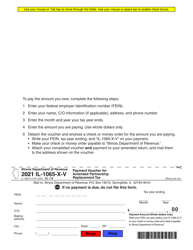

This version of the form is not currently in use and is provided for reference only. Download this version of

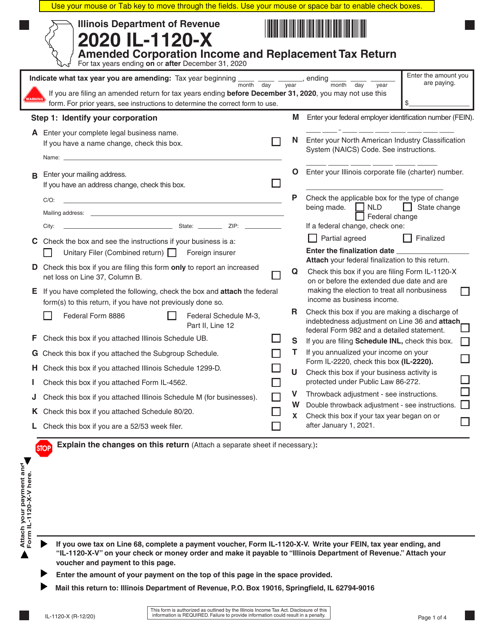

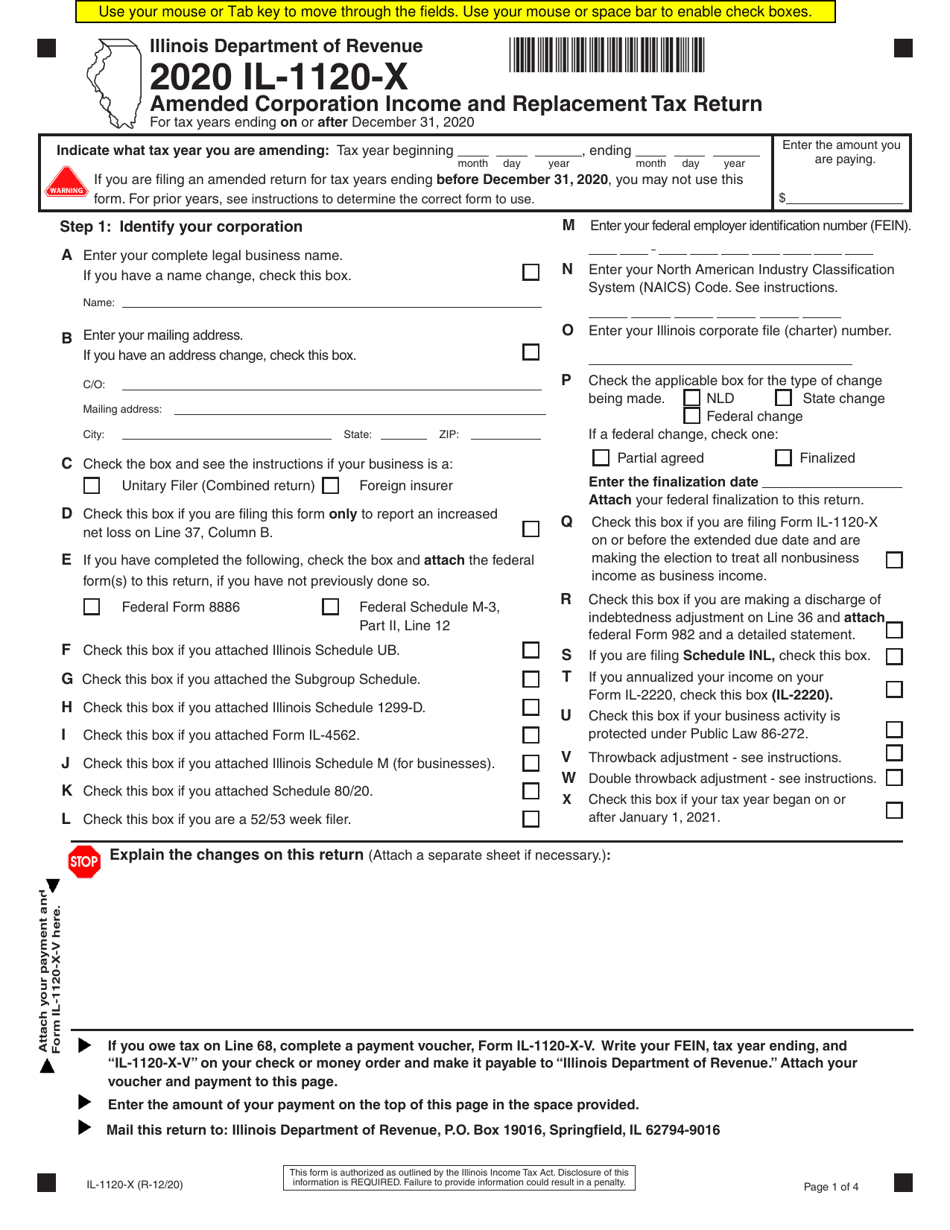

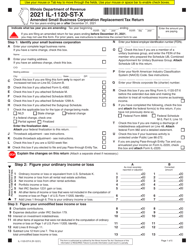

Form IL-1120-X

for the current year.

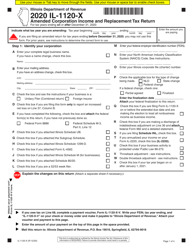

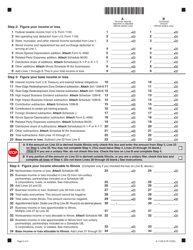

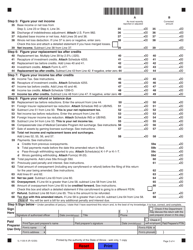

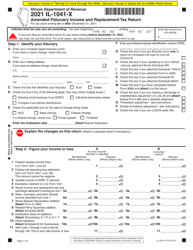

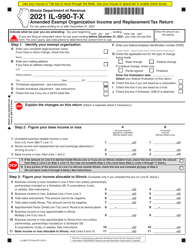

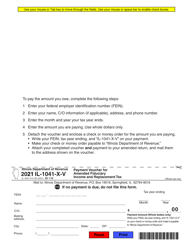

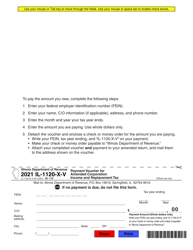

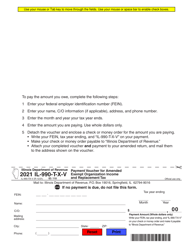

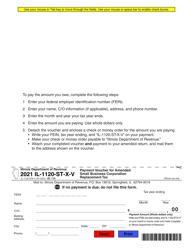

Form IL-1120-X Amended Corporation Income and Replacement Tax Return - Illinois

What Is Form IL-1120-X?

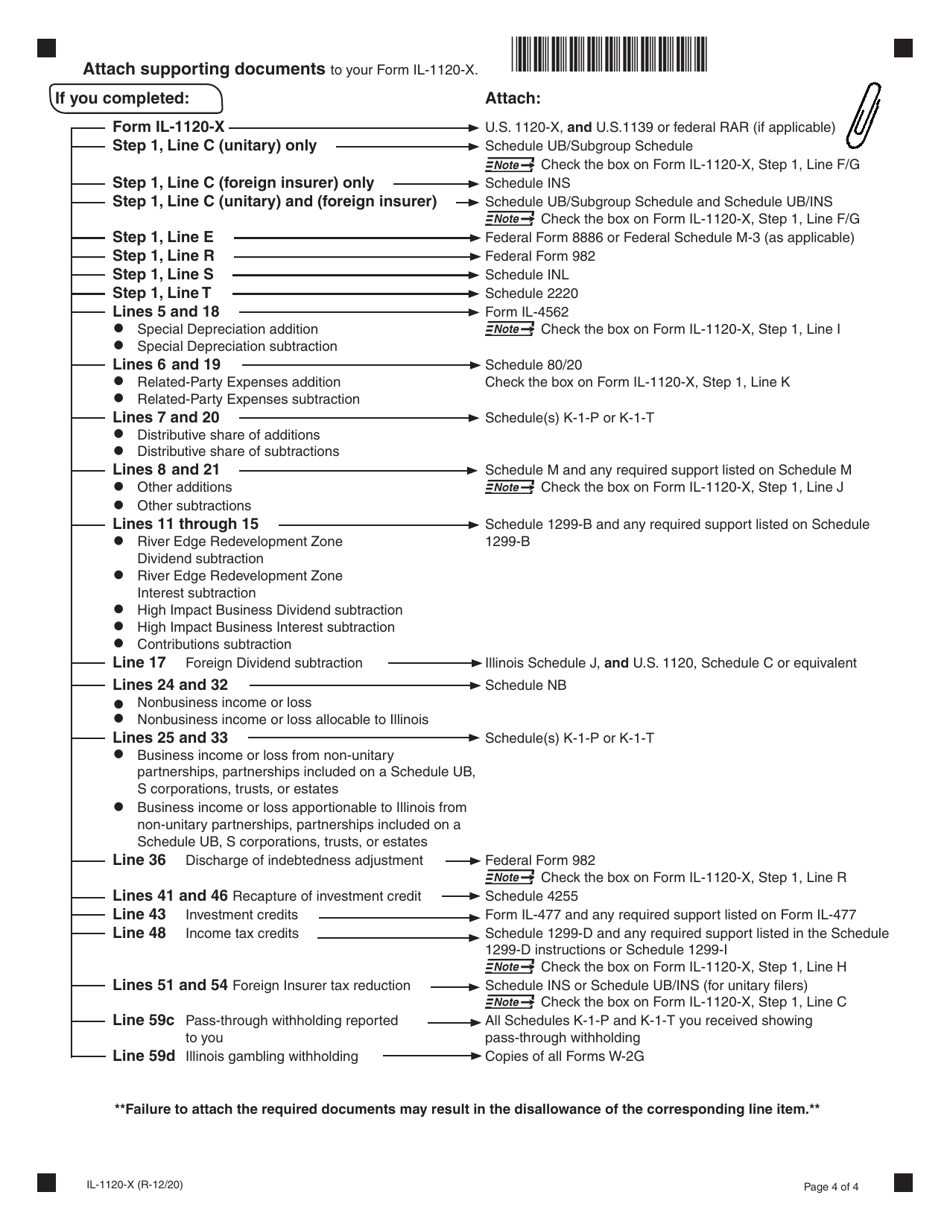

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-1120-X?

A: Form IL-1120-X is the Amended Corporation Income and Replacement Tax Return for Illinois.

Q: Who needs to file Form IL-1120-X?

A: Corporations in Illinois that need to amend their previously filed income and replacement tax return.

Q: When should Form IL-1120-X be filed?

A: Form IL-1120-X should be filed within three years from the original due date or two years from the date the tax was paid, whichever is later.

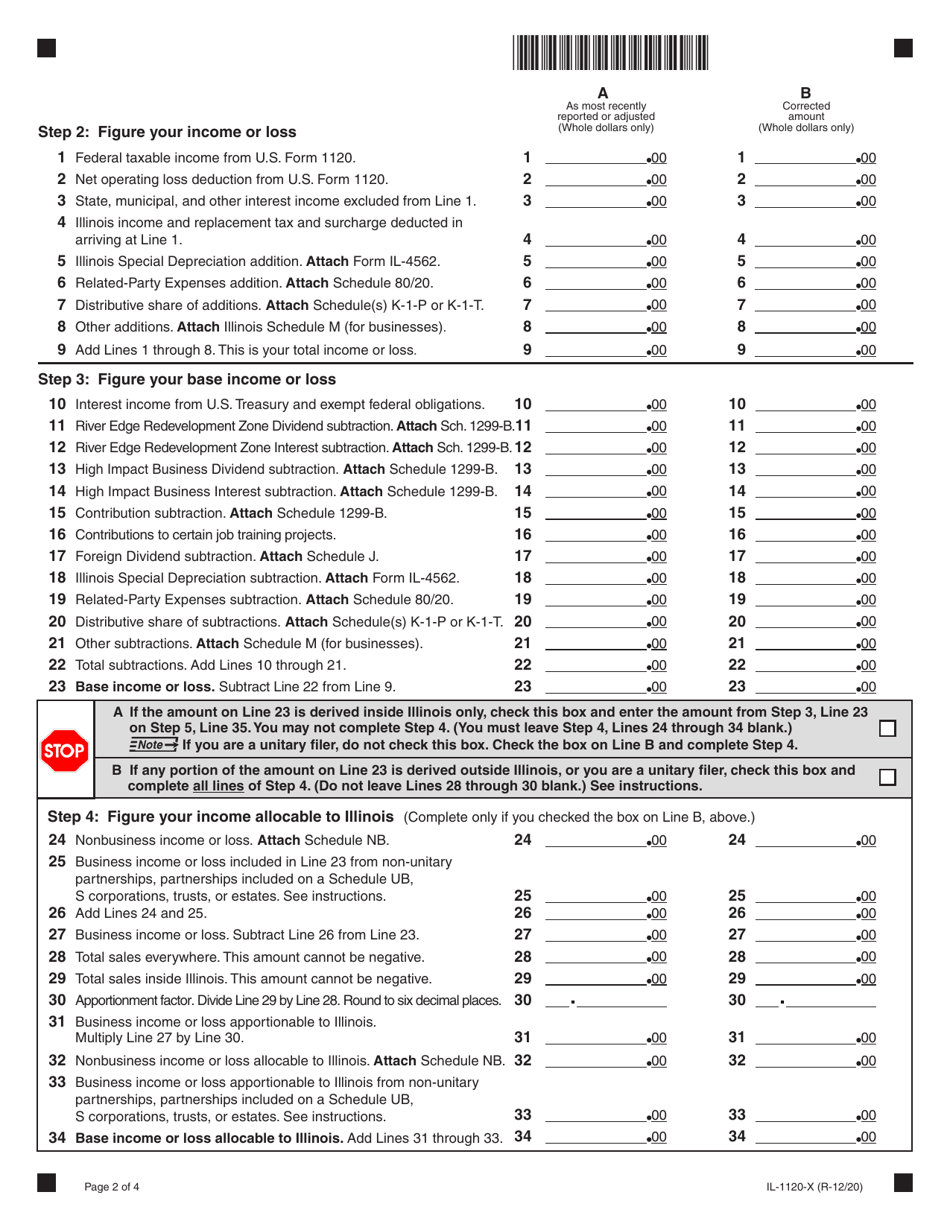

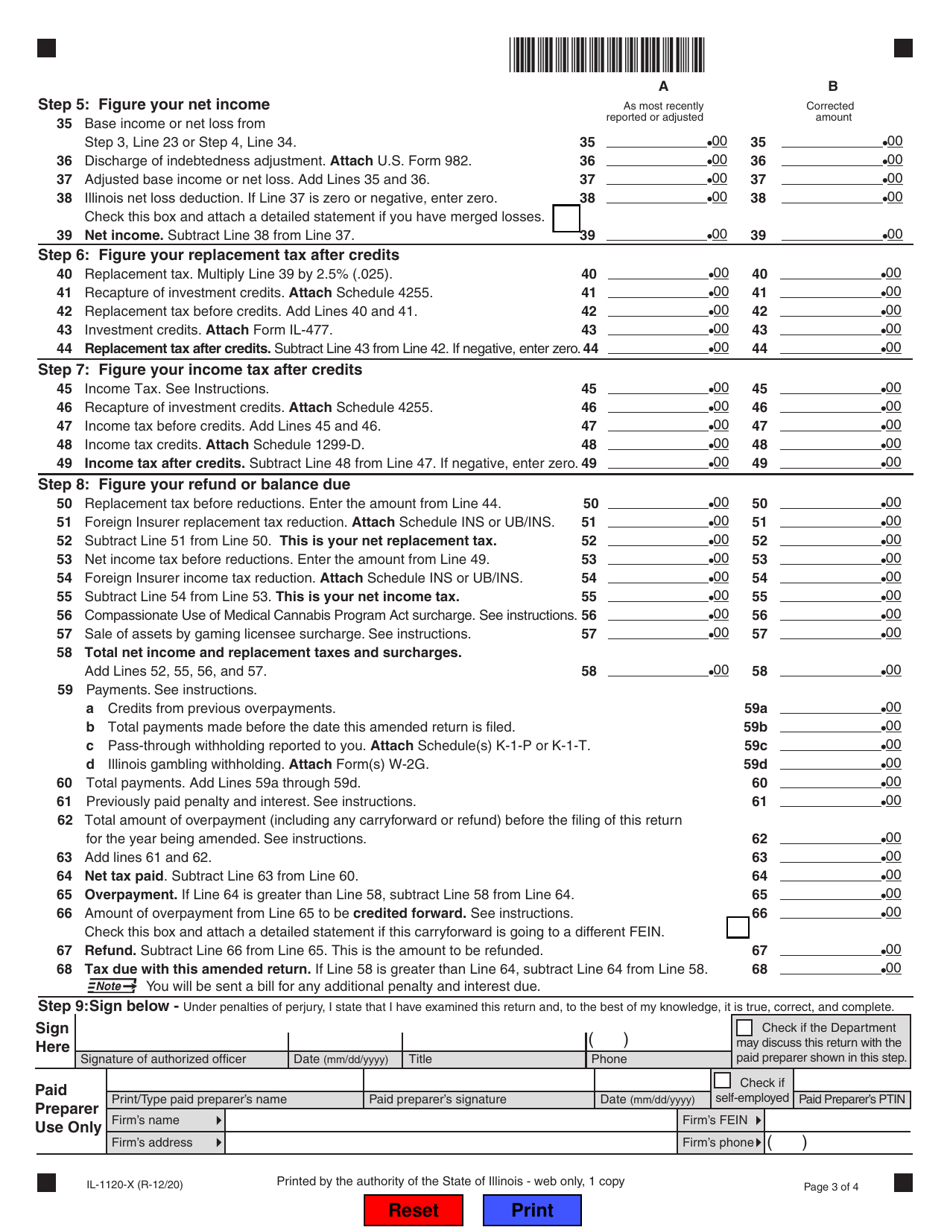

Q: What information is required on Form IL-1120-X?

A: Form IL-1120-X requires the corporation to provide information about the original return, the changes being made, and the reasons for the changes.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1120-X by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.