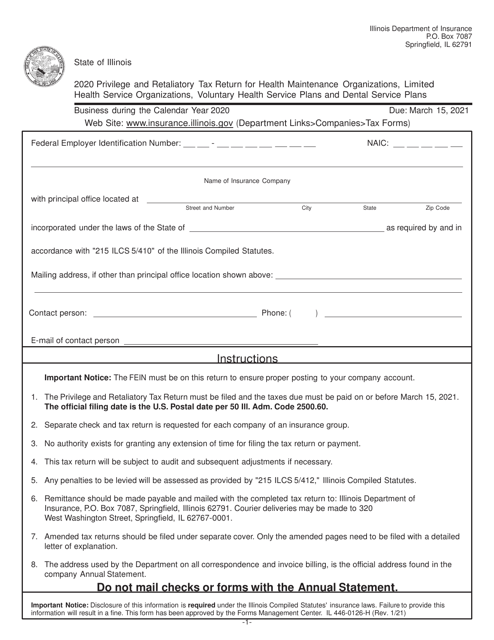

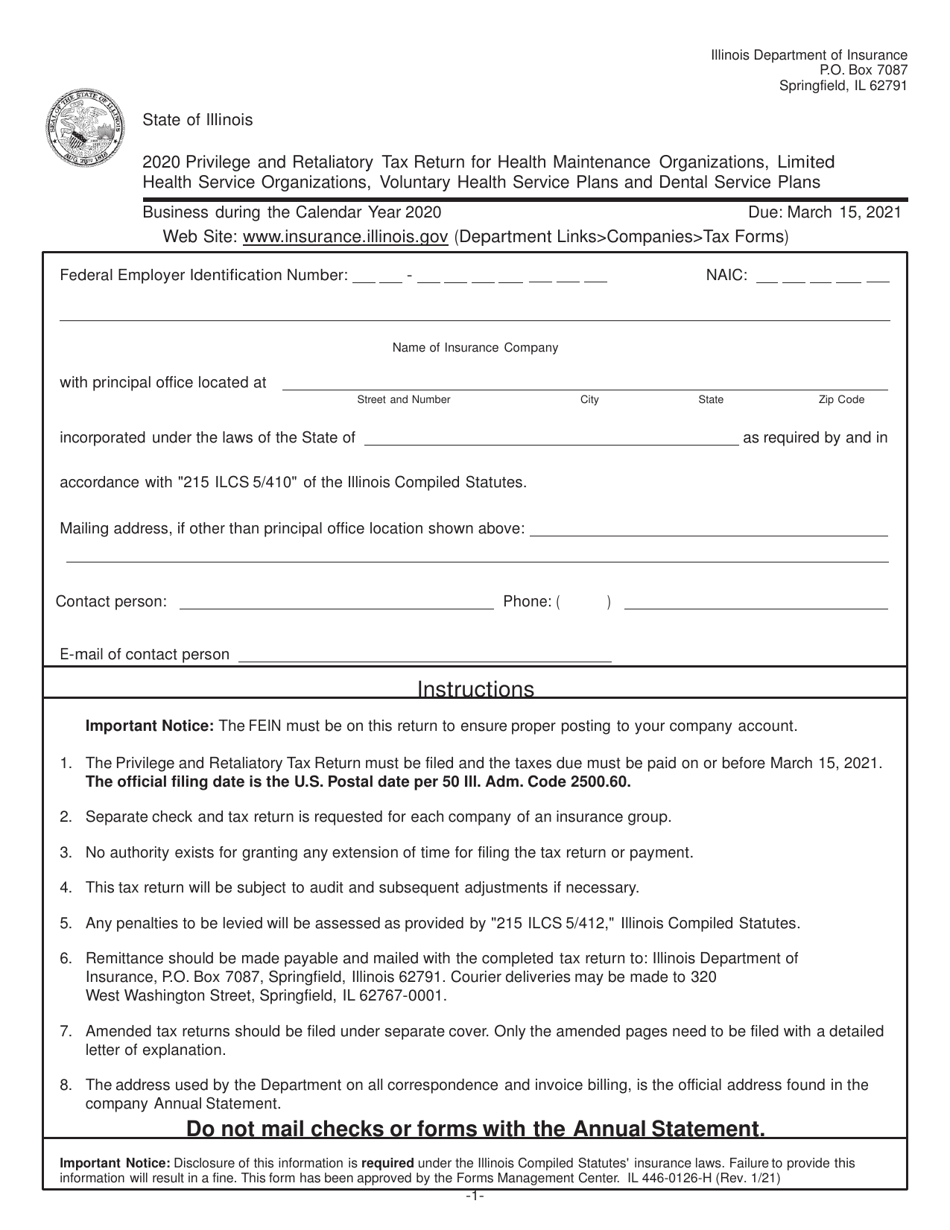

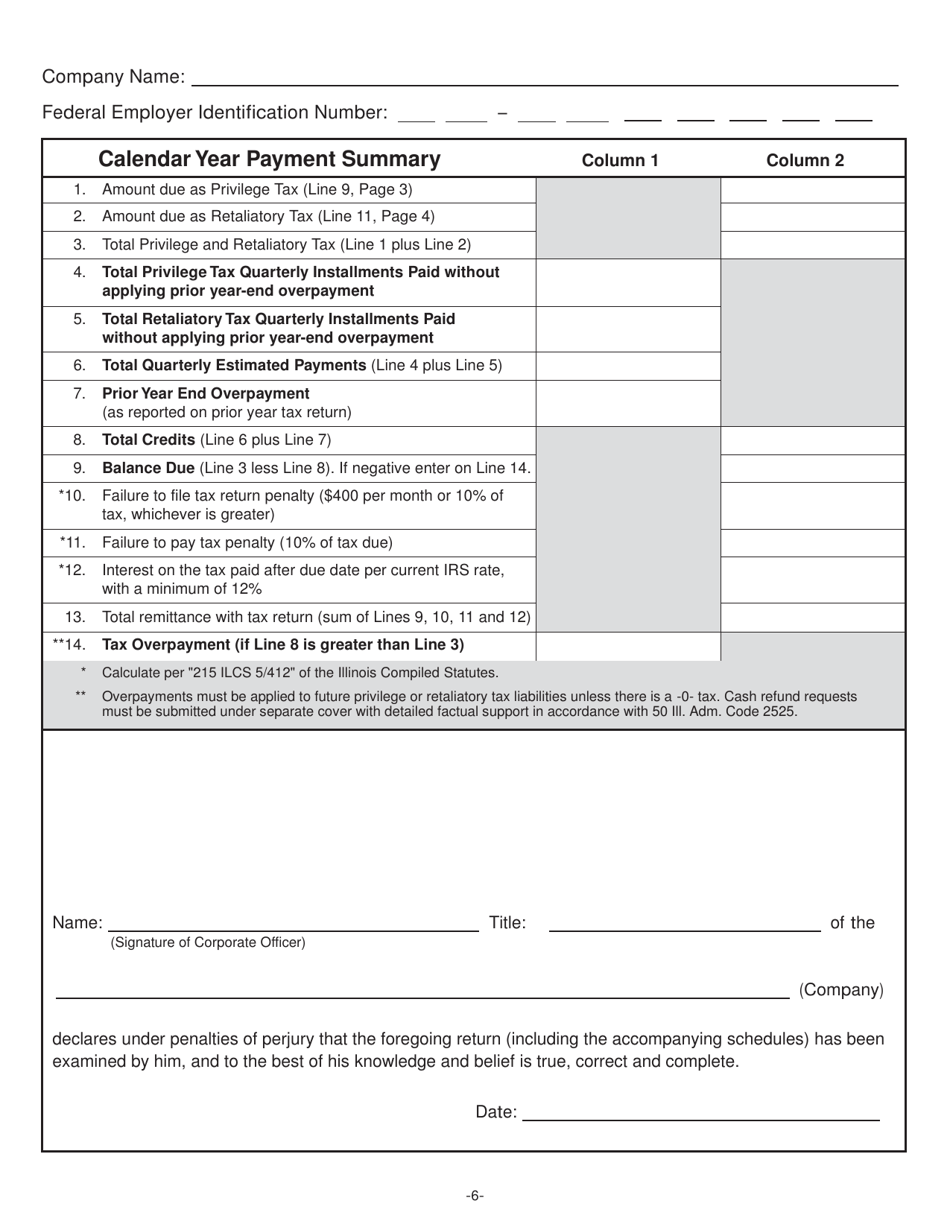

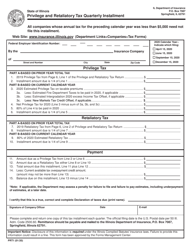

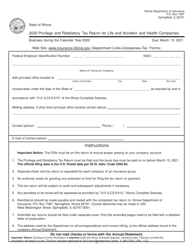

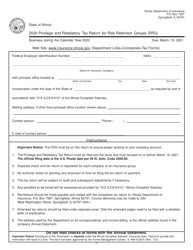

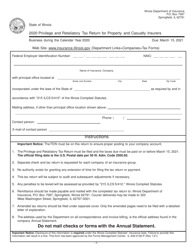

Form IL446-0126-H Privilege and Retaliatory Tax Return for Health Maintenance Organizations, Limited Health Service Organizations, Voluntary Health Service Plans and Dental Service Plans - Illinois

What Is Form IL446-0126-H?

This is a legal form that was released by the Illinois Department of Insurance - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL446-0126-H?

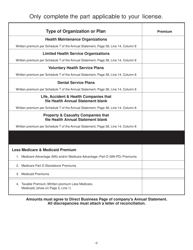

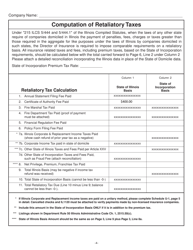

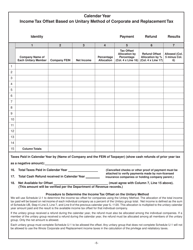

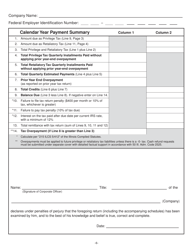

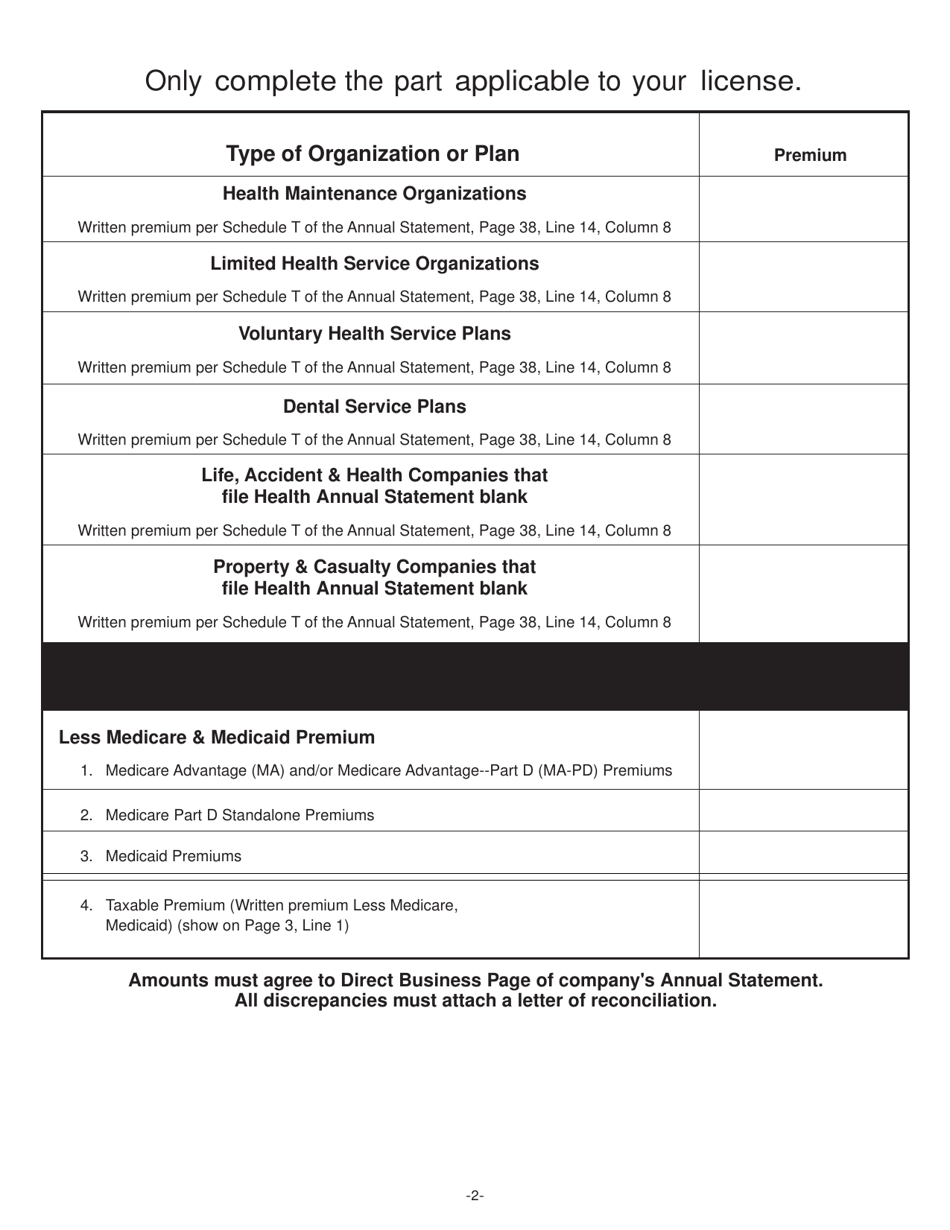

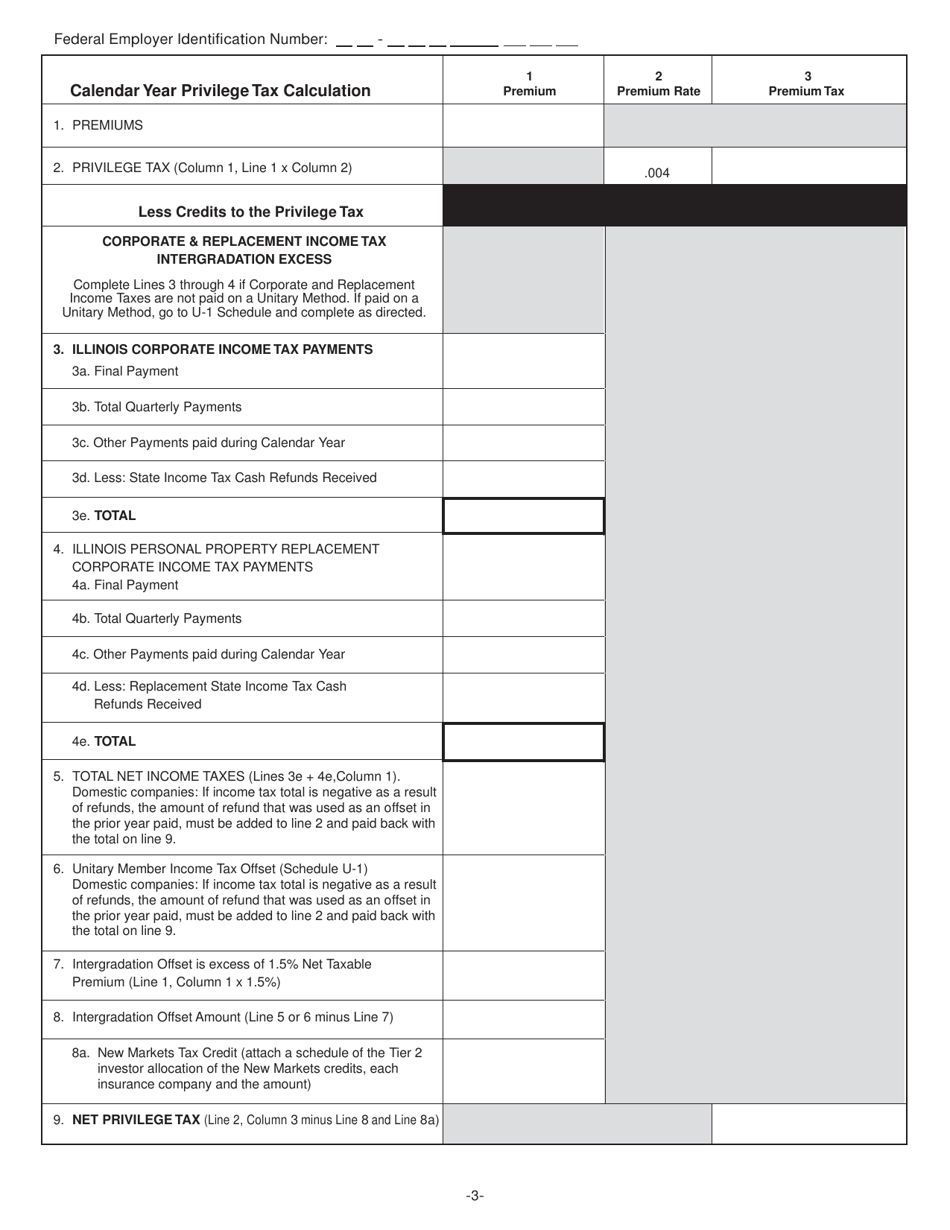

A: Form IL446-0126-H is a tax return form for Health Maintenance Organizations (HMOs), Limited Health Service Organizations (LHSOs), Voluntary Health Service Plans, and Dental Service Plans operating in Illinois.

Q: Who needs to file Form IL446-0126-H?

A: Health Maintenance Organizations (HMOs), Limited Health Service Organizations (LHSOs), Voluntary Health Service Plans, and Dental Service Plans operating in Illinois need to file Form IL446-0126-H.

Q: What is the purpose of Form IL446-0126-H?

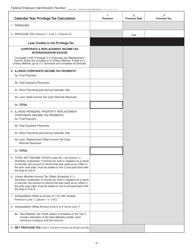

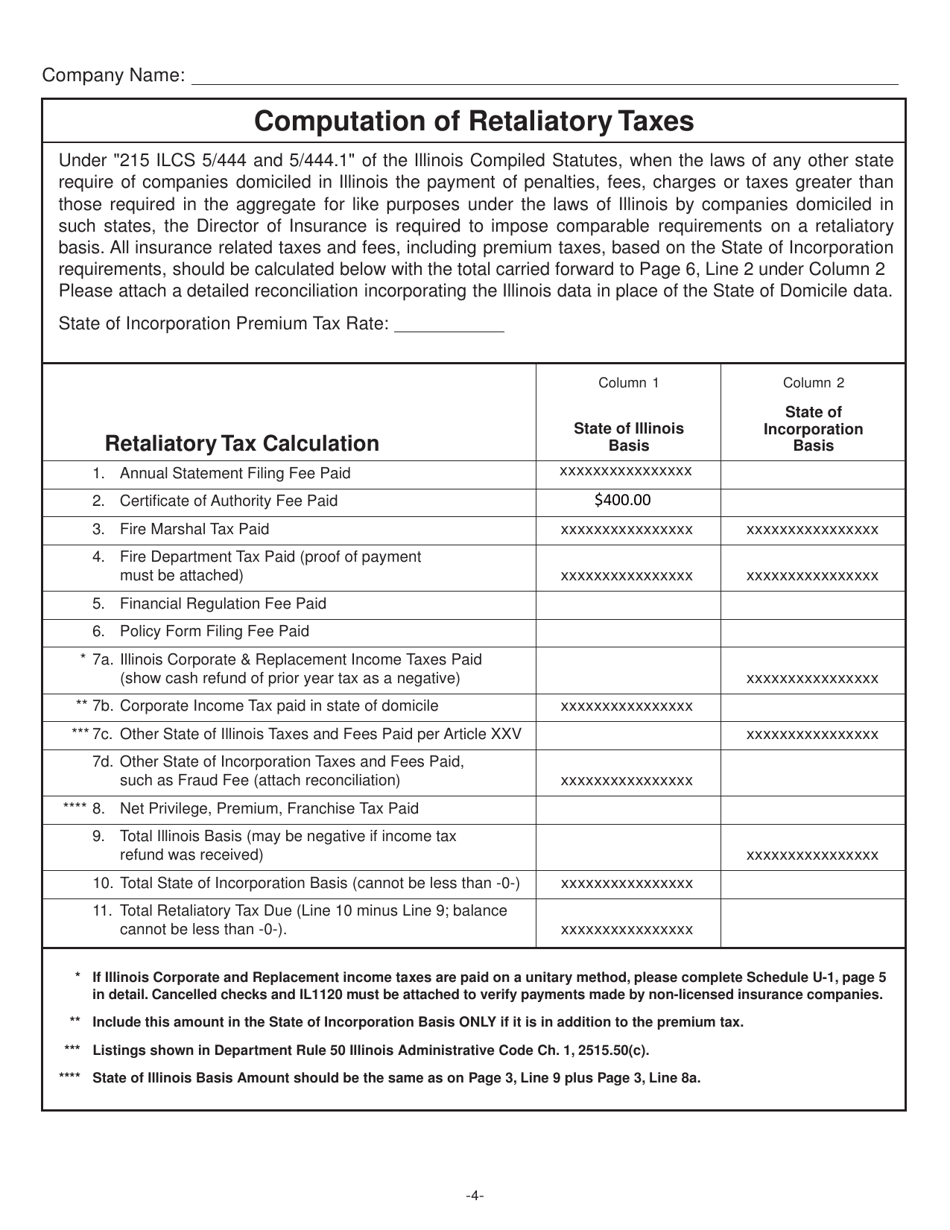

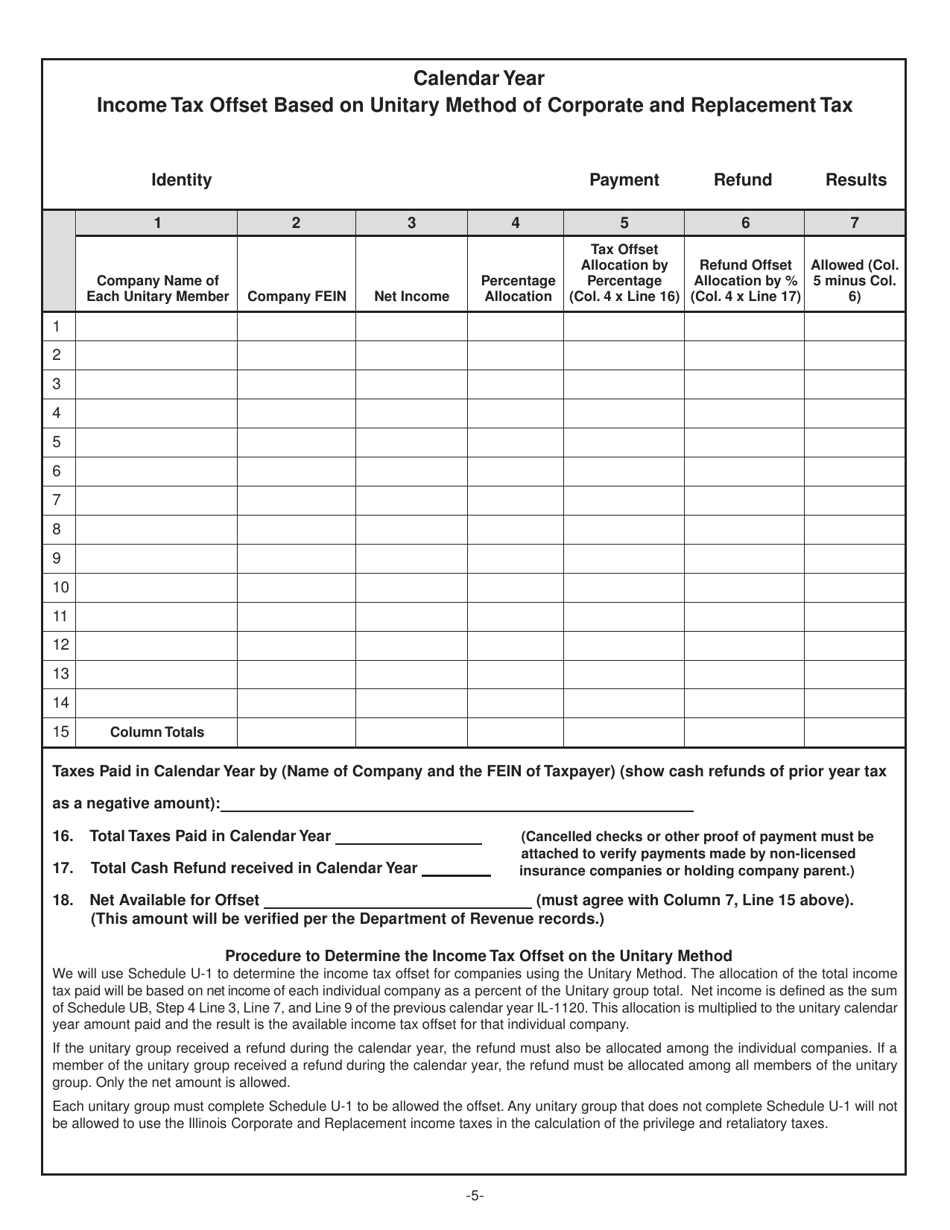

A: The purpose of Form IL446-0126-H is to report and pay the Privilege and Retaliatory Tax for HMOs, LHSOs, Voluntary Health Service Plans, and Dental Service Plans in Illinois.

Q: When is Form IL446-0126-H due?

A: Form IL446-0126-H is due on or before the 15th day of the 4th month following the end of the tax year.

Q: Are there any penalties for late filing or non-filing of Form IL446-0126-H?

A: Yes, there are penalties for late filing or non-filing of Form IL446-0126-H. It is important to file the form and make the tax payment on time to avoid penalties.

Q: What information is required to complete Form IL446-0126-H?

A: The form requires information such as the organization's name, address, federal identification number, tax year period, gross premiums, and calculation of the Privilege and Retaliatory Tax.

Q: Is there an extension available for filing Form IL446-0126-H?

A: Yes, an extension of time to file Form IL446-0126-H may be requested, but the tax payment is still due on the original due date.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL446-0126-H by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.