This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-501-NC

for the current year.

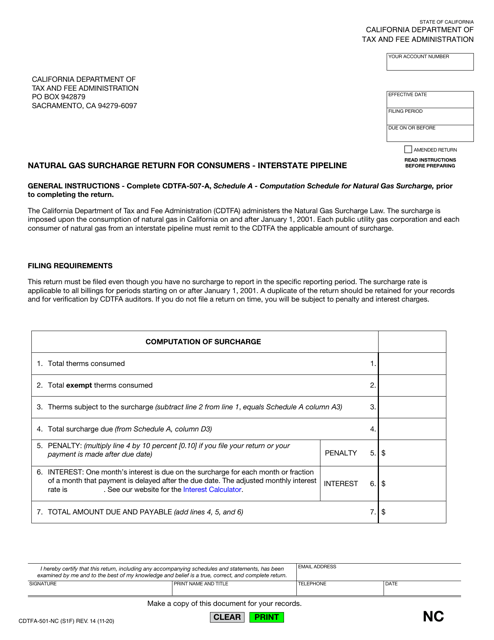

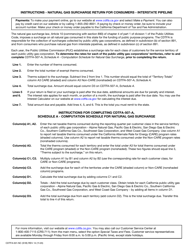

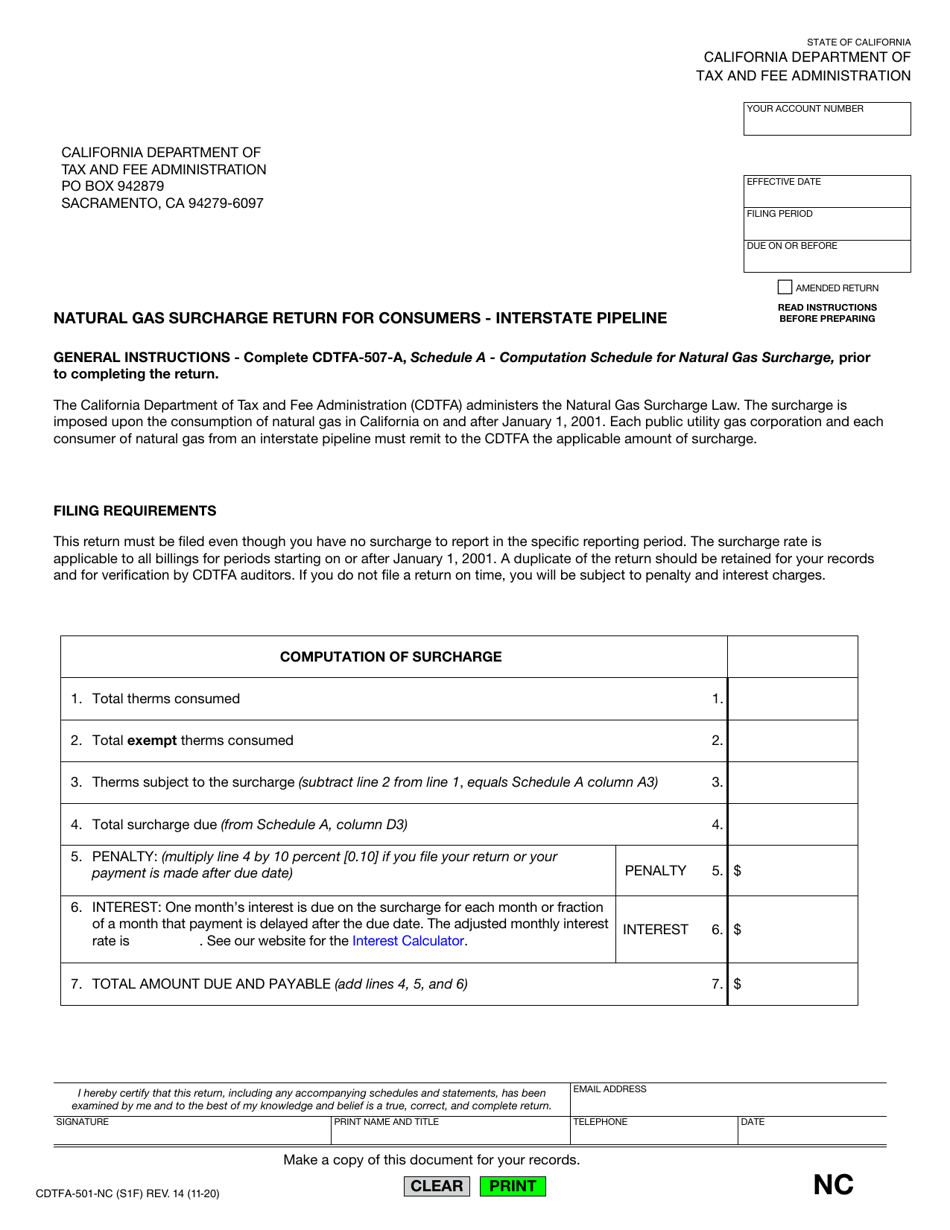

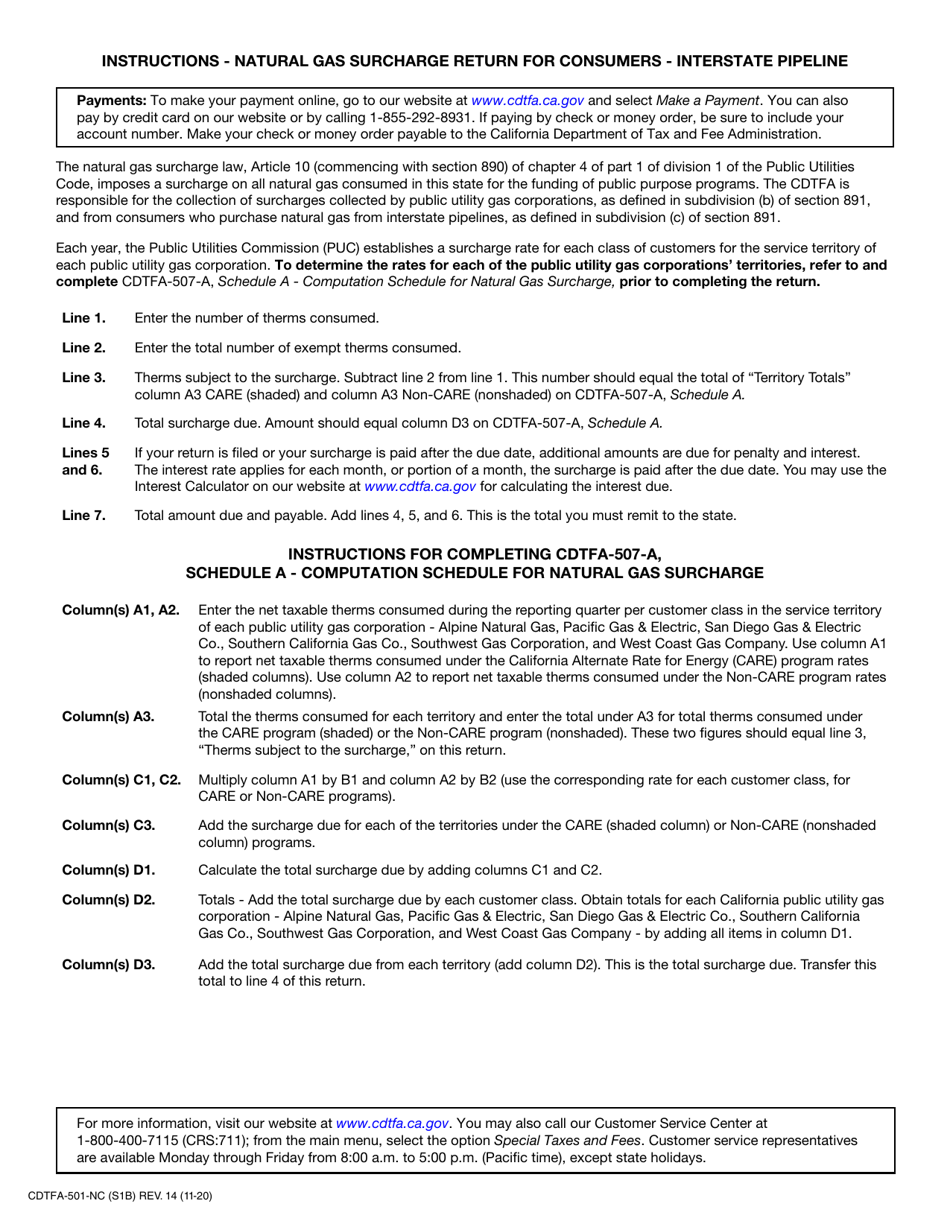

Form CDTFA-501-NC Natural Gas Surcharge Return for Consumers - Interstate Pipeline - California

What Is Form CDTFA-501-NC?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-501-NC?

A: Form CDTFA-501-NC is a return form for reporting the natural gas surcharge for consumers on interstate pipeline in California.

Q: Who needs to file Form CDTFA-501-NC?

A: Consumers on interstate pipeline in California need to file Form CDTFA-501-NC.

Q: What is the purpose of Form CDTFA-501-NC?

A: The purpose of Form CDTFA-501-NC is to report and pay the natural gas surcharge for consumers on interstate pipeline in California.

Q: When is Form CDTFA-501-NC due?

A: Form CDTFA-501-NC is due on a quarterly basis, with filing deadlines falling on the last day of the month following the end of each quarter.

Q: Are there any penalties for late filing of Form CDTFA-501-NC?

A: Yes, penalties may apply for late filing of Form CDTFA-501-NC. It is important to file and pay the surcharge on time to avoid penalties and potential interest charges.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-NC by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.