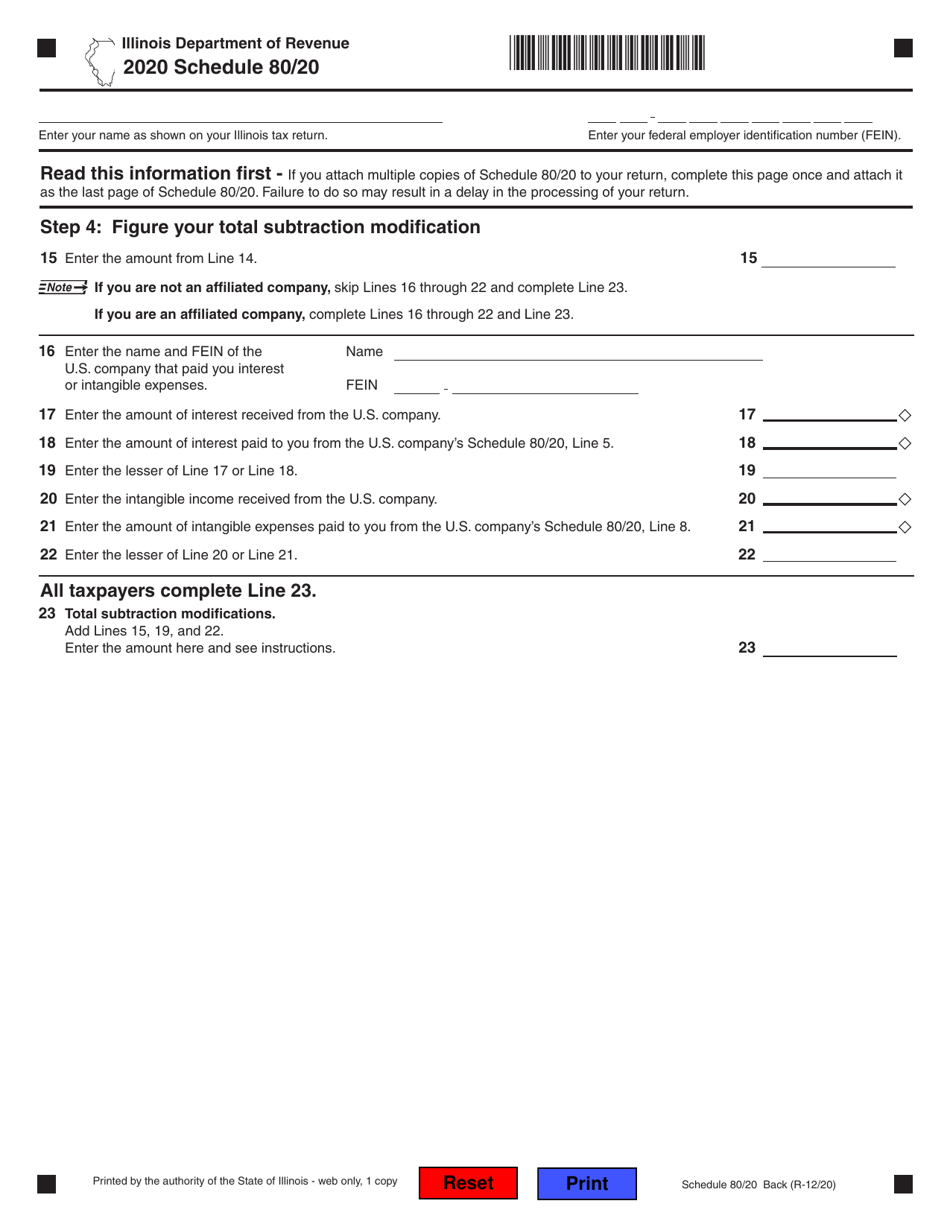

This version of the form is not currently in use and is provided for reference only. Download this version of

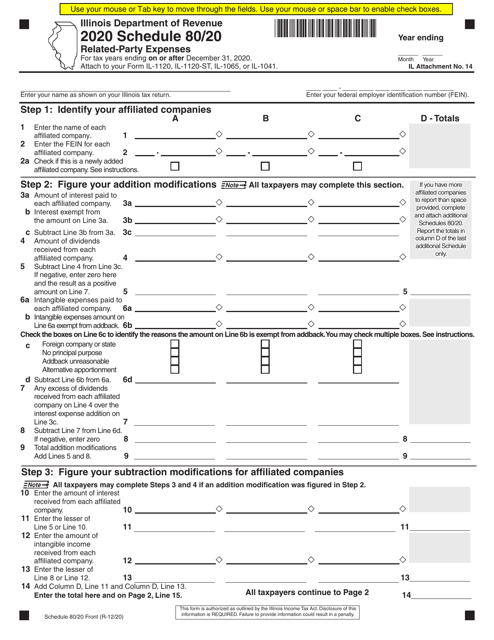

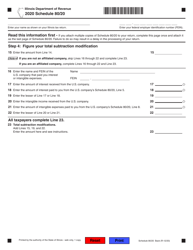

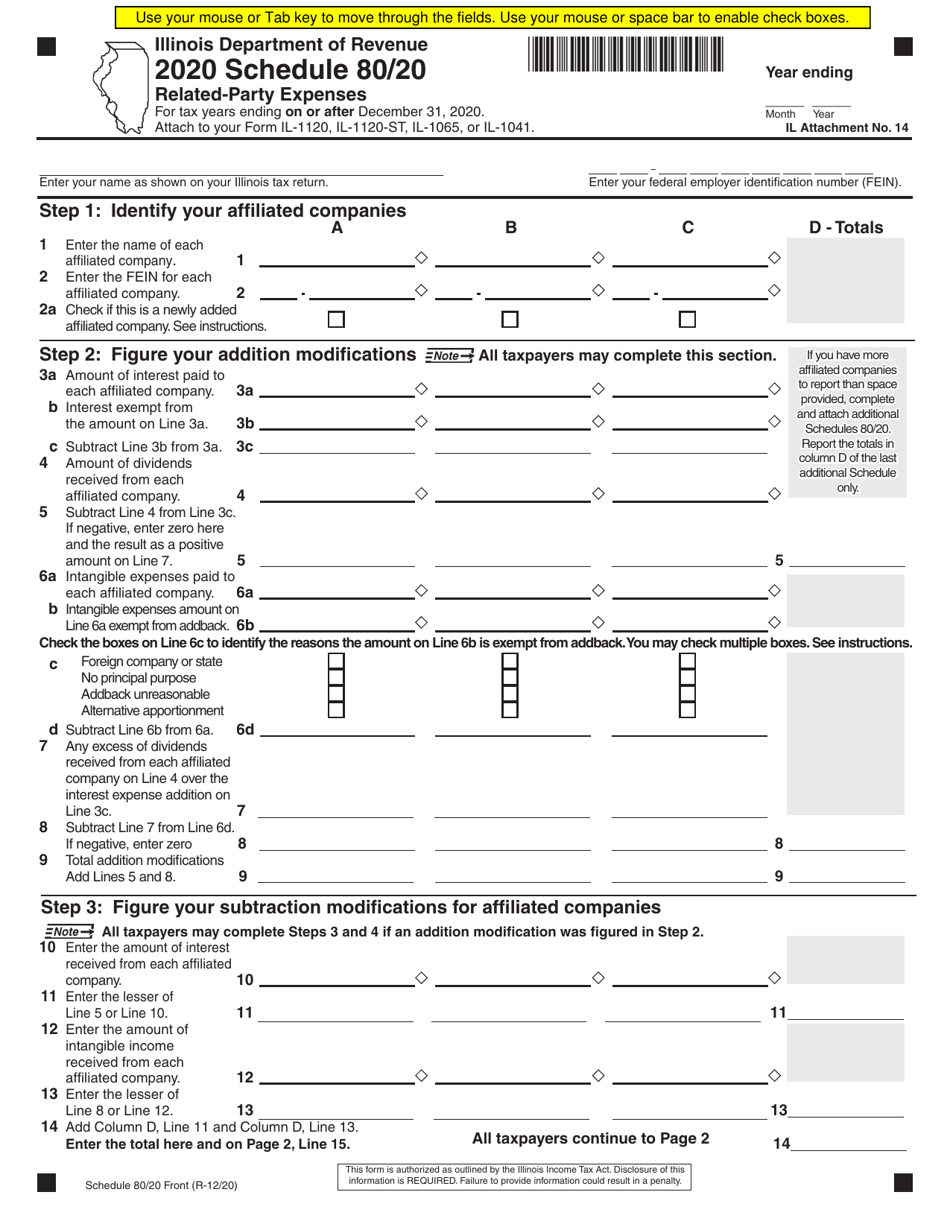

Schedule 80/20

for the current year.

Schedule 80 / 20 Related-Party Expenses - Illinois

What Is Schedule 80/20?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 80/20?

A: Schedule 80/20 refers to a specific section of the tax code that deals with related-party expenses.

Q: What are related-party expenses?

A: Related-party expenses are transactions between two parties that have a close relationship, such as family members or businesses under common ownership.

Q: Why is Schedule 80/20 important?

A: Schedule 80/20 is important because it determines the deductibility of related-party expenses for tax purposes.

Q: What does Schedule 80/20 require for deductibility?

A: Schedule 80/20 requires that related-party expenses be incurred for ordinary and necessary business purposes to be deductible.

Q: Does Schedule 80/20 apply to all states?

A: No, Schedule 80/20 is specific to Illinois and may not apply in other states.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 80/20 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.