This version of the form is not currently in use and is provided for reference only. Download this version of

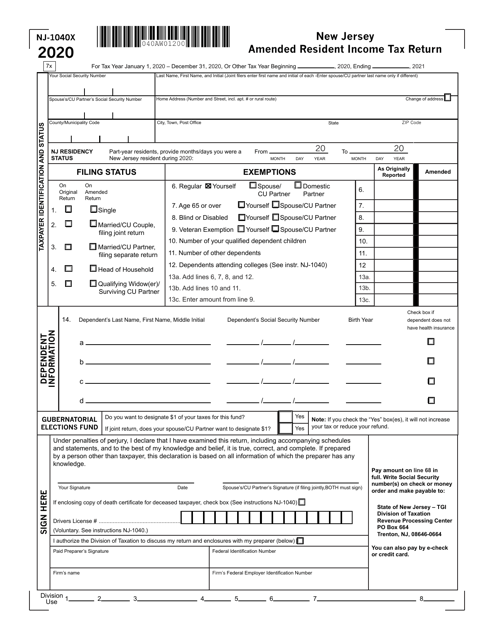

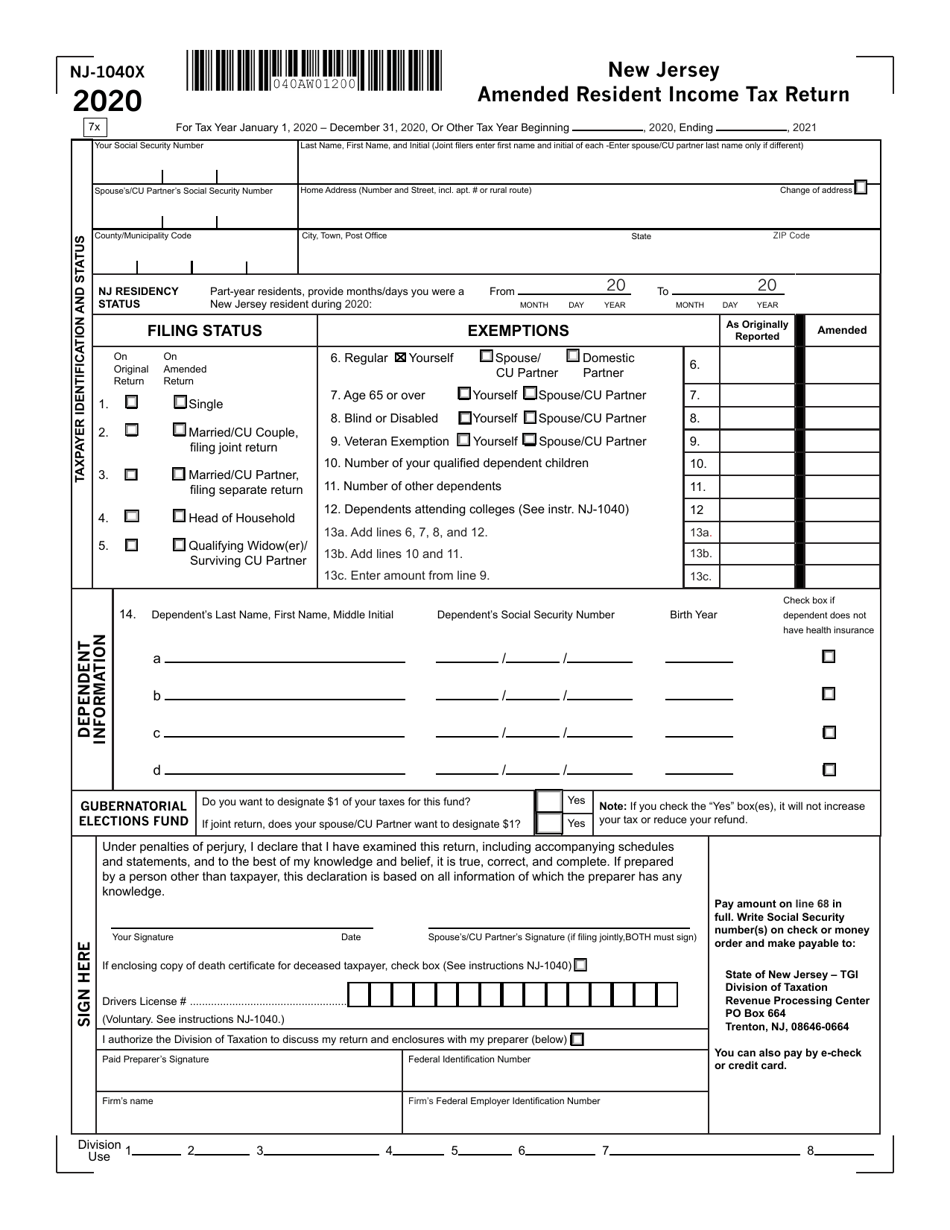

Form NJ-1040X

for the current year.

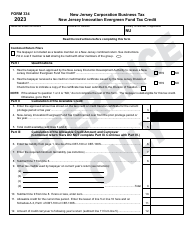

Form NJ-1040X New Jersey Amended Resident Income Tax Return - New Jersey

What Is Form NJ-1040X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040X?

A: Form NJ-1040X is the New Jersey Amended Resident Income Tax Return, used to correct errors or make changes to a previously filed New Jersey tax return.

Q: Who should file Form NJ-1040X?

A: You should file Form NJ-1040X if you need to make changes to your previously filed New Jersey income tax return, such as correcting errors or updating your information.

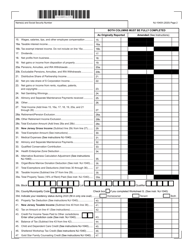

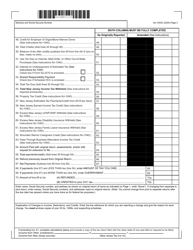

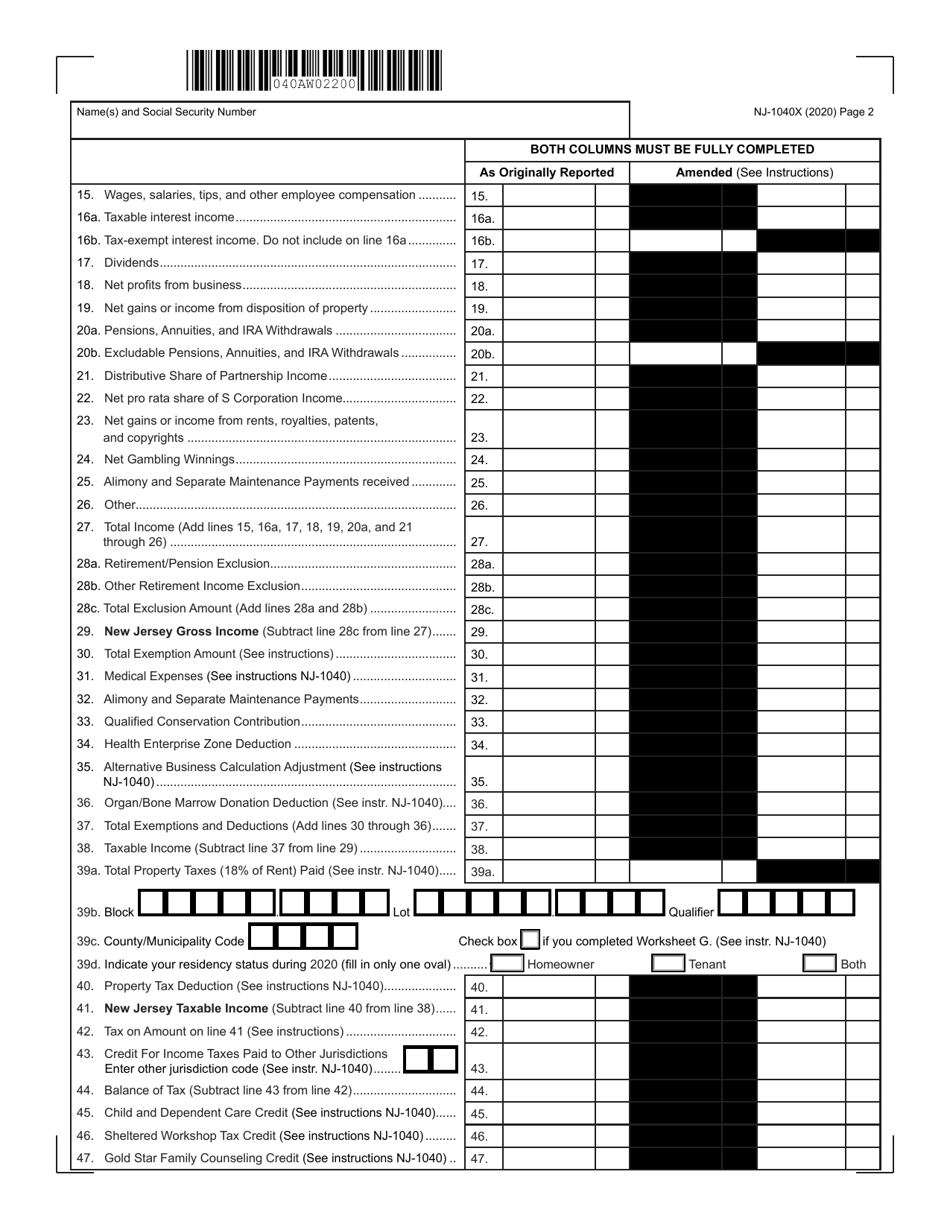

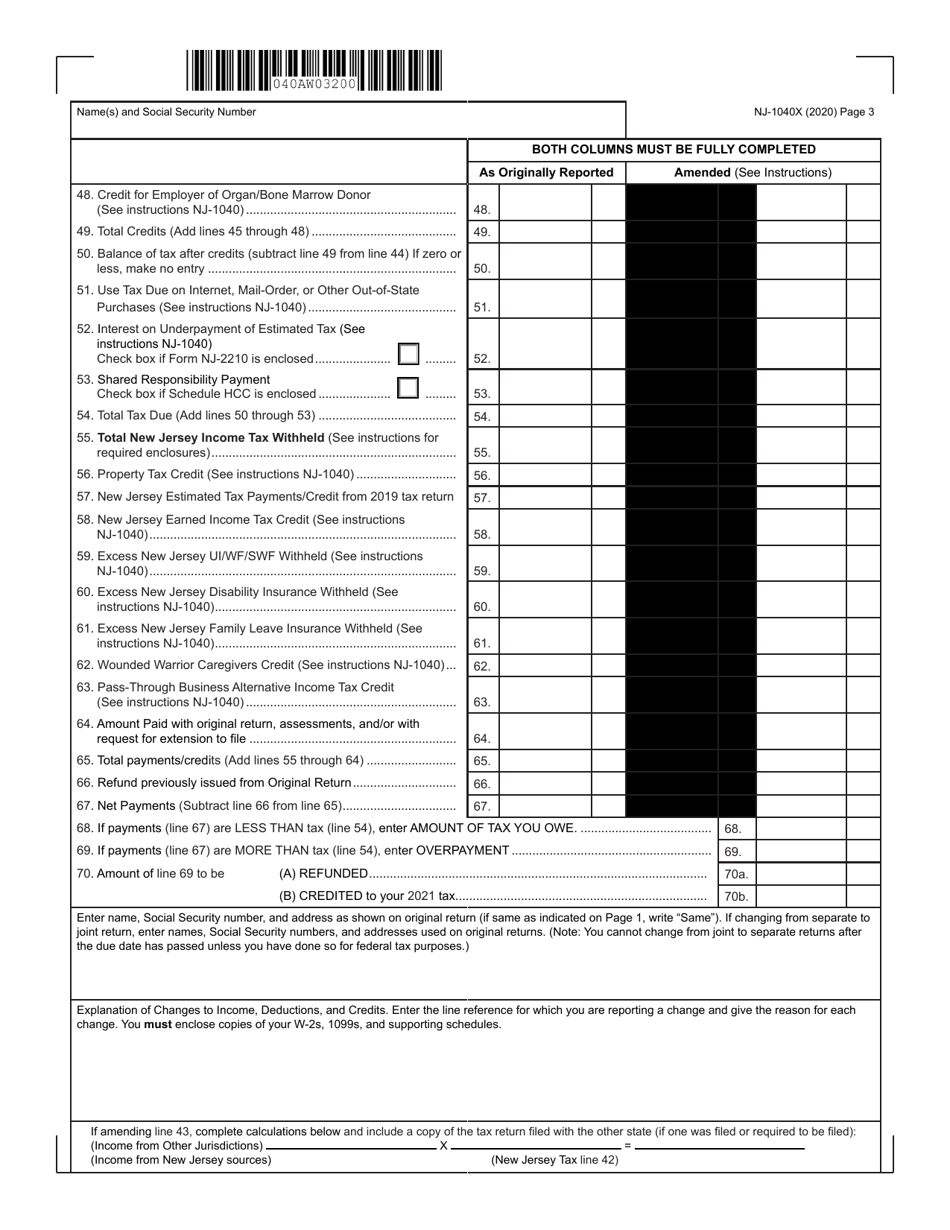

Q: What information do I need to complete Form NJ-1040X?

A: To complete Form NJ-1040X, you will need your original New Jersey tax return, any supporting documentation for the changes you are making, and any additional forms or schedules that are necessary.

Q: Are there any special instructions for completing Form NJ-1040X?

A: Yes, there are specific instructions provided on the form that will guide you through the process of completing and filing Form NJ-1040X. It's important to carefully follow these instructions to ensure accuracy.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.