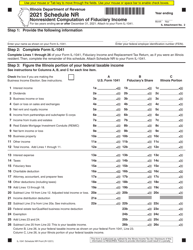

This version of the form is not currently in use and is provided for reference only. Download this version of

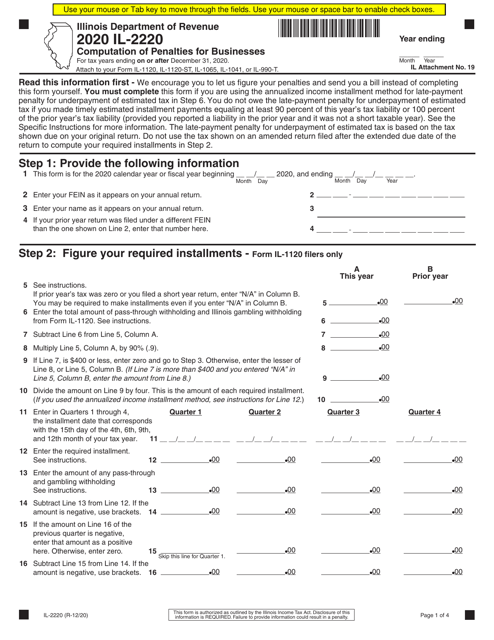

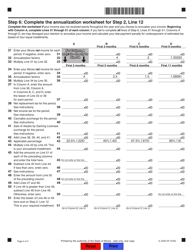

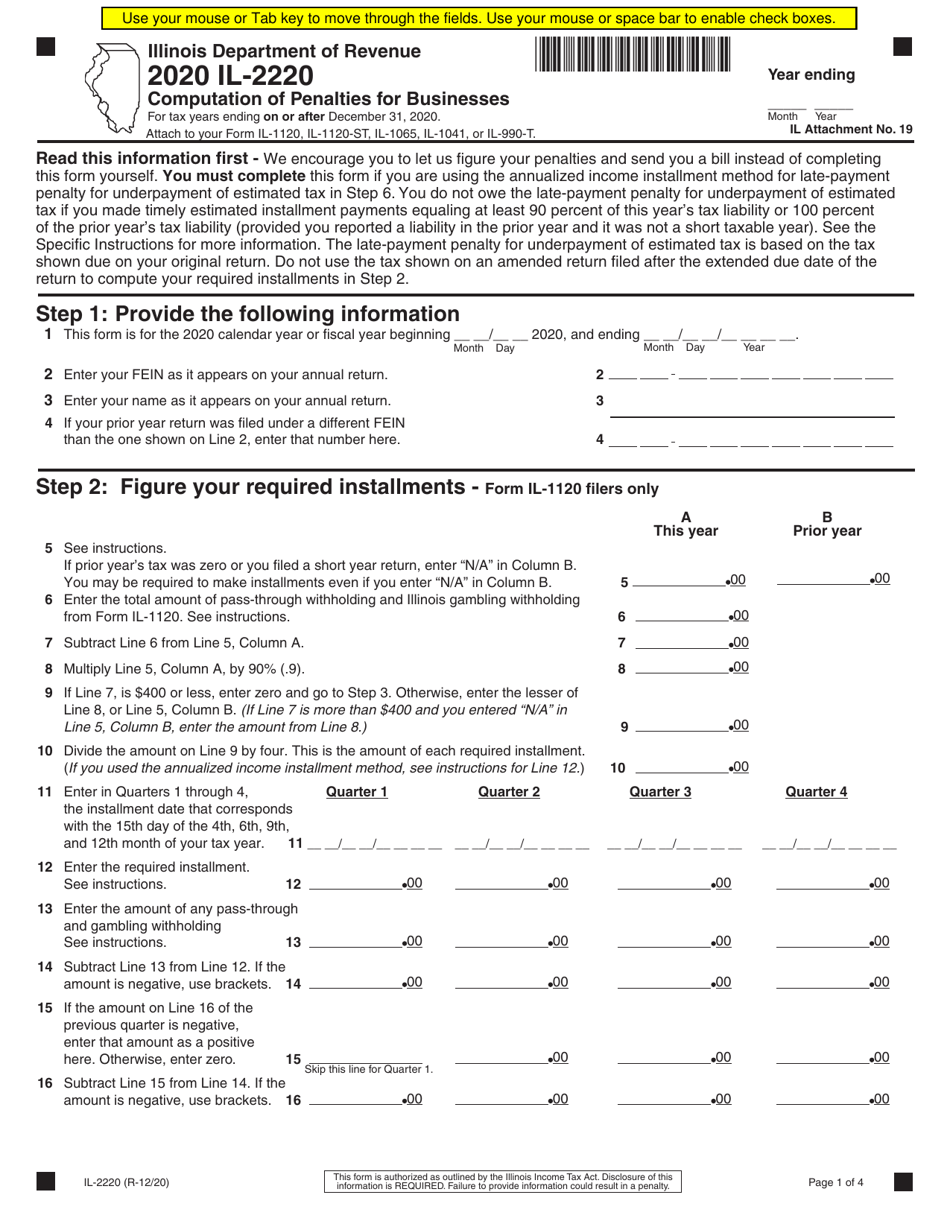

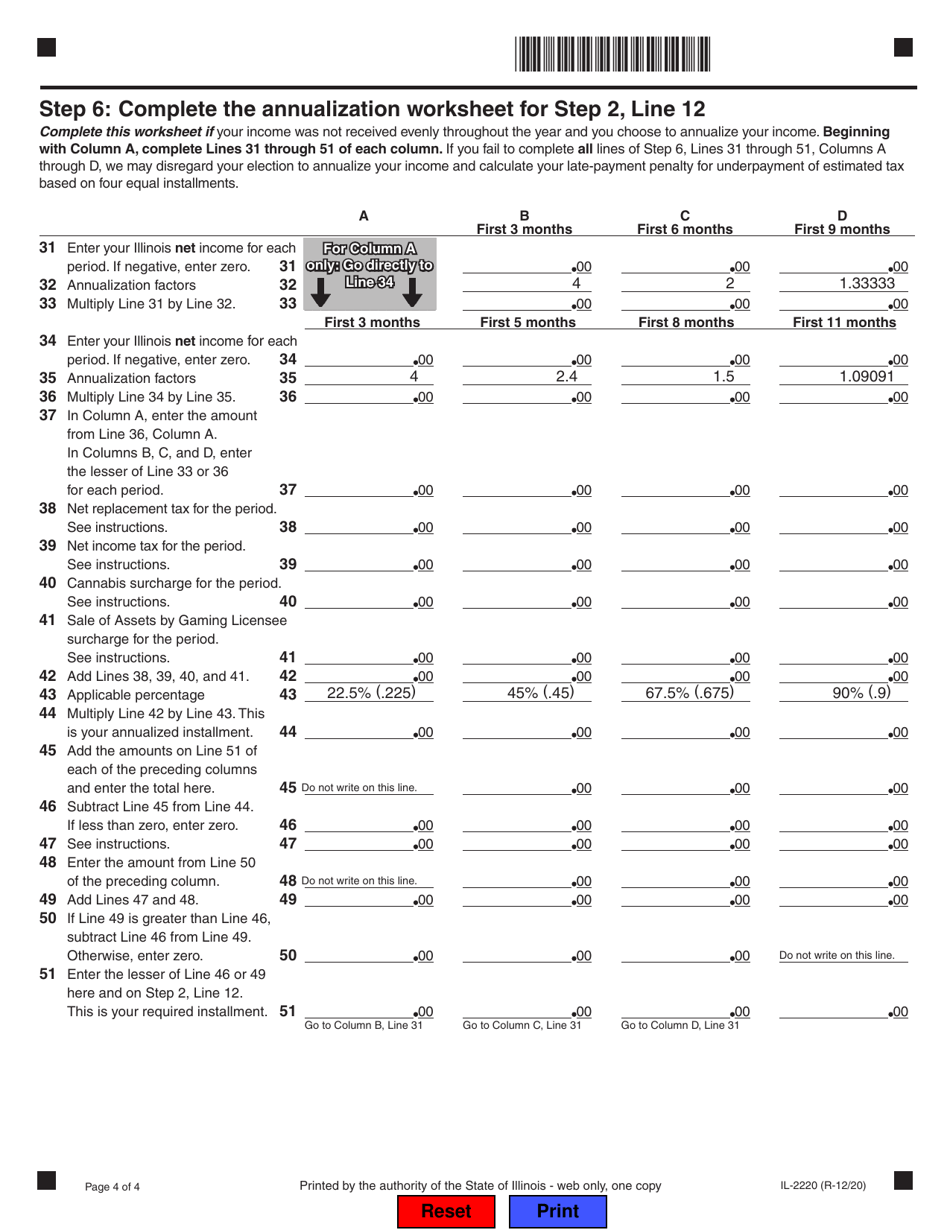

Form IL-2220

for the current year.

Form IL-2220 Computation of Penalties for Businesses - Illinois

What Is Form IL-2220?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-2220?

A: Form IL-2220 is a form used in Illinois to compute penalties for businesses.

Q: Who needs to file Form IL-2220?

A: Businesses in Illinois that incurred penalties during the tax year need to file Form IL-2220.

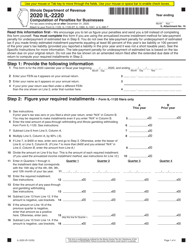

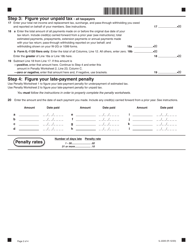

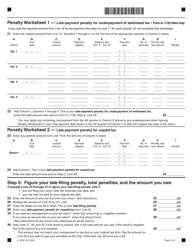

Q: What penalties does Form IL-2220 compute?

A: Form IL-2220 computes penalties related to income tax, sales tax, percentage-of-completion contracts, withholding tax, and various other taxes and fees.

Q: How is the penalty amount computed?

A: The penalty amount is calculated based on the tax or fee owed, the amount paid on time, and the number of days the payment was overdue.

Q: What is the purpose of filing Form IL-2220?

A: Filing Form IL-2220 helps businesses calculate and pay the appropriate penalties for late tax or fee payments in Illinois.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2220 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.