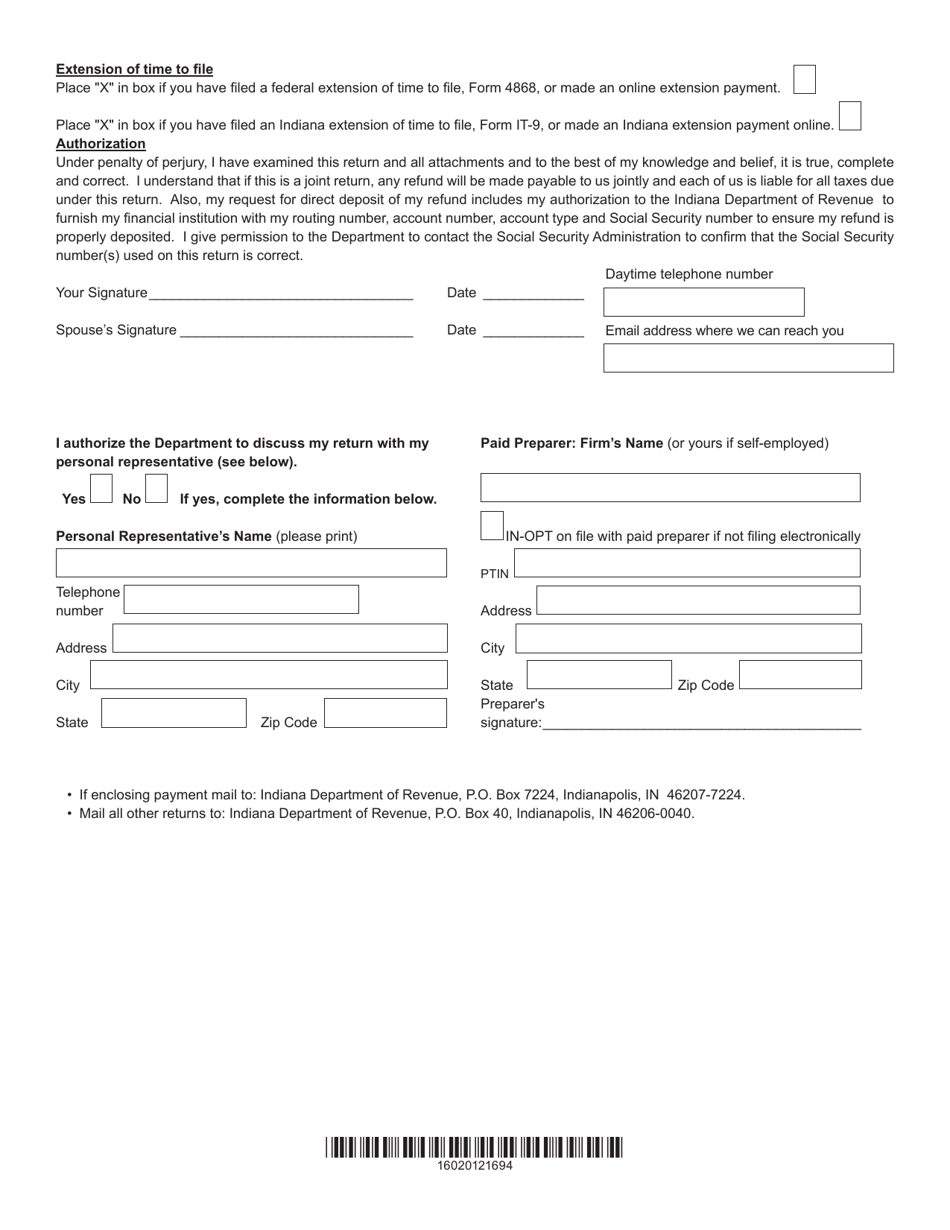

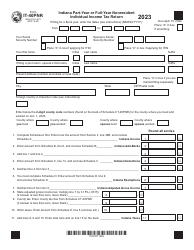

Form IT-40RNR (State Form 44406) Reciprocal Nonresident Indiana Individual Income Tax Return - Indiana

What Is Form IT-40RNR (State Form 44406)?

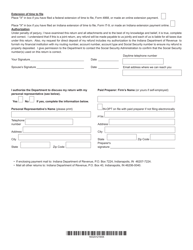

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-40RNR?

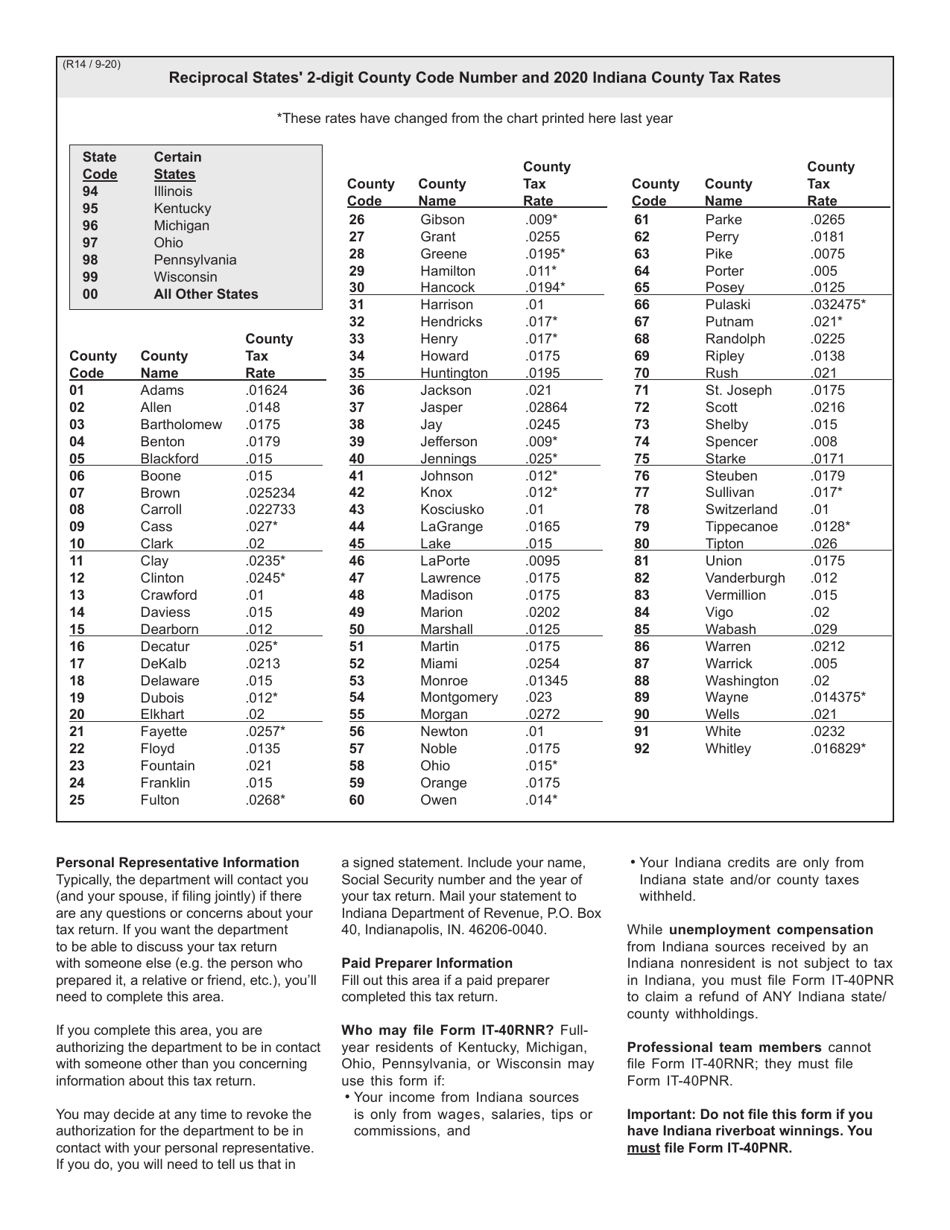

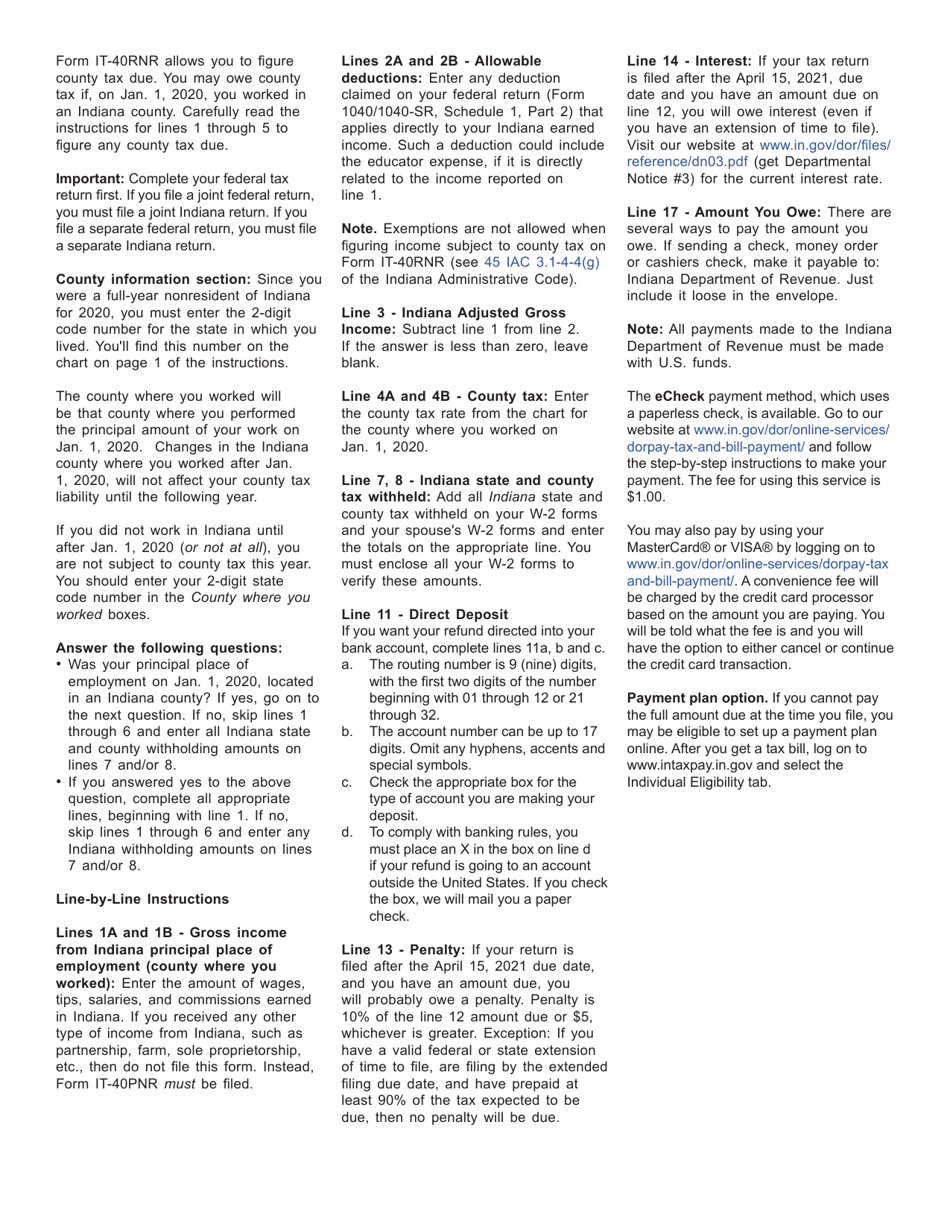

A: Form IT-40RNR is the Reciprocal Nonresident Indiana Individual Income Tax Return for Indiana residents who earned income in another state.

Q: Who needs to file Form IT-40RNR?

A: Indiana residents who earned income in another state and want to claim a credit for taxes paid to that state.

Q: What information do I need to complete Form IT-40RNR?

A: You will need information about your income earned in the other state, as well as any taxes paid to that state.

Q: When is the deadline to file Form IT-40RNR?

A: The deadline to file Form IT-40RNR is the same as the deadline for filing your federal income tax return, usually April 15th.

Q: Can I still claim a refund if I file Form IT-40RNR?

A: Yes, if you overpaid taxes to the other state, you may be eligible for a refund.

Q: Are there any penalties for not filing Form IT-40RNR?

A: Failure to file Form IT-40RNR may result in penalties and interest on your tax liability.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-40RNR (State Form 44406) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.