This version of the form is not currently in use and is provided for reference only. Download this version of

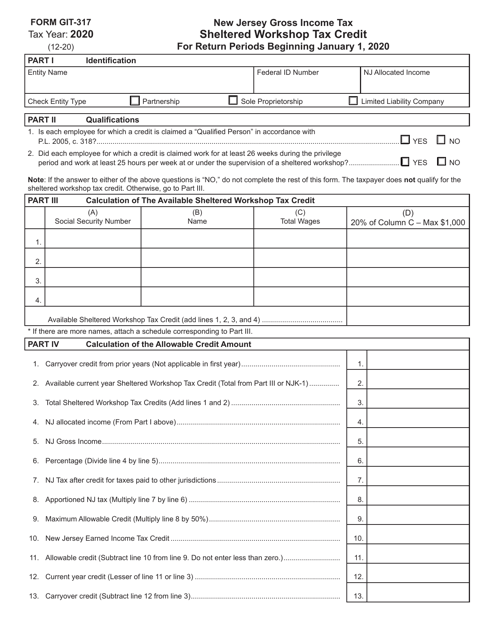

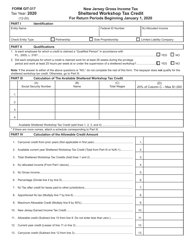

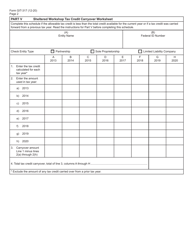

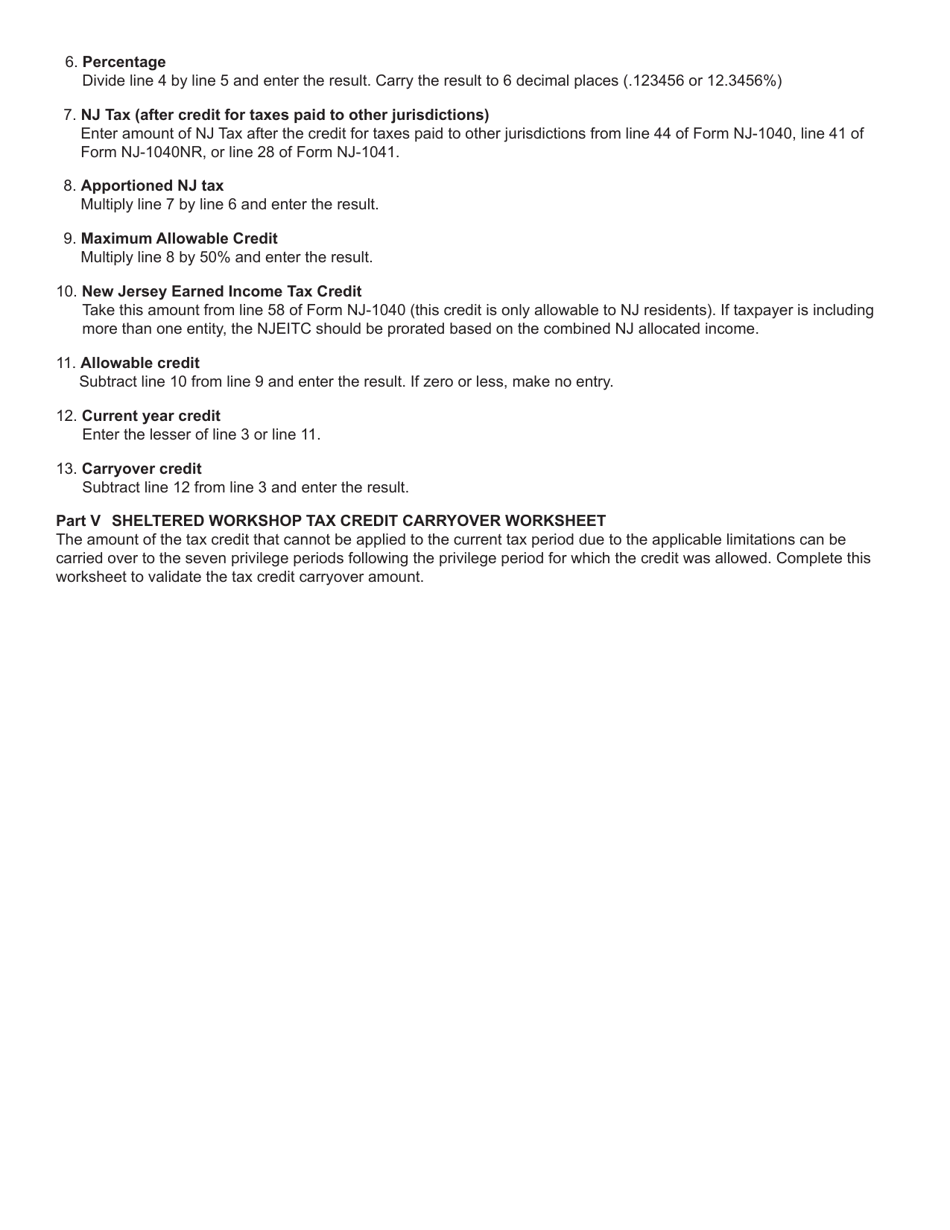

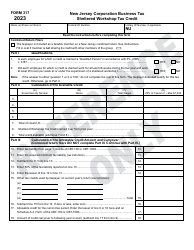

Form GIT-317

for the current year.

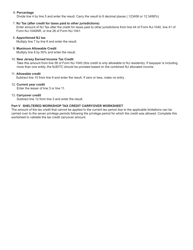

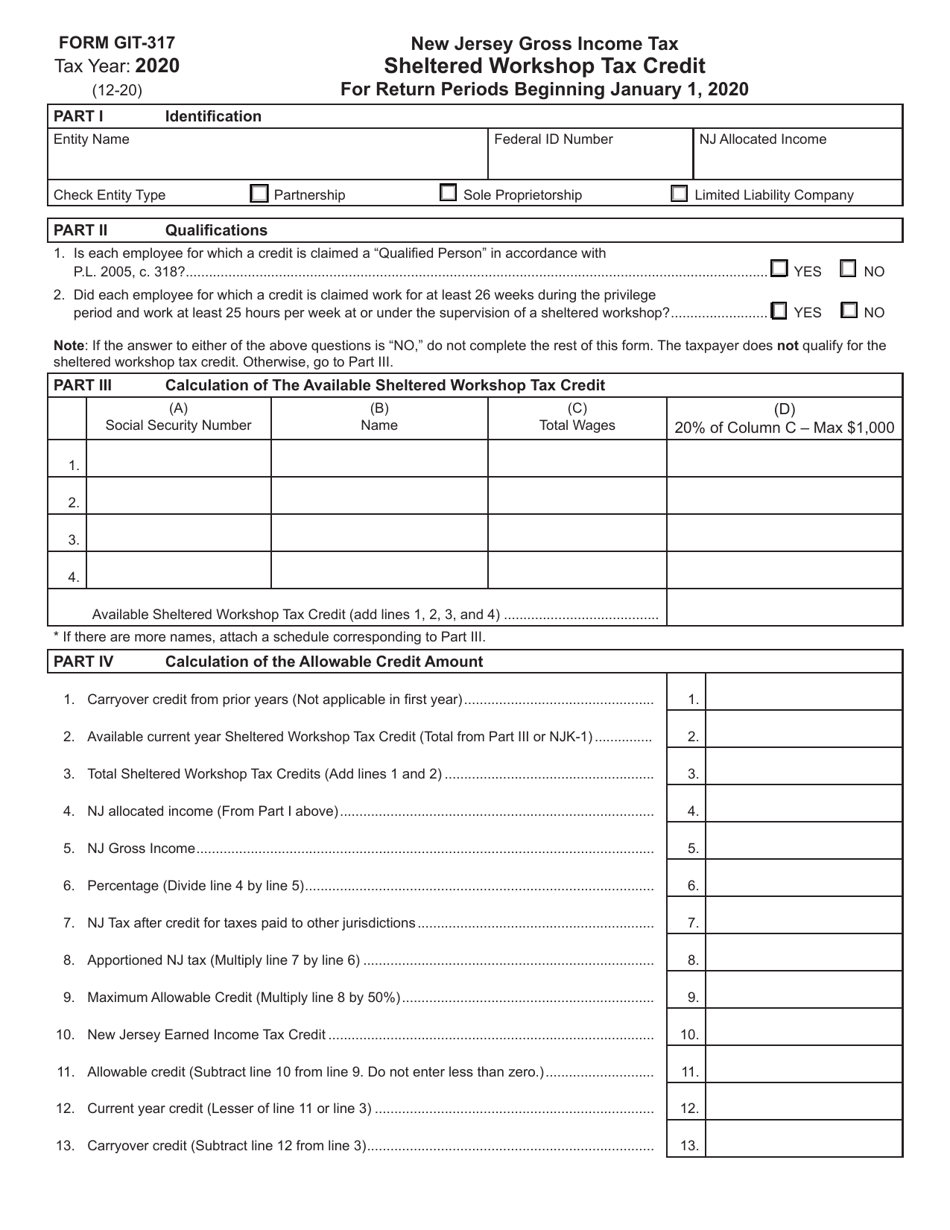

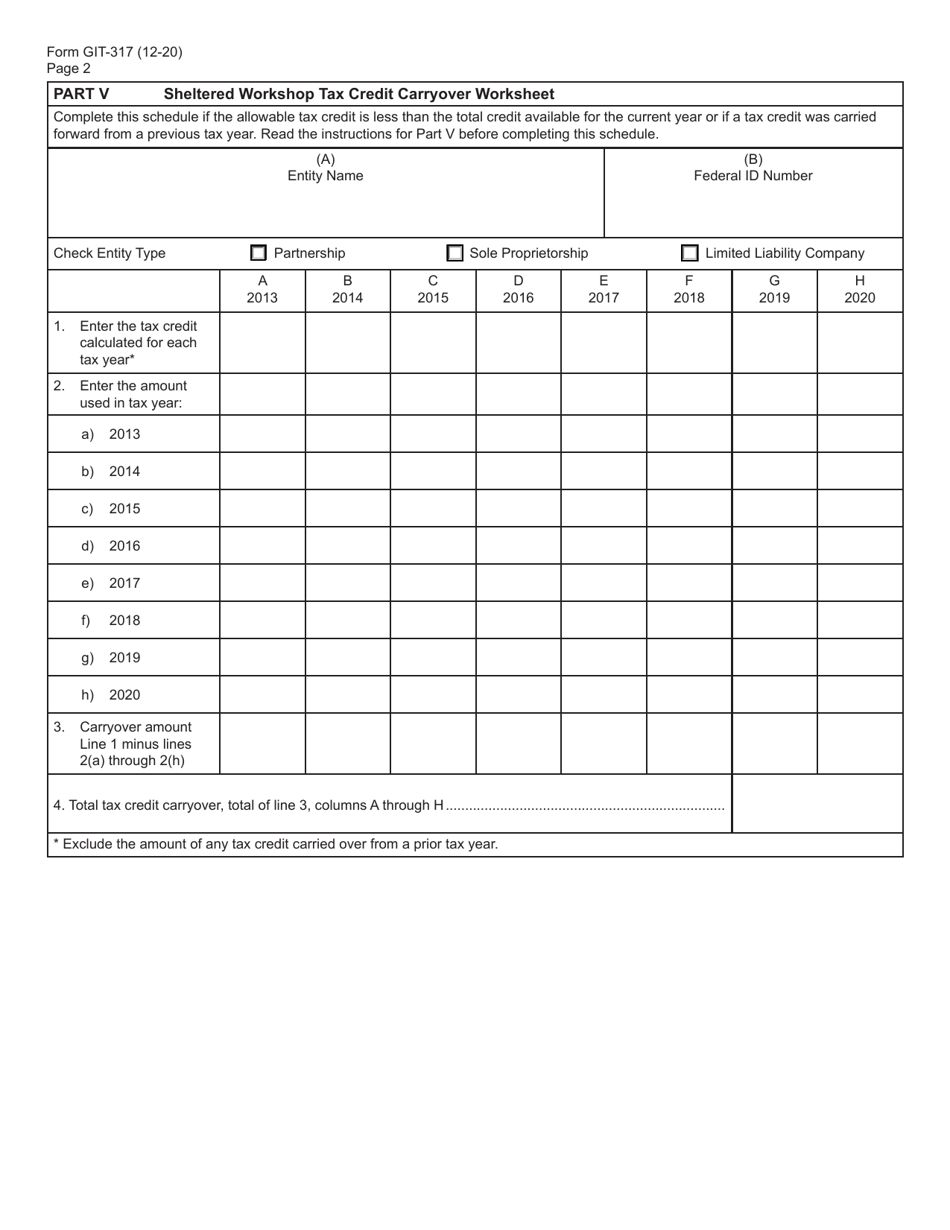

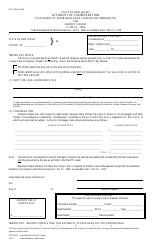

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

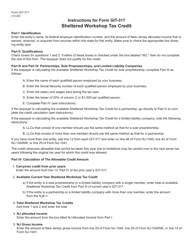

What Is Form GIT-317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT-317 Sheltered Workshop Tax Credit?

A: The GIT-317 Sheltered Workshop Tax Credit is a tax credit offered by the state of New Jersey for employers who hire workers with disabilities from sheltered workshops.

Q: Who is eligible for the GIT-317 Sheltered Workshop Tax Credit?

A: Employers in New Jersey who hire workers with disabilities from sheltered workshops are eligible for the tax credit.

Q: How much is the GIT-317 Sheltered Workshop Tax Credit?

A: The tax credit is equal to 20% of the wages paid to eligible workers with disabilities, up to a maximum of $5,000 per worker per tax year.

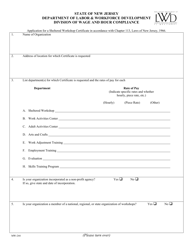

Q: What is a sheltered workshop?

A: A sheltered workshop is a vocational rehabilitation facility that provides employment opportunities for individuals with disabilities who may not be able to work in regular workplaces.

Q: How can employers claim the GIT-317 Sheltered Workshop Tax Credit?

A: Employers must complete and file Form GIT-317 with the New Jersey Division of Taxation to claim the tax credit.

Q: Are there any requirements for workers with disabilities to qualify for the tax credit?

A: Yes, workers must meet certain eligibility criteria, including being certified as having a physical or mental disability by a qualified agency or professional.

Q: Is there a limit to the number of workers with disabilities that an employer can claim the tax credit for?

A: No, there is no limit to the number of workers with disabilities for whom an employer can claim the tax credit.

Q: Are there any deadlines for claiming the tax credit?

A: Yes, employers must file Form GIT-317 by the due date of their business tax returns for the tax year in which the wages were paid.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.