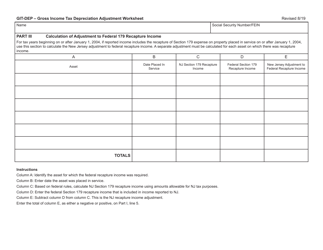

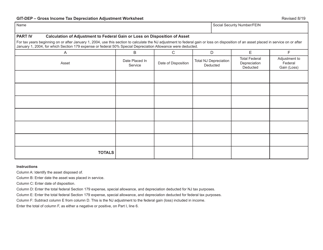

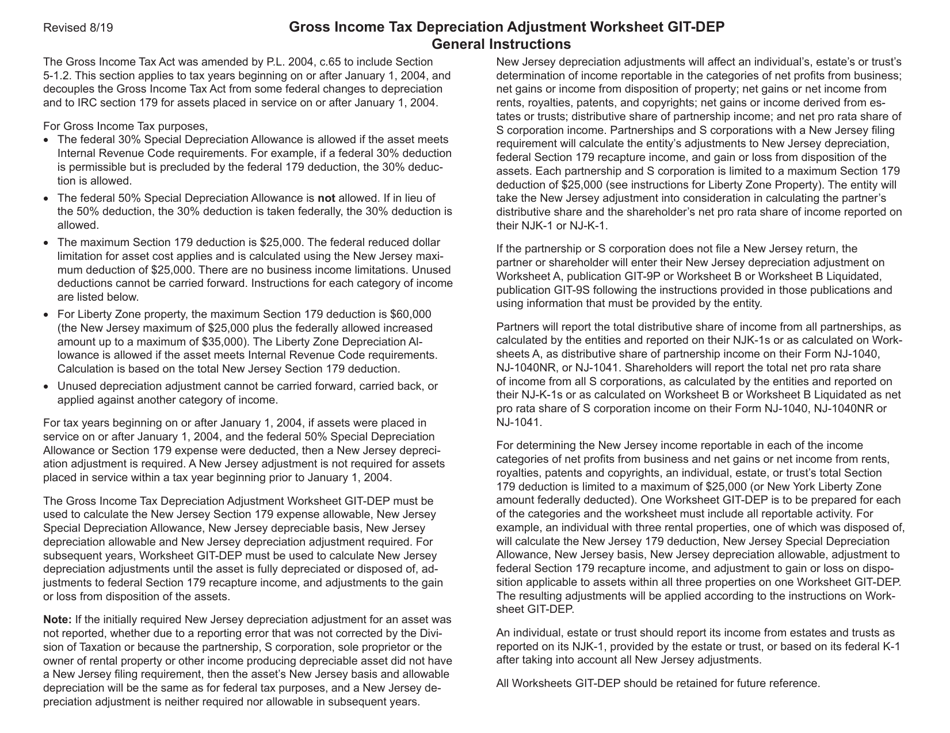

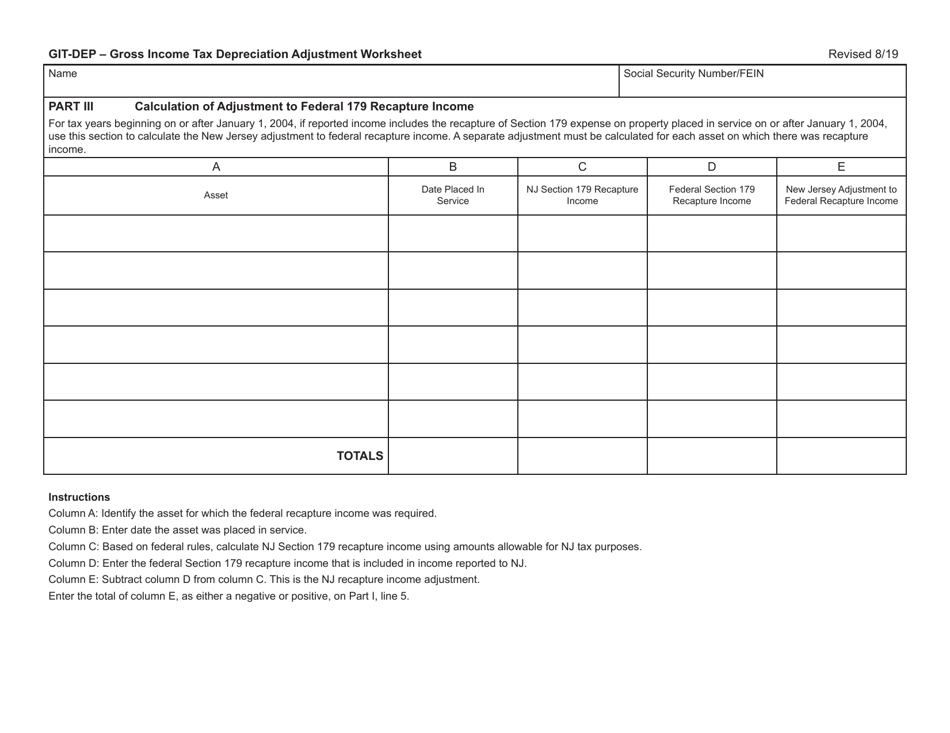

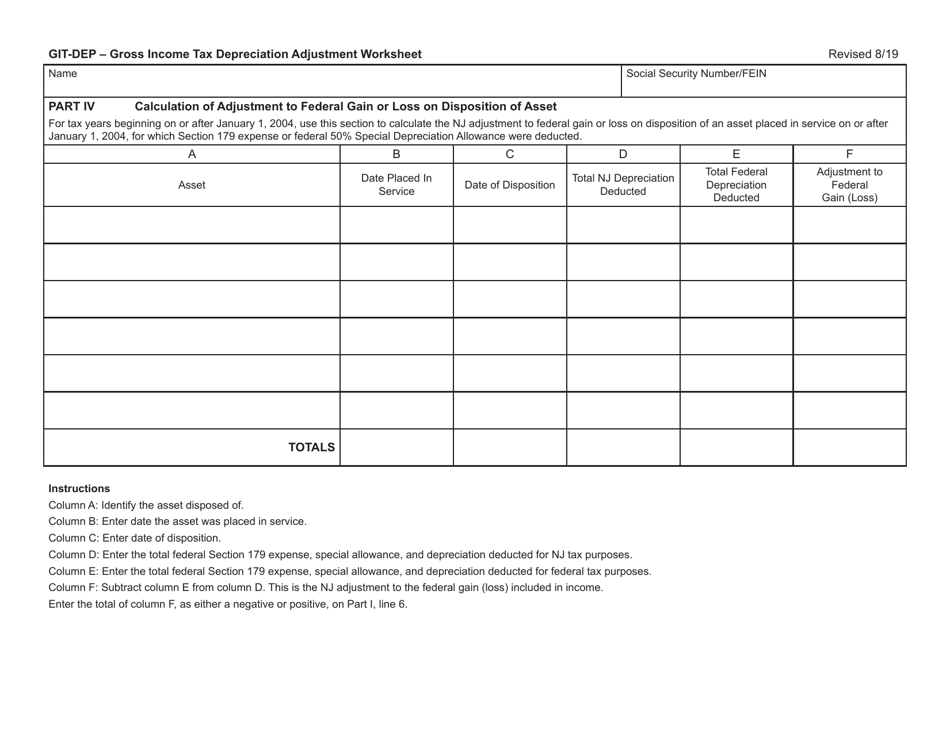

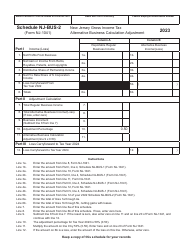

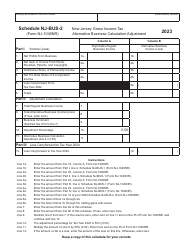

Form GIT-DEP Gross Income Tax Depreciation Adjustment Worksheet - New Jersey

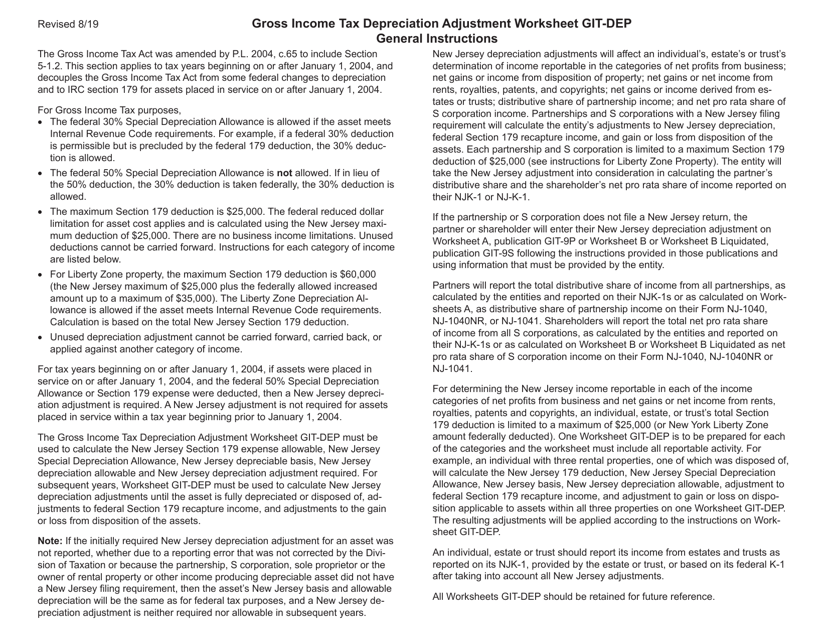

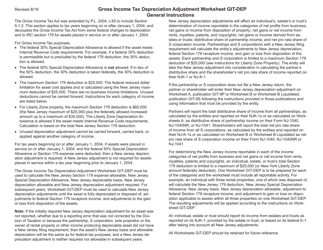

What Is Form GIT-DEP?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GIT-DEP form?

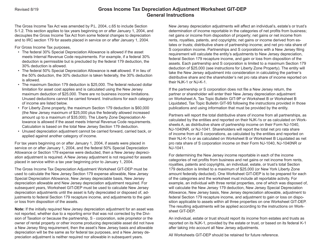

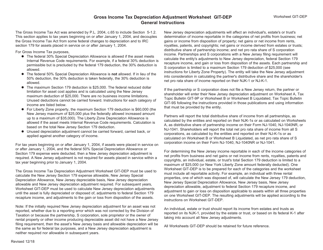

A: GIT-DEP form stands for Gross Income Tax Depreciation Adjustment Worksheet. It is used in the state of New Jersey.

Q: Who should fill out the GIT-DEP form?

A: The GIT-DEP form should be filled out by individuals or businesses in New Jersey who need to make adjustments to their gross income tax due to depreciation.

Q: What is the purpose of the GIT-DEP form?

A: The purpose of the GIT-DEP form is to calculate and adjust the gross incometax liability based on depreciation expenses.

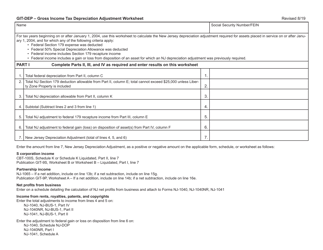

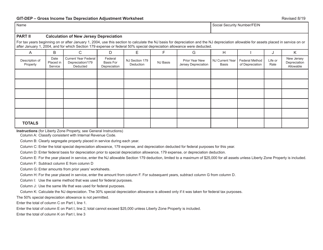

Q: What information do I need to fill out the GIT-DEP form?

A: You will need information such as the taxpayer's name and identification number, type and tax year of the property, and details of the depreciation expenses.

Q: Are there any additional forms required to be submitted along with the GIT-DEP form?

A: Yes, you may need to submit supporting documents such as federal Form 4562 and Schedule A.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-DEP by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.