This version of the form is not currently in use and is provided for reference only. Download this version of

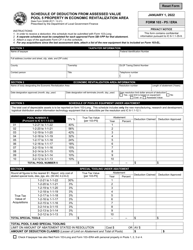

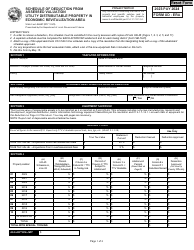

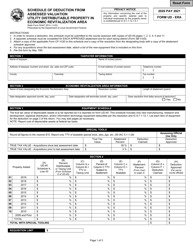

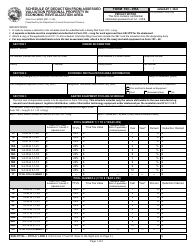

Form UD-ERA (State Form 52447)

for the current year.

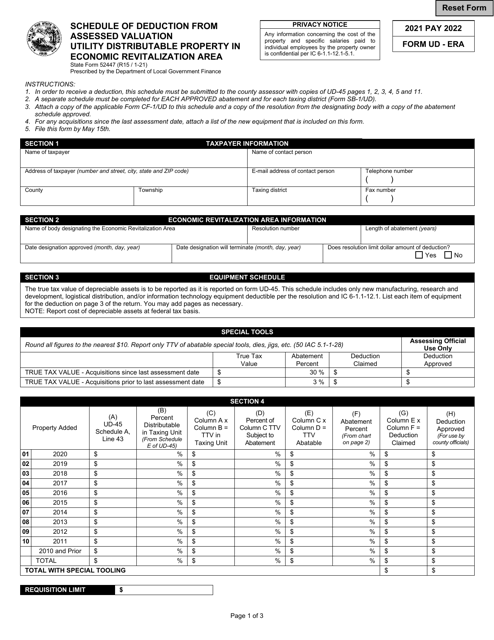

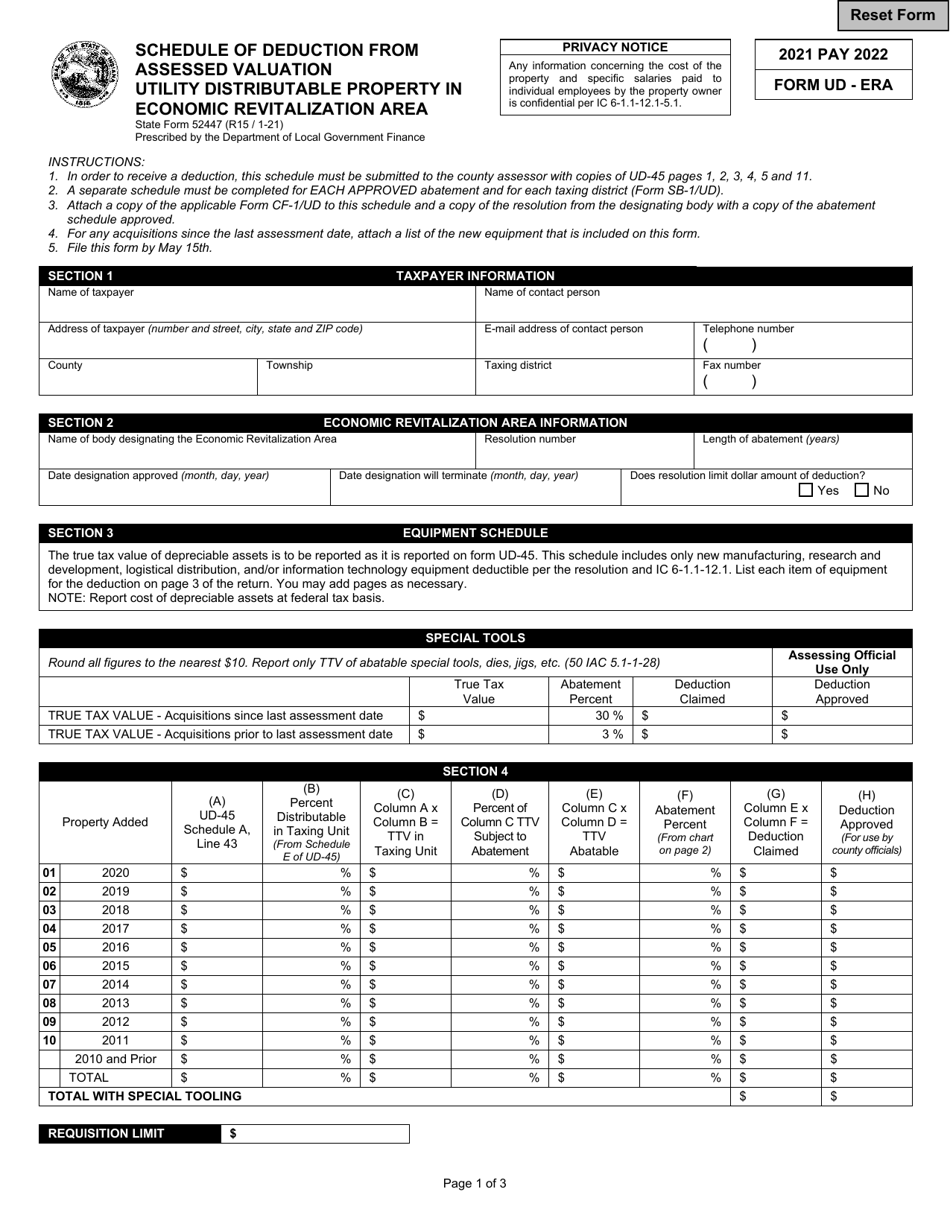

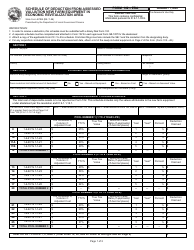

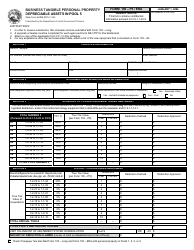

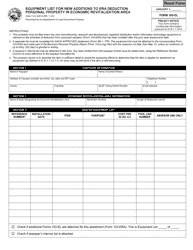

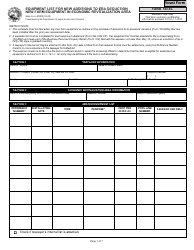

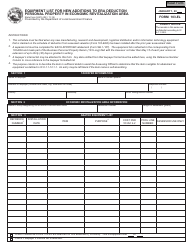

Form UD-ERA (State Form 52447) Schedule of Deduction From Assessed Valuation Utility Distributable Property in Economic Revitalization Area - Indiana

What Is Form UD-ERA (State Form 52447)?

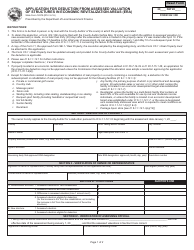

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UD-ERA?

A: Form UD-ERA (State Form 52447) is the Schedule of Deduction From Assessed Valuation Utility Distributable Property in Economic Revitalization Area.

Q: What is the purpose of Form UD-ERA?

A: The purpose of Form UD-ERA is to claim a deduction from the assessed valuation of utility distributable property in an Economic Revitalization Area in Indiana.

Q: Who needs to file Form UD-ERA?

A: Property owners or operators of utility distributable property in an Economic Revitalization Area in Indiana need to file Form UD-ERA.

Q: What is a deduction from assessed valuation?

A: A deduction from assessed valuation is a reduction in the assessed value of a property, which in turn reduces the property taxes owed.

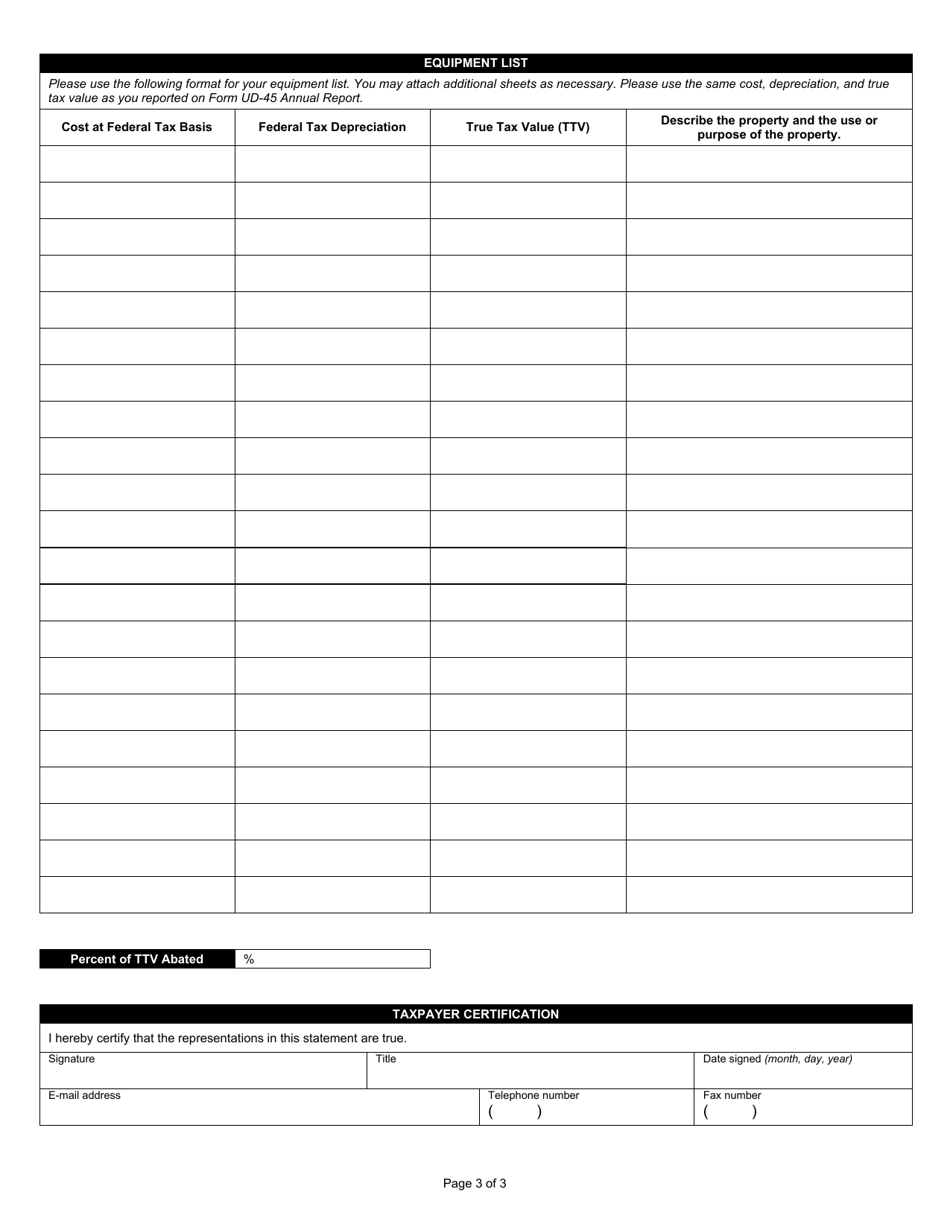

Q: What is utility distributable property?

A: Utility distributable property refers to tangible property used by a public utility that is necessary for the production, generation, transmission, or distribution of utility services.

Q: What is an Economic Revitalization Area?

A: An Economic Revitalization Area is an area designated by local government to promote economic development and revitalization through certain tax incentives.

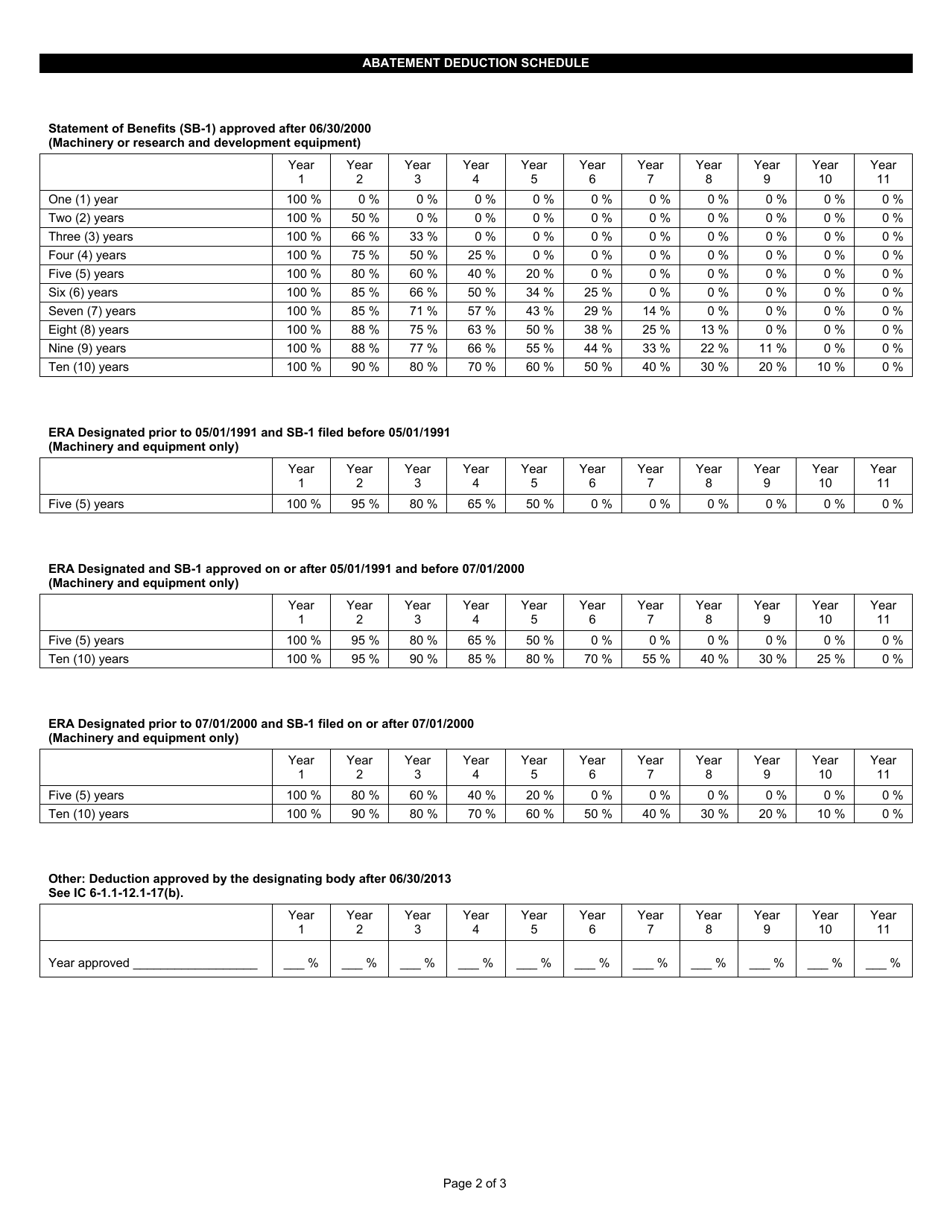

Q: Are there any qualifications for the deduction?

A: Yes, there are specific qualifications that need to be met in order to claim the deduction. It is advisable to review the instructions and eligibility criteria provided with the form.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UD-ERA (State Form 52447) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.