This version of the form is not currently in use and is provided for reference only. Download this version of

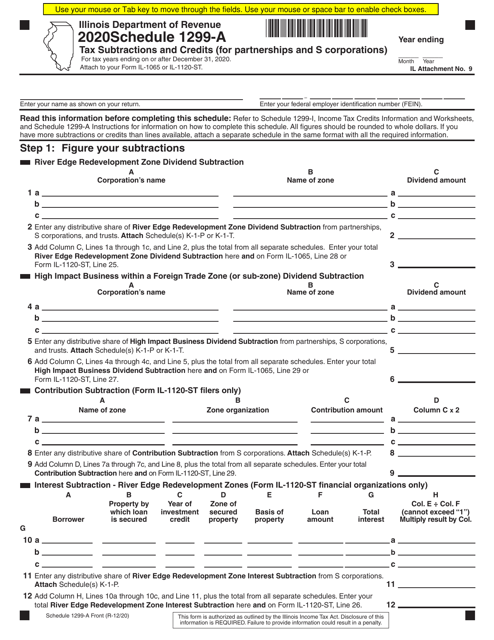

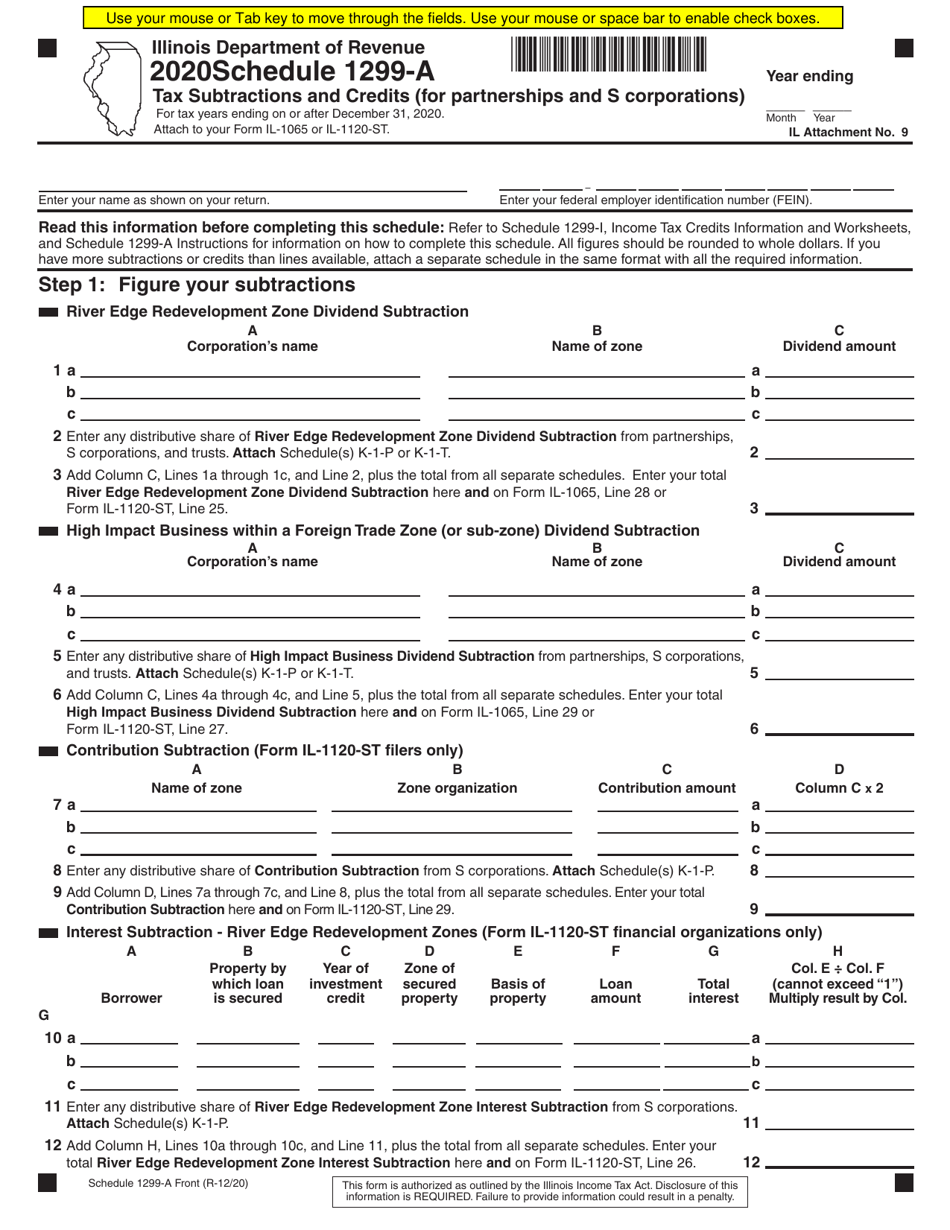

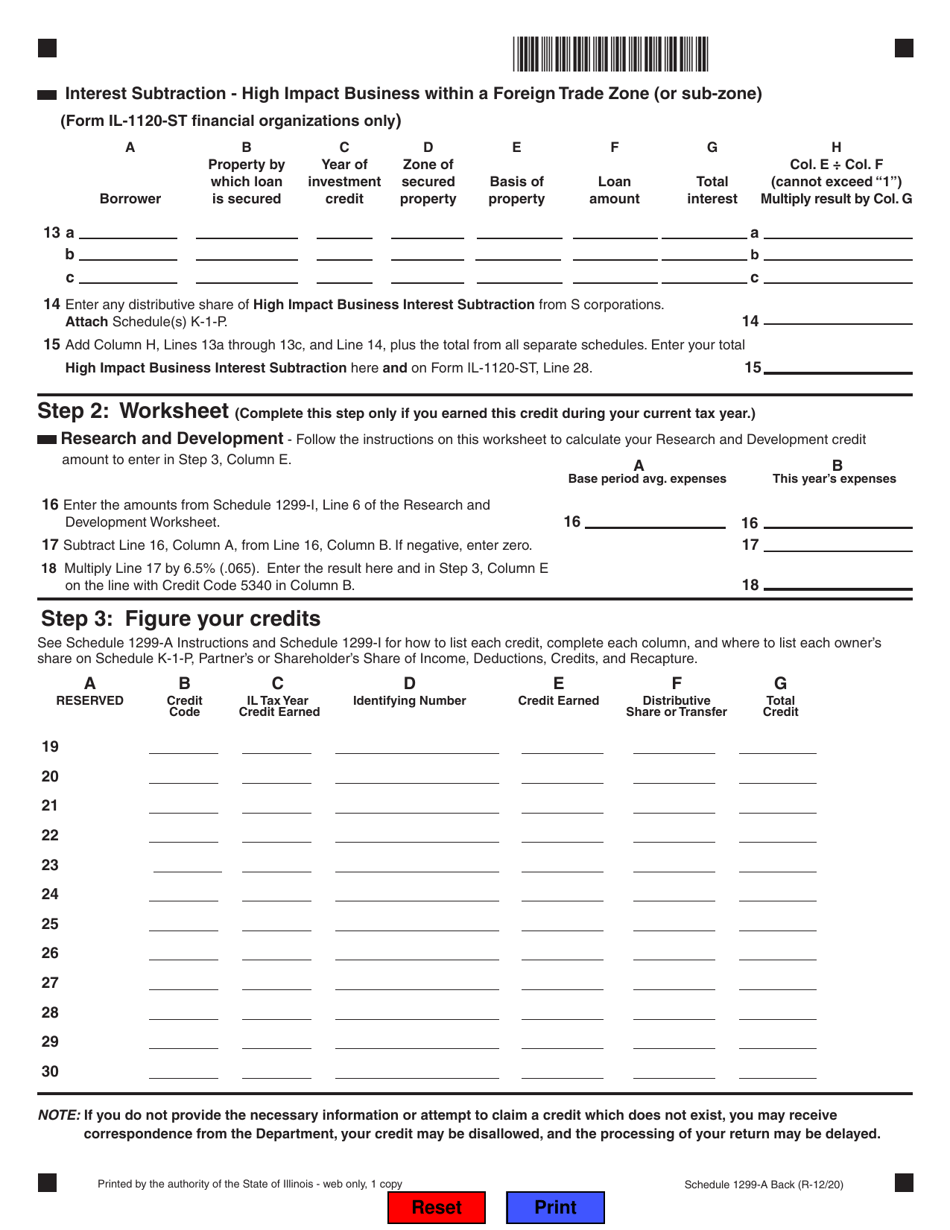

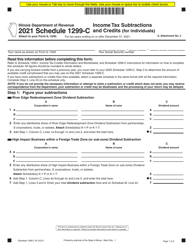

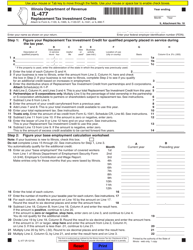

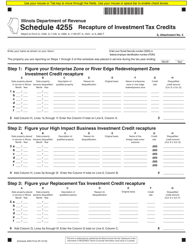

Schedule 1299-A

for the current year.

Schedule 1299-A Tax Subtractions and Credits (For Partnerships and S Corporations) - Illinois

What Is Schedule 1299-A?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 1299-A?

A: Schedule 1299-A is a tax form specifically for partnerships and S corporations in Illinois.

Q: What is the purpose of Schedule 1299-A?

A: The purpose of Schedule 1299-A is to calculate tax subtractions and credits for partnerships and S corporations in Illinois.

Q: Who needs to file Schedule 1299-A?

A: Partnerships and S corporations in Illinois need to file Schedule 1299-A.

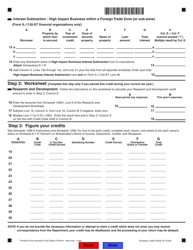

Q: What information is required on Schedule 1299-A?

A: Schedule 1299-A requires information regarding tax subtractions and credits for partnerships and S corporations in Illinois.

Q: When is the deadline to file Schedule 1299-A?

A: The deadline to file Schedule 1299-A is usually the same as the deadline to file the Illinois tax return for partnerships and S corporations.

Q: What are the consequences of not filing Schedule 1299-A?

A: Failure to file Schedule 1299-A may result in penalties and interest charges from the Illinois Department of Revenue.

Q: Can Schedule 1299-A be amended?

A: Yes, if there are errors or changes to the information provided on Schedule 1299-A, an amended form can be filed.

Q: Is Schedule 1299-A the only tax form required for partnerships and S corporations in Illinois?

A: No, partnerships and S corporations may need to file other tax forms in addition to Schedule 1299-A depending on their specific circumstances.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 1299-A by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.