This version of the form is not currently in use and is provided for reference only. Download this version of

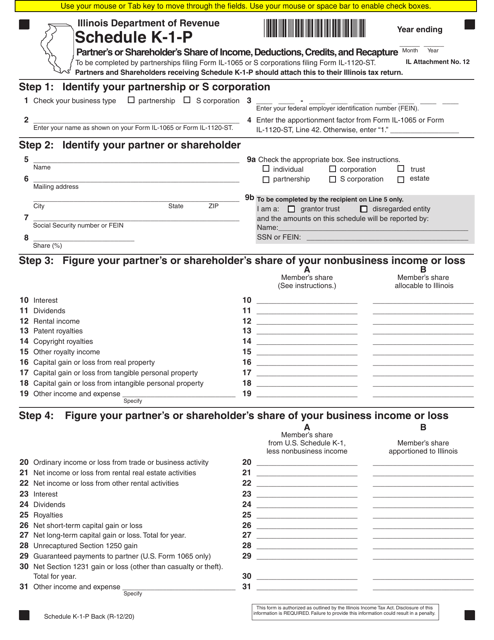

Schedule K-1-P

for the current year.

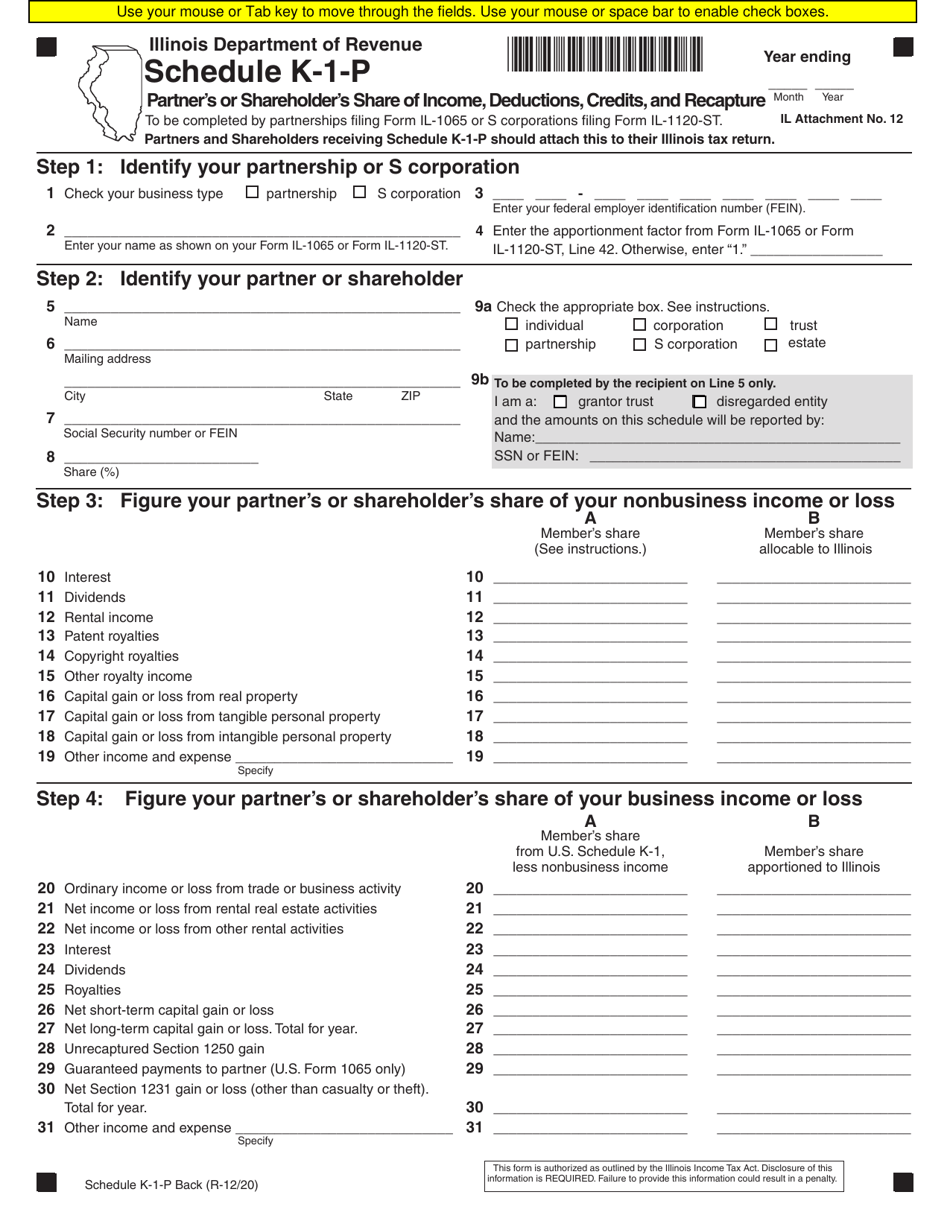

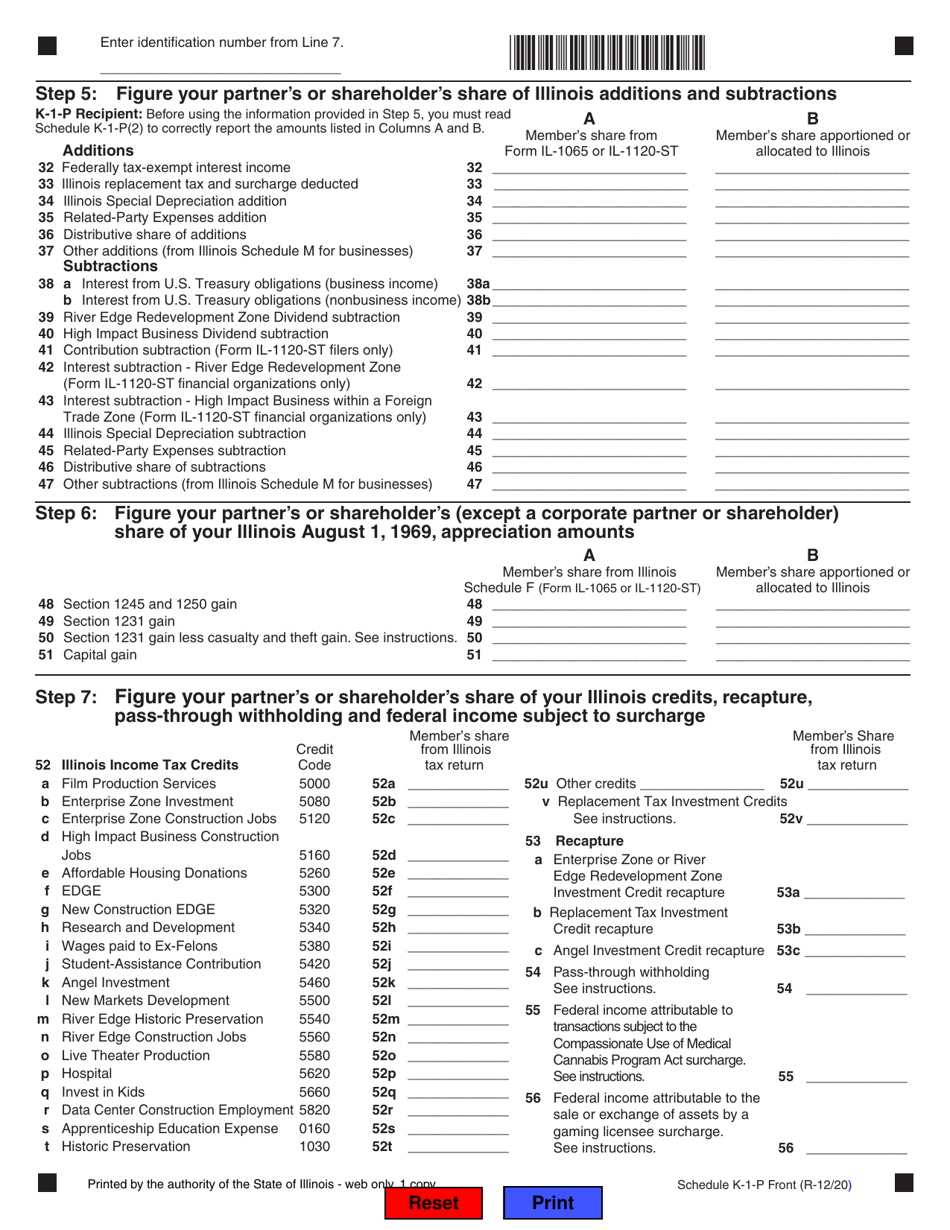

Schedule K-1-P Partner's or Shareholder's Share of Income, Deductions, Credits, and Recapture - Illinois

What Is Schedule K-1-P?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-1-P?

A: Schedule K-1-P is a tax form used by partners or shareholders in Illinois to report their share of income, deductions, credits, and recapture.

Q: Who needs to file Schedule K-1-P?

A: Partners or shareholders in Illinois who receive income, deductions, credits, or recapture from a partnership or S corporation need to file Schedule K-1-P.

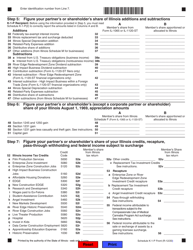

Q: What information is reported on Schedule K-1-P?

A: Schedule K-1-P reports the partner's or shareholder's share of income, deductions, credits, and recapture from a partnership or S corporation.

Q: When is Schedule K-1-P due?

A: Schedule K-1-P is typically due on the same date as your individual income tax return, which is usually April 15th, unless an extension has been granted.

Q: Are there any penalties for not filing Schedule K-1-P?

A: Yes, failure to file Schedule K-1-P or reporting incorrect information can result in penalties and interest.

Q: Can Schedule K-1-P be filed electronically?

A: Yes, Schedule K-1-P can be filed electronically through the Illinois Department of Revenue's e-filing system.

Q: Do I need to include Schedule K-1-P with my federal tax return?

A: No, Schedule K-1-P is specific to Illinois and should only be filed with your Illinois state tax return.

Q: Can I amend Schedule K-1-P if I made a mistake?

A: Yes, if you made a mistake on Schedule K-1-P, you can file an amended tax return with the corrected information.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-1-P by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.