This version of the form is not currently in use and is provided for reference only. Download this version of

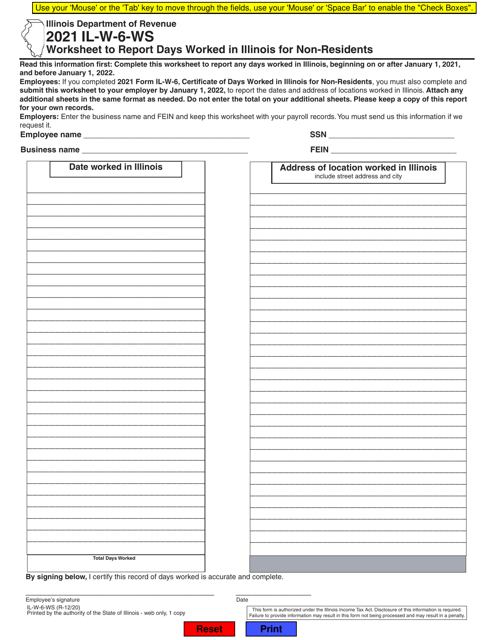

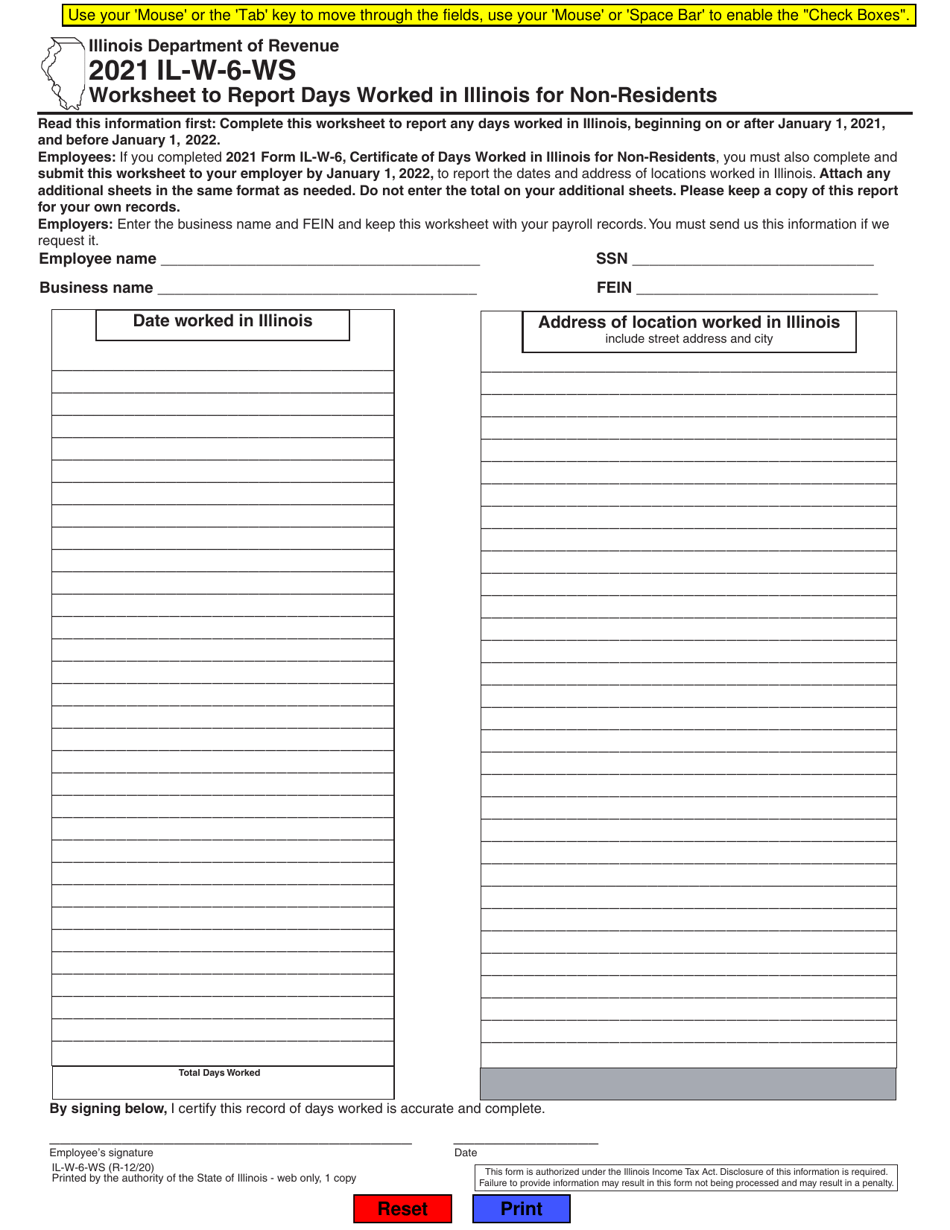

Form IL-W-6-WS

for the current year.

Form IL-W-6-WS Worksheet to Report Days Worked in Illinois for Non-residents - Illinois

What Is Form IL-W-6-WS?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form IL-W-6-WS?

A: Form IL-W-6-WS is a worksheet used to report the number of days worked in Illinois by non-residents.

Q: Who should use form IL-W-6-WS?

A: Non-residents who have worked in Illinois and need to report the number of days worked.

Q: What information is required on form IL-W-6-WS?

A: Form IL-W-6-WS requires the employee's name, Social Security number, employer's name and address, and the number of days worked in Illinois.

Q: How should form IL-W-6-WS be filed?

A: Form IL-W-6-WS should be filed with the Illinois Department of Revenue by the employer.

Q: What is the deadline for filing form IL-W-6-WS?

A: Form IL-W-6-WS must be filed by January 31st of the following year.

Q: What happens if form IL-W-6-WS is not filed?

A: Failure to file form IL-W-6-WS may result in penalties and interest.

Q: Is form IL-W-6-WS required for residents of Illinois?

A: No, form IL-W-6-WS is only required for non-residents who have worked in Illinois.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-W-6-WS by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.