This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M

for the current year.

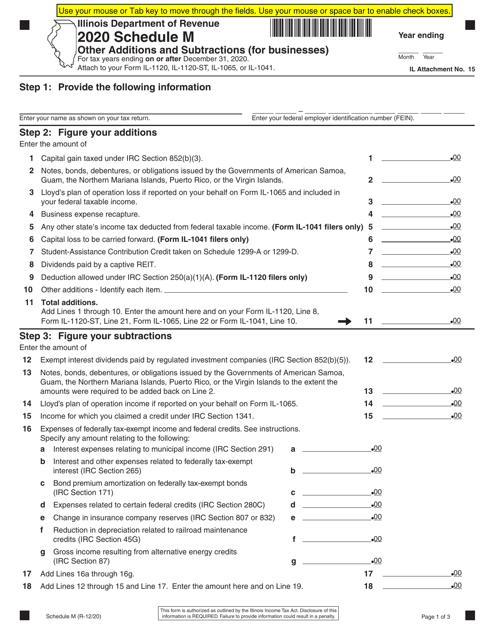

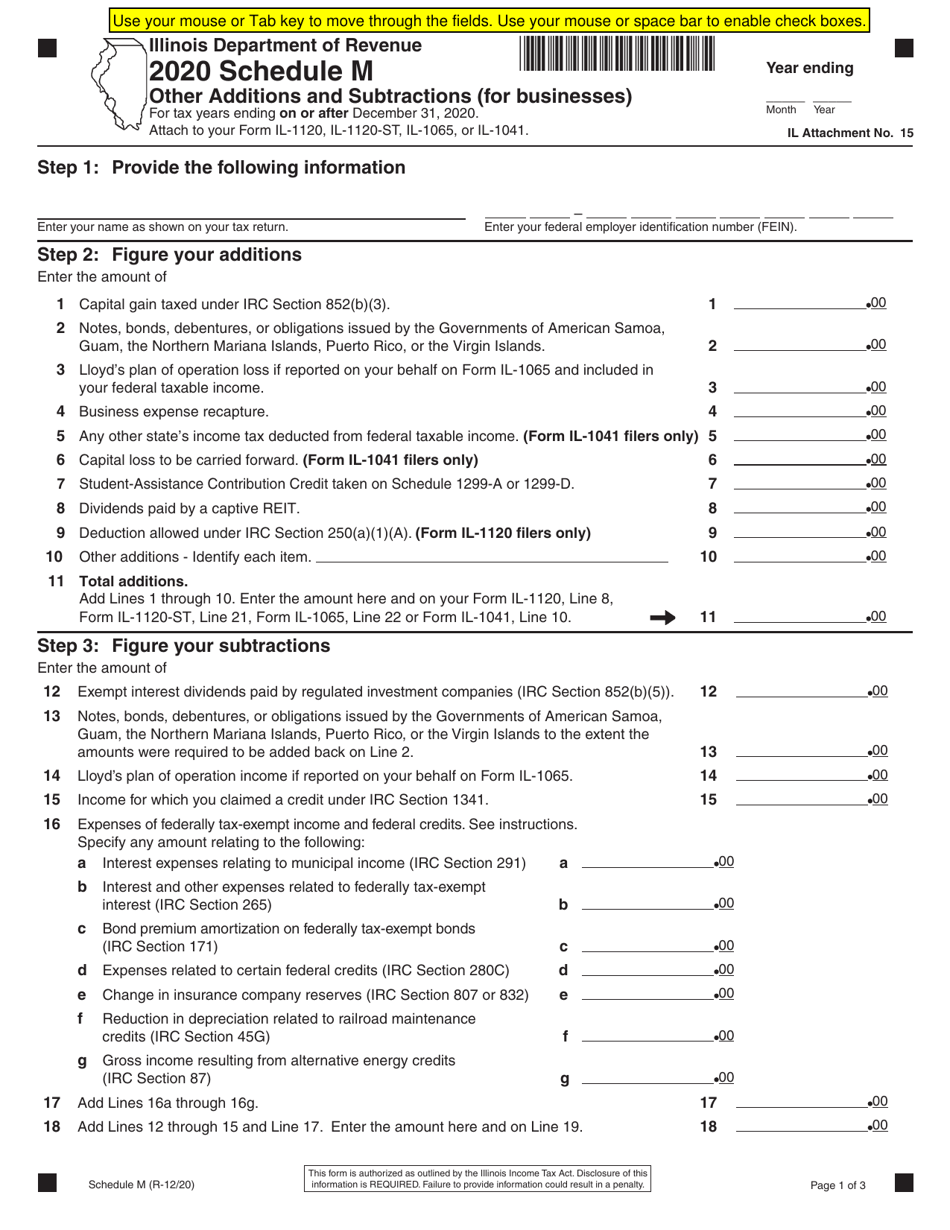

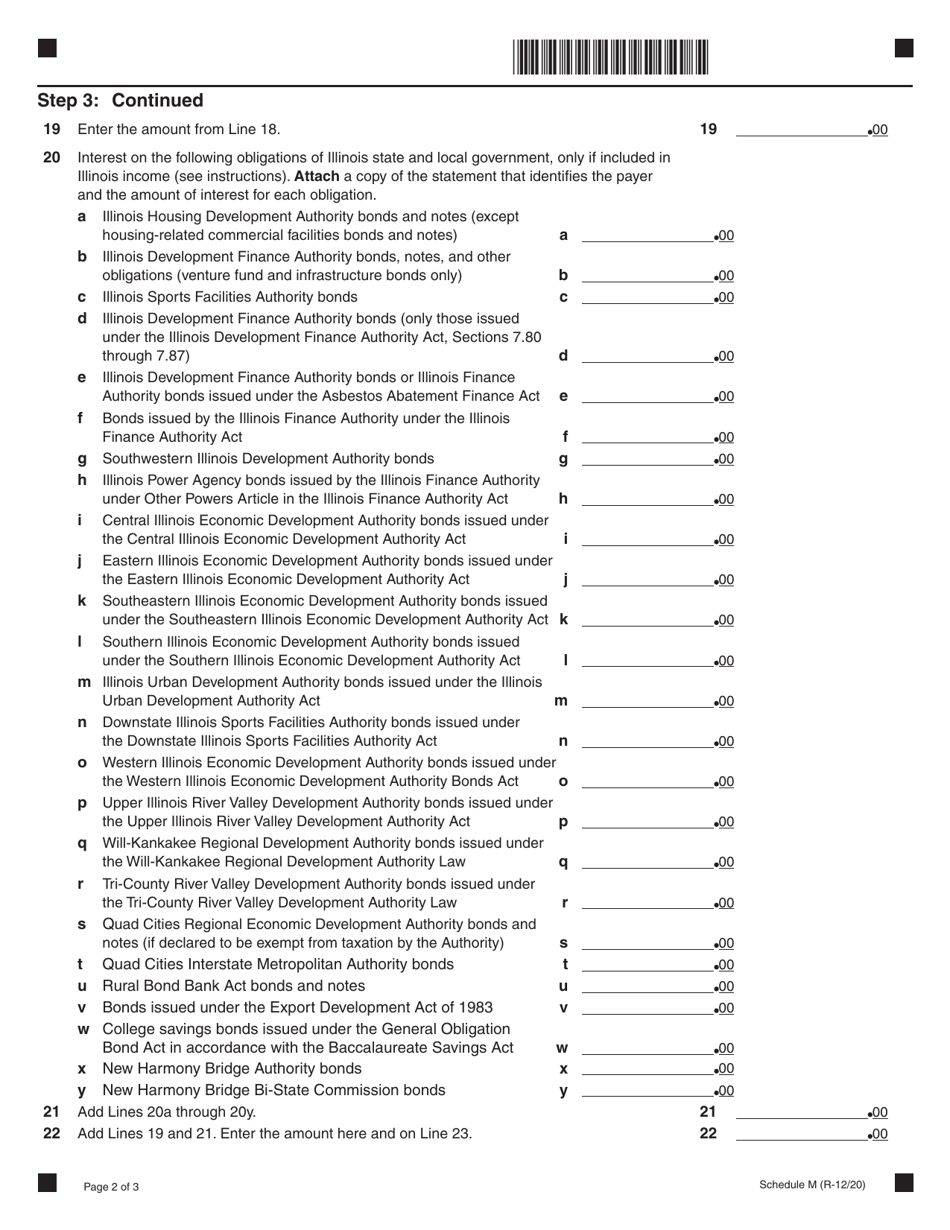

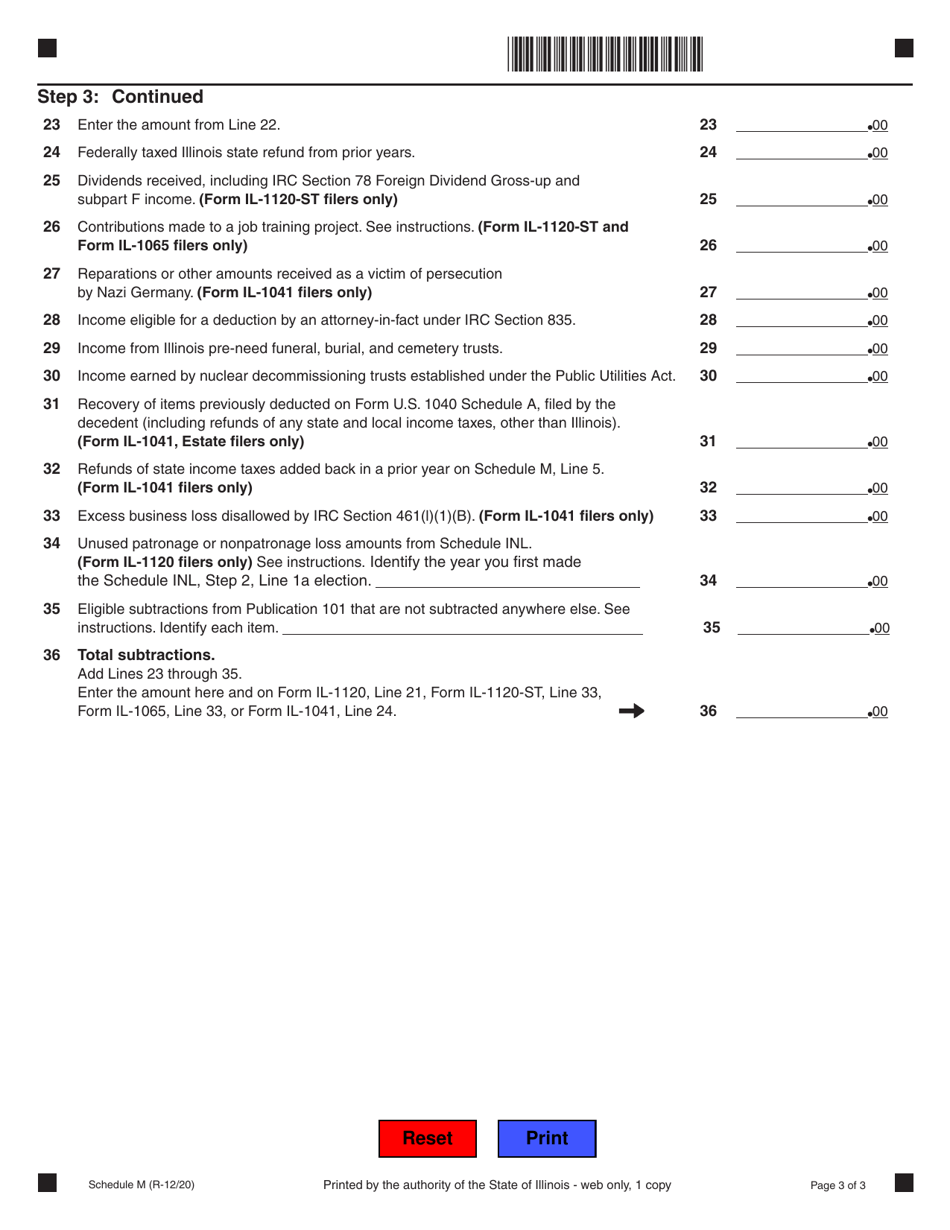

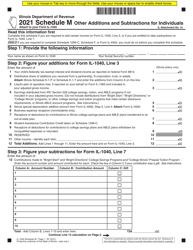

Schedule M Other Additions and Subtractions (For Businesses) - Illinois

What Is Schedule M?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M?

A: Schedule M is a form used by businesses in Illinois to report other additions and subtractions to their income.

Q: What are additions and subtractions?

A: Additions and subtractions refer to items that are added or subtracted from a business's income to determine their taxable income.

Q: What kind of additions and subtractions are reported on Schedule M?

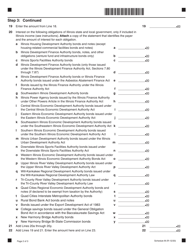

A: Schedule M includes items such as depreciation, bad debts, and certain federal deductions that need to be adjusted for Illinois tax purposes.

Q: Do all businesses in Illinois need to file Schedule M?

A: No, Schedule M is only required for businesses that have specific additions or subtractions to report.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.