This version of the form is not currently in use and is provided for reference only. Download this version of

Form CDTFA-501-NW

for the current year.

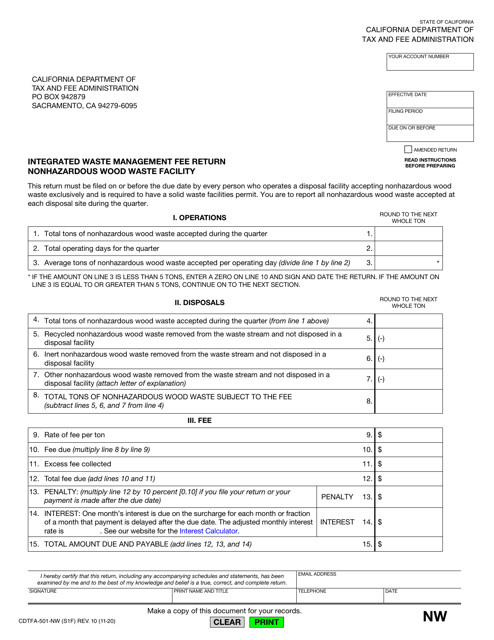

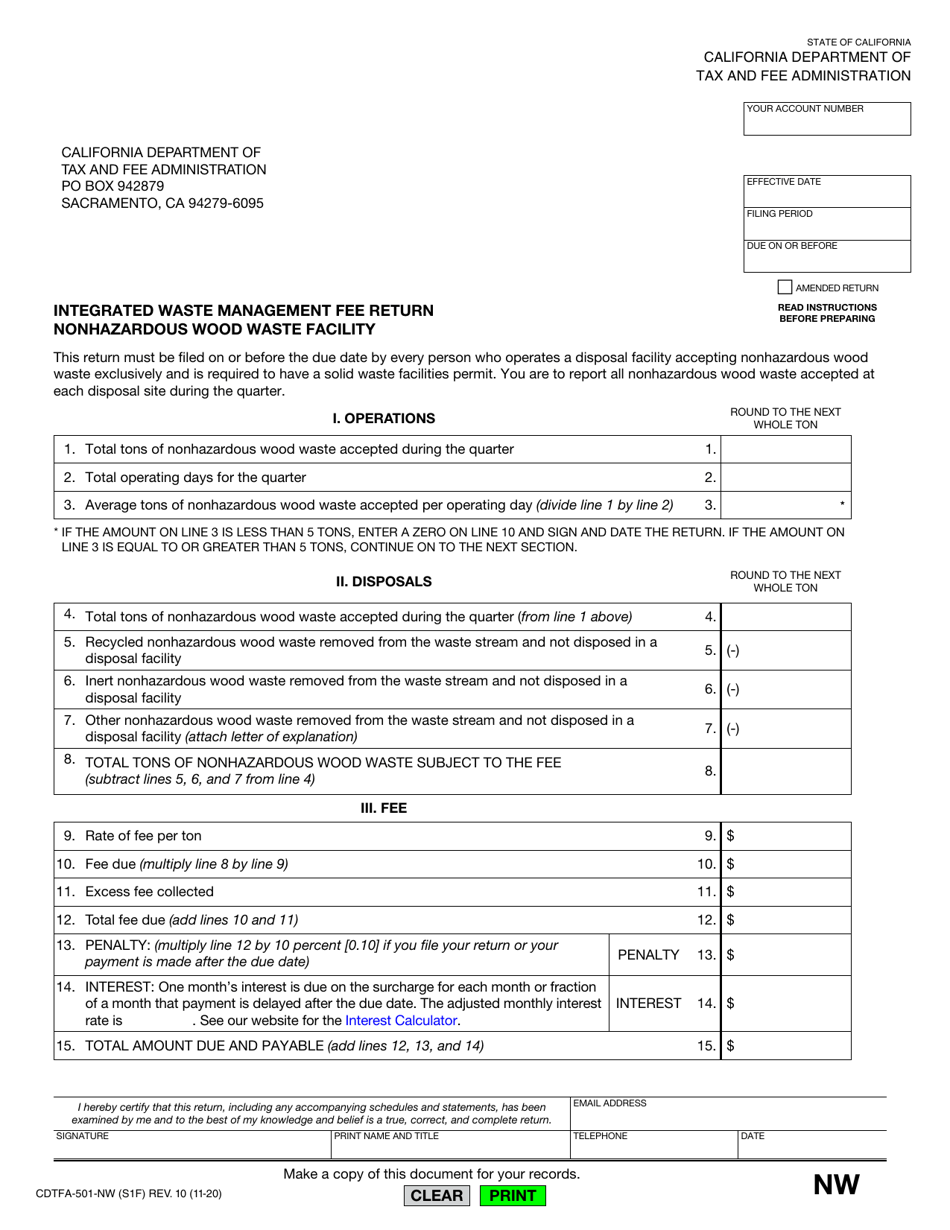

Form CDTFA-501-NW Integrated Waste Management Fee Return - Nonhazardous Wood Waste Facility - California

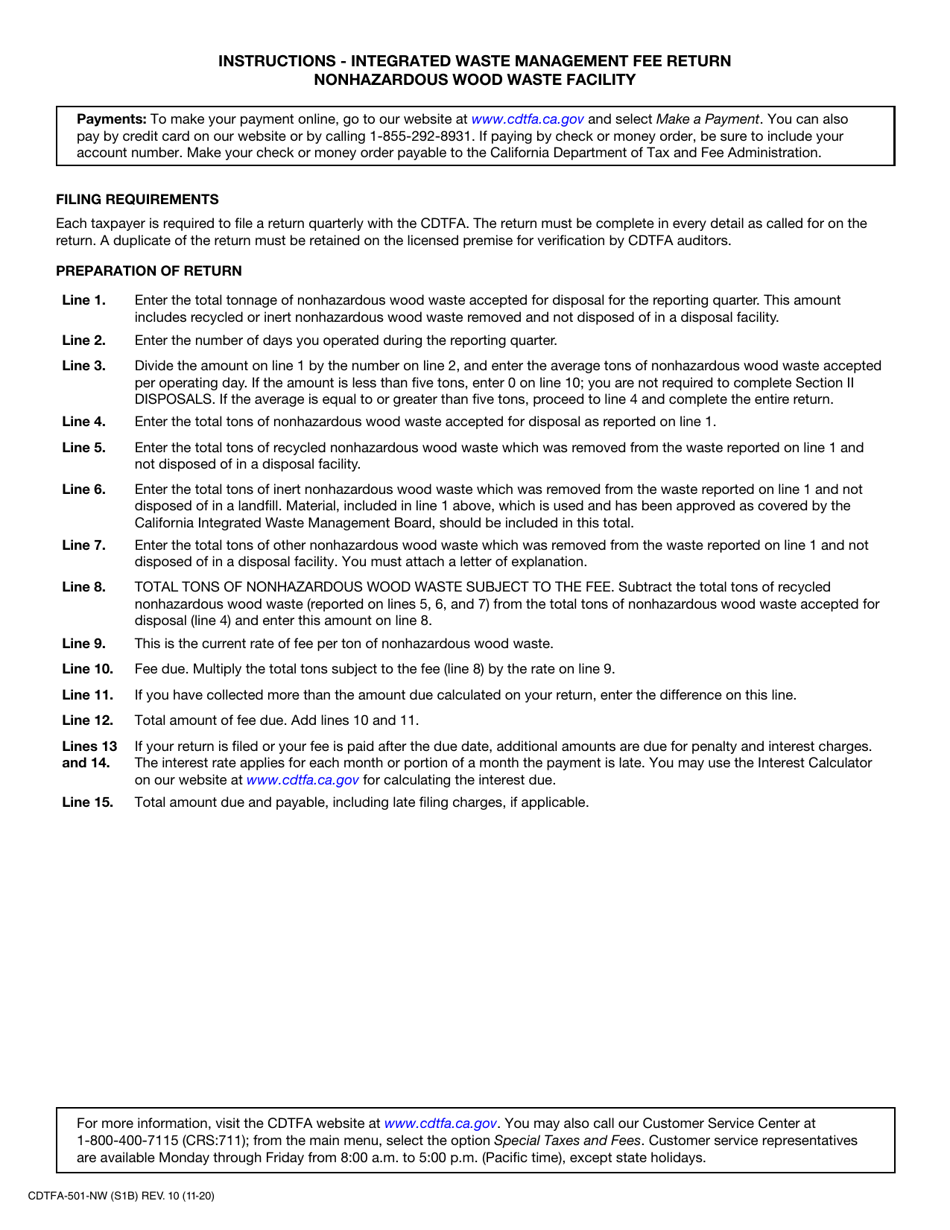

What Is Form CDTFA-501-NW?

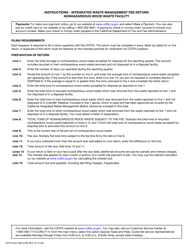

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: Who needs to file Form CDTFA-501-NW?

A: Nonhazardous wood waste facility in California.

Q: What is the purpose of Form CDTFA-501-NW?

A: To report and pay the Integrated Waste Management Fee for nonhazardous wood waste facilities.

Q: How often do you need to file Form CDTFA-501-NW?

A: Quarterly, due on the last day of the month following the end of the quarter.

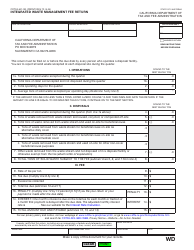

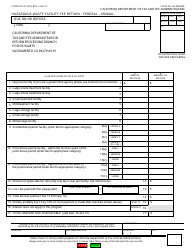

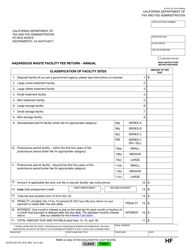

Q: What information is required on Form CDTFA-501-NW?

A: Information about the facility, the amount of nonhazardous wood waste received and processed, and the calculation of the fee.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing and non-compliance with the Integrated Waste Management Fee requirements.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-501-NW by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.