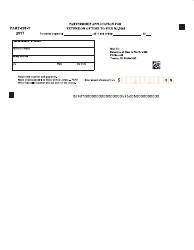

This version of the form is not currently in use and is provided for reference only. Download this version of

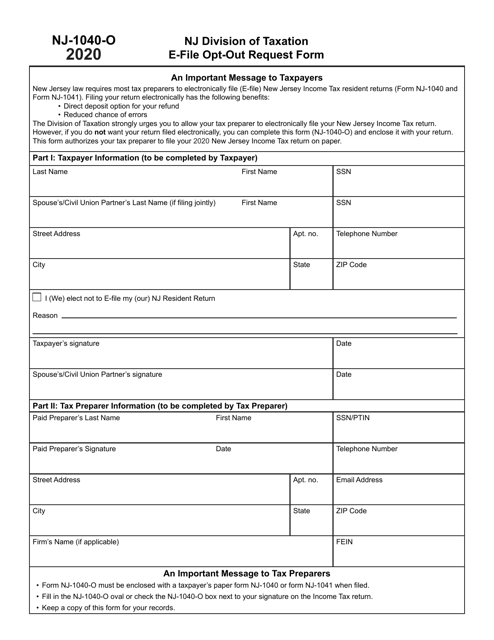

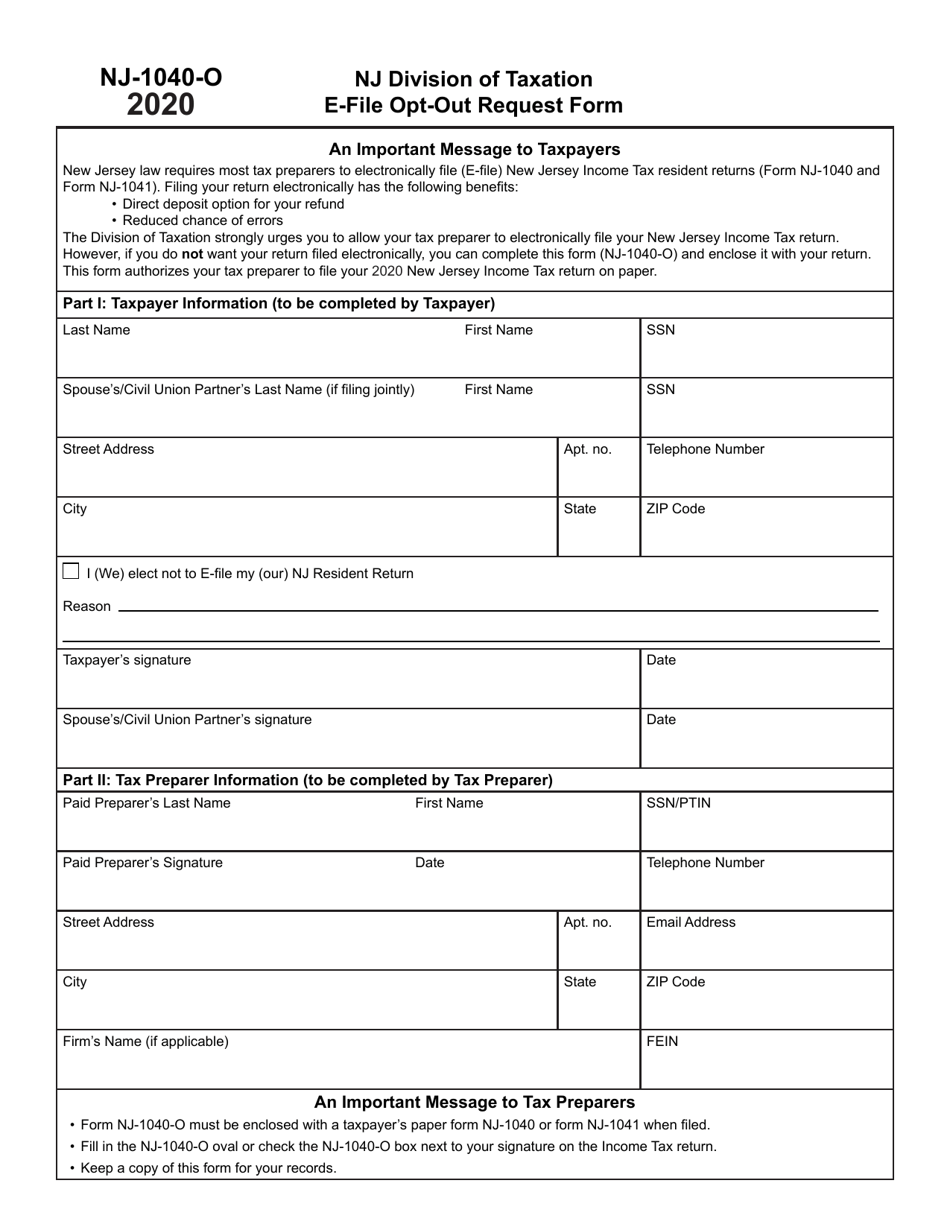

Form NJ-1040-O

for the current year.

Form NJ-1040-O E-File Opt-Out Request Form - New Jersey

What Is Form NJ-1040-O?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the NJ-1040-O E-File Opt-Out Request Form?

A: The NJ-1040-O E-File Opt-Out Request Form is a form used in New Jersey to request opting out of e-filing your state tax return.

Q: Who needs to use the NJ-1040-O form?

A: Anyone who prefers to file their state tax return by paper instead of electronically may use the NJ-1040-O form.

Q: Can I still e-file my federal tax return if I opt out of e-filing in New Jersey?

A: Yes, opting out of e-filing in New Jersey does not affect your ability to e-file your federal tax return.

Q: Are there any specific requirements for using the NJ-1040-O form?

A: The NJ-1040-O form should only be used if you meet the eligibility requirements outlined by the New Jersey Division of Taxation.

Q: When is the deadline to submit the NJ-1040-O form?

A: The deadline to submit the NJ-1040-O form is typically the same as the deadline for filing your state tax return, which is April 15th or the following business day if it falls on a weekend or holiday.

Q: Is there a fee for opting out of e-filing?

A: No, there is no fee associated with opting out of e-filing your state tax return in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-O by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.