This version of the form is not currently in use and is provided for reference only. Download this version of

Form ADOR10834

for the current year.

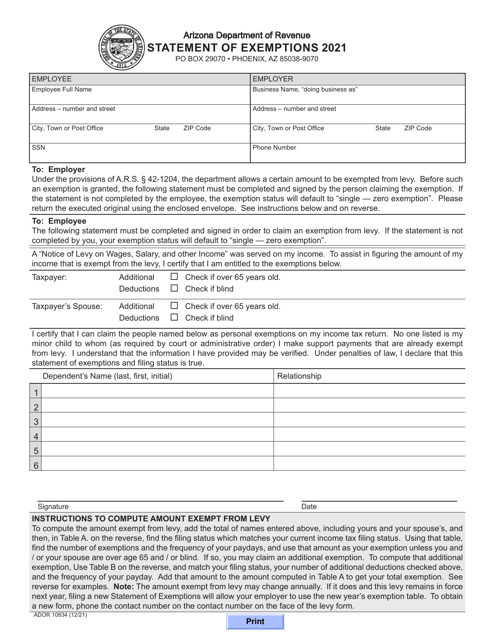

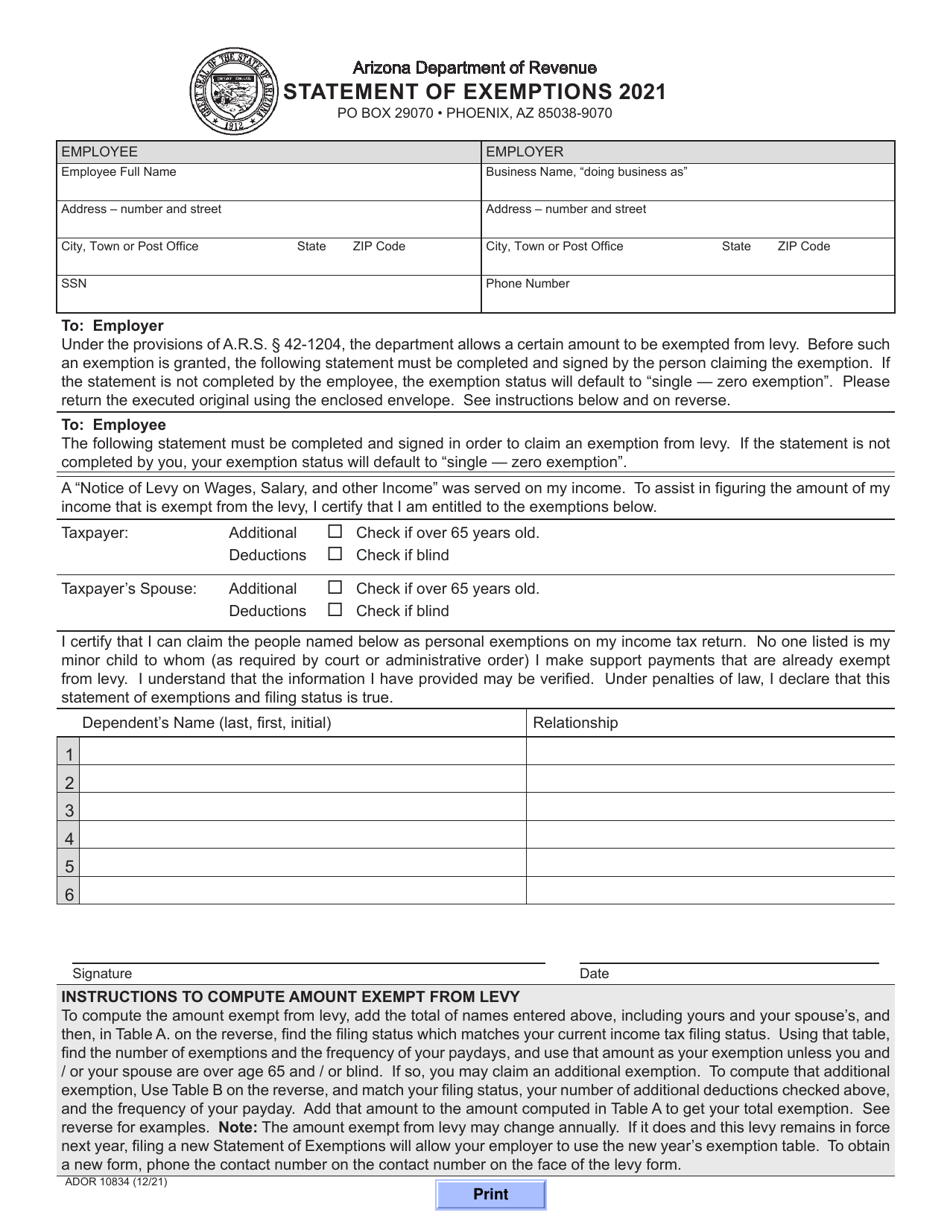

Form ADOR10834 Statement of Exemptions - Arizona

What Is Form ADOR10834?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR10834?

A: Form ADOR10834 is a Statement of Exemptions for Arizona.

Q: Who needs to file Form ADOR10834?

A: Form ADOR10834 needs to be filed by individuals or businesses claiming exemptions in Arizona.

Q: What is the purpose of Form ADOR10834?

A: The purpose of Form ADOR10834 is to claim exemptions and provide supporting documentation for tax purposes in Arizona.

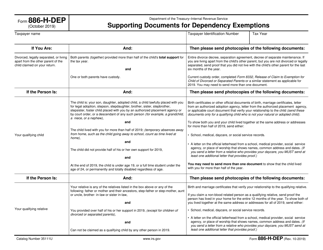

Q: What are the exemptions that can be claimed on Form ADOR10834?

A: Exemptions that can be claimed on Form ADOR10834 include personal exemptions, dependent exemptions, and miscellaneous exemptions as allowed by Arizona tax law.

Q: Is Form ADOR10834 required to be filed every year?

A: Yes, Form ADOR10834 needs to be filed annually to claim exemptions in Arizona.

Q: Are there any deadlines for filing Form ADOR10834?

A: The deadline for filing Form ADOR10834 is typically April 15th of each year, unless an extension has been granted.

Q: What should I do if I am unsure about how tofill out Form ADOR10834?

A: If you are unsure about how to fill out Form ADOR10834, it is recommended to seek assistance from a tax professional or contact the Arizona Department of Revenue for guidance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR10834 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.