This version of the form is not currently in use and is provided for reference only. Download this version of

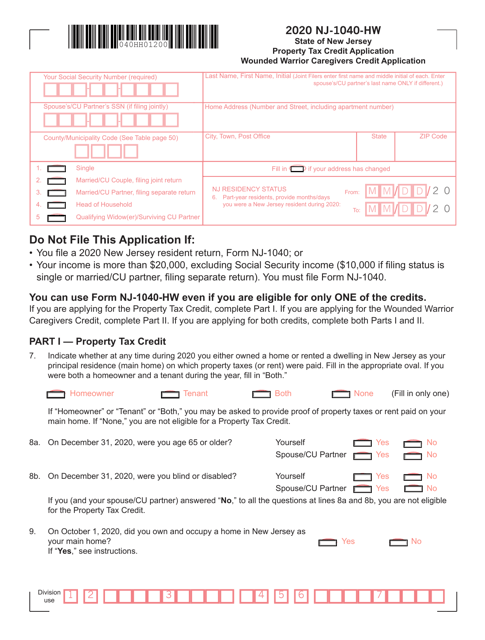

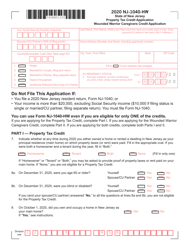

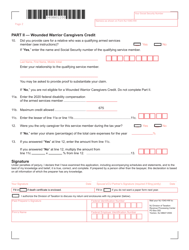

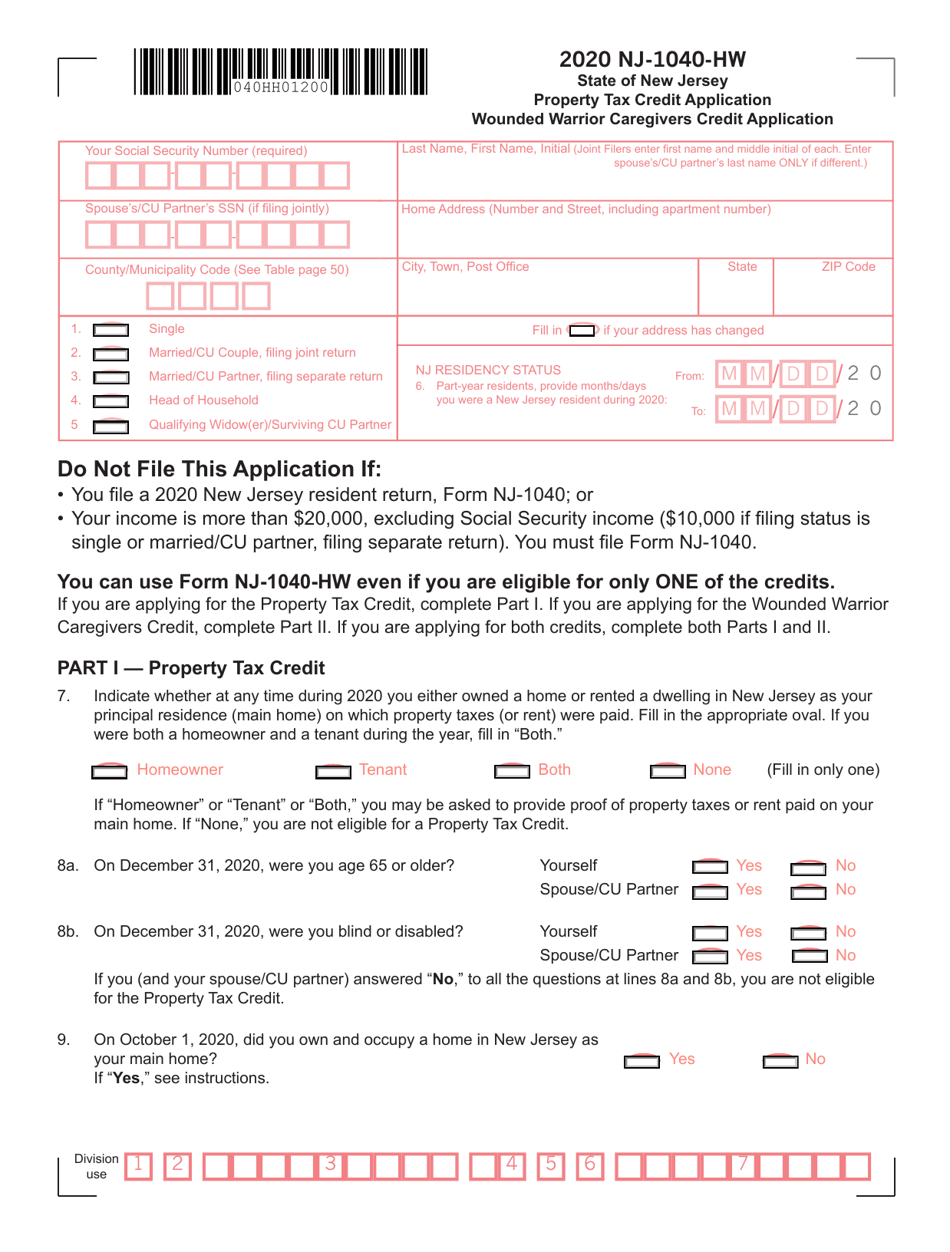

Form NJ-1040-HW

for the current year.

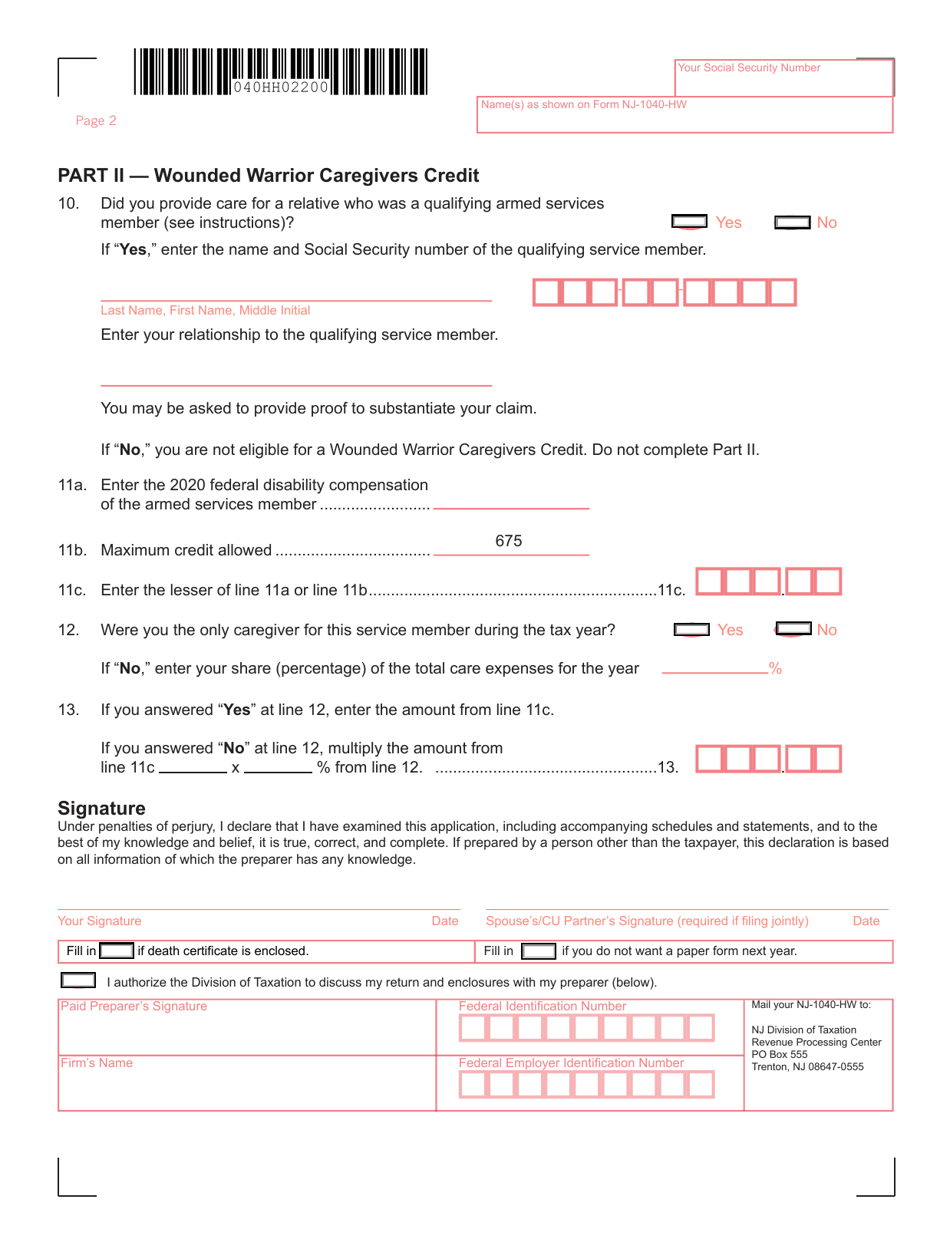

Form NJ-1040-HW Property Tax Credit Application Wounded Warrior Caregivers Credit Application - New Jersey

What Is Form NJ-1040-HW?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040-HW?

A: Form NJ-1040-HW is the Property Tax Credit Application for Wounded Warrior Caregivers Credit in New Jersey.

Q: Who can use Form NJ-1040-HW?

A: This form is for Wounded Warrior Caregivers who want to apply for property tax credit in New Jersey.

Q: What is the purpose of the Wounded Warrior Caregivers Credit?

A: The Wounded Warrior Caregivers Credit is designed to provide property tax relief to caregivers of certain wounded veterans in New Jersey.

Q: Is the Wounded Warrior Caregivers Credit available in other states?

A: No, the Wounded Warrior Caregivers Credit is specific to the state of New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-HW by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.