This version of the form is not currently in use and is provided for reference only. Download this version of

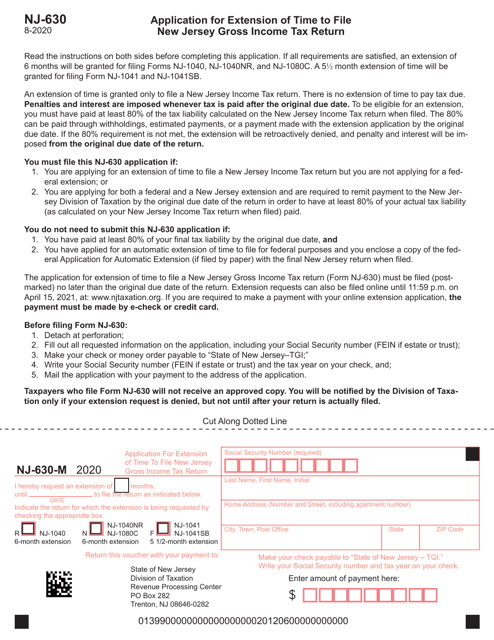

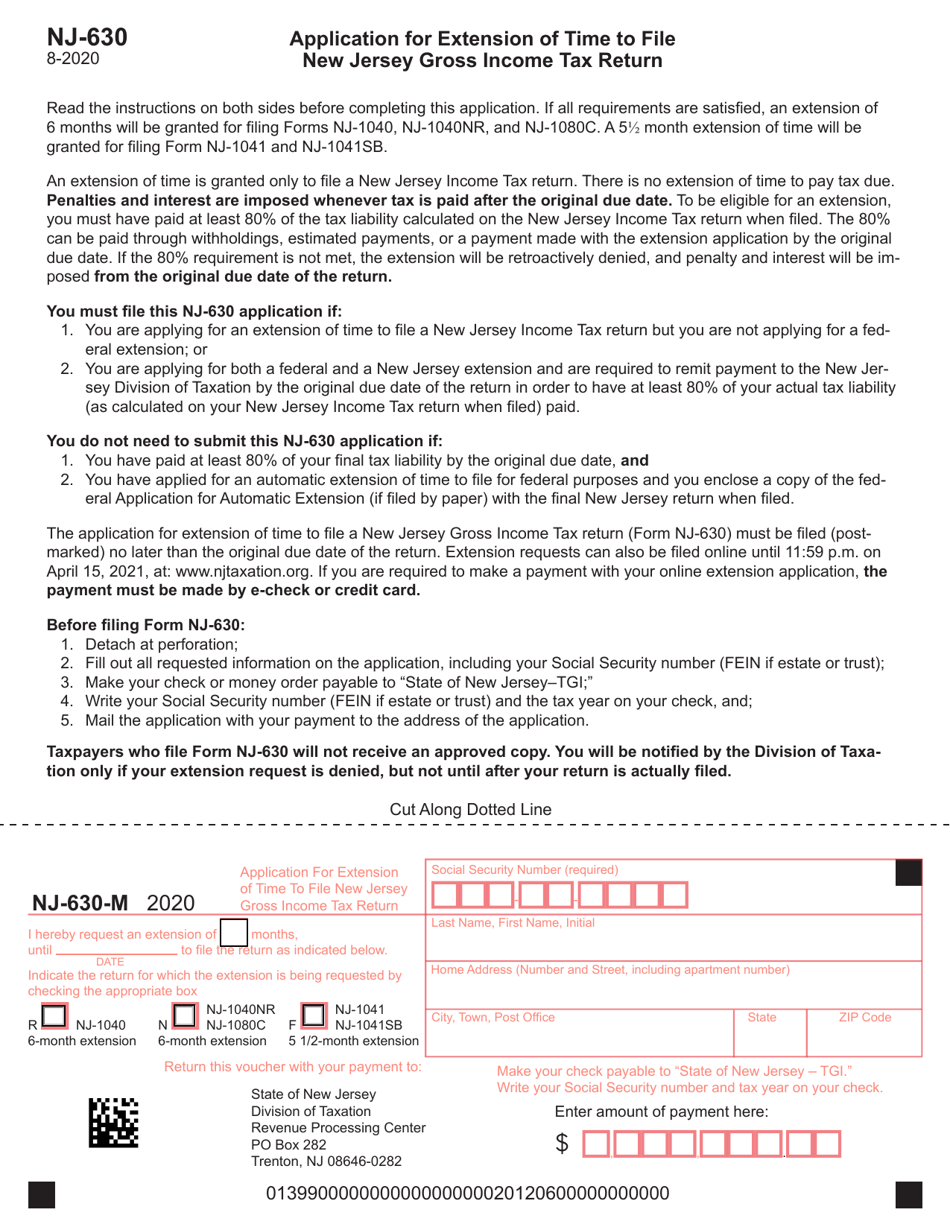

Form NJ-630

for the current year.

Form NJ-630 Application for Extension of Time to File New Jersey Gross Income Tax Return - New Jersey

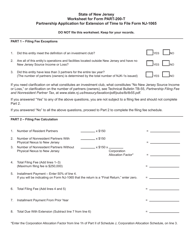

What Is Form NJ-630?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-630?

A: Form NJ-630 is the Application for Extension of Time to File New Jersey Gross Income Tax Return.

Q: What is the purpose of Form NJ-630?

A: The purpose of Form NJ-630 is to request an extension of time to file your New Jersey Gross Income Tax Return.

Q: Who should file Form NJ-630?

A: Anyone who needs extra time to file their New Jersey Gross Income Tax Return should file Form NJ-630.

Q: When is the deadline to file Form NJ-630?

A: Form NJ-630 must be filed by the original due date of your New Jersey Gross Income Tax Return.

Q: How long of an extension does Form NJ-630 provide?

A: Form NJ-630 provides an automatic extension of 6 months to file your New Jersey Gross Income Tax Return.

Q: Are there any requirements to qualify for the extension?

A: No, there are no specific requirements to qualify for the automatic extension provided by Form NJ-630.

Q: Is there any penalty for filing Form NJ-630?

A: There is no penalty for filing Form NJ-630 as long as you file by the original due date of your New Jersey Gross Income Tax Return.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-630 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.