This version of the form is not currently in use and is provided for reference only. Download this version of

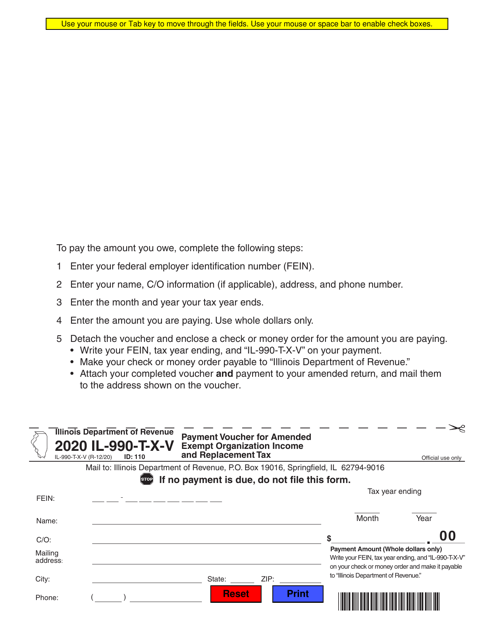

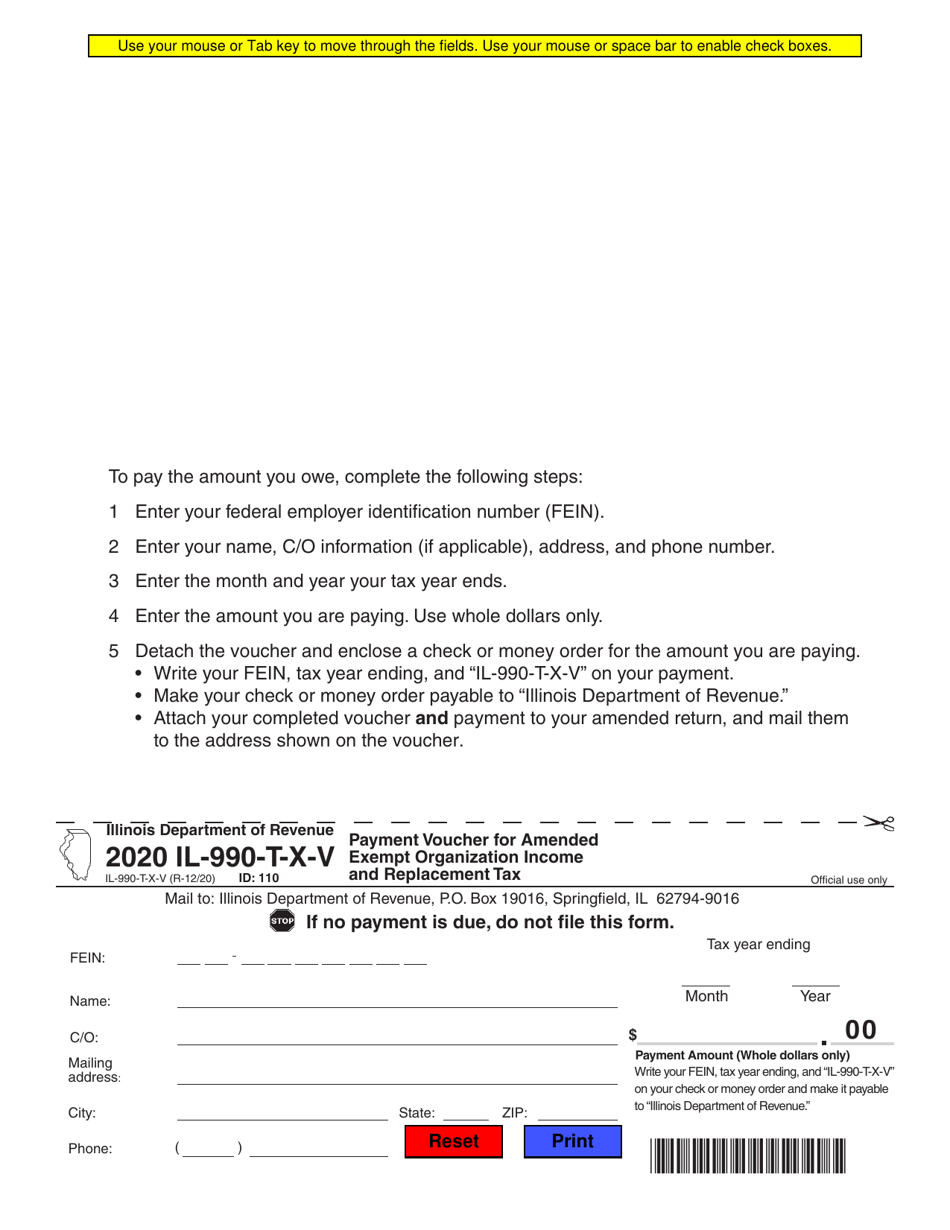

Form IL-990-T-X-V

for the current year.

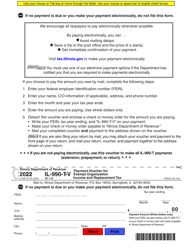

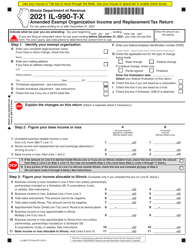

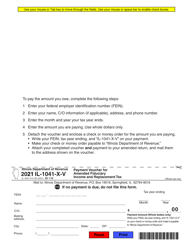

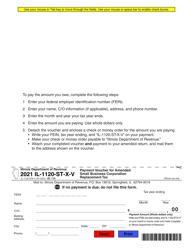

Form IL-990-T-X-V Payment Voucher for Amended Exempt Organization Income and Replacement Tax - Illinois

What Is Form IL-990-T-X-V?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-990-T-X-V?

A: Form IL-990-T-X-V is the payment voucher for amended exempt organization income and replacement tax in Illinois.

Q: Who needs to use Form IL-990-T-X-V?

A: Exempt organizations in Illinois who are amending their income and replacement tax return and need to make a payment should use Form IL-990-T-X-V.

Q: What is the purpose of Form IL-990-T-X-V?

A: The purpose of Form IL-990-T-X-V is to provide a voucher for making a payment for amended exempt organization income and replacement tax in Illinois.

Q: When is Form IL-990-T-X-V due?

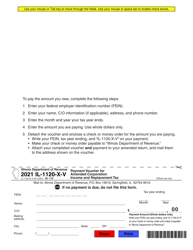

A: The due date for Form IL-990-T-X-V depends on the due date of the amended income and replacement tax return. It should be filed and payment should be made with the amended return.

Q: What should be included with Form IL-990-T-X-V?

A: Form IL-990-T-X-V should be accompanied by the payment for the amended exempt organization income and replacement tax.

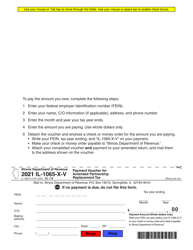

Q: Is Form IL-990-T-X-V only for Illinois residents?

A: No, Form IL-990-T-X-V is for all exempt organizations, regardless of residency, who are amending their income and replacement tax return in Illinois.

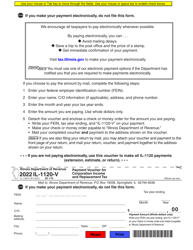

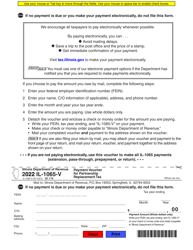

Q: Can Form IL-990-T-X-V be e-filed?

A: No, at this time, Form IL-990-T-X-V cannot be e-filed. It must be filed by mail with the payment.

Q: Are there any penalties for not filing Form IL-990-T-X-V?

A: Failure to file Form IL-990-T-X-V or making a late payment may result in penalties and interest being assessed by the Illinois Department of Revenue.

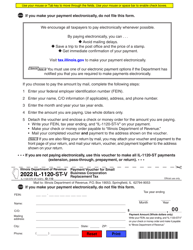

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-990-T-X-V by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.