This version of the form is not currently in use and is provided for reference only. Download this version of

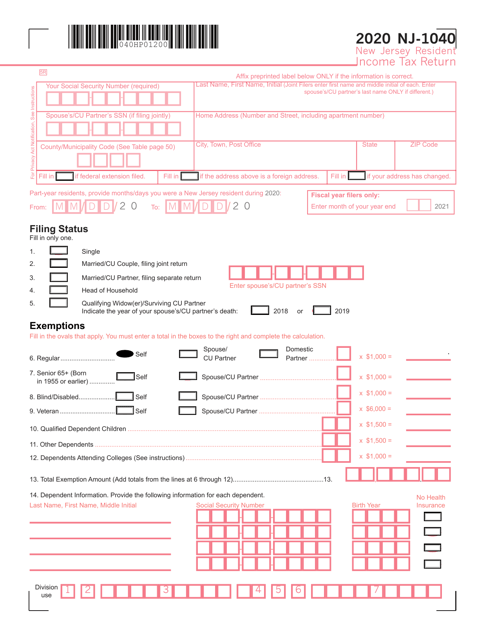

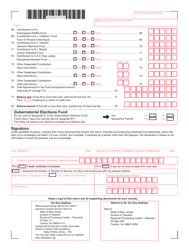

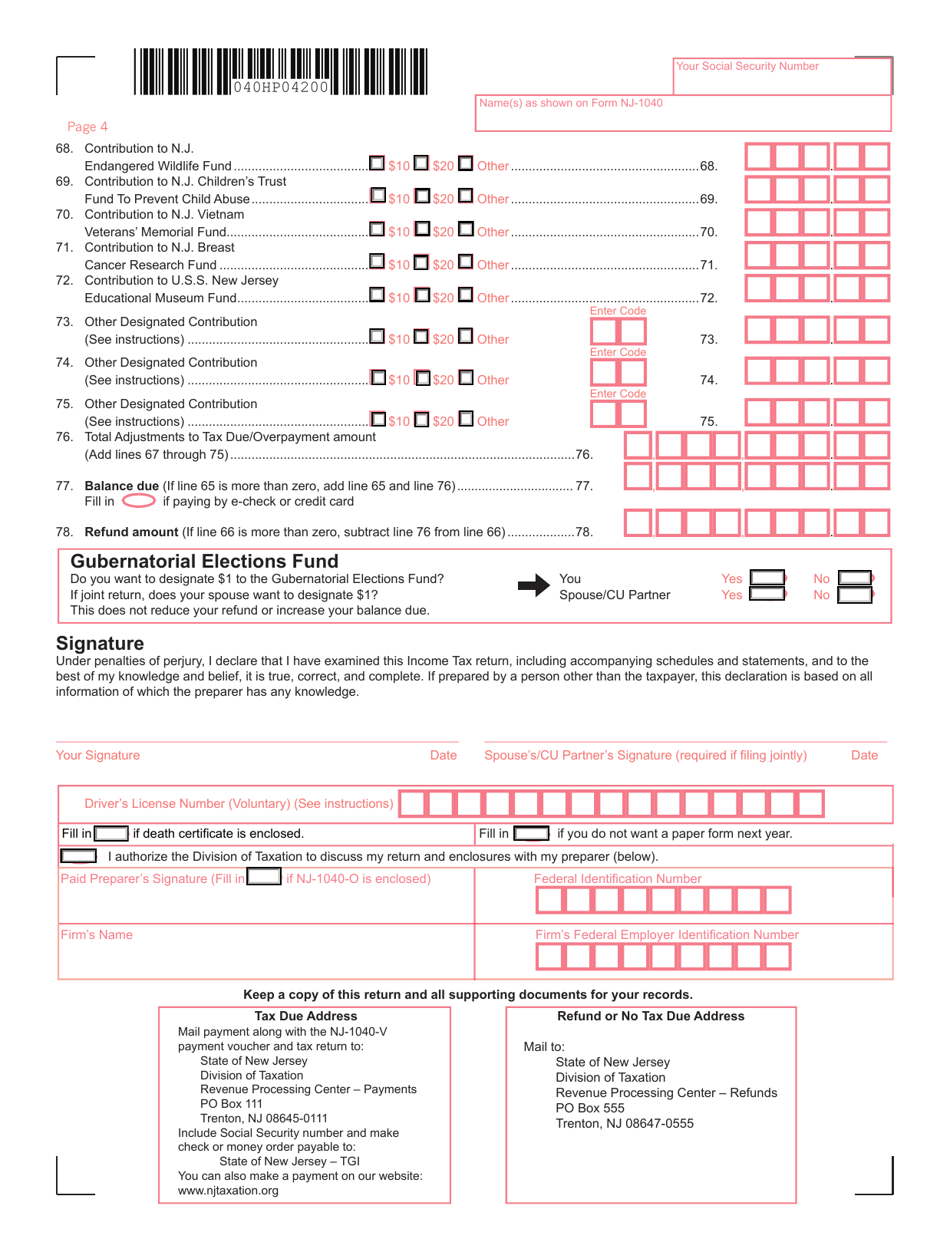

Form NJ-1040

for the current year.

Form NJ-1040 New Jersey Resident Income Tax Return - New Jersey

What Is Form NJ-1040?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040?

A: Form NJ-1040 is the New Jersey Resident Income Tax Return.

Q: Who is required to file Form NJ-1040?

A: All New Jersey residents who have earned income during the year are required to file Form NJ-1040.

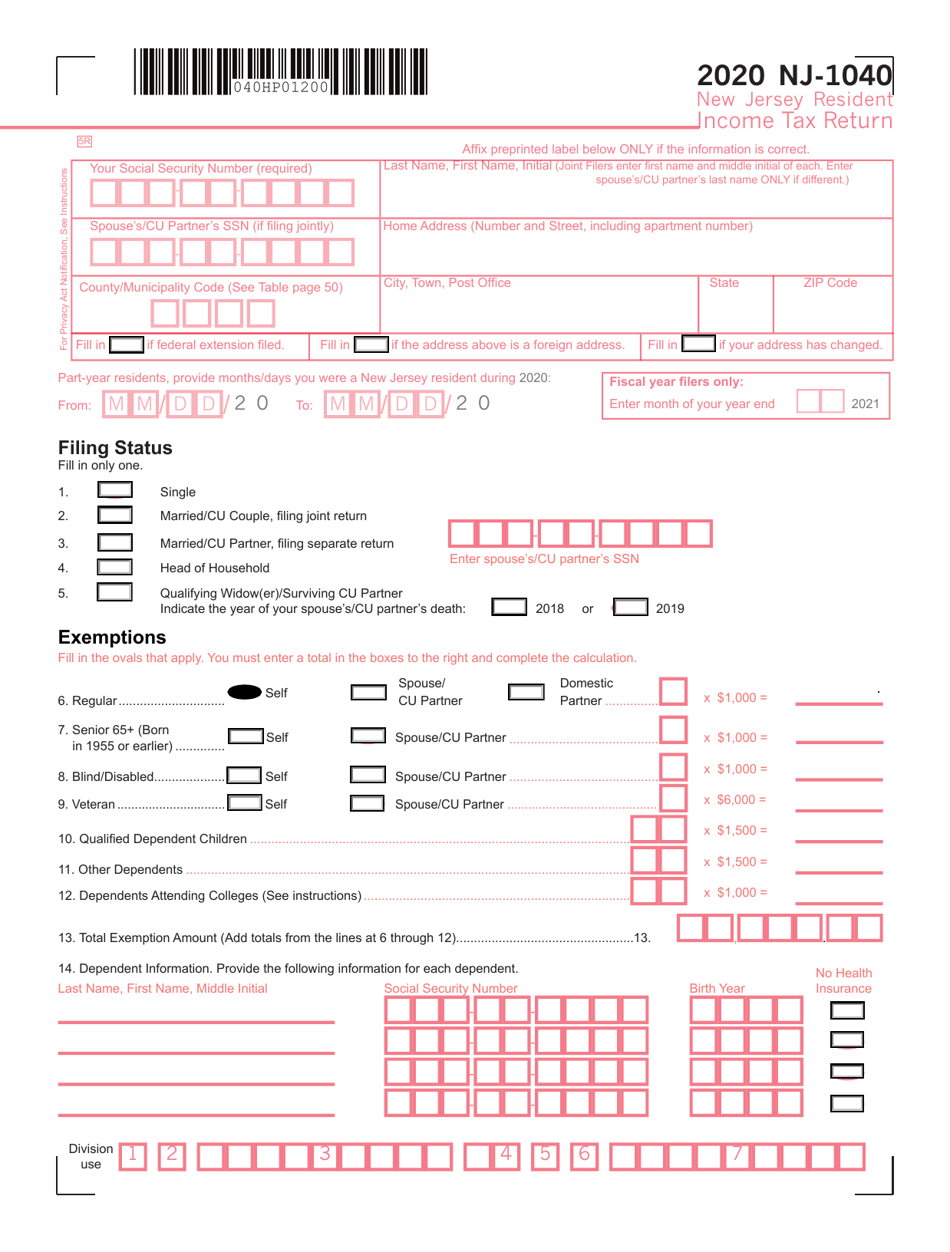

Q: What information do I need to complete Form NJ-1040?

A: You will need to gather your income statements, deductions, and other relevant financial information to complete Form NJ-1040.

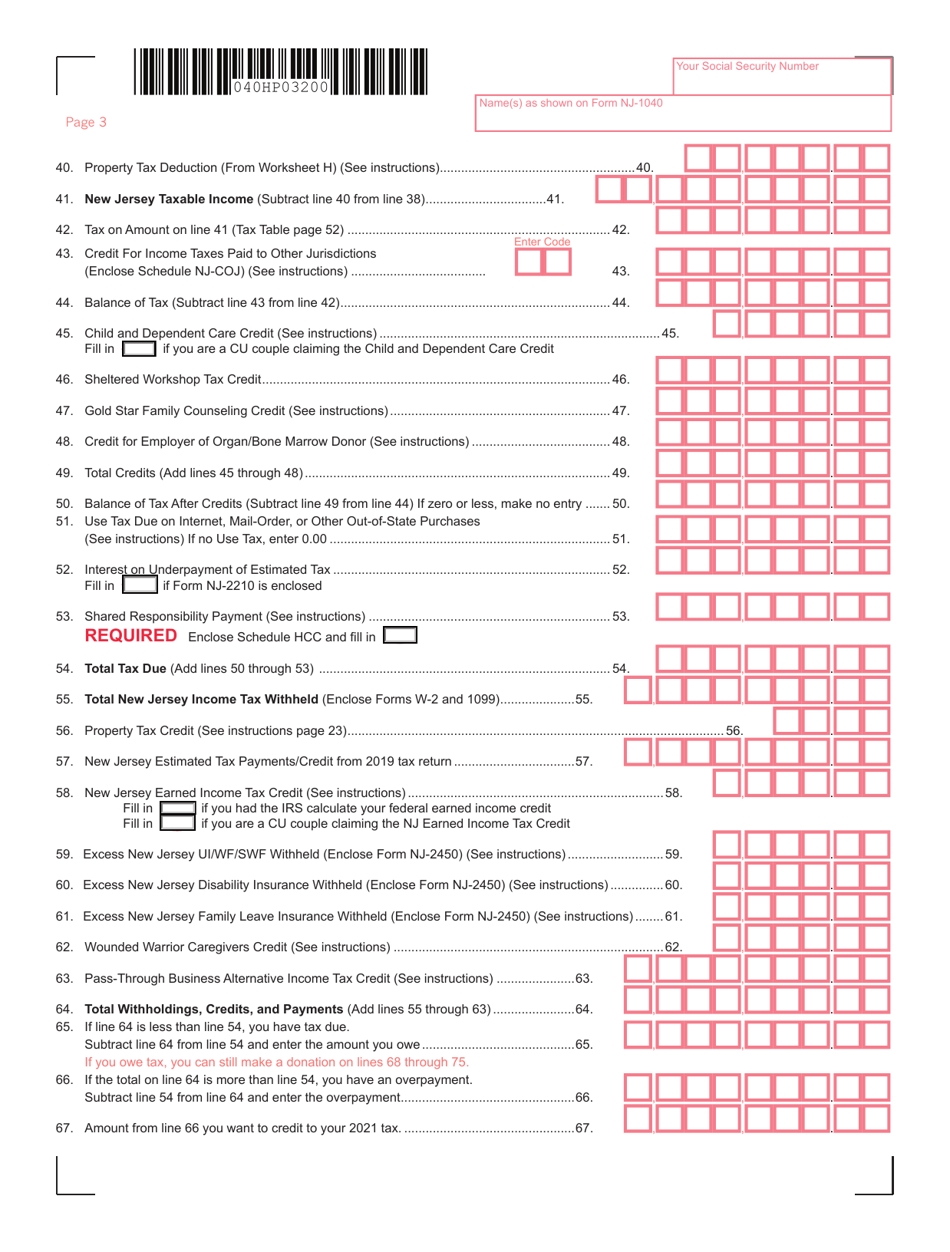

Q: When is the deadline to file Form NJ-1040?

A: The deadline to file Form NJ-1040 is April 15th, or the next business day if it falls on a weekend or holiday.

Q: Can I e-file Form NJ-1040?

A: Yes, you can electronically file Form NJ-1040 using NJFiling or other approved tax software.

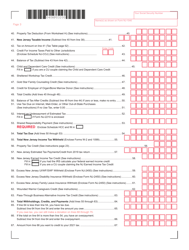

Q: What if I can't pay the full amount of tax owed on Form NJ-1040?

A: If you can't pay the full amount of tax owed, you should still file Form NJ-1040 on time and contact the New Jersey Division of Taxation to discuss payment options.

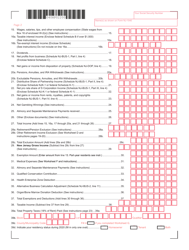

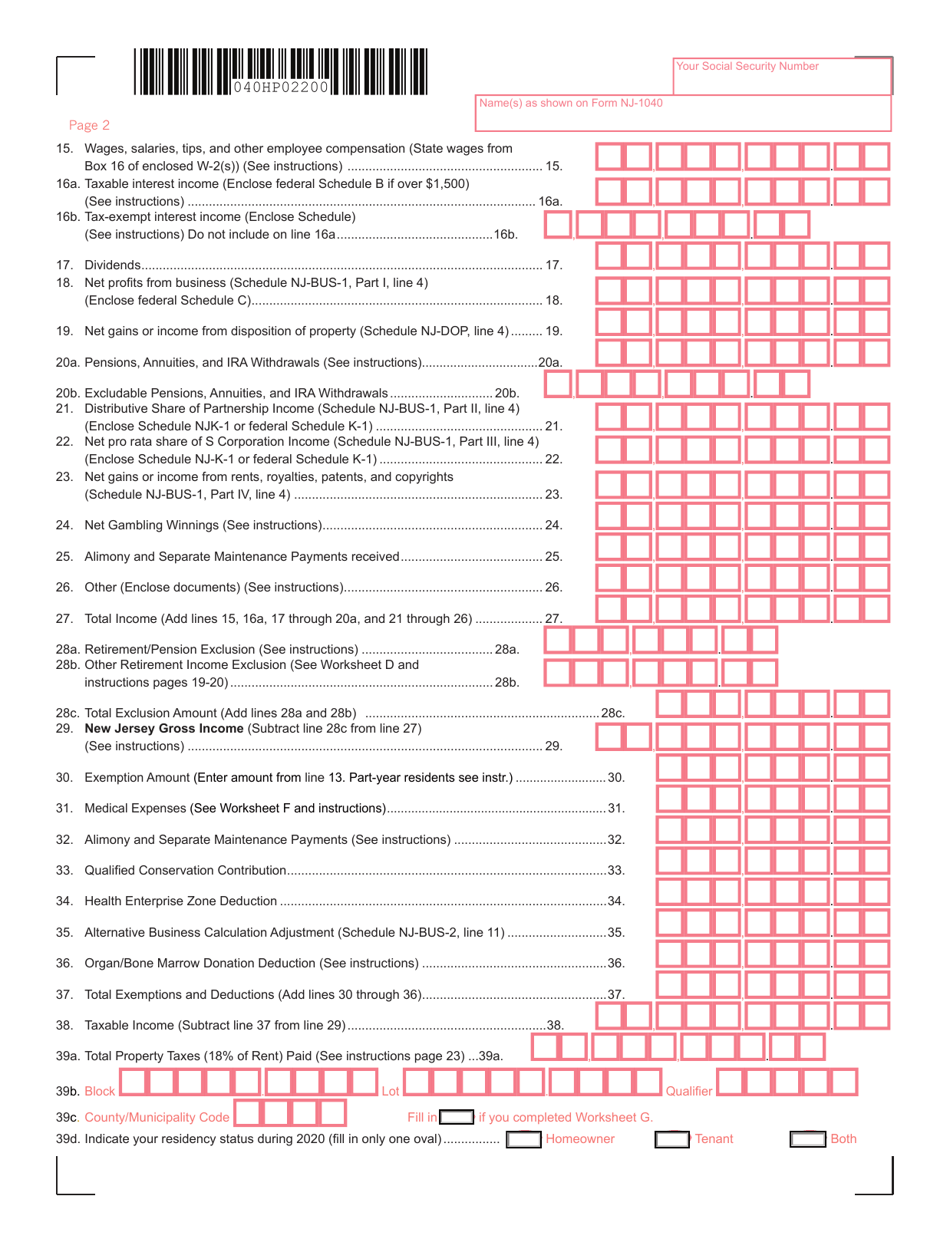

Q: Are there any credits or deductions available on Form NJ-1040?

A: Yes, there are various credits and deductions available on Form NJ-1040, such as the Earned Income Tax Credit and the Property Tax Deduction.

Q: What happens if I don't file Form NJ-1040?

A: If you don't file Form NJ-1040 or request an extension by the deadline, you may face penalties and interest on any unpaid tax amount.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.