This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-1065E

for the current year.

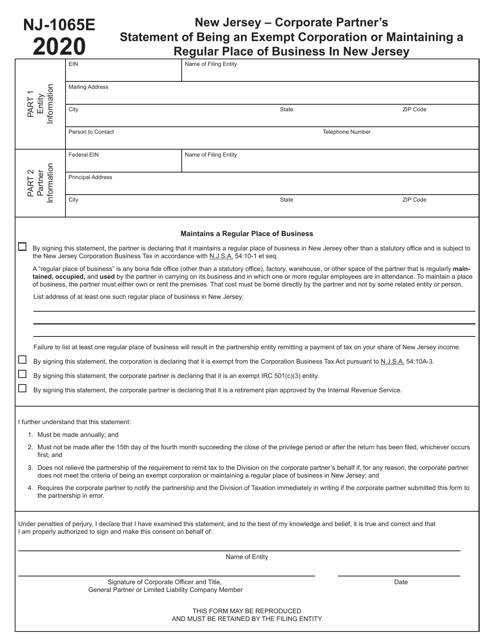

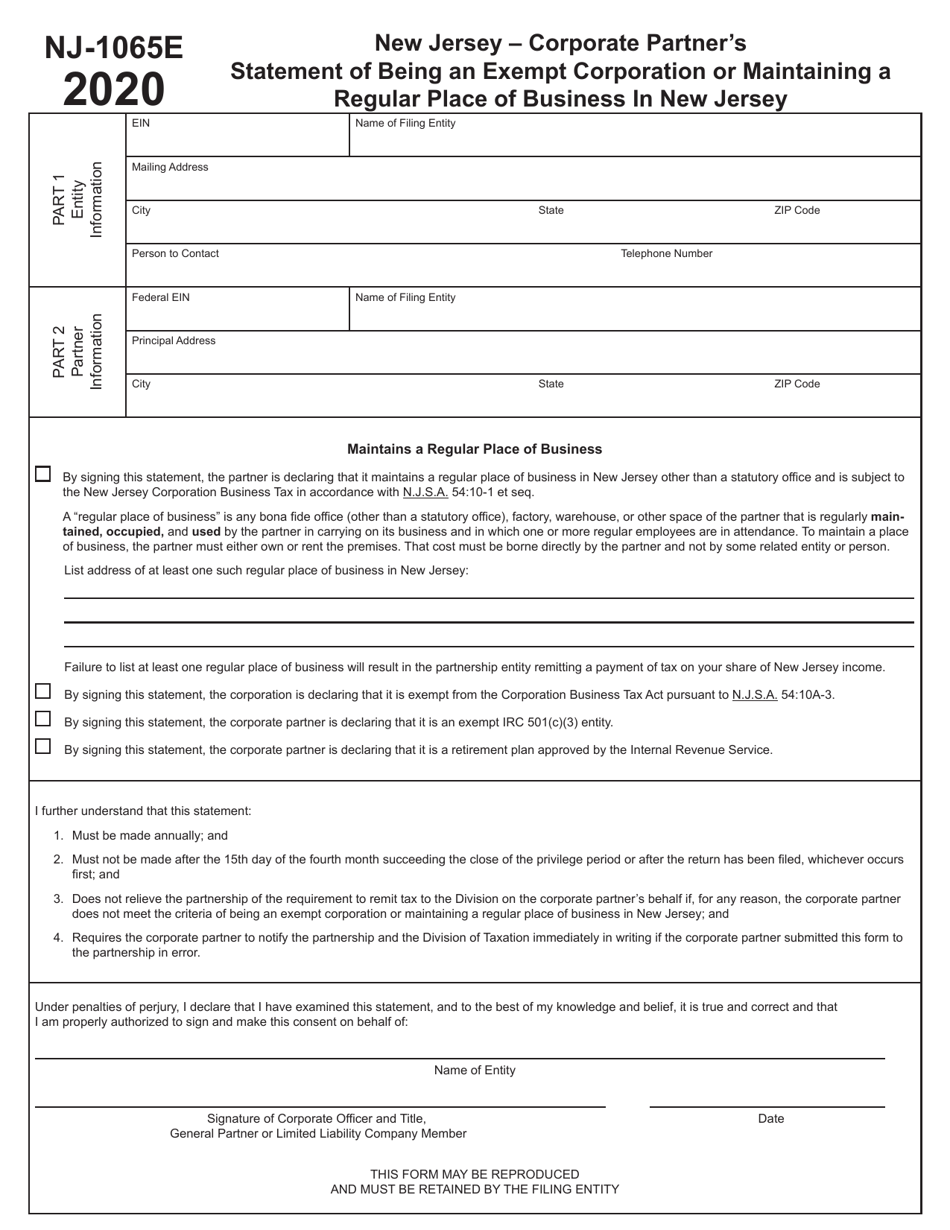

Form NJ-1065E Corporate Partner's Statement of Being an Exempt Corporation or Maintaining a Regular Place of Business in New Jersey - New Jersey

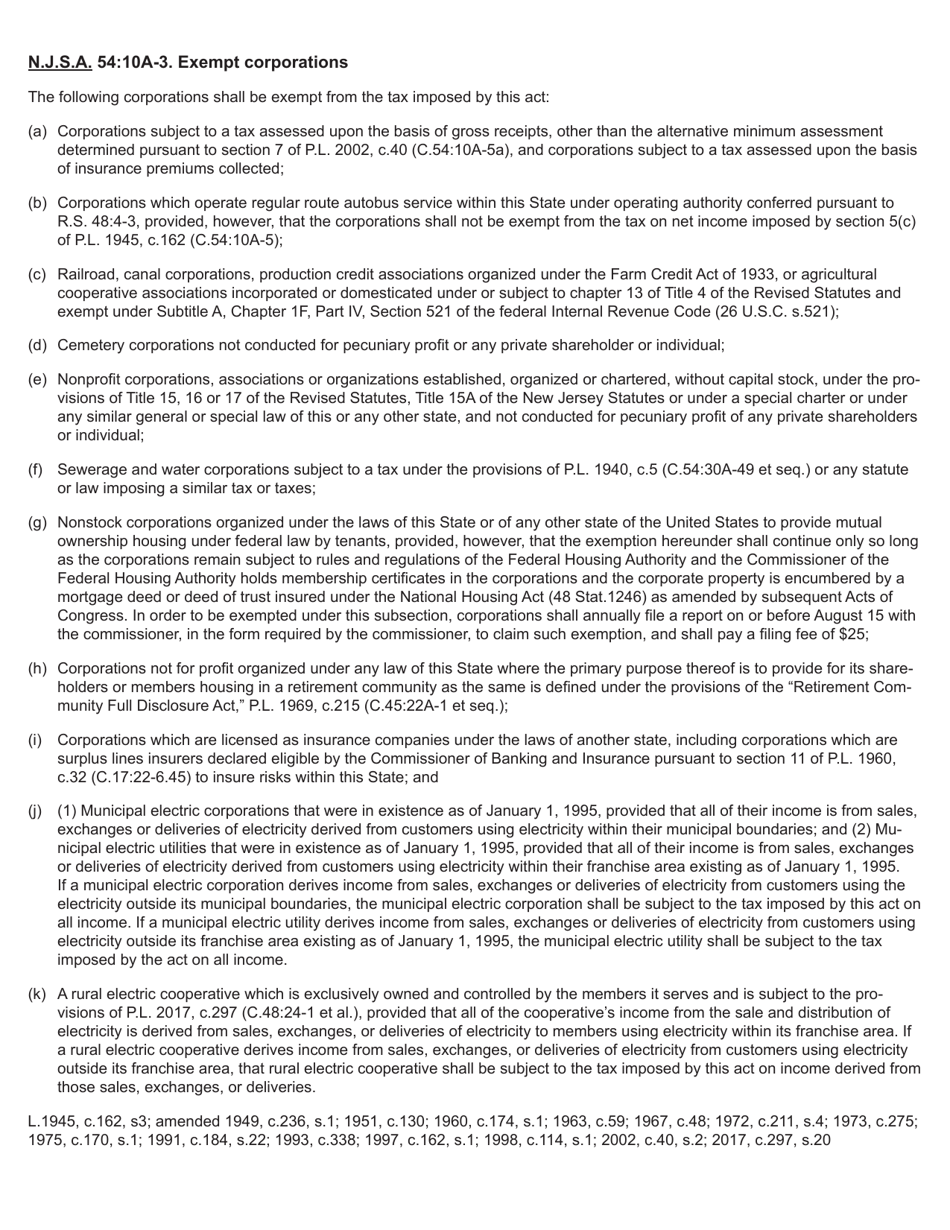

What Is Form NJ-1065E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1065E?

A: Form NJ-1065E is the Corporate Partner's Statement of Being an Exempt Corporation or Maintaining a Regular Place of Business in New Jersey.

Q: Who needs to file Form NJ-1065E?

A: Exempt corporations or corporations maintaining a regular place of business in New Jersey that are filing a partnership return (Form NJ-1065) need to file Form NJ-1065E.

Q: What is the purpose of Form NJ-1065E?

A: The purpose of Form NJ-1065E is to provide information to the New Jersey Division of Taxation about the exempt status or regular place of business of a corporation filing a partnership return.

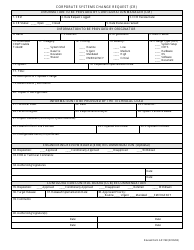

Q: What information is required on Form NJ-1065E?

A: Form NJ-1065E requires information such as the corporation's federal identification number, business address, exempt status determination, and other relevant details.

Q: When is Form NJ-1065E due?

A: Form NJ-1065E is due at the same time as the partnership return (Form NJ-1065), which is generally due on or before the 15th day of the fourth month following the close of the tax year.

Q: Is there a fee for filing Form NJ-1065E?

A: There is no fee for filing Form NJ-1065E.

Q: What happens if Form NJ-1065E is not filed or filed late?

A: Failure to file Form NJ-1065E or filing it late may result in penalties imposed by the New Jersey Division of Taxation.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1065E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.