This version of the form is not currently in use and is provided for reference only. Download this version of

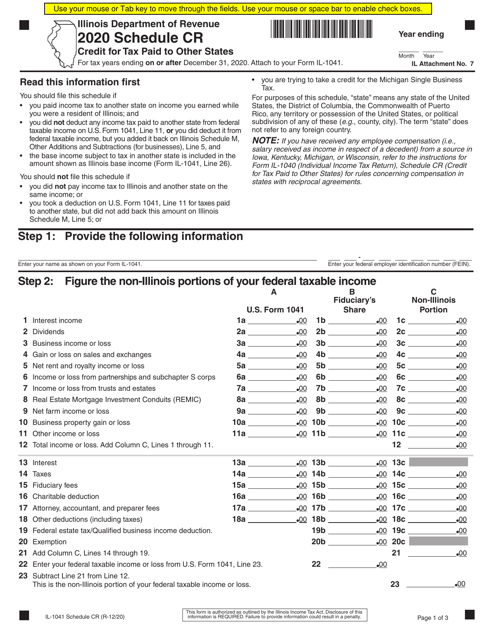

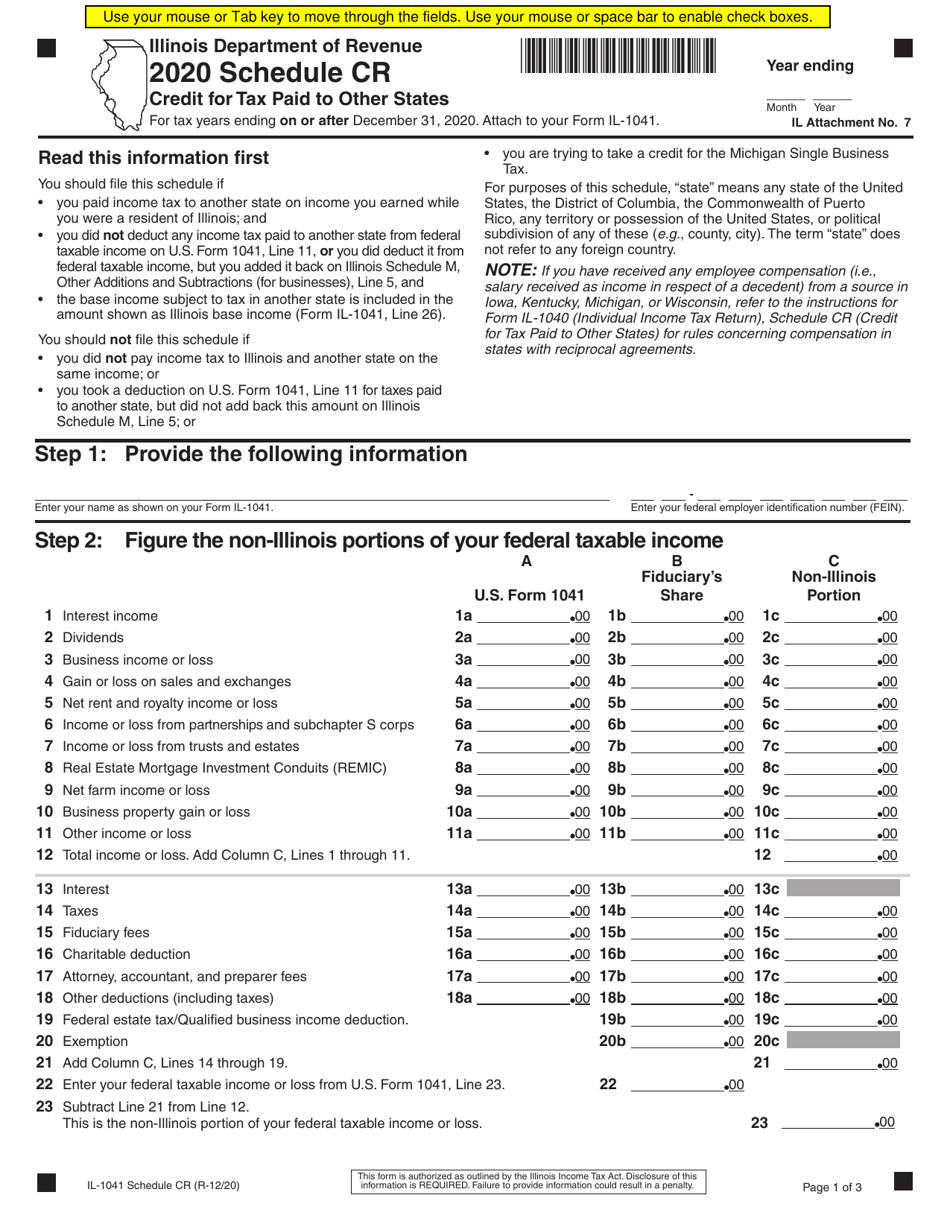

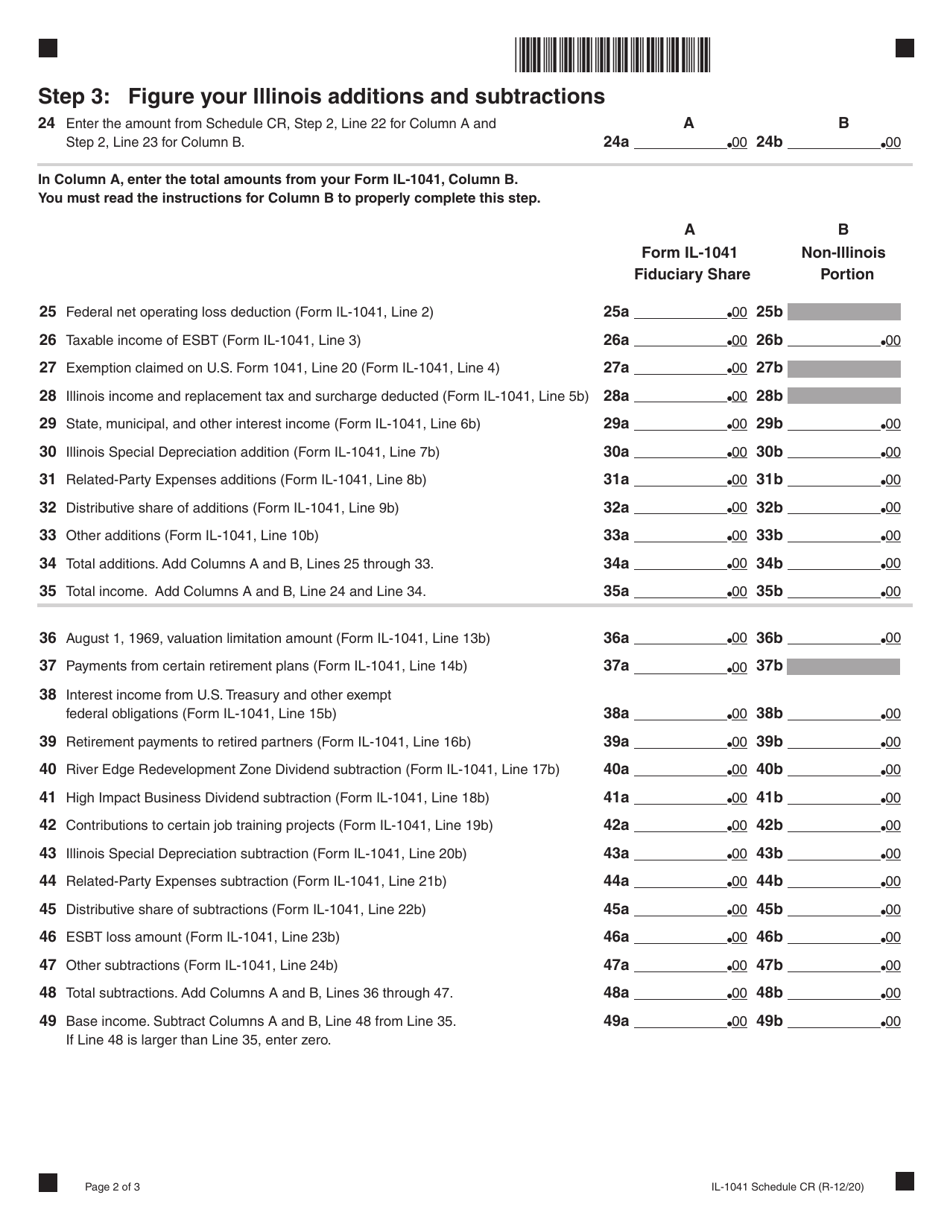

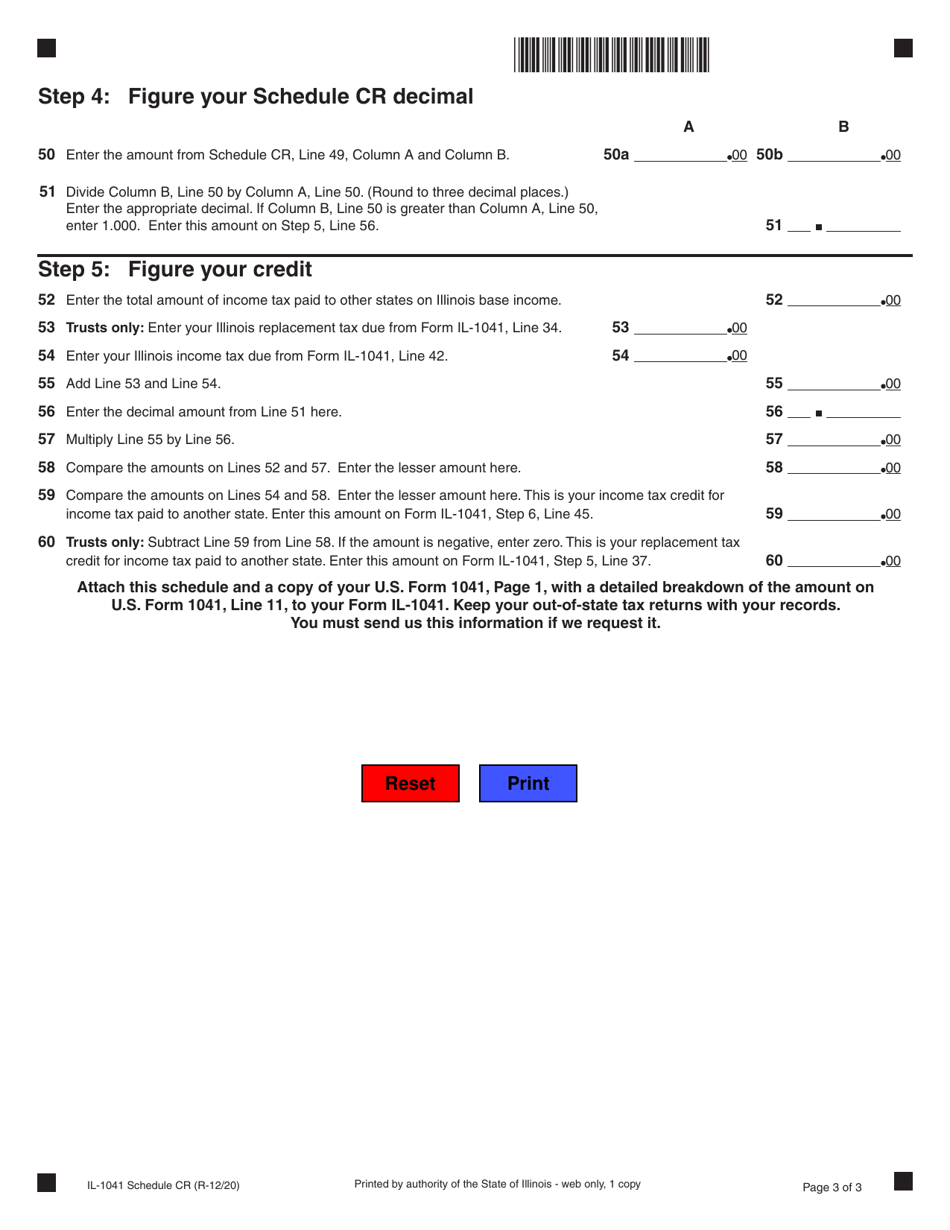

Form IL-1041 Schedule CR

for the current year.

Form IL-1041 Schedule CR Credit for Tax Paid to Other States - Illinois

What Is Form IL-1041 Schedule CR?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1041 Schedule CR?

A: Form IL-1041 Schedule CR is a tax form used by individual or fiduciary taxpayers in Illinois to claim a credit for taxes paid to other states.

Q: Who needs to file Form IL-1041 Schedule CR?

A: Individual or fiduciary taxpayers in Illinois who paid taxes to other states and want to claim a credit for those taxes.

Q: What is the purpose of Form IL-1041 Schedule CR?

A: The purpose of this form is to prevent double taxation by allowing taxpayers to claim a credit for taxes paid to other states.

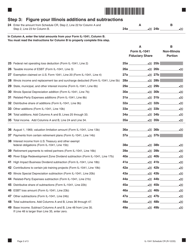

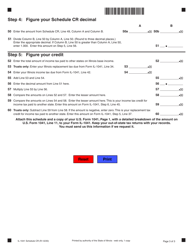

Q: How do I fill out Form IL-1041 Schedule CR?

A: You will need to enter the relevant information regarding the taxes paid to other states and calculate the credit amount based on the instructions provided with the form.

Q: When is Form IL-1041 Schedule CR due?

A: The due date for Form IL-1041 Schedule CR is the same as the due date for the Illinois income tax return, which is typically April 15th.

Q: Can I e-file Form IL-1041 Schedule CR?

A: Yes, you can e-file Form IL-1041 Schedule CR if you are filing your Illinois income tax return electronically.

Q: Is there a fee to file Form IL-1041 Schedule CR?

A: There is no fee to file Form IL-1041 Schedule CR, but you may have to pay a fee if you choose to e-file your Illinois income tax return.

Q: Can I amend Form IL-1041 Schedule CR?

A: Yes, you can amend Form IL-1041 Schedule CR by filing Form IL-1041-X within three years of the original due date of the return.

Q: What should I do if I have more questions about Form IL-1041 Schedule CR?

A: If you have more questions about Form IL-1041 Schedule CR, you should consult the instructions provided with the form or contact the Illinois Department of Revenue for assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1041 Schedule CR by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.