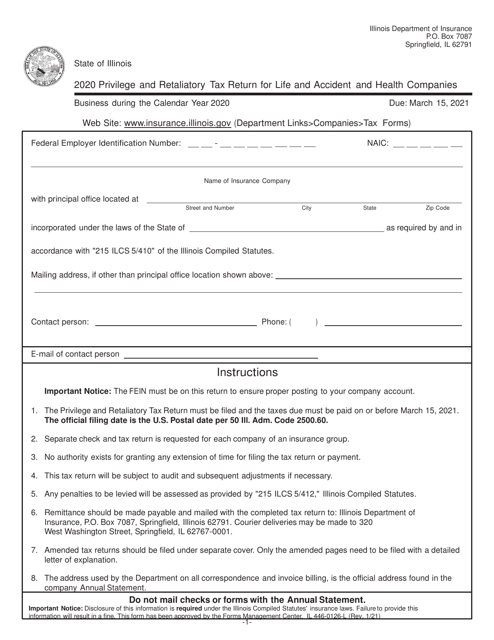

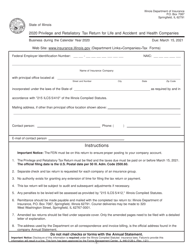

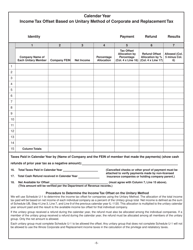

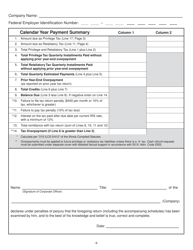

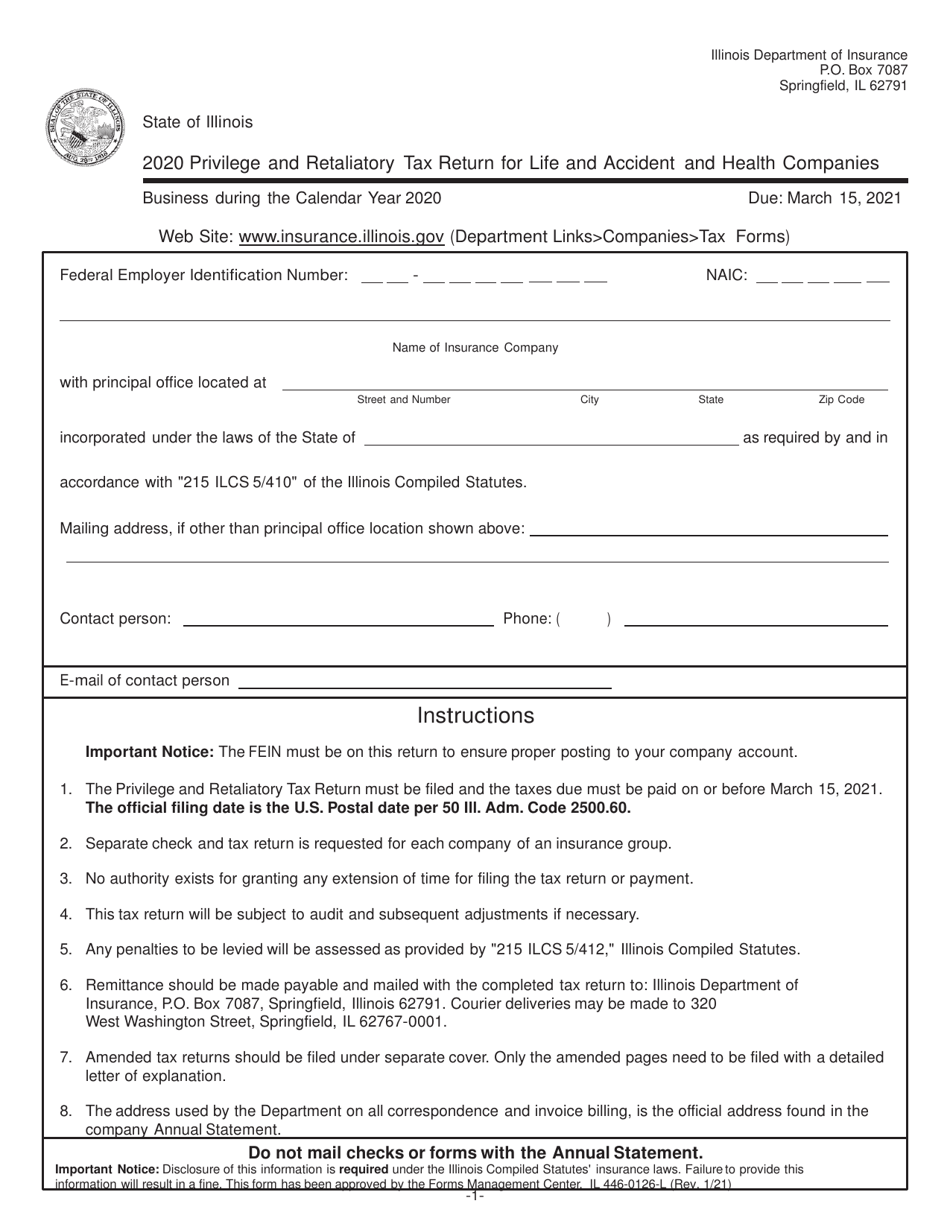

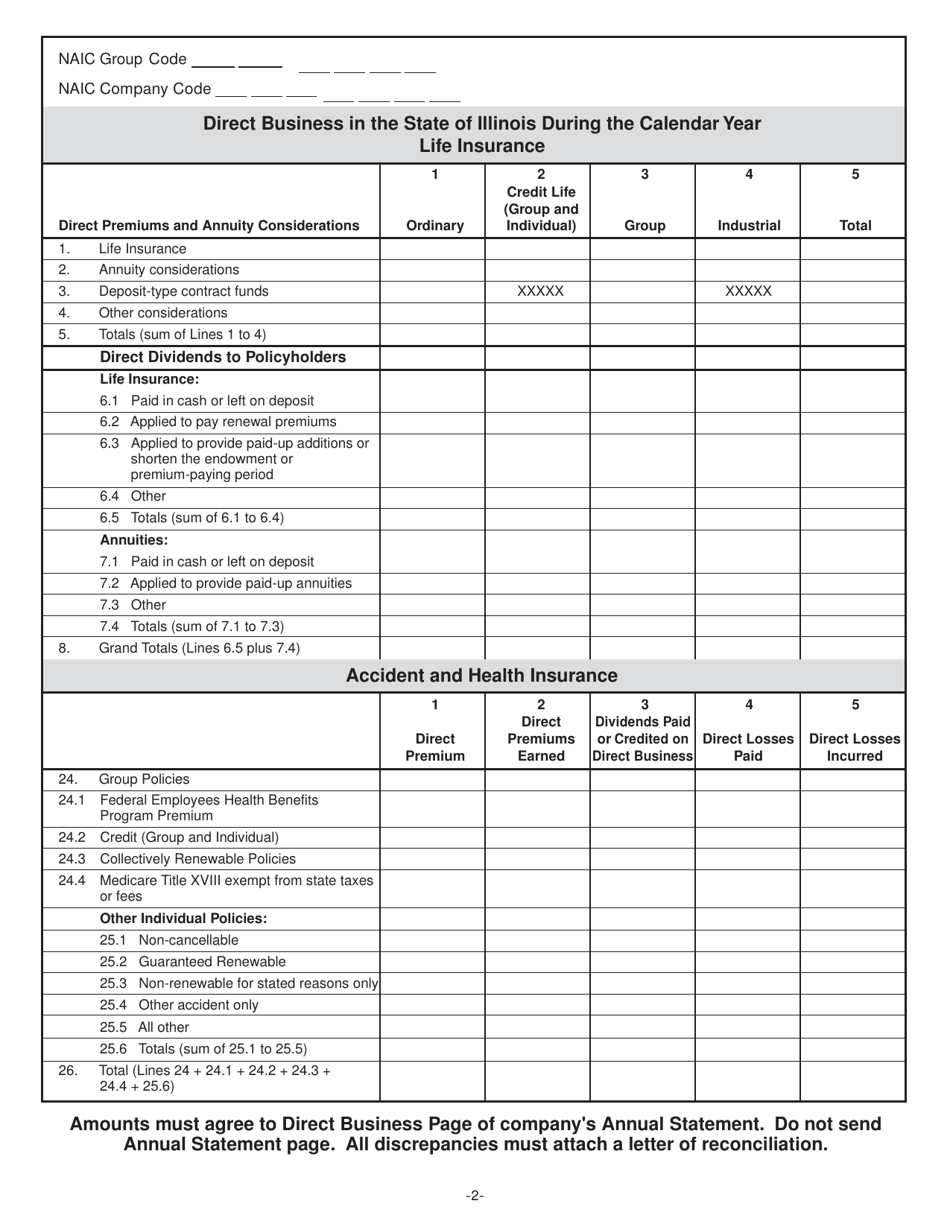

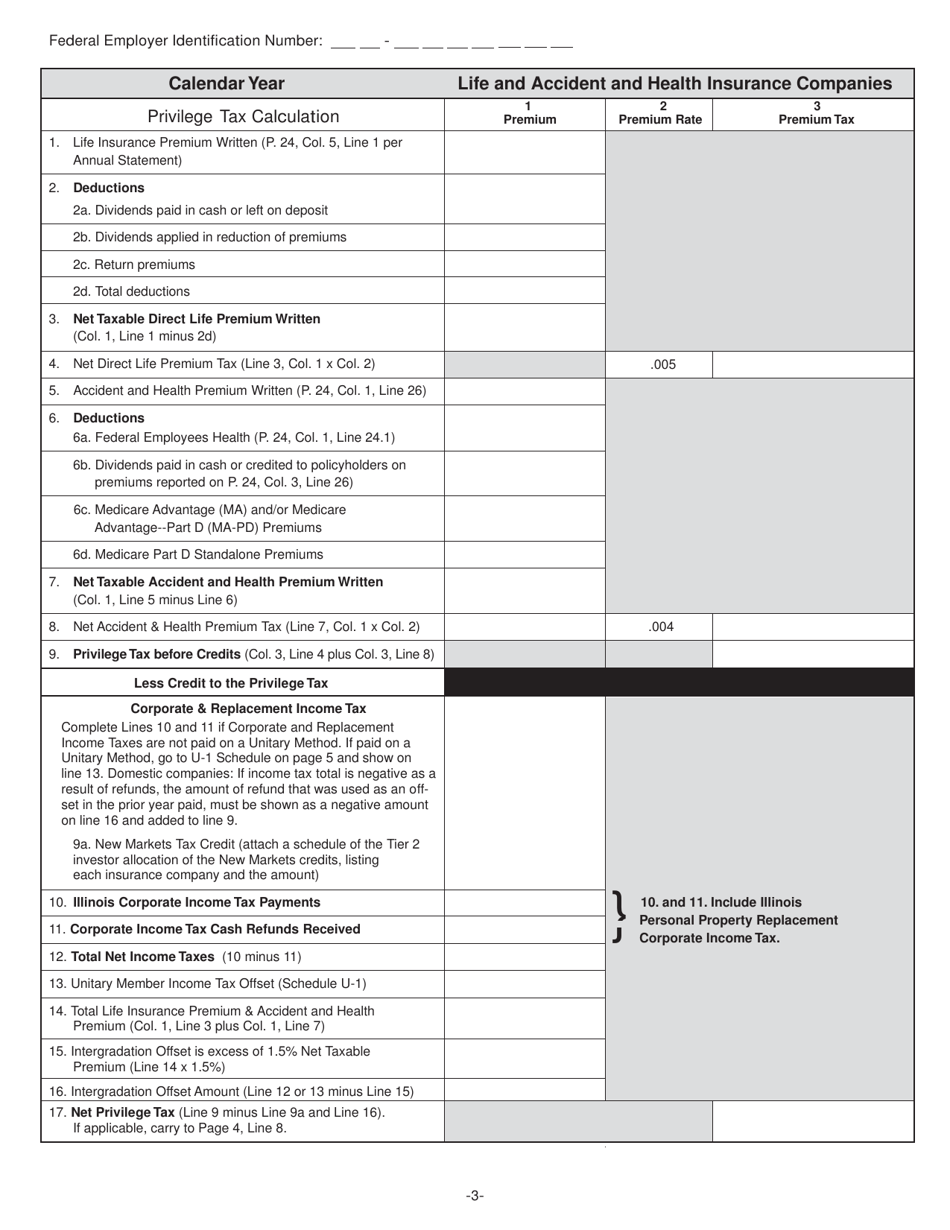

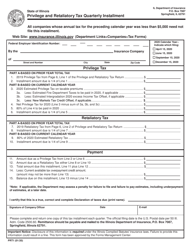

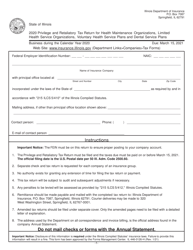

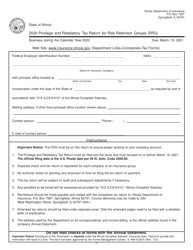

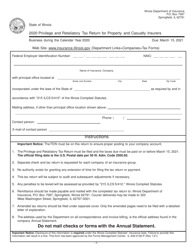

Form IL446-0126-L Privilege and Retaliatory Tax Return for Life and Accident and Health Companies - Illinois

What Is Form IL446-0126-L?

This is a legal form that was released by the Illinois Department of Insurance - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL446-0126-L?

A: Form IL446-0126-L is the Privilege and Retaliatory Tax Return for Life and Accident and Health Companies in Illinois.

Q: Who needs to file Form IL446-0126-L?

A: Life and Accident and Health Companies in Illinois need to file Form IL446-0126-L.

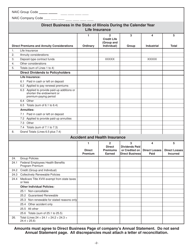

Q: What is the purpose of Form IL446-0126-L?

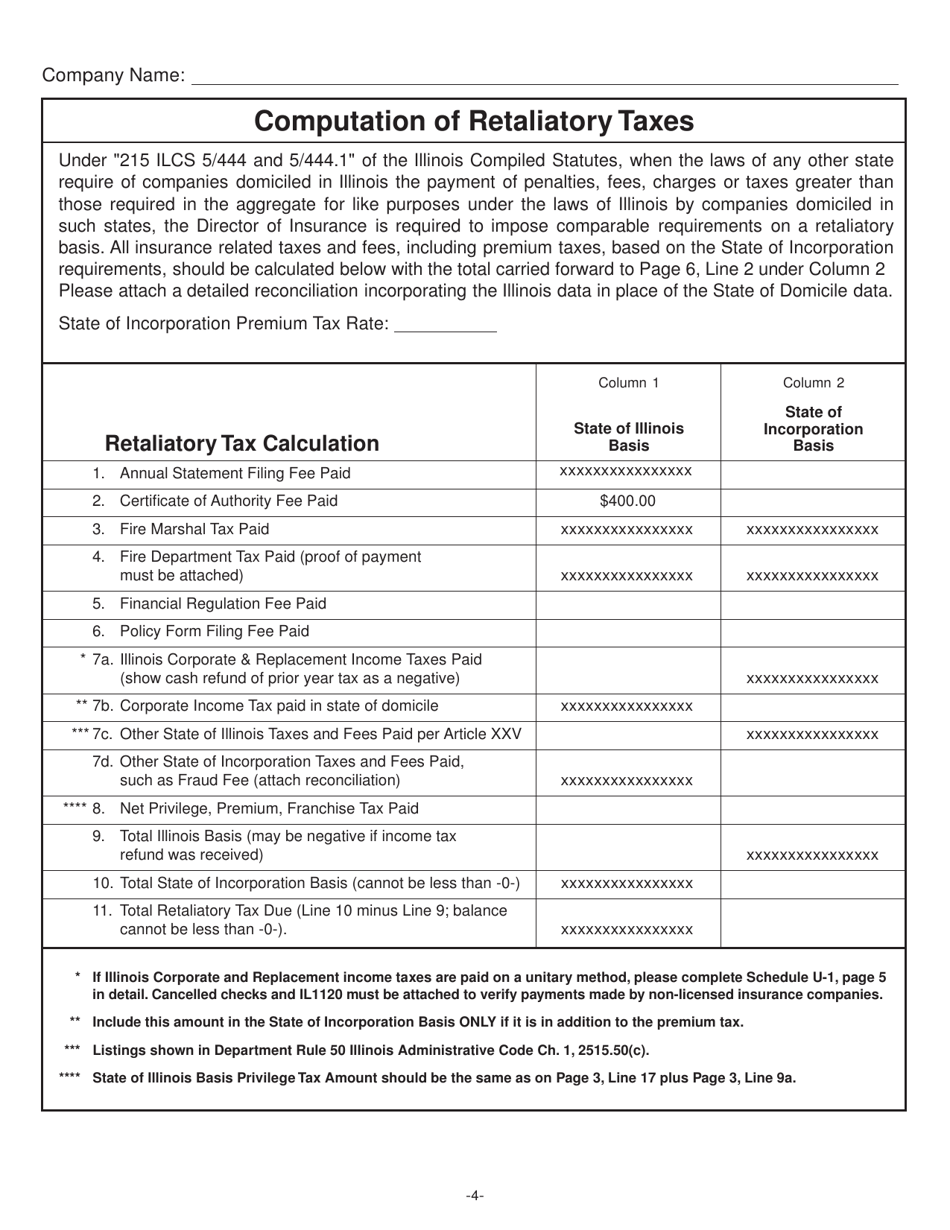

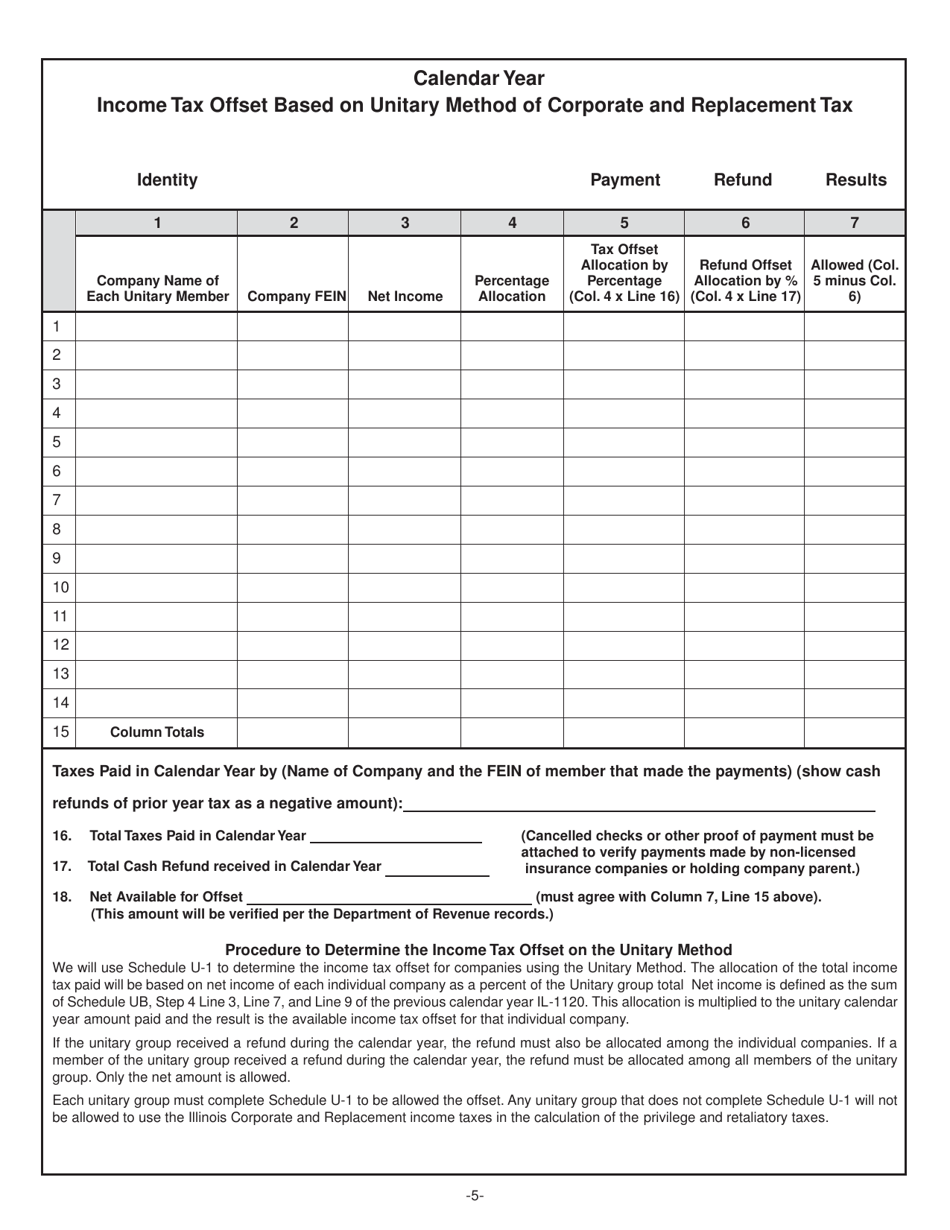

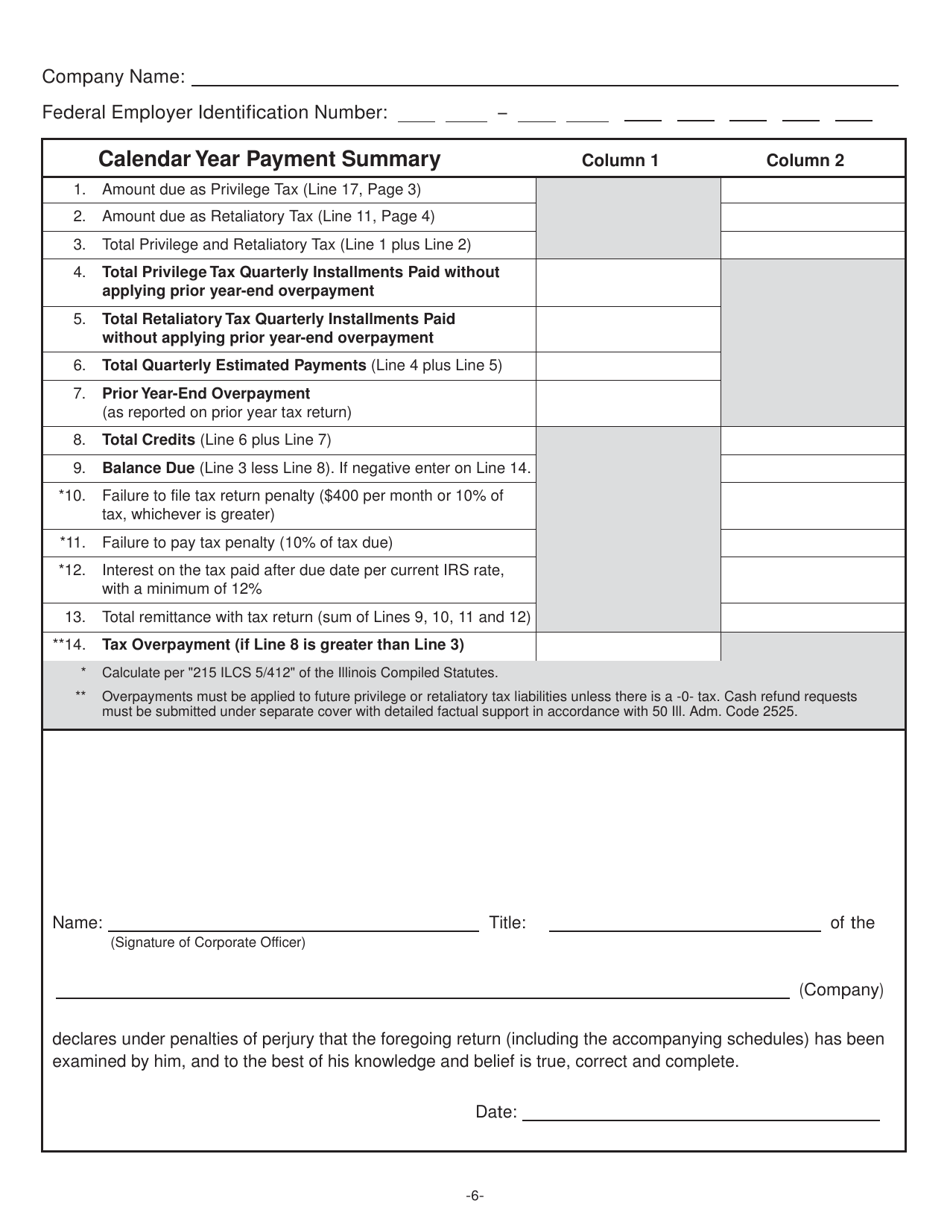

A: The purpose of Form IL446-0126-L is to report and pay the privilege and retaliatory taxes for Life and Accident and Health Companies in Illinois.

Q: When is the deadline to file Form IL446-0126-L?

A: The deadline to file Form IL446-0126-L is usually April 15th.

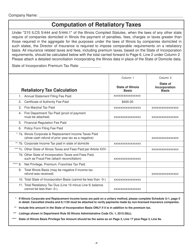

Q: What are privilege and retaliatory taxes?

A: Privilege and retaliatory taxes are taxes imposed on insurance companies for the privilege of conducting business in a state and in retaliation for similar taxes imposed by other states on companies incorporated in the taxing state.

Q: Are there any penalties for late filing of Form IL446-0126-L?

A: Yes, there may be penalties for late filing of Form IL446-0126-L. It is important to file the form on time to avoid penalties.

Q: Is Form IL446-0126-L applicable to all insurance companies?

A: No, Form IL446-0126-L is specifically for Life and Accident and Health Companies in Illinois.

Q: Are there any exemptions or deductions available on Form IL446-0126-L?

A: There may be exemptions or deductions available on Form IL446-0126-L. It is recommended to review the instructions for the form or consult with a tax professional for more information.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL446-0126-L by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.