This version of the form is not currently in use and is provided for reference only. Download this version of

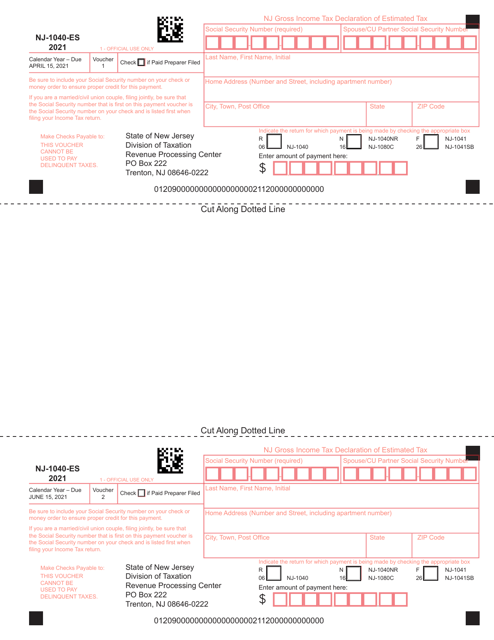

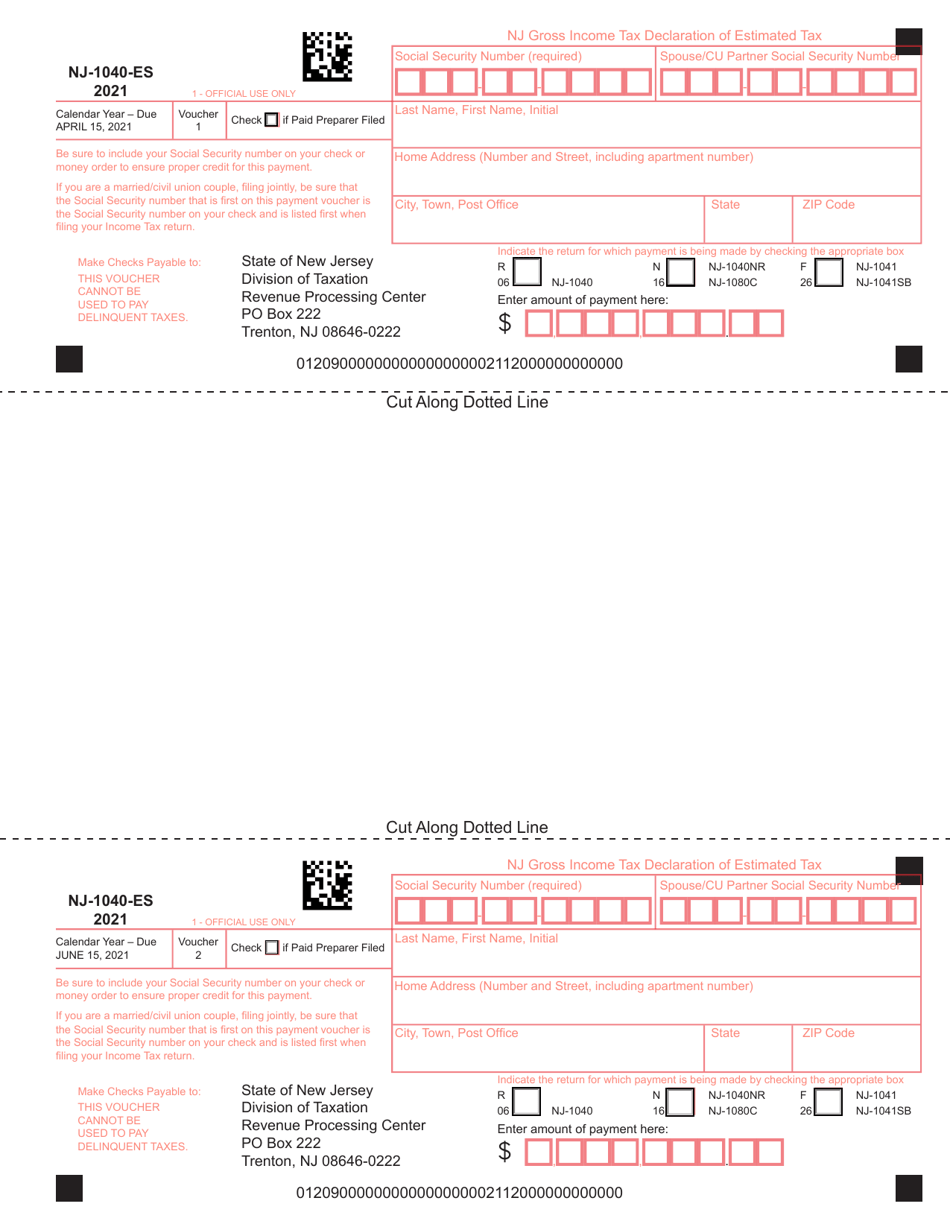

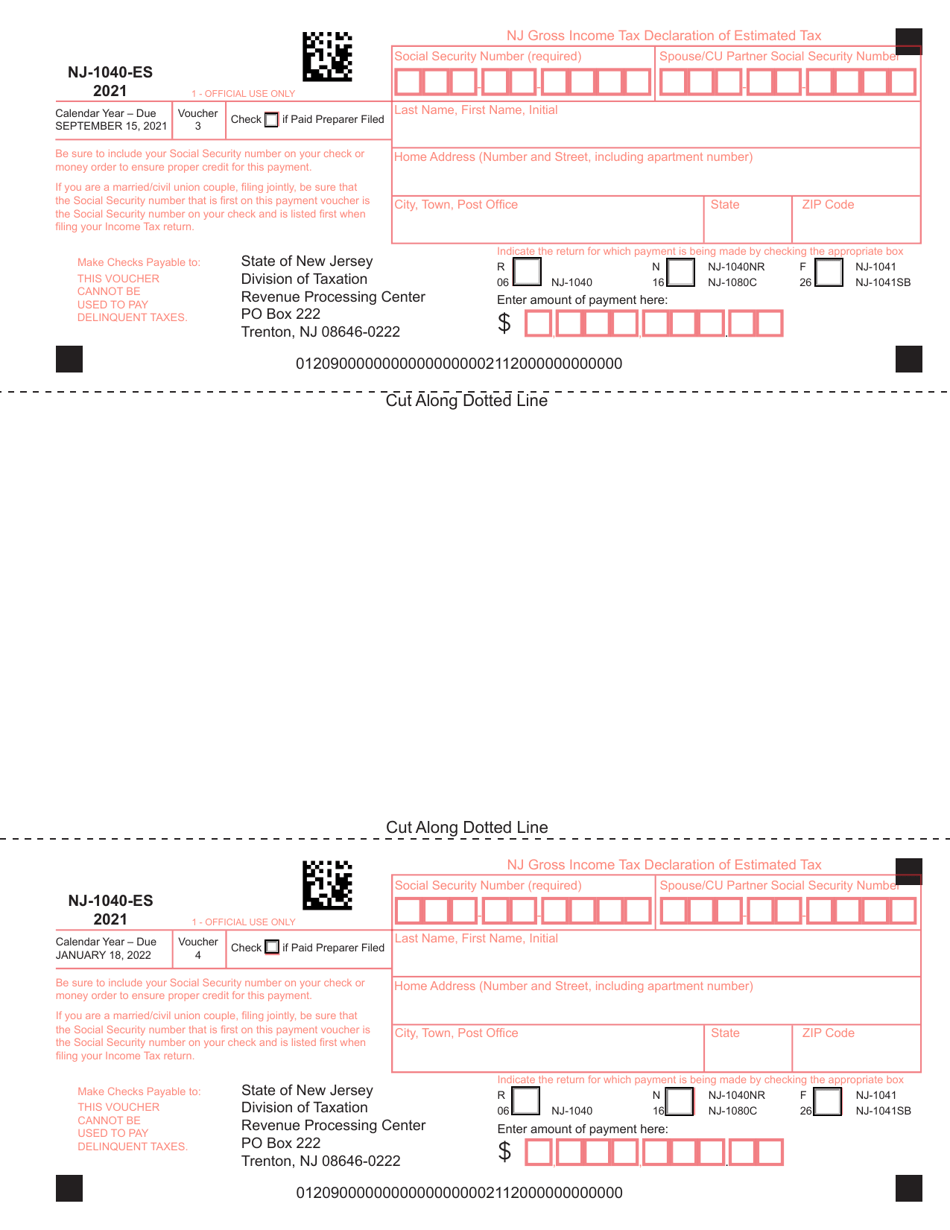

Form NJ-1040-ES

for the current year.

Form NJ-1040-ES Estimated Tax Voucher - New Jersey

What Is Form NJ-1040-ES?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040-ES?

A: Form NJ-1040-ES is the Estimated Tax Voucher for New Jersey.

Q: What is the purpose of Form NJ-1040-ES?

A: The purpose of Form NJ-1040-ES is to make estimated tax payments for income earned in New Jersey.

Q: Who needs to fill out Form NJ-1040-ES?

A: Individuals who expect to owe New Jersey income tax and meet certain income thresholds need to fill out Form NJ-1040-ES.

Q: When is Form NJ-1040-ES due?

A: Form NJ-1040-ES is due quarterly, with payment deadlines of April 15th, June 15th, September 15th, and January 15th of the following year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-ES by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.