This version of the form is not currently in use and is provided for reference only. Download this version of

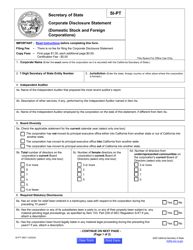

Form SI-PT

for the current year.

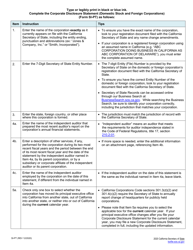

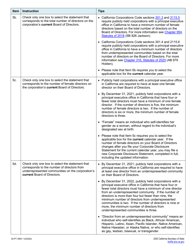

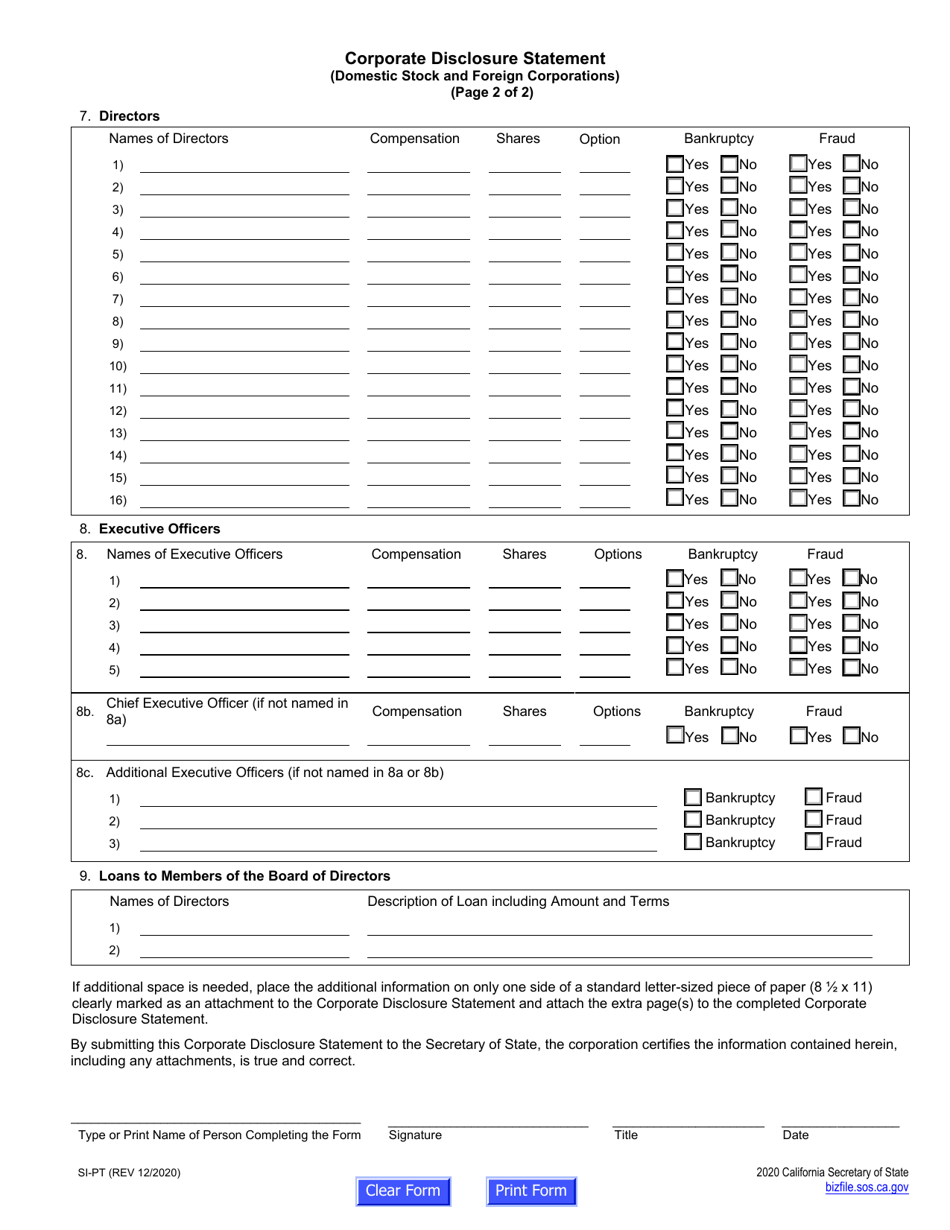

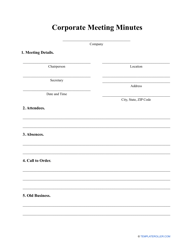

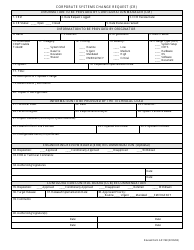

Form SI-PT Corporate Disclosure Statement (Domestic Stock and Foreign Corporations) - California

What Is Form SI-PT?

This is a legal form that was released by the California Secretary of State - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SI-PT?

A: Form SI-PT is the Corporate Disclosure Statement for Domestic Stock and Foreign Corporations in California.

Q: Who needs to file Form SI-PT?

A: Domestic stock corporations and foreign corporations doing business in California must file Form SI-PT.

Q: What is the purpose of Form SI-PT?

A: The purpose of Form SI-PT is to provide information about the corporate structure and principal business activities of corporations.

Q: Is Form SI-PT required annually?

A: Yes, Form SI-PT must be filed annually by the corporation.

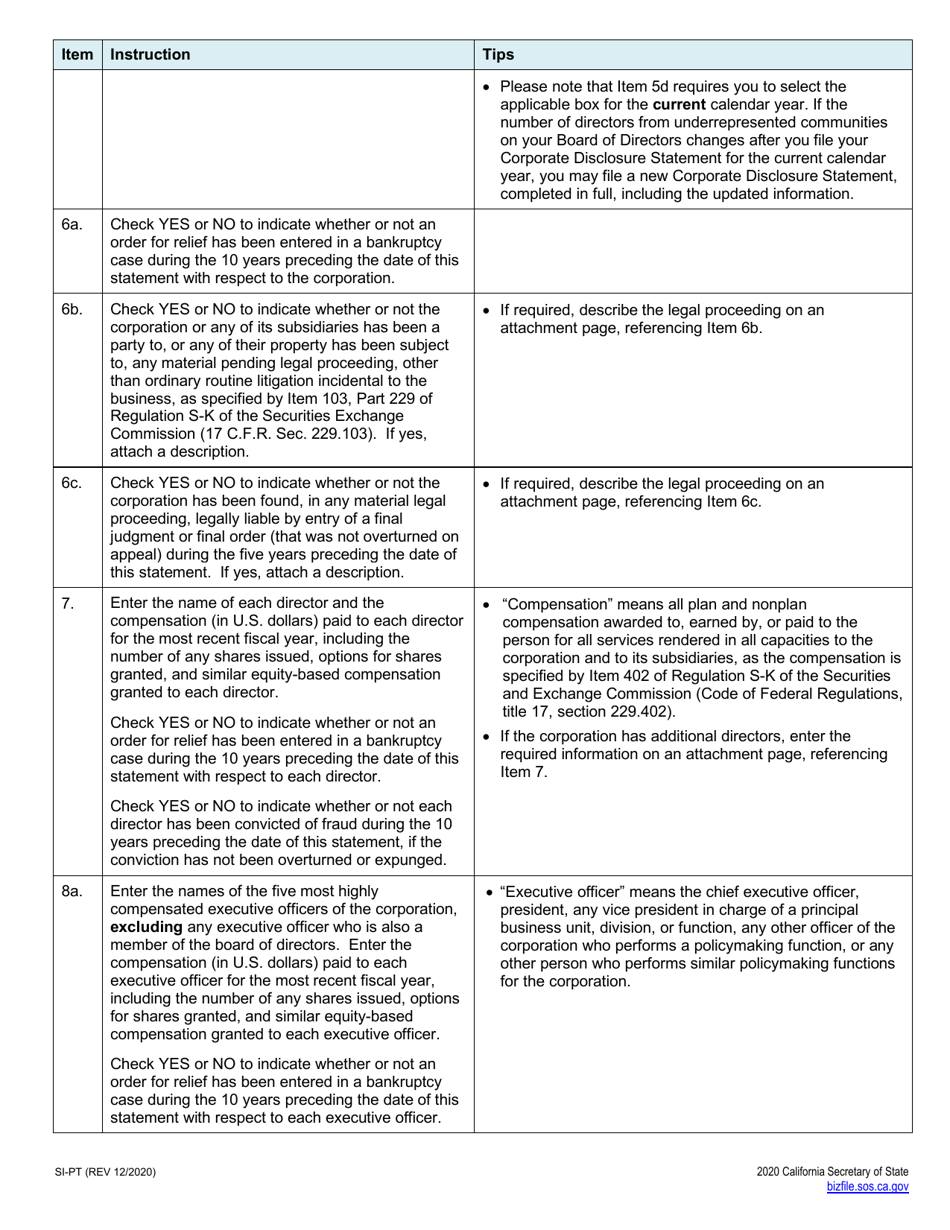

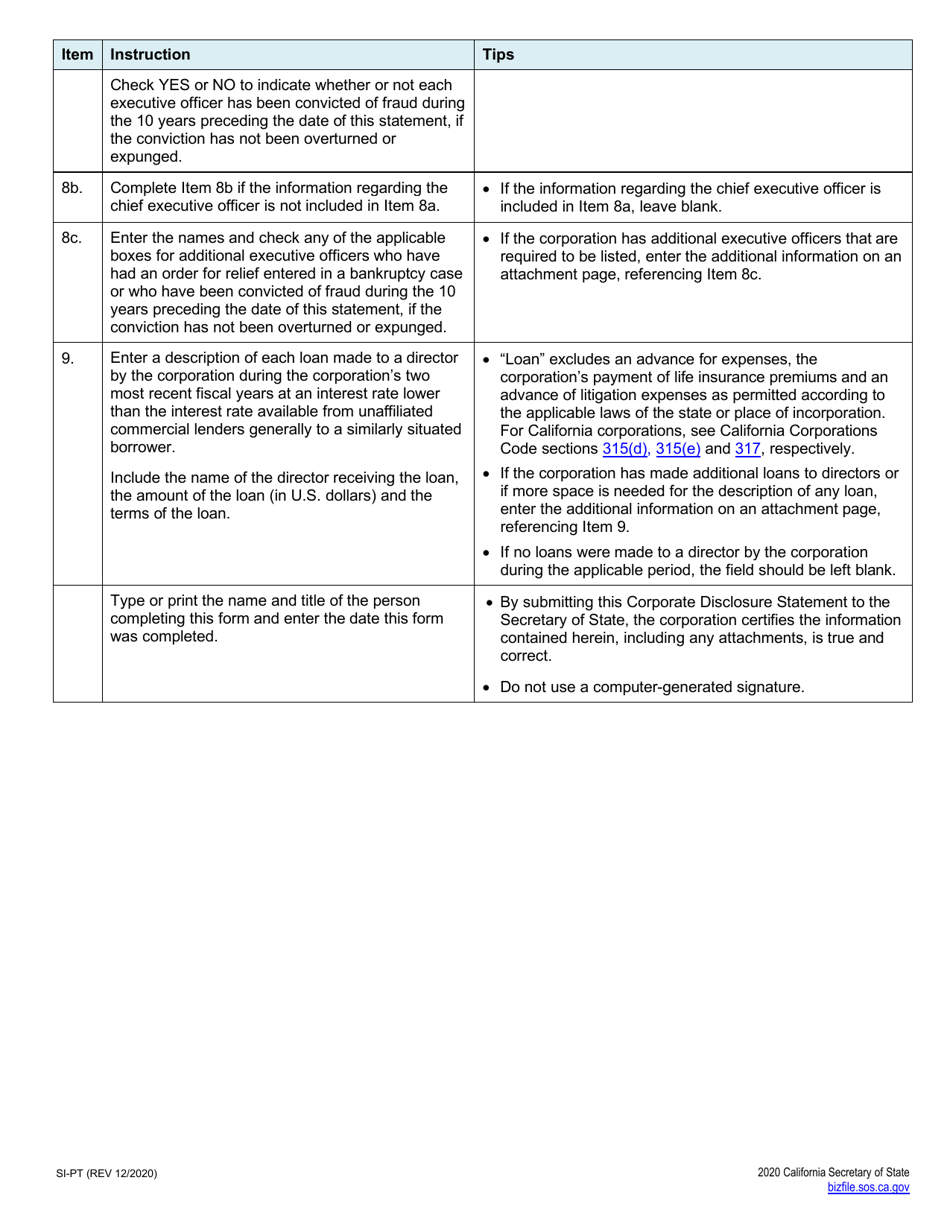

Q: What information is required on Form SI-PT?

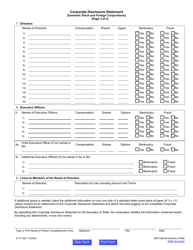

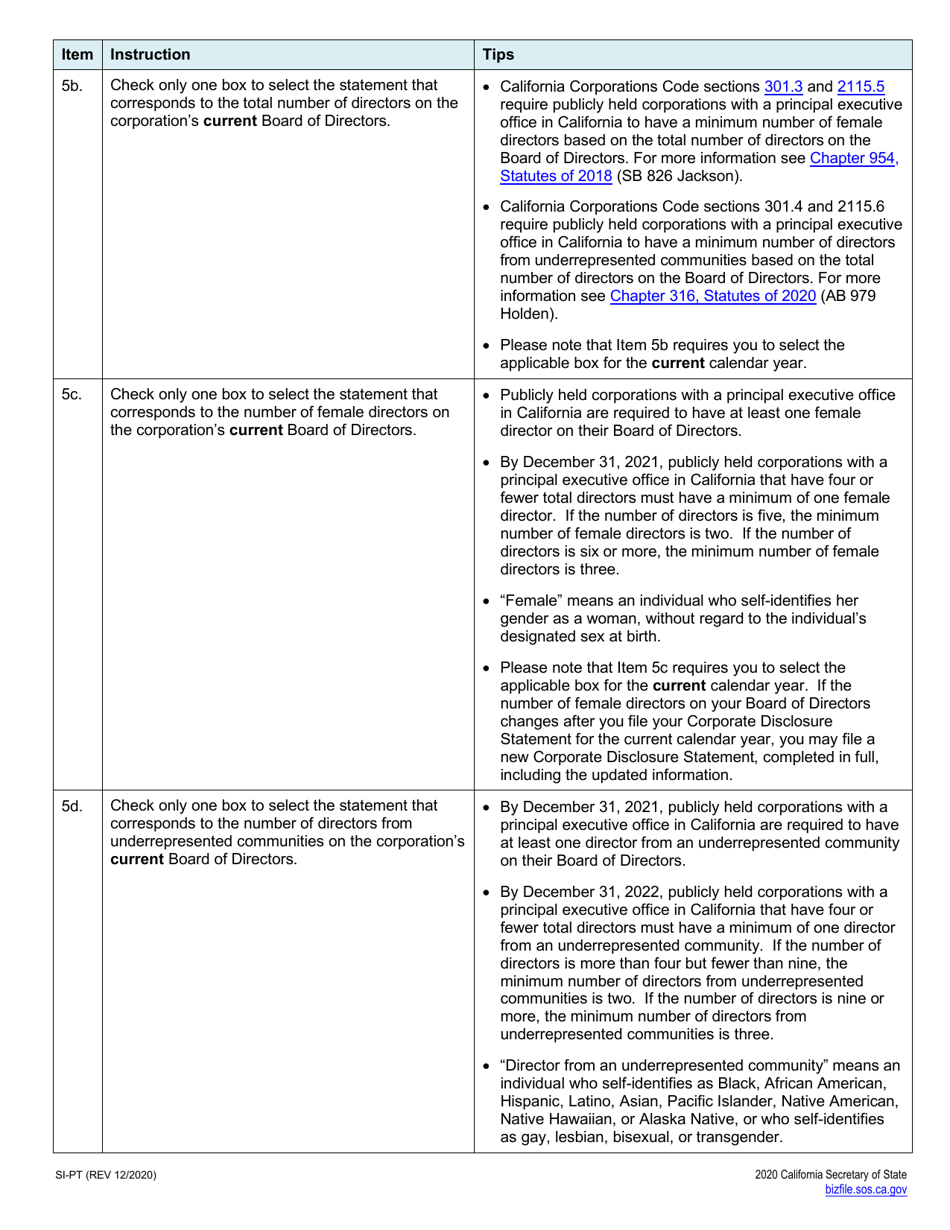

A: Form SI-PT requires information such as the corporation's name, business address, registered agent, and details about the directors and officers.

Q: How much does it cost to file Form SI-PT?

A: The filing fee for Form SI-PT is $25 for domestic stock corporations and $25 for foreign corporations.

Q: When is the deadline to file Form SI-PT?

A: Form SI-PT must be filed by the last day of the month in which the corporation was formed or registered to do business in California.

Q: What happens if Form SI-PT is not filed?

A: Failure to file Form SI-PT may result in penalties and the loss of certain rights and privileges of the corporation in California.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the California Secretary of State;

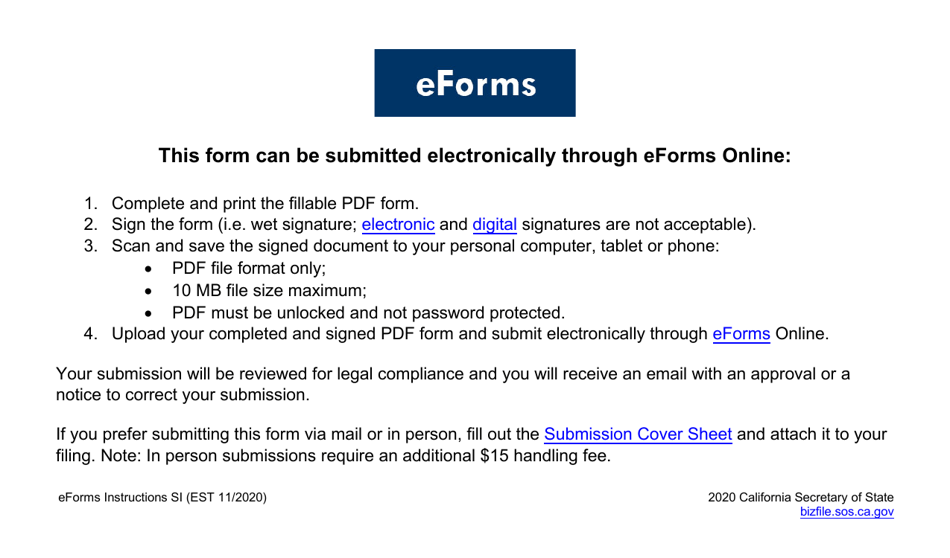

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SI-PT by clicking the link below or browse more documents and templates provided by the California Secretary of State.