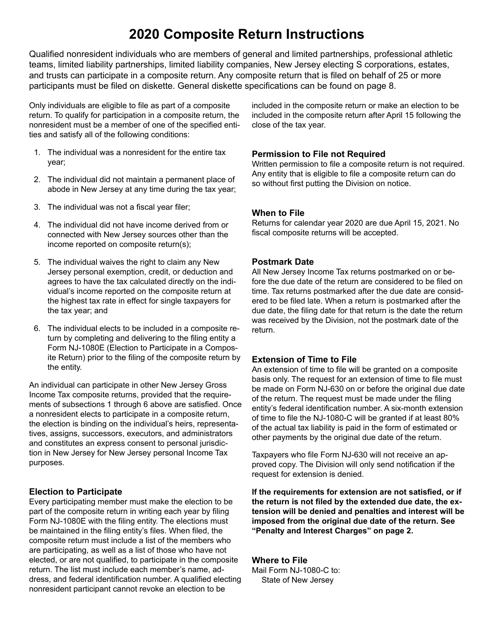

Instructions for Form NJ-1080A, NJ-1080B, NJ-1080C, NJ-1080E - New Jersey

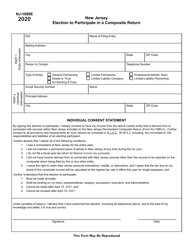

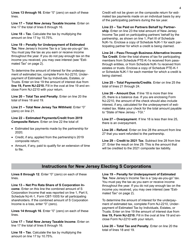

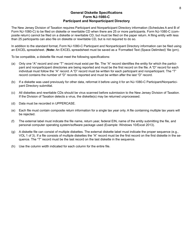

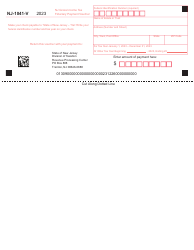

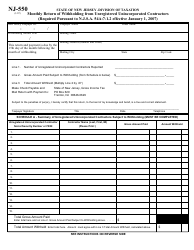

This document contains official instructions for Form NJ-1080A , Form NJ-1080B , Form NJ-1080C , and Form NJ-1080E . All forms are released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form NJ-1080E is available for download through this link.

FAQ

Q: What are Form NJ-1080A, NJ-1080B, NJ-1080C, and NJ-1080E?

A: They are forms used in New Jersey for certain tax purposes.

Q: What is the purpose of Form NJ-1080A?

A: Form NJ-1080A is used to calculate the New Jersey Gross Income Tax for part-year residents.

Q: What is the purpose of Form NJ-1080B?

A: Form NJ-1080B is used to calculate the New Jersey Income Tax for New Jersey Lottery winners.

Q: What is the purpose of Form NJ-1080C?

A: Form NJ-1080C is used to calculate the New Jersey Gross Income Tax for nonresidents.

Q: What is the purpose of Form NJ-1080E?

A: Form NJ-1080E is used to claim the New Jersey Earned Income Credit.

Q: Is there a deadline for filing these forms?

A: Yes, the deadline for filing these forms is typically April 15th, unless an extension has been granted.

Q: Are there any additional requirements for filing these forms?

A: Yes, you may need to attach other supporting documents depending on your specific circumstances. It's best to review the instructions for each form to ensure you meet all requirements.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.