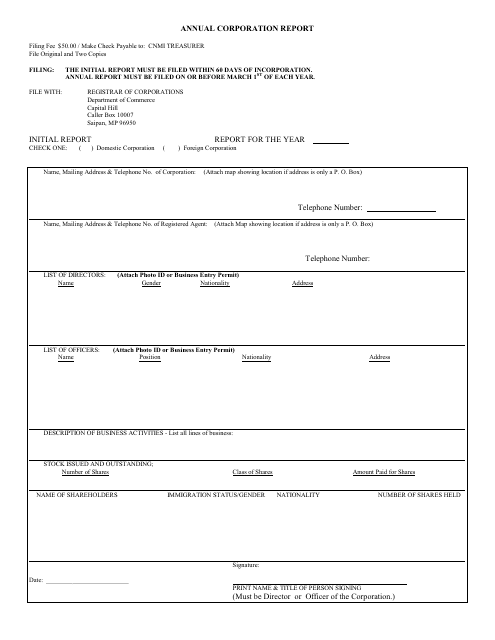

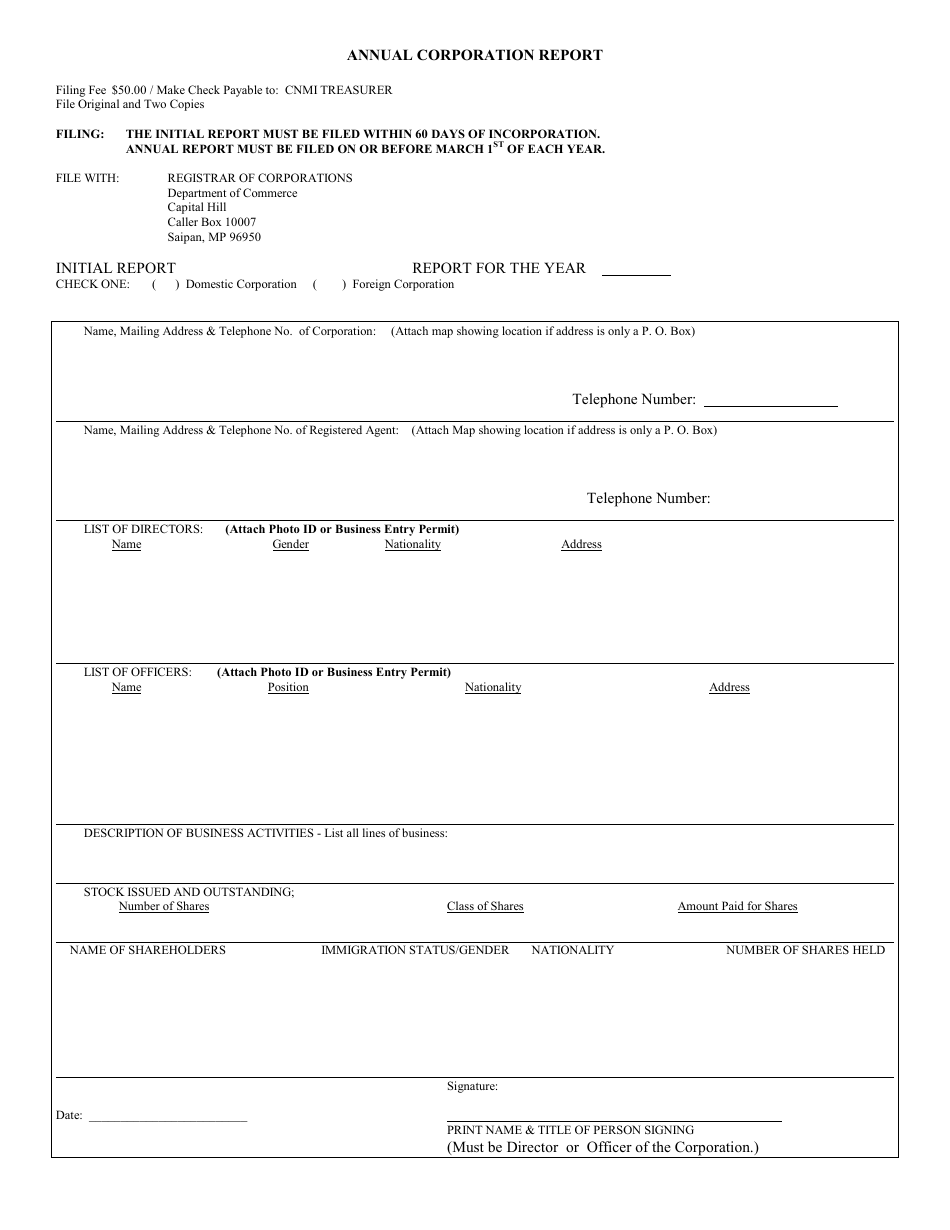

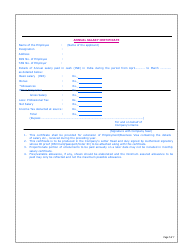

Annual Corporation Report Form

The Annual Corporation Report Form is used to disclose important information about a corporation's financial status, operations, and governance to the state government. This form is typically submitted on a yearly basis to maintain legal compliance and transparency.

The annual corporation report form is typically filed by the corporation itself.

FAQ

Q: What is an Annual Corporation Report form?

A: An Annual Corporation Report form is a document that a corporation is required to file with the relevant government agency, usually the Secretary of State or Department of Corporations, to provide updated information about the corporation's business operations and ownership.

Q: What information is typically included in an Annual Corporation Report form?

A: The information typically included in an Annual Corporation Report form may vary depending on the state, but it generally includes details such as the corporation's name, address, registered agents, directors, officers, and sometimes financial information.

Q: Why is an Annual Corporation Report form required?

A: An Annual Corporation Report form is required to maintain the corporation's legal status and compliance with state laws. It helps ensure transparency and accuracy of information for public record purposes.

Q: When is an Annual Corporation Report form due?

A: The due date for filing an Annual Corporation Report form varies by state, but it is often on the anniversary of the corporation's incorporation or on a specific date determined by the state's filing requirements.

Q: What happens if a corporation fails to file an Annual Corporation Report form?

A: If a corporation fails to file an Annual Corporation Report form, it may face penalties or consequences such as late fees, loss of good standing, or even dissolution of the corporation.