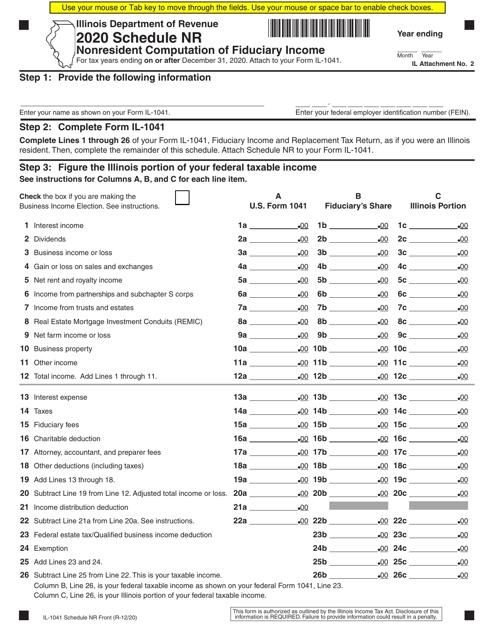

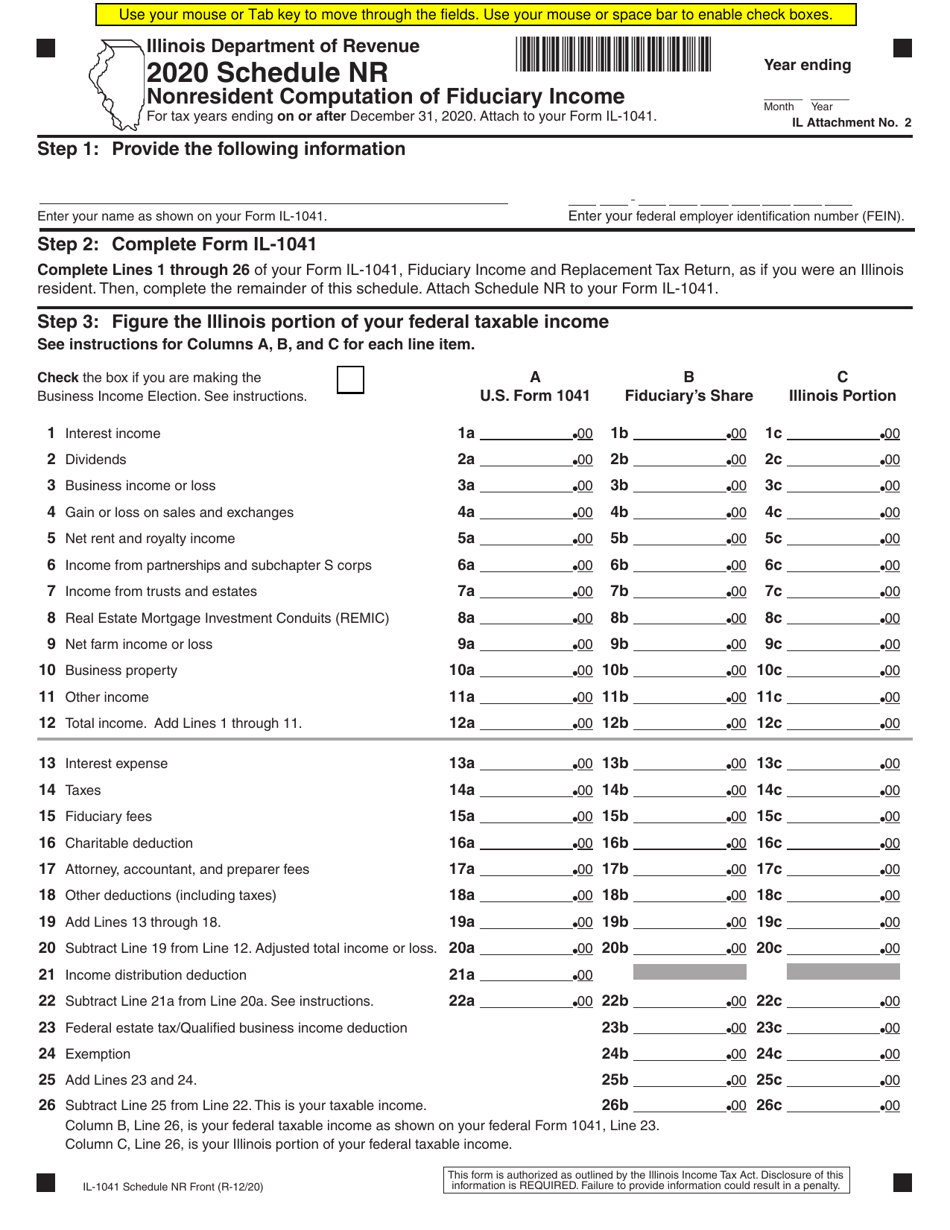

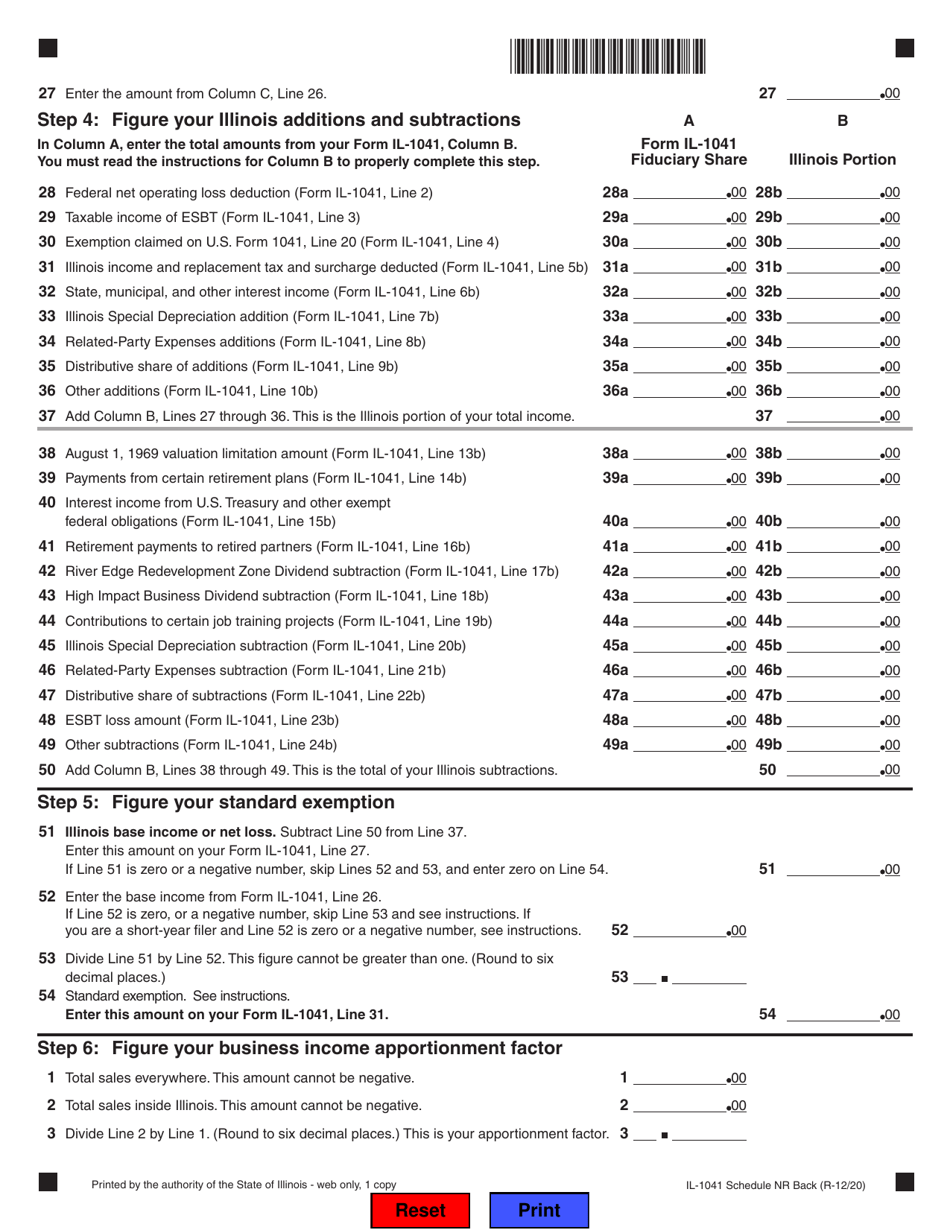

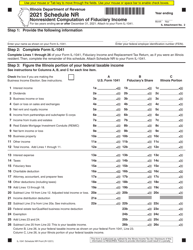

Schedule NR Nonresident Computation of Fiduciary Income - Illinois

What Is Schedule NR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NR?

A: Schedule NR is a form used in Illinois to calculate the fiduciary income of nonresidents.

Q: Who needs to file Schedule NR?

A: Nonresidents who have fiduciary income from Illinois sources need to file Schedule NR.

Q: What is fiduciary income?

A: Fiduciary income is income received by a person or entity acting as a trustee or executor of an estate, or as a guardian or conservator of a minor or disabled person.

Q: What are Illinois sources of income?

A: Illinois sources of income include income from property located in Illinois, business income from an Illinois business, and income from services performed in Illinois.

Q: Is Schedule NR required for residents of Illinois?

A: No, Schedule NR is only for nonresidents.

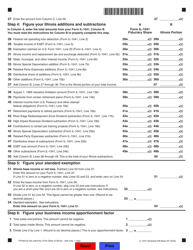

Q: How do I fill out Schedule NR?

A: You will need to provide information about your fiduciary income and deductions related to Illinois sources. Follow the instructions on the form to complete it correctly.

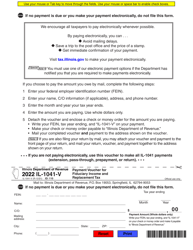

Q: When is the deadline to file Schedule NR?

A: The deadline to file Schedule NR is the same as the deadline to file your Illinois income tax return, which is typically April 15th.

Q: Can I e-file Schedule NR?

A: Yes, you can e-file Schedule NR if you are filing your Illinois income tax return electronically.

Q: What happens if I don't file Schedule NR?

A: If you are required to file Schedule NR and fail to do so, you may be subject to penalties and interest on any unpaid tax liability.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.