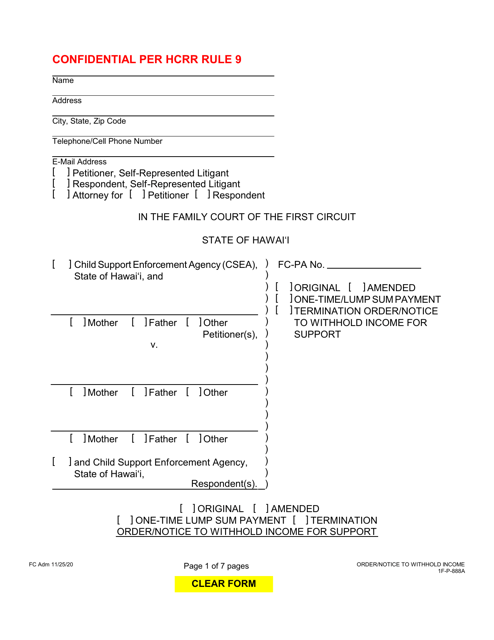

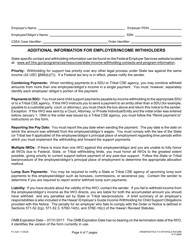

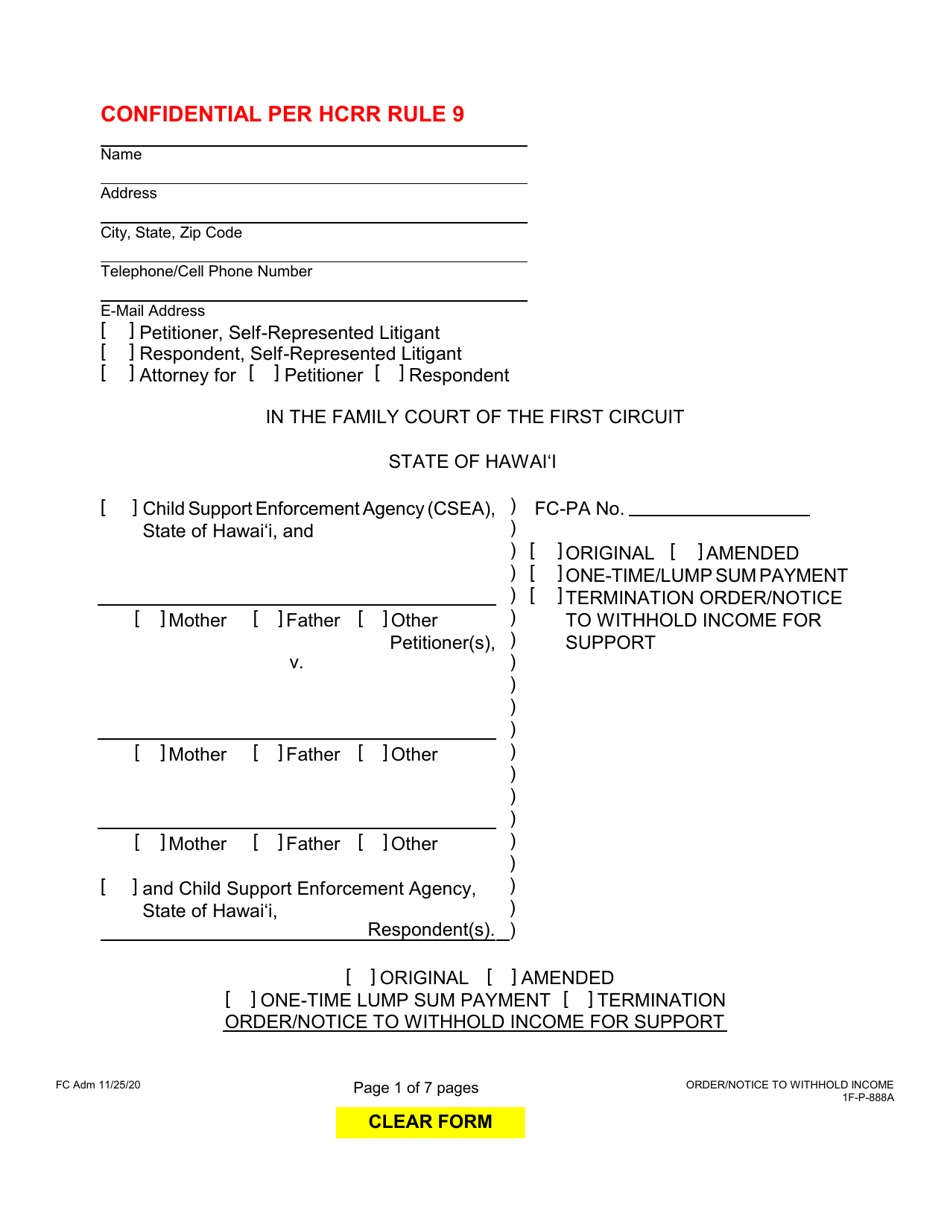

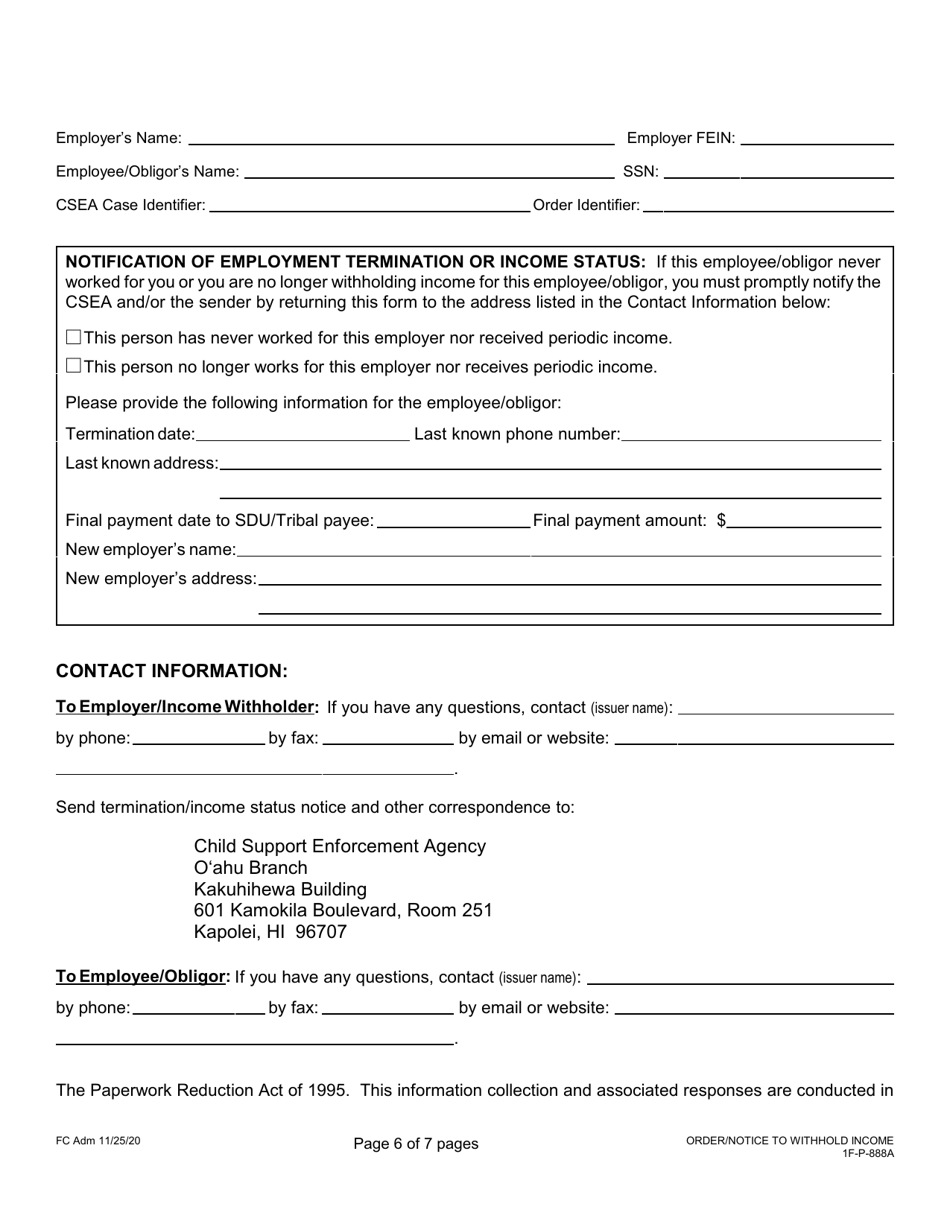

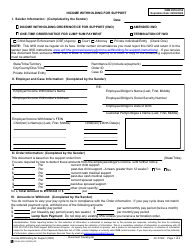

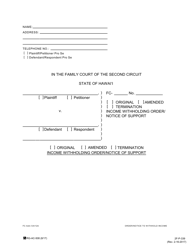

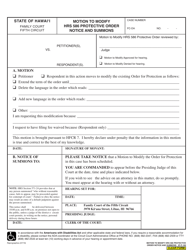

Form 1F-P-888A Order / Notice to Withhold Income for Support - Hawaii

What Is Form 1F-P-888A?

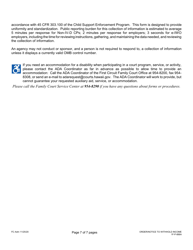

This is a legal form that was released by the Hawaii Family Court - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

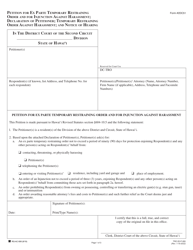

Q: What is Form 1F-P-888A?

A: Form 1F-P-888A is an Order/Notice to Withhold Income for Support in Hawaii.

Q: What is the purpose of Form 1F-P-888A?

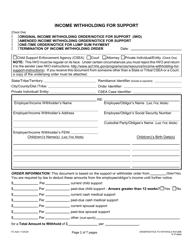

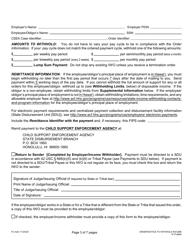

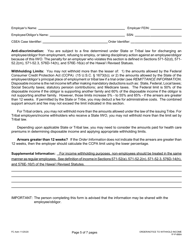

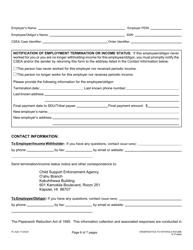

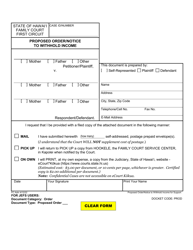

A: The purpose of Form 1F-P-888A is to inform an employer to withhold income from an employee to fulfill a child support obligation.

Q: Who uses Form 1F-P-888A?

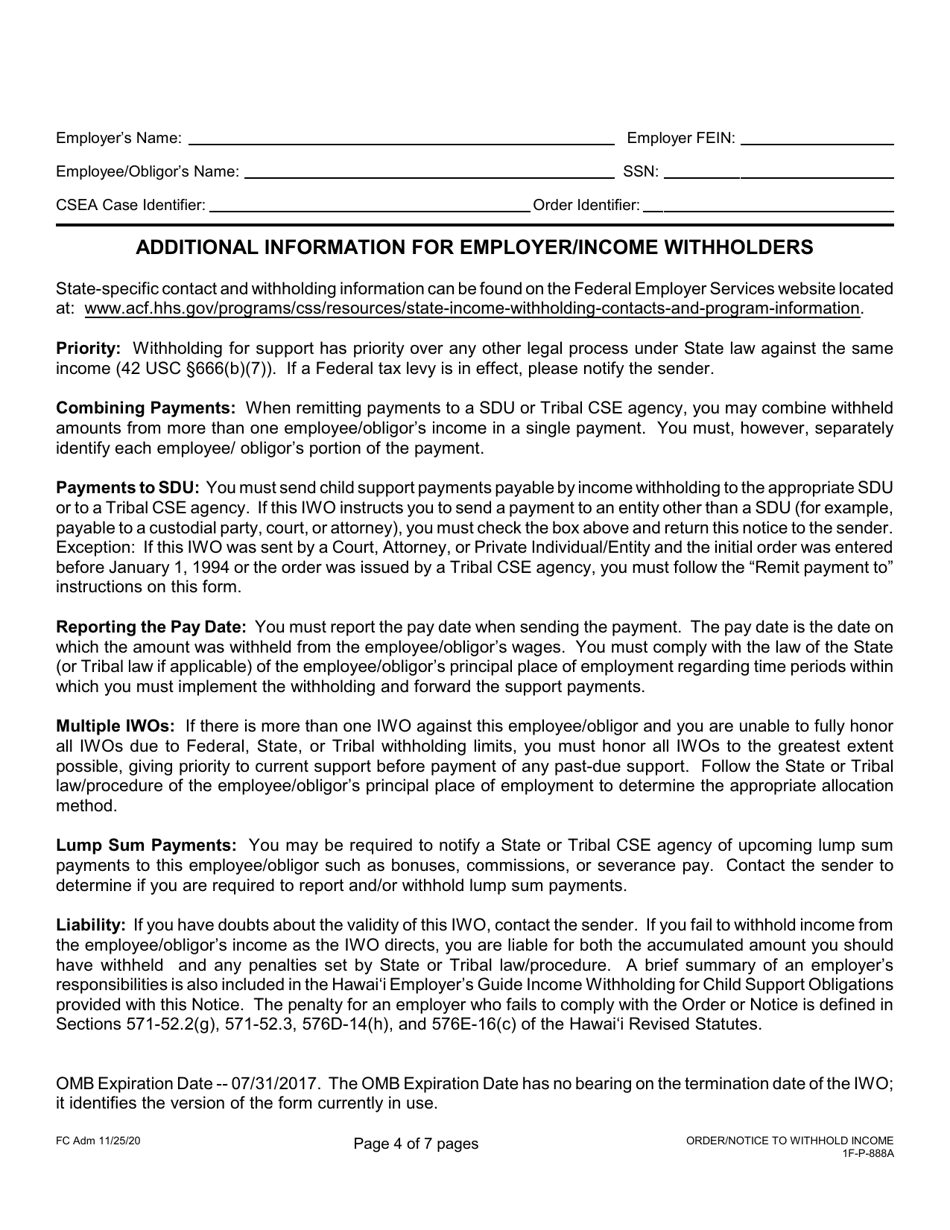

A: This form is used by the State of Hawaii Child Support Enforcement Agency, employers, and employees.

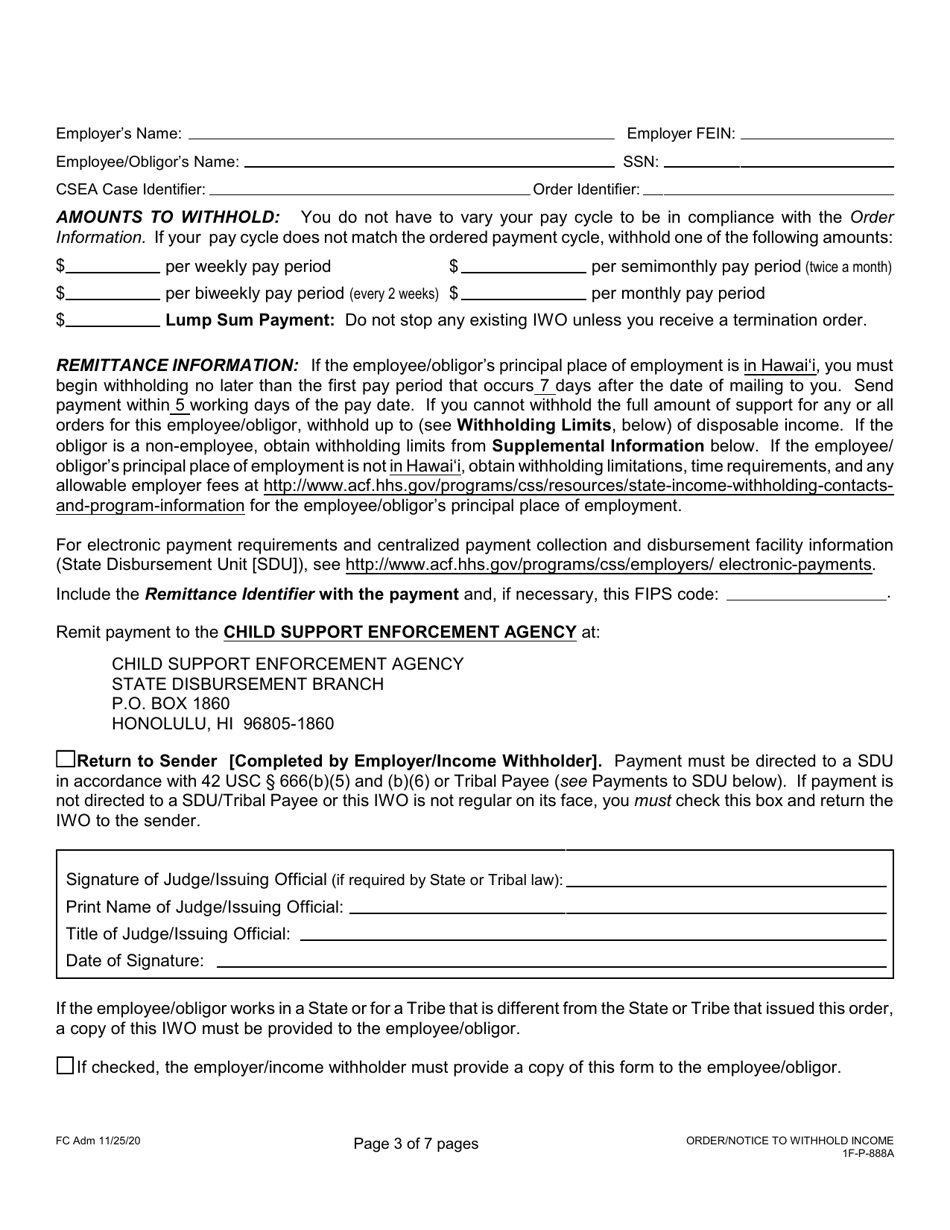

Q: What information is required on Form 1F-P-888A?

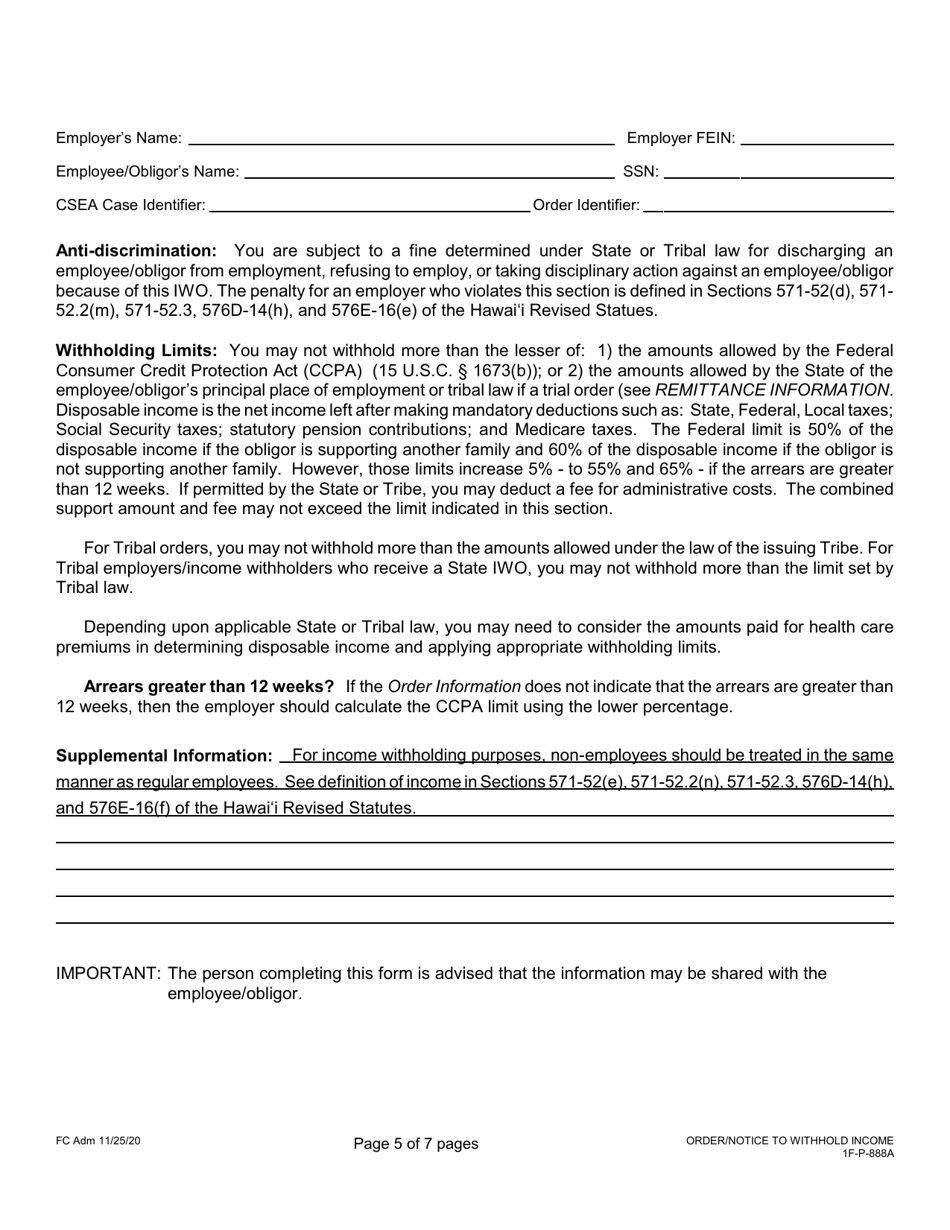

A: The form requires information about the employee, employer, child support case, and the amount to be withheld from the employee's income.

Q: Are there any fees associated with Form 1F-P-888A?

A: No, there are no fees associated with Form 1F-P-888A.

Q: Can Form 1F-P-888A be used outside of Hawaii?

A: No, Form 1F-P-888A is specific to the State of Hawaii and cannot be used in other states.

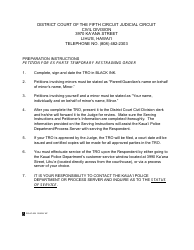

Q: What happens after Form 1F-P-888A is submitted?

A: After the form is submitted, the employer is required to withhold the specified amount from the employee's income and remit it to the State of Hawaii Child Support Enforcement Agency.

Form Details:

- Released on November 25, 2020;

- The latest edition provided by the Hawaii Family Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1F-P-888A by clicking the link below or browse more documents and templates provided by the Hawaii Family Court.