This version of the form is not currently in use and is provided for reference only. Download this version of

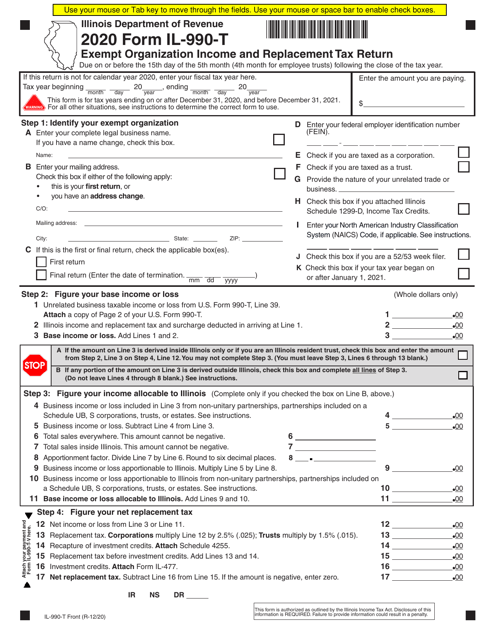

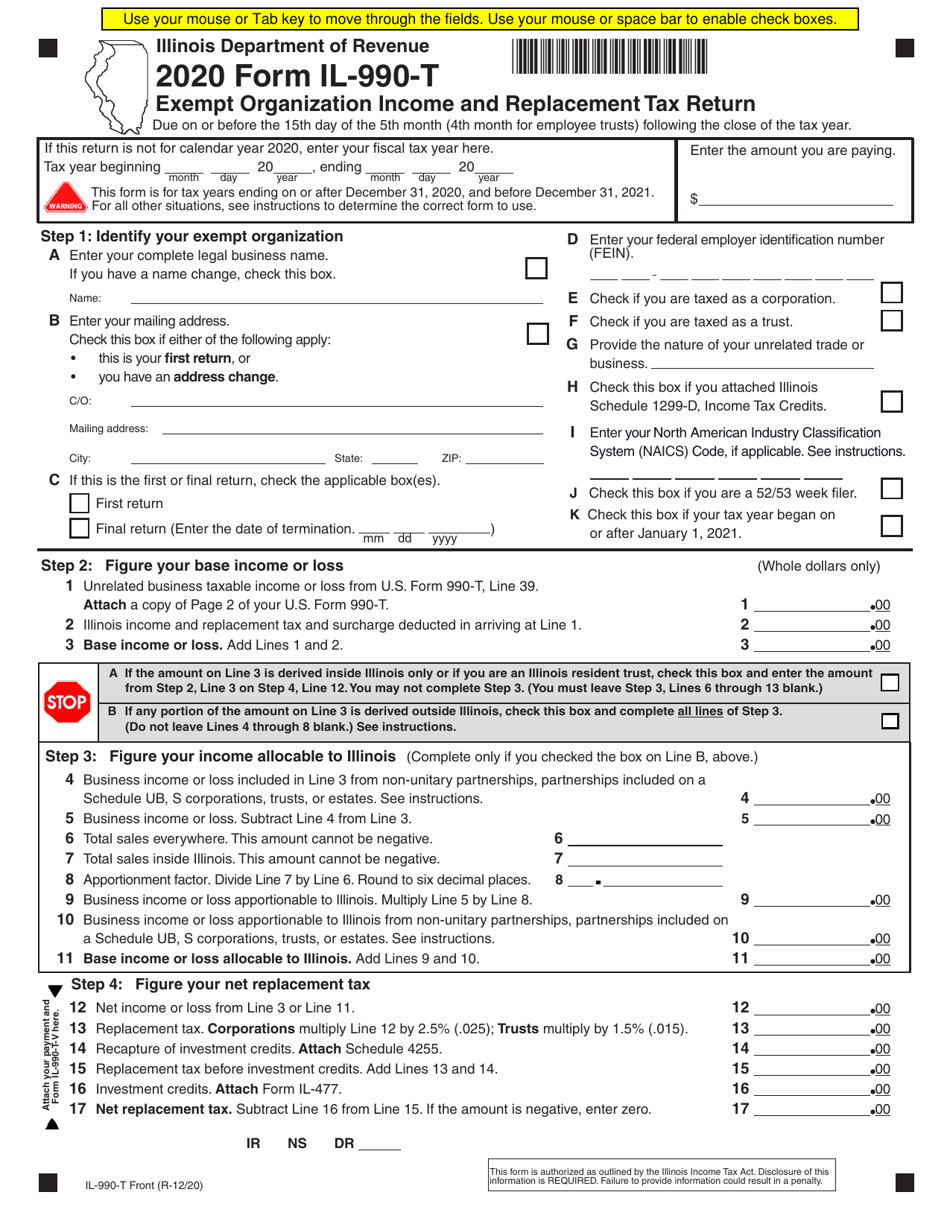

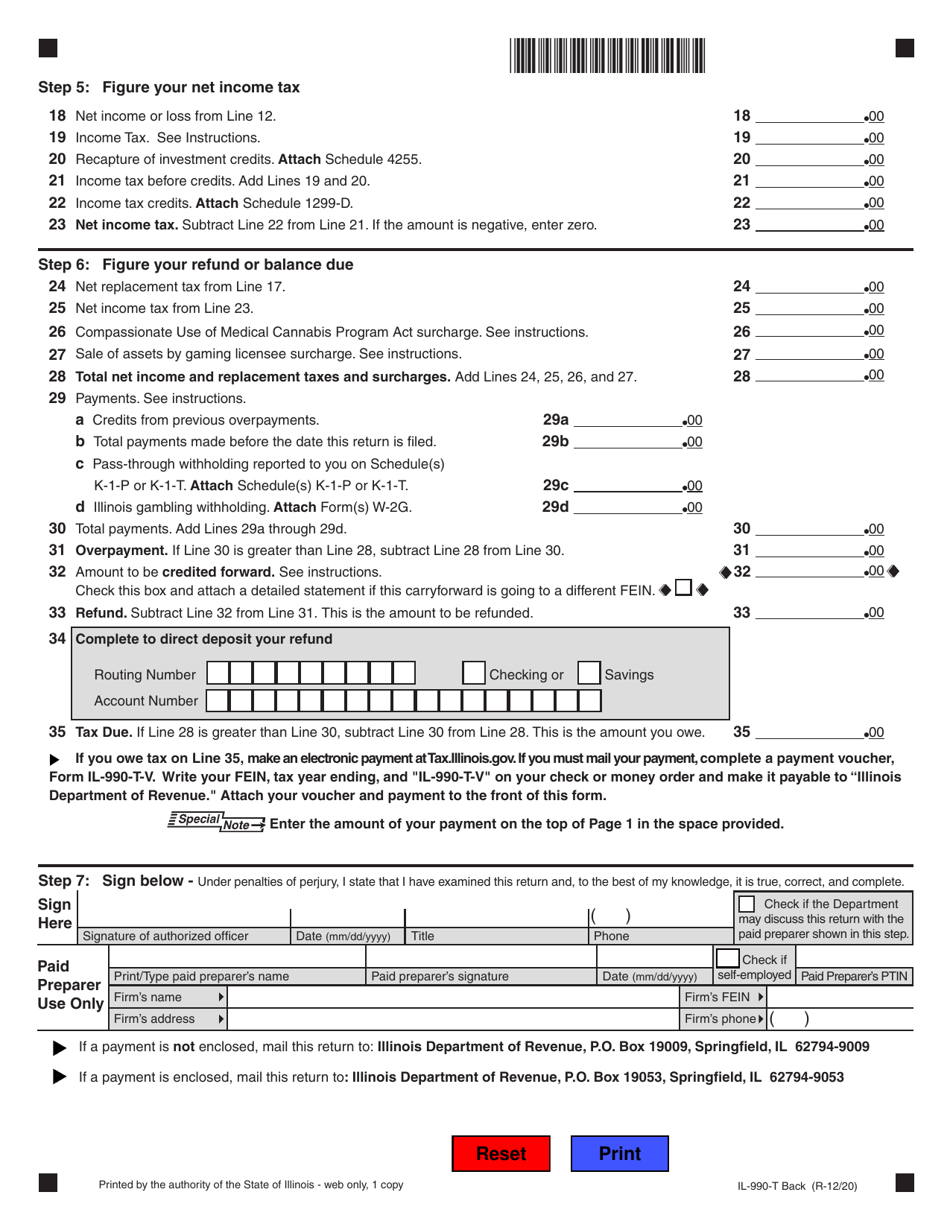

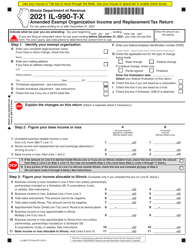

Form IL-990-T

for the current year.

Form IL-990-T Exempt Organization Income and Replacement Tax Return - Illinois

What Is Form IL-990-T?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-990-T?

A: Form IL-990-T is a tax return form specifically designed for exempt organizations in Illinois to report their income and replacement tax liabilities.

Q: Who needs to file Form IL-990-T?

A: Exempt organizations in Illinois that have unrelated business income, as defined by the Internal Revenue Service (IRS), need to file Form IL-990-T.

Q: What is the purpose of Form IL-990-T?

A: The purpose of Form IL-990-T is to calculate and report the unrelated business incometax liability of exempt organizations in Illinois.

Q: When is Form IL-990-T due?

A: Form IL-990-T is due on the 15th day of the fifth month following the close of the organization's taxable year.

Q: Are there any penalties for late filing of Form IL-990-T?

A: Yes, there are penalties for late filing of Form IL-990-T. It is important to file the form by the due date to avoid any penalties or interest charges.

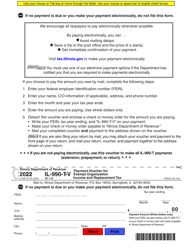

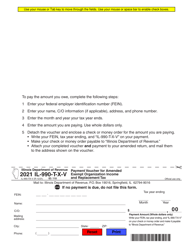

Q: Can Form IL-990-T be filed electronically?

A: Yes, Form IL-990-T can be filed electronically using the Illinois Department of Revenue's e-filing system.

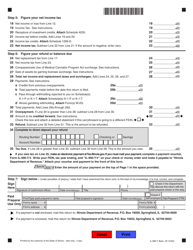

Q: What should I include when filing Form IL-990-T?

A: When filing Form IL-990-T, you should include all necessary supporting documentation, such as schedules and forms required to report unrelated business income.

Q: Can I claim any deductions or credits on Form IL-990-T?

A: Yes, you can claim deductions and credits on Form IL-990-T. Make sure to review the instructions and consult with a tax professional to determine which deductions and credits you may be eligible for.

Q: What if I have questions or need assistance with Form IL-990-T?

A: If you have questions or need assistance with Form IL-990-T, you can contact the Illinois Department of Revenue directly for guidance and support.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.