This version of the form is not currently in use and is provided for reference only. Download this version of

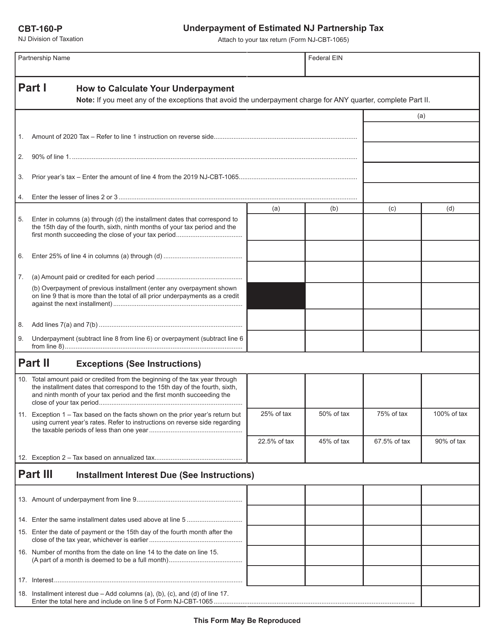

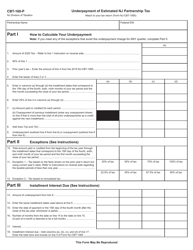

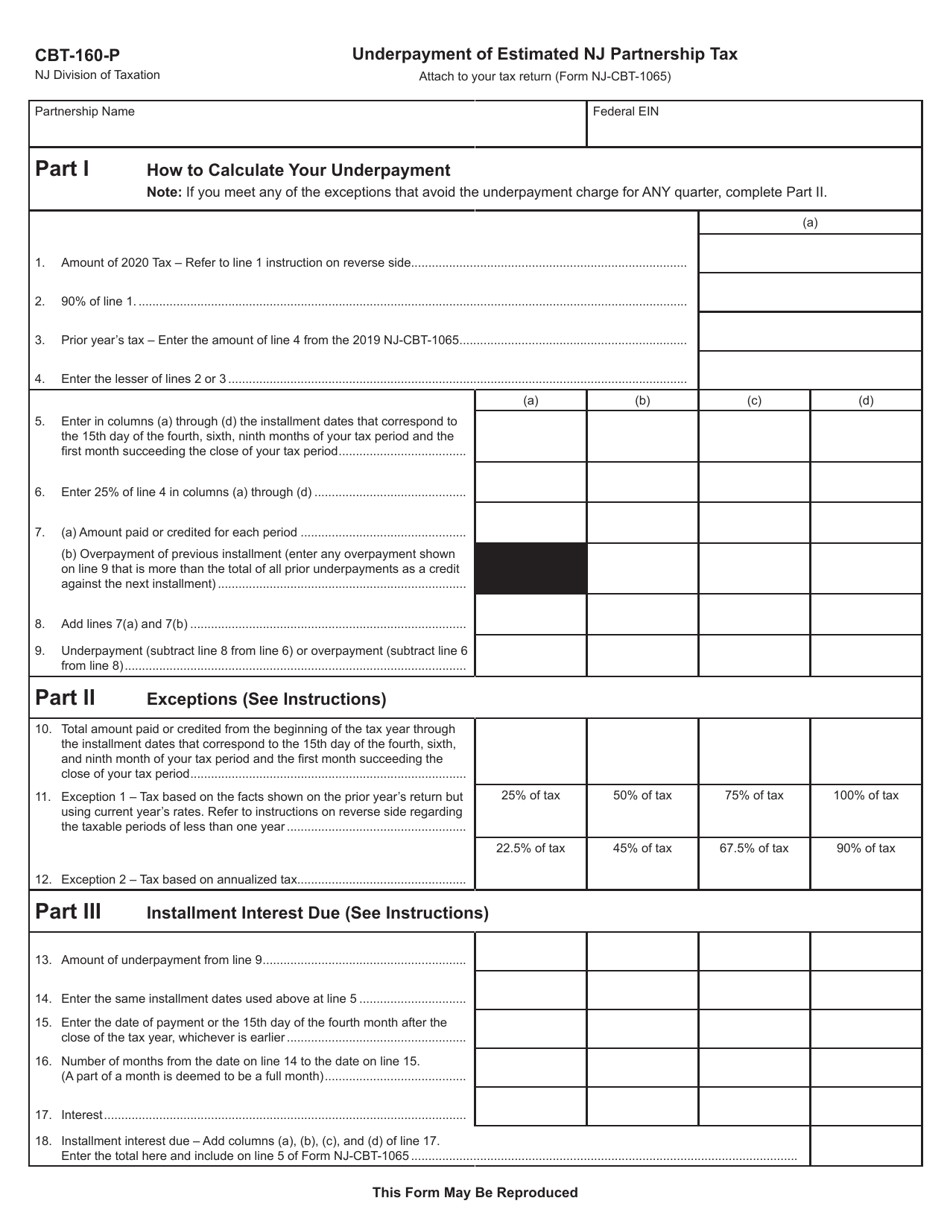

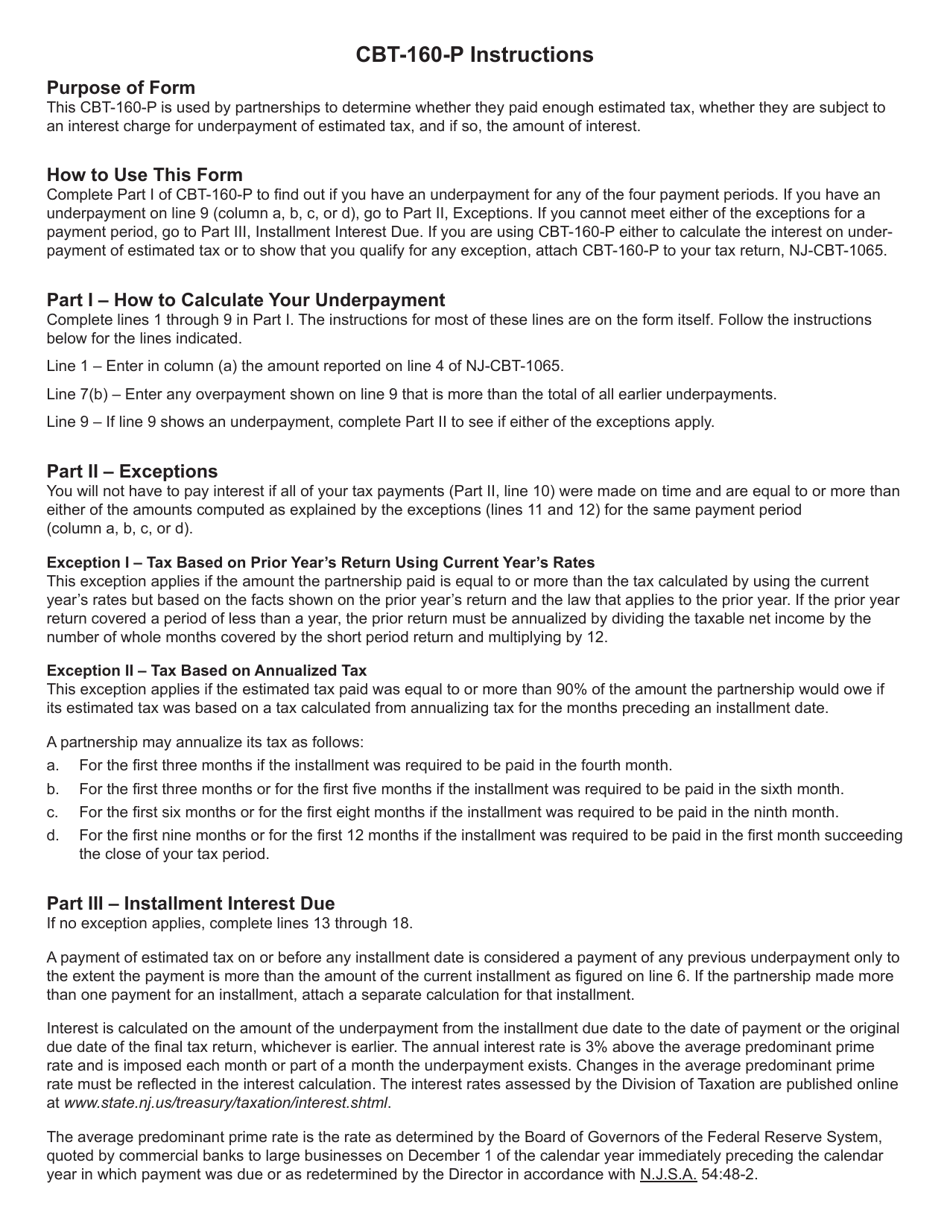

Form CBT-160-P

for the current year.

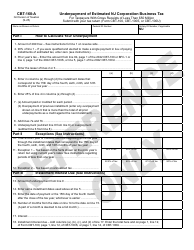

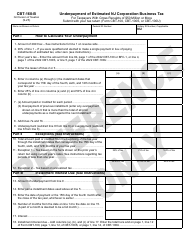

Form CBT-160-P Underpayment of Estimated N.j. Partnership Tax - New Jersey

What Is Form CBT-160-P?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-160-P?

A: Form CBT-160-P is the form used for reporting underpayment of estimated New Jersey Partnership Tax.

Q: Who needs to file Form CBT-160-P?

A: Partnerships in New Jersey that have underpaid their estimated taxes need to file Form CBT-160-P.

Q: What is the purpose of Form CBT-160-P?

A: The purpose of Form CBT-160-P is to calculate and report the underpayment of estimated New Jersey Partnership Tax.

Q: When is Form CBT-160-P due?

A: Form CBT-160-P is due on the same date as the partnership's New Jersey tax return, which is typically April 15th.

Q: What happens if a partnership fails to file Form CBT-160-P?

A: If a partnership fails to file Form CBT-160-P, they may be subject to penalties and interest on the underpaid taxes.

Q: Are there any additional forms or documentation required with Form CBT-160-P?

A: No, Form CBT-160-P does not require any additional forms or documentation.

Q: Is there a fee for filing Form CBT-160-P?

A: No, there is no fee for filing Form CBT-160-P.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBT-160-P by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.