This version of the form is not currently in use and is provided for reference only. Download this version of

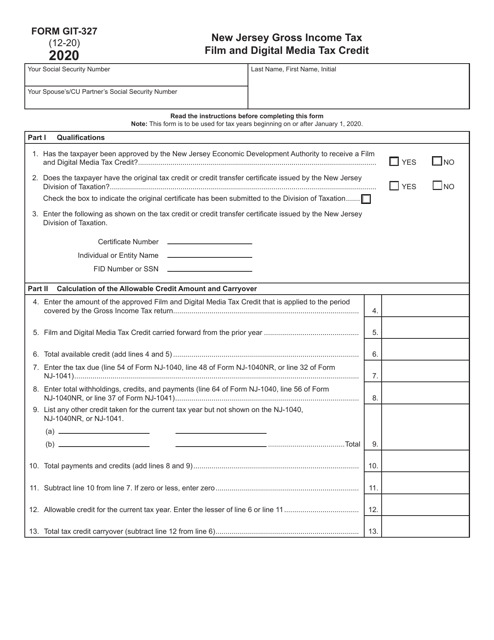

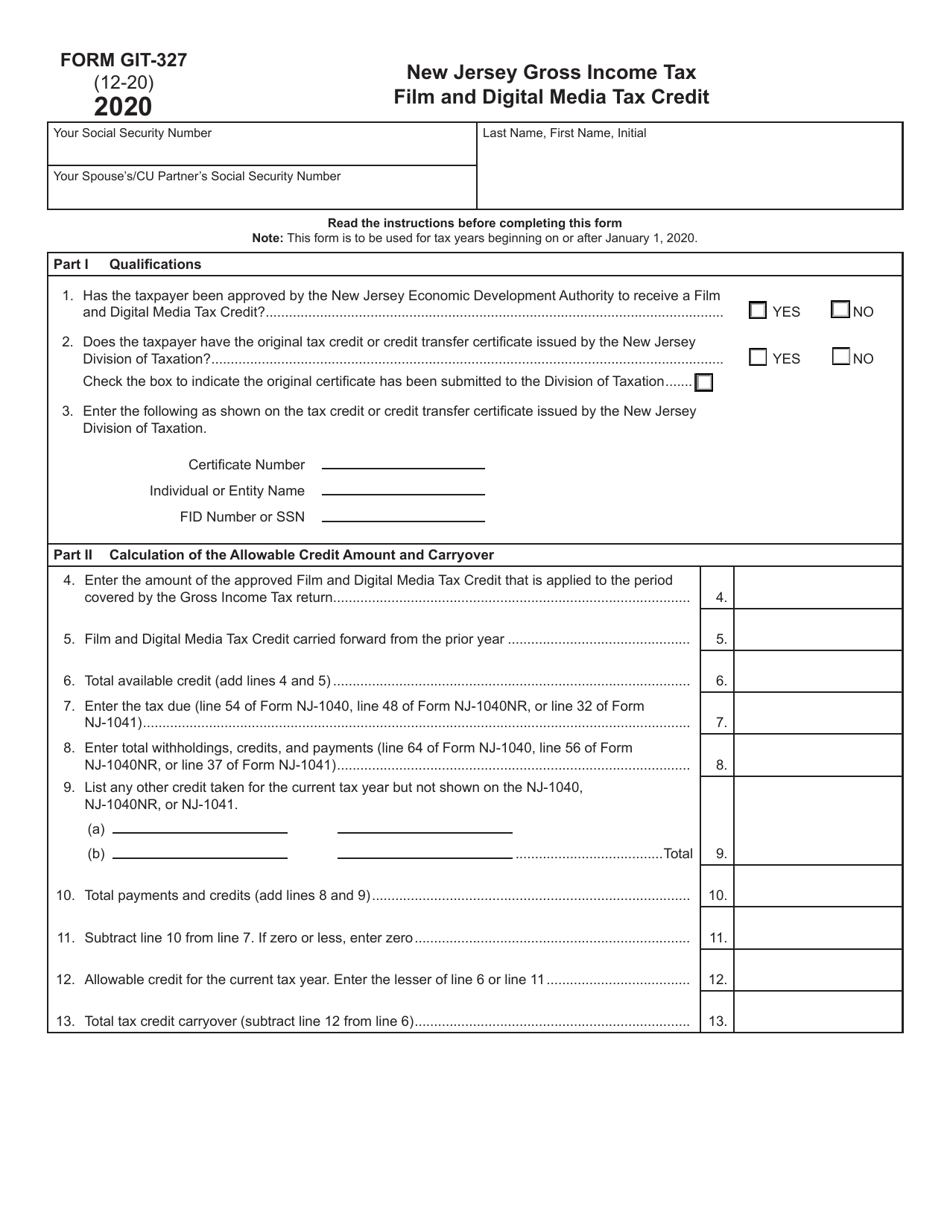

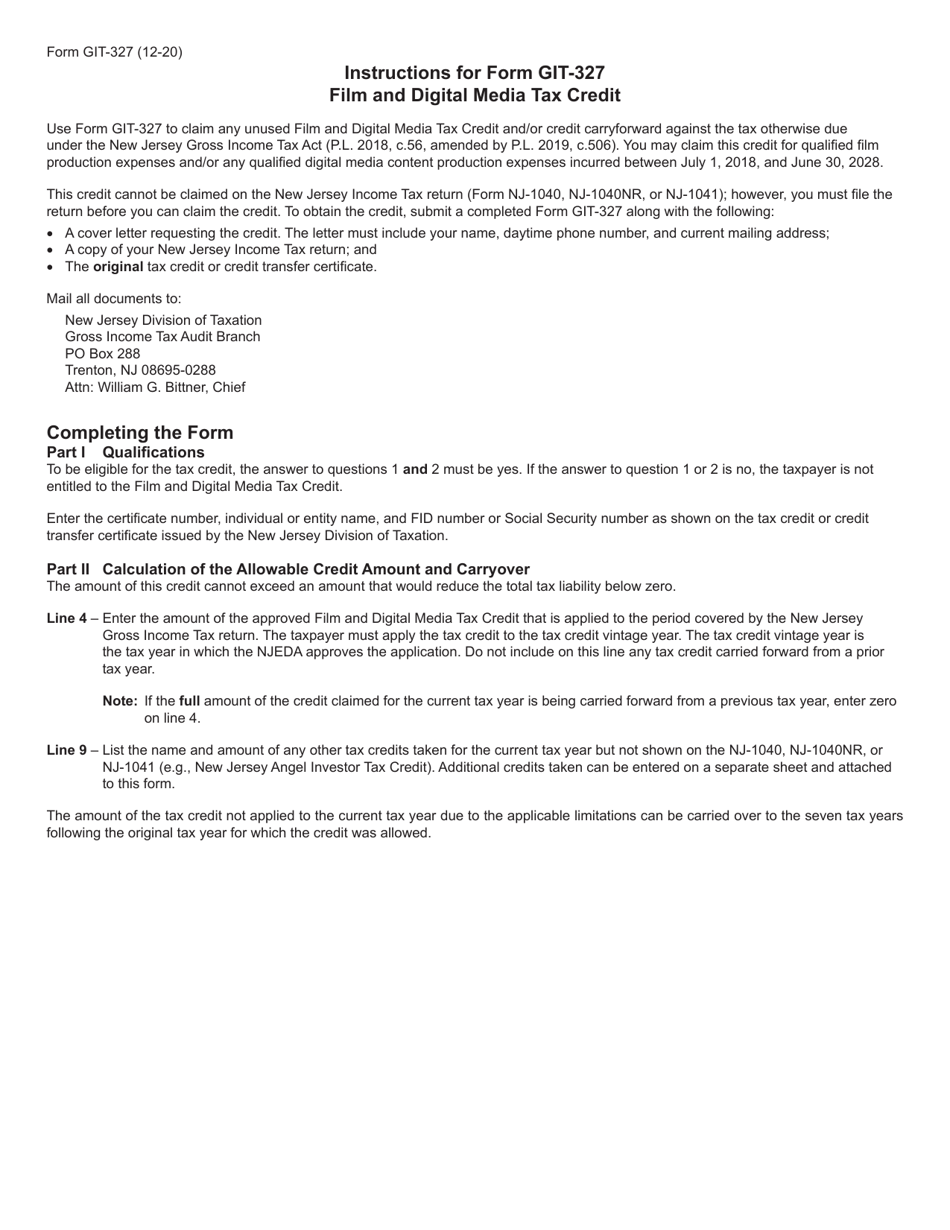

Form GIT-327

for the current year.

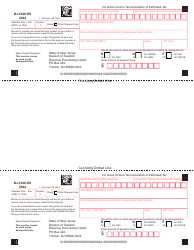

Form GIT-327 New Jersey Gross Income Tax Film and Digital Media Tax Credit - New Jersey

What Is Form GIT-327?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GIT-327?

A: Form GIT-327 is the New Jersey Gross Income Tax Film and Digital MediaTax Credit form.

Q: What is the purpose of Form GIT-327?

A: Form GIT-327 is used to claim the New Jersey Gross Income Tax Film and Digital Media Tax Credit.

Q: Who can use Form GIT-327?

A: Form GIT-327 can be used by individuals, estates, and trusts that have qualified film and digital media production expenses.

Q: What expenses can be claimed on Form GIT-327?

A: Qualified film and digital media production expenses such as wages, salaries, and fringe benefits for production personnel, certain production-related expenses, and certain post-production expenses can be claimed on Form GIT-327.

Q: How do I file Form GIT-327?

A: Form GIT-327 should be filed by attaching it to your New Jersey Gross Income Tax return.

Q: What is the deadline for filing Form GIT-327?

A: The deadline for filing Form GIT-327 is the same as the deadline for filing your New Jersey Gross Income Tax return, which is usually April 15th.

Q: Is there a limit to the amount of tax credit that can be claimed using Form GIT-327?

A: Yes, there is a limit to the amount of tax credit that can be claimed using Form GIT-327. The annual aggregate film tax credit cap is $75 million.

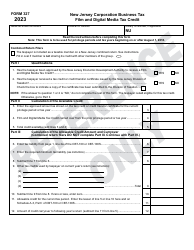

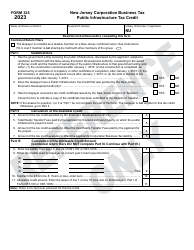

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-327 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.