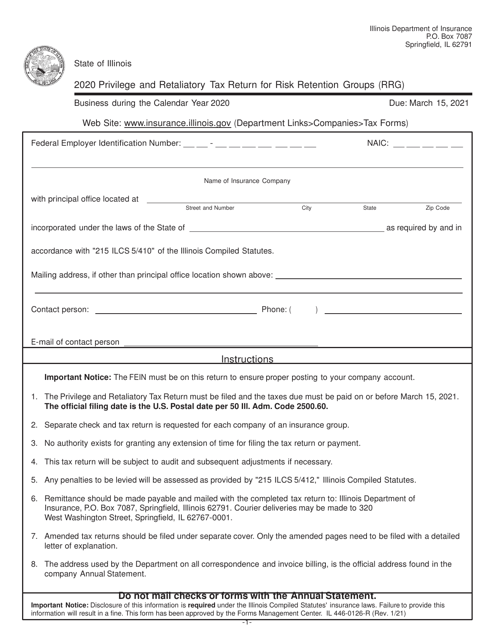

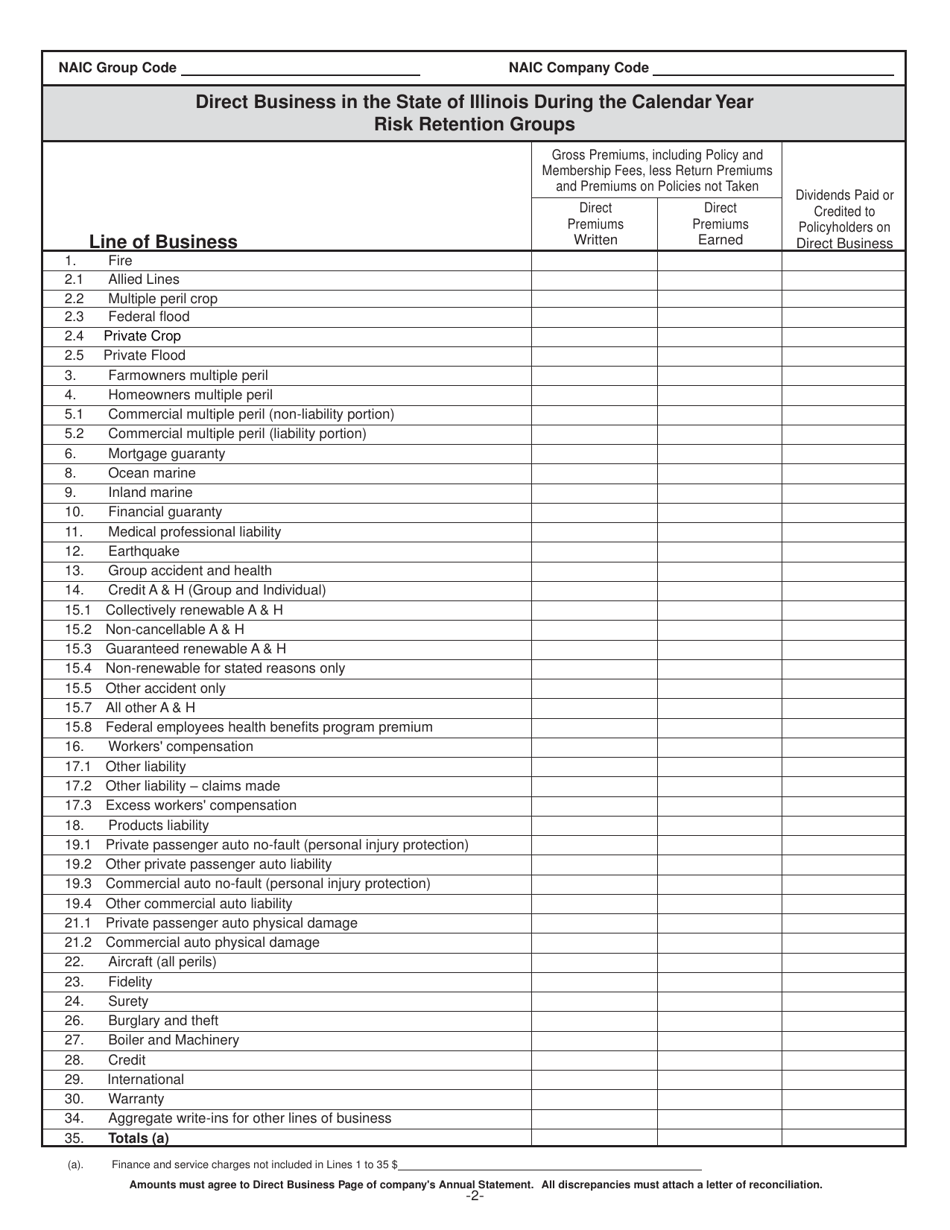

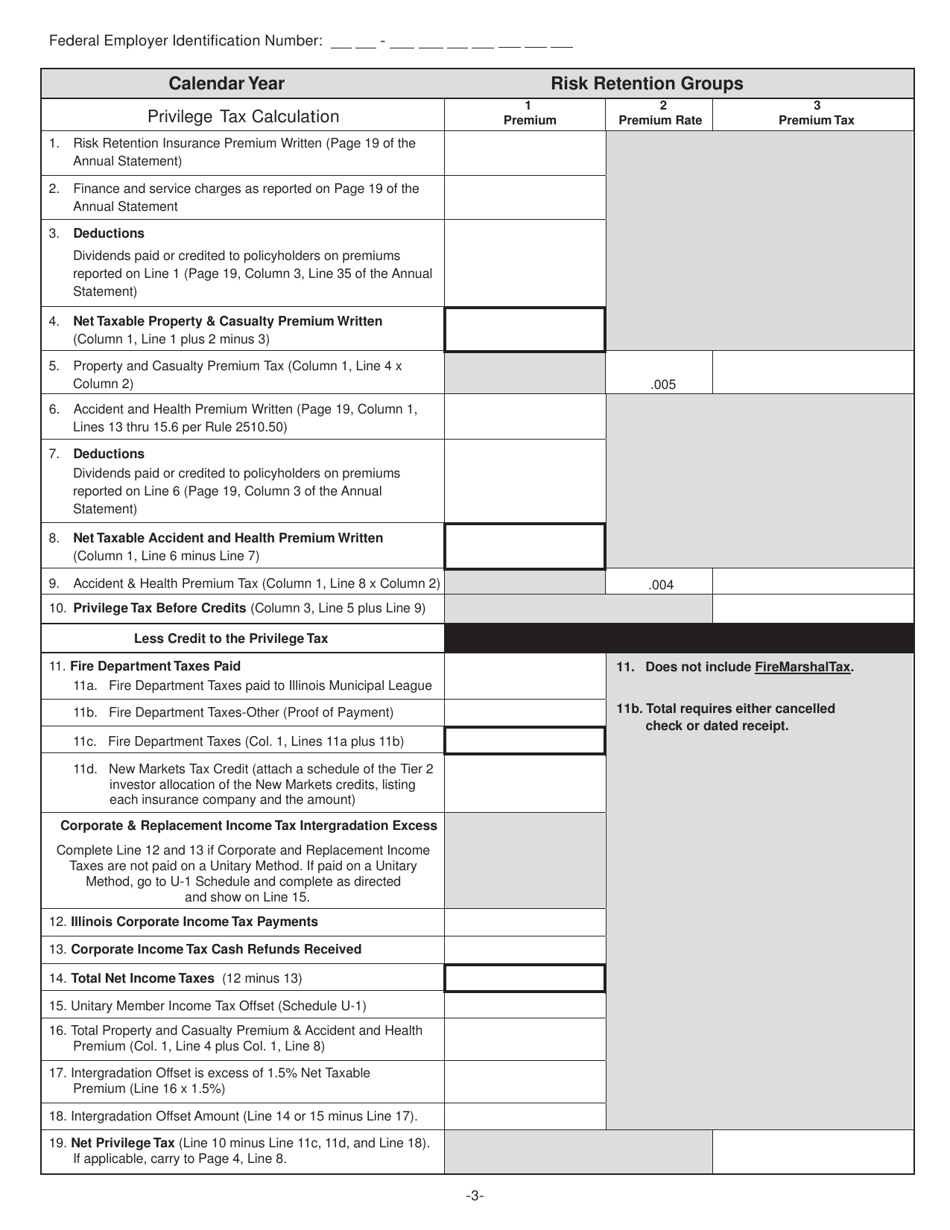

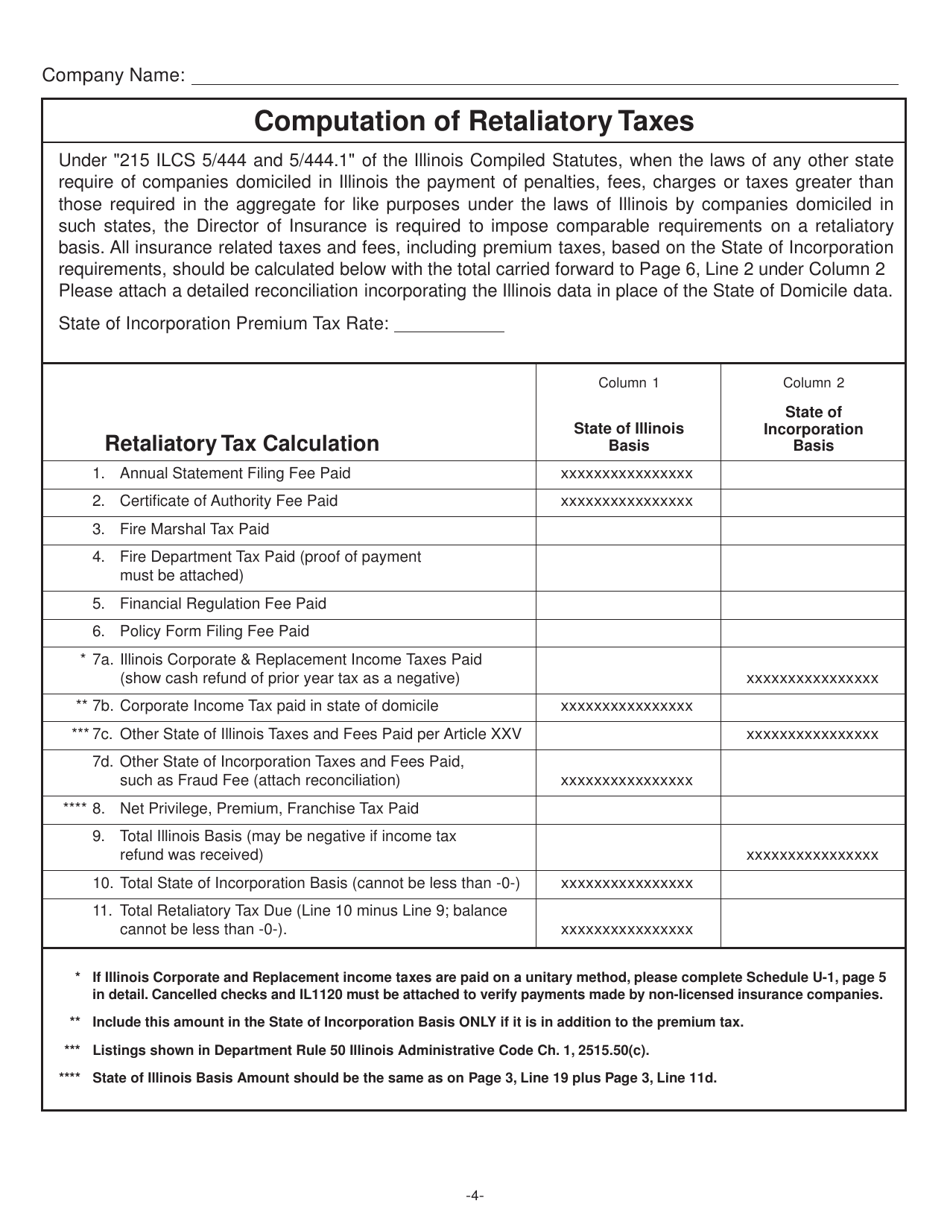

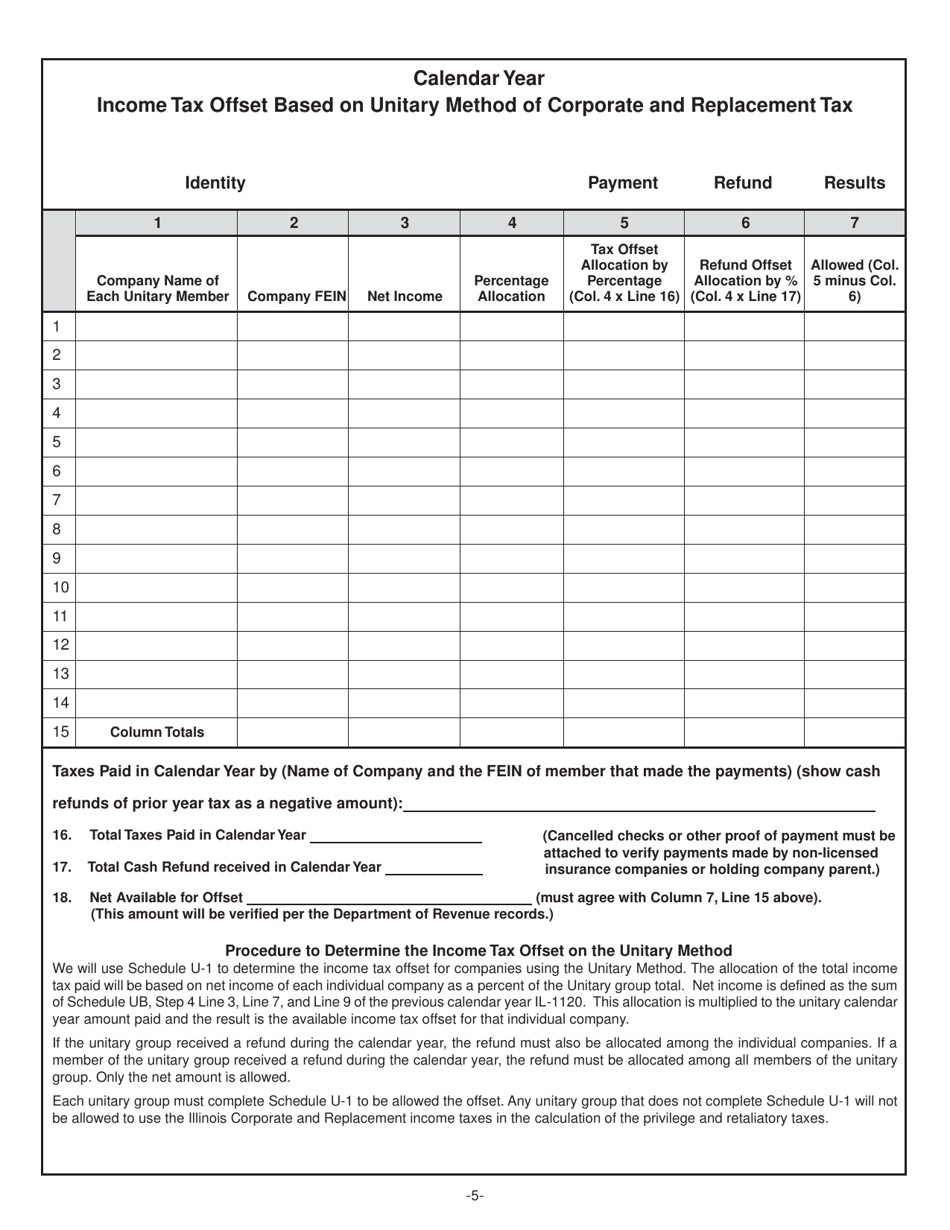

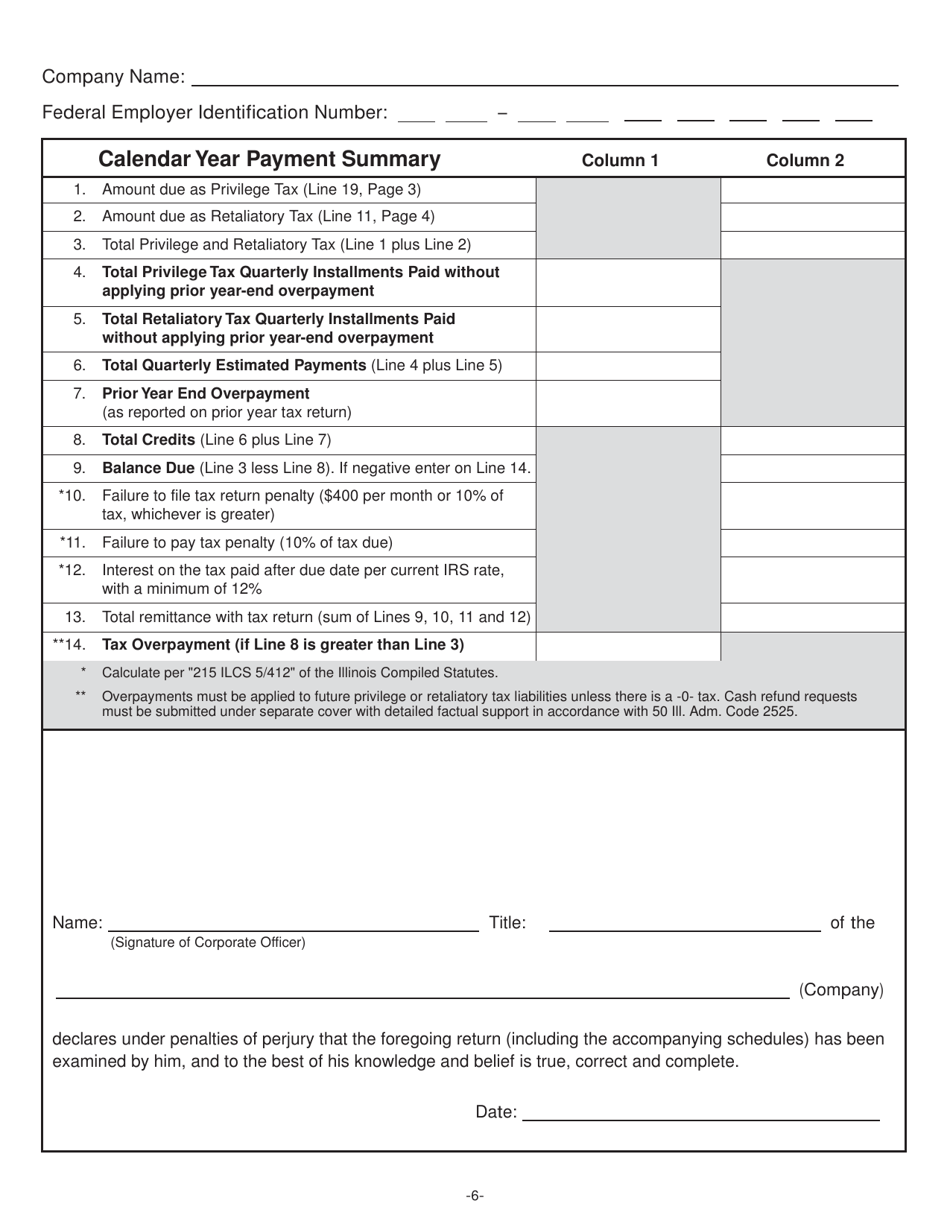

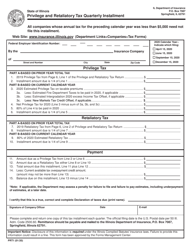

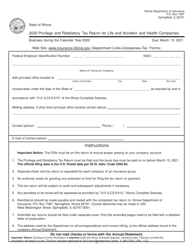

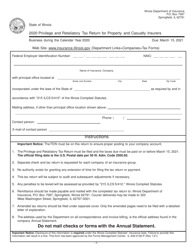

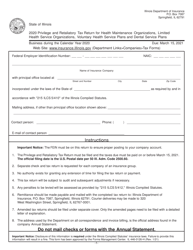

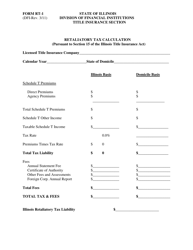

Form IL446-0126-R Privilege and Retaliatory Tax Return for Risk Retention Groups (Rrg) - Illinois

What Is Form IL446-0126-R?

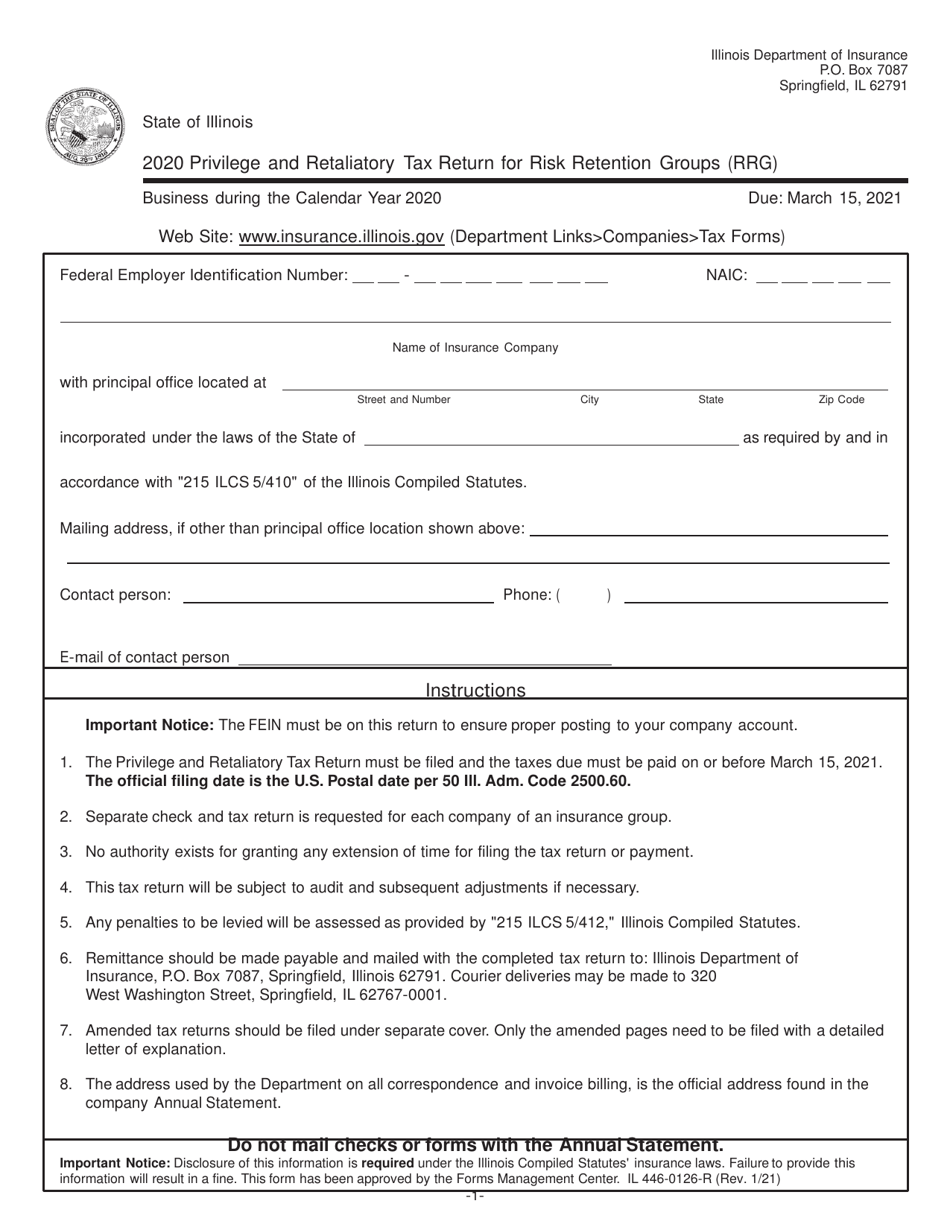

This is a legal form that was released by the Illinois Department of Insurance - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL446-0126-R?

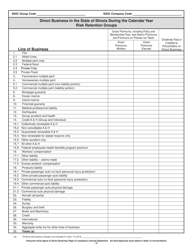

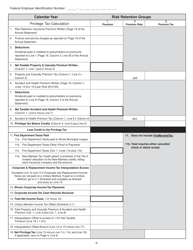

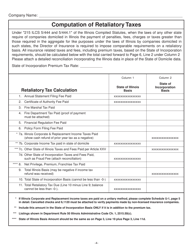

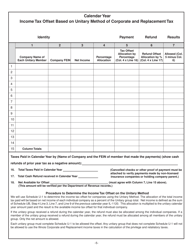

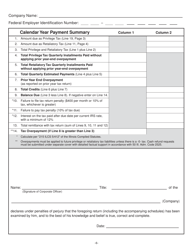

A: Form IL446-0126-R is the Privilege and Retaliatory Tax Return for Risk Retention Groups (RRG) in Illinois.

Q: Who needs to file Form IL446-0126-R?

A: Risk Retention Groups (RRGs) operating in Illinois are required to file Form IL446-0126-R.

Q: What is the purpose of Form IL446-0126-R?

A: Form IL446-0126-R is used to report and pay privilege and retaliatory taxes by RRGs operating in Illinois.

Q: When is Form IL446-0126-R due?

A: Form IL446-0126-R must be filed by the 15th day of the 5th month following the end of the tax year.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Illinois Department of Insurance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IL446-0126-R by clicking the link below or browse more documents and templates provided by the Illinois Department of Insurance.