This version of the form is not currently in use and is provided for reference only. Download this version of

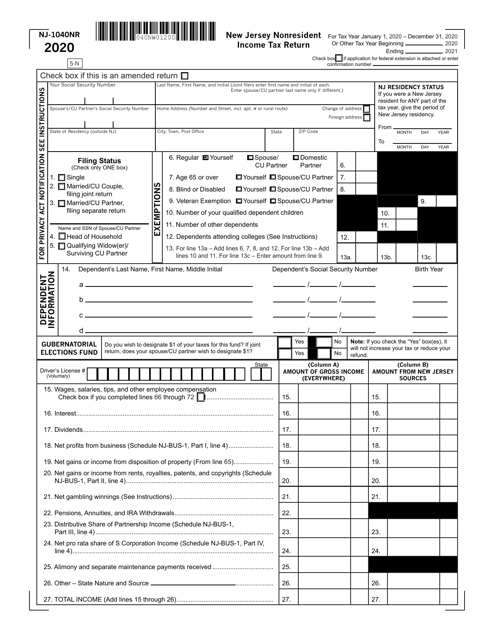

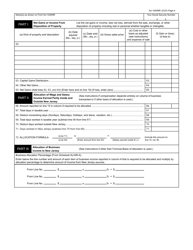

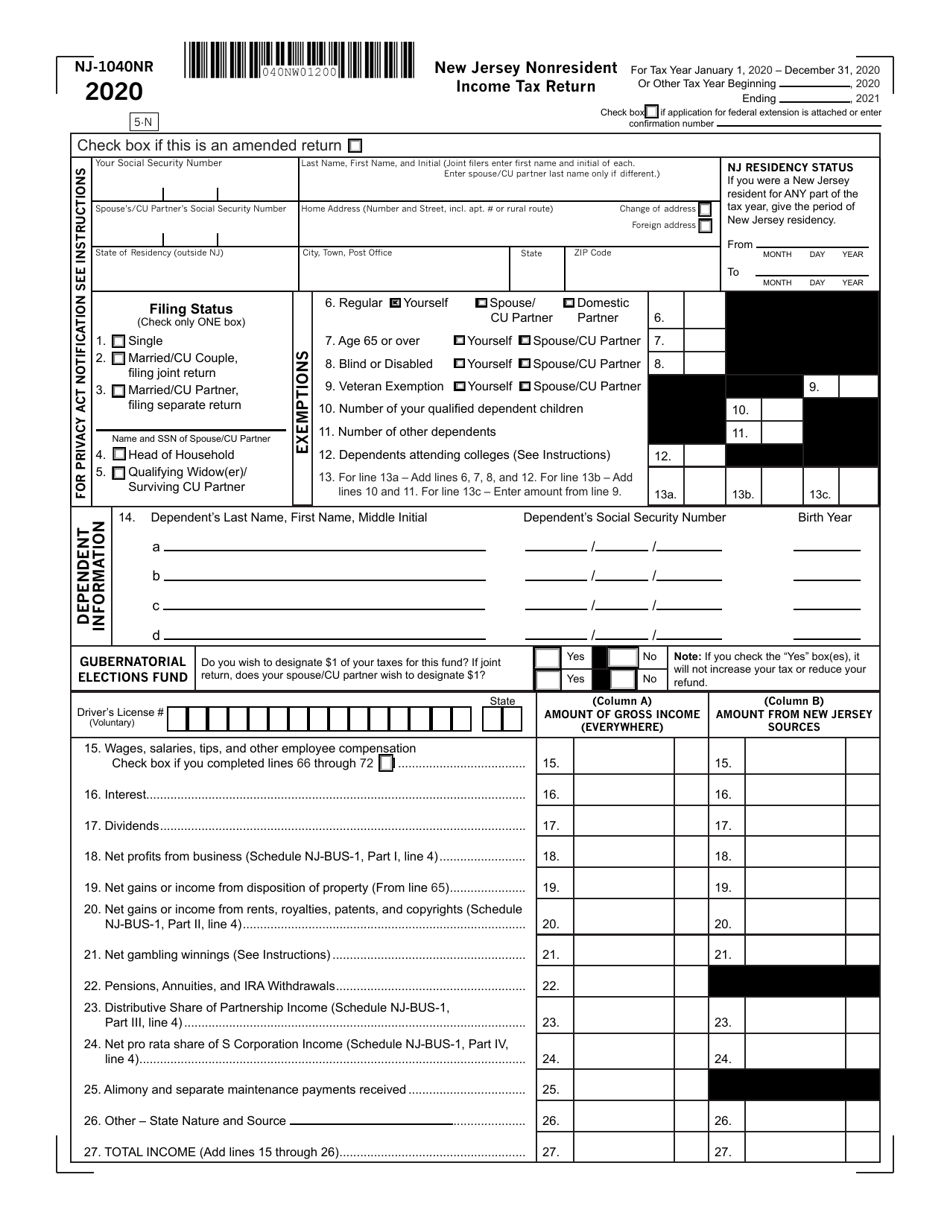

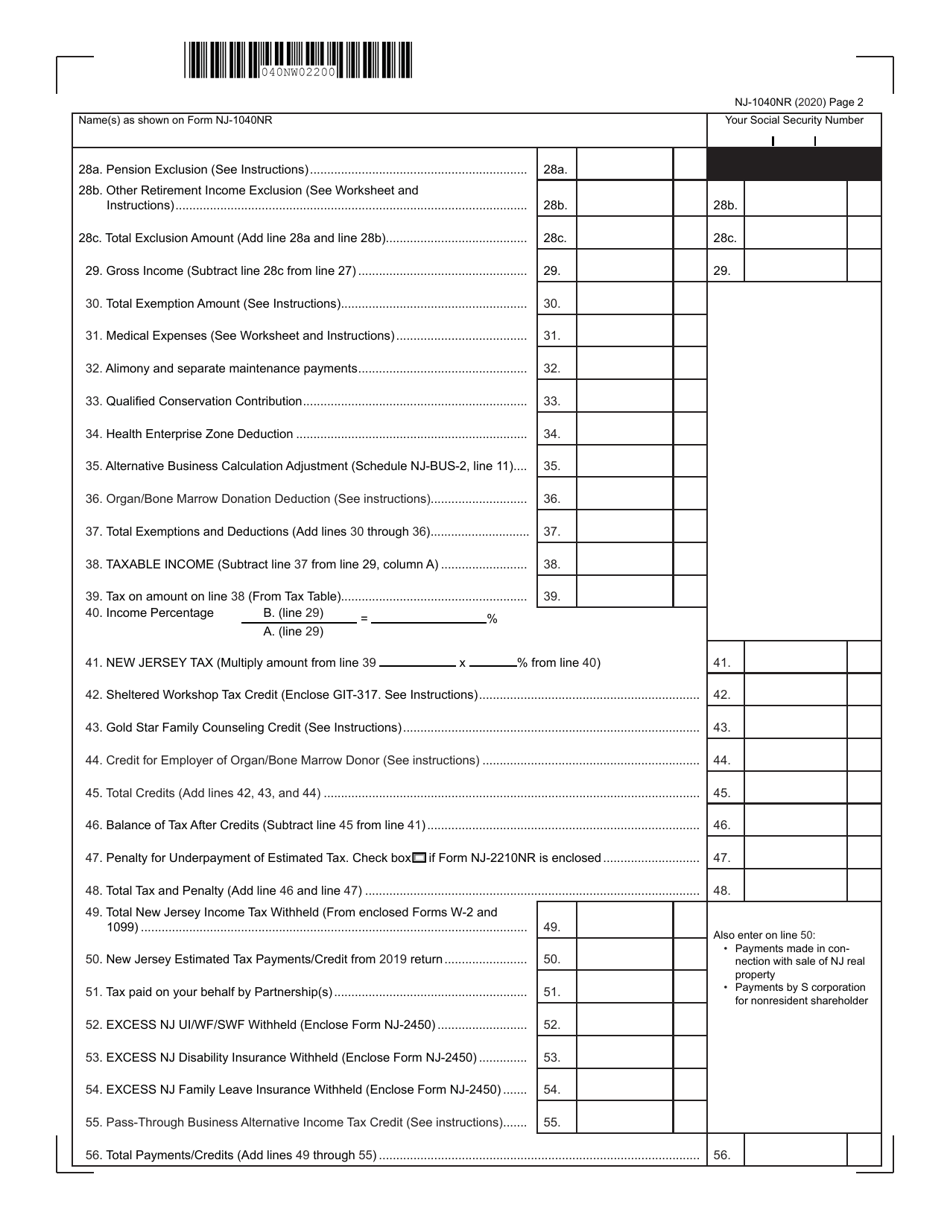

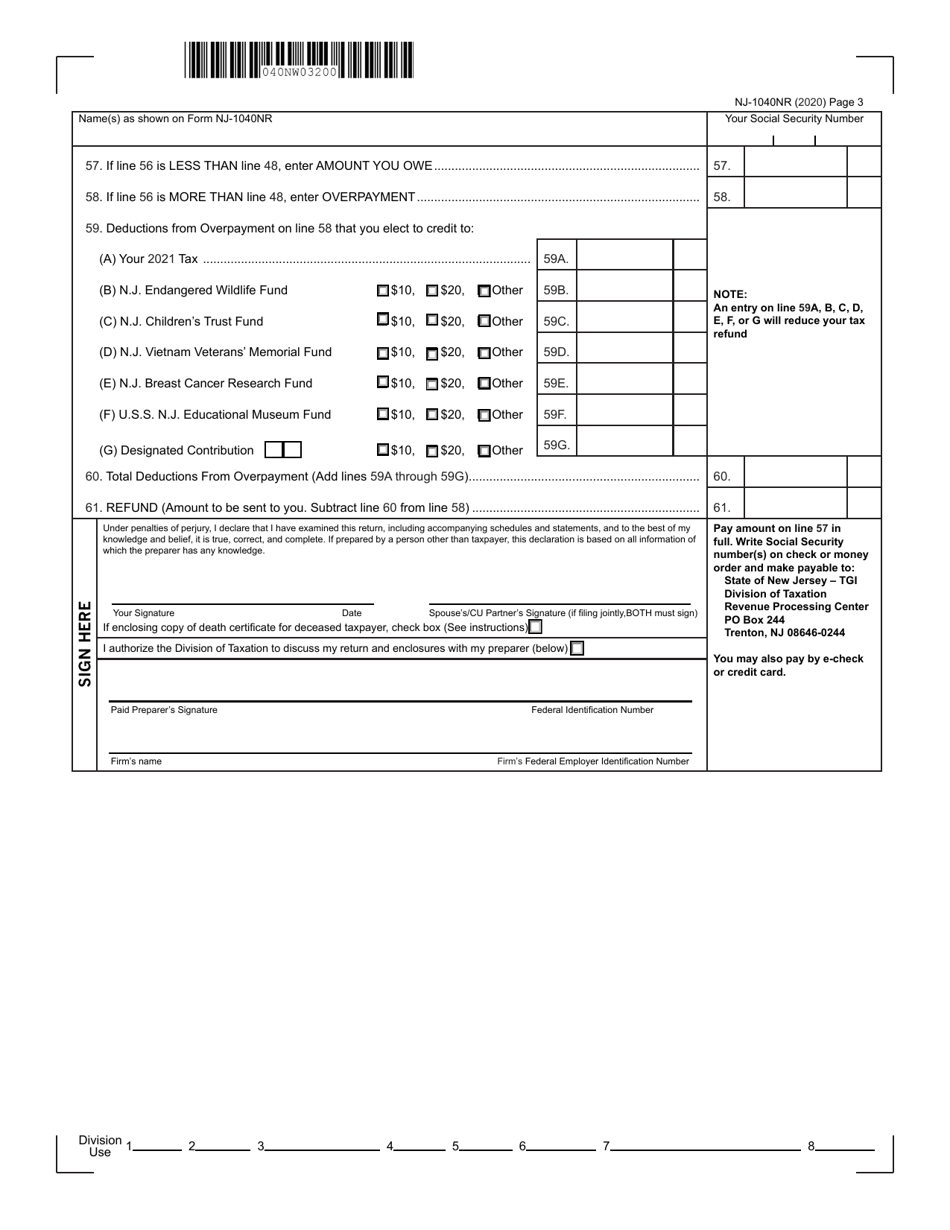

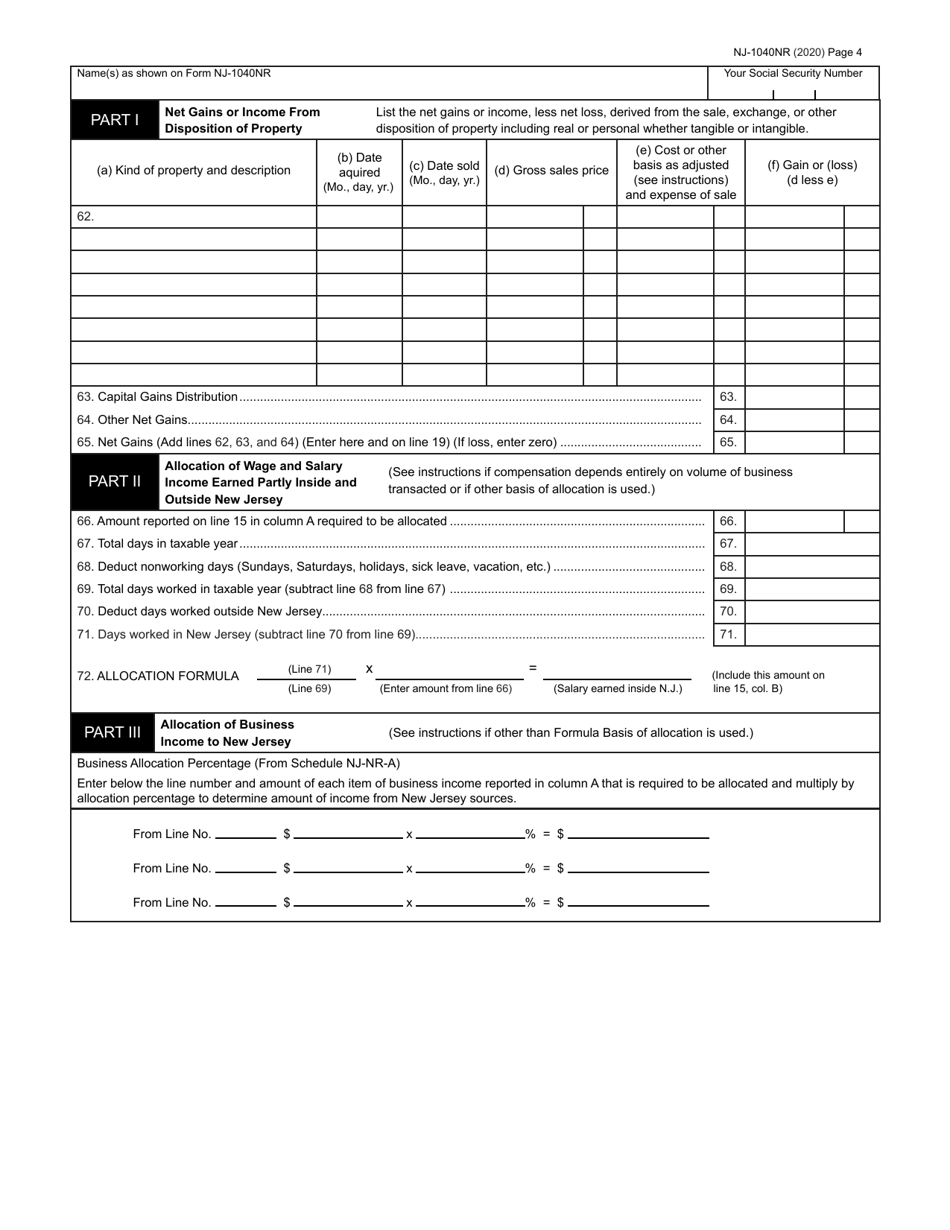

Form NJ-1040NR

for the current year.

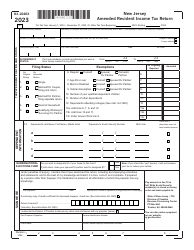

Form NJ-1040NR New Jersey Nonresident Income Tax Return - New Jersey

What Is Form NJ-1040NR?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form NJ-1040NR?

A: Form NJ-1040NR is a tax return specifically for nonresidents of New Jersey who have income or financial activities in the state.

Q: Who needs to file Form NJ-1040NR?

A: Nonresidents of New Jersey who have income or financial activities in the state need to file Form NJ-1040NR.

Q: When is the deadline to file Form NJ-1040NR?

A: The deadline to file Form NJ-1040NR is usually April 15th, but it may vary depending on certain circumstances.

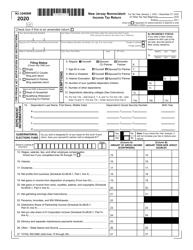

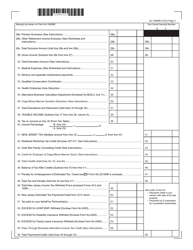

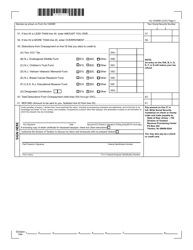

Q: What information is needed to complete Form NJ-1040NR?

A: To complete Form NJ-1040NR, you will need to provide information about your income, deductions, and credits related to New Jersey.

Q: Can I e-file Form NJ-1040NR?

A: Yes, you can e-file Form NJ-1040NR using approved tax software or through a tax professional.

Q: Are there any specific instructions for Form NJ-1040NR?

A: Yes, Form NJ-1040NR comes with instructions that explain how to complete the form and provide additional guidance.

Q: What if I don't have any income or activities in New Jersey?

A: If you have no income or activities in New Jersey, you generally do not need to file Form NJ-1040NR.

Q: What happens if I don't file Form NJ-1040NR?

A: If you are required to file Form NJ-1040NR but fail to do so, you may face penalties and interest on any unpaid taxes.

Q: Can I get help with completing Form NJ-1040NR?

A: Yes, you can seek assistance from a tax professional or contact the New Jersey Division of Taxation for help with completing the form.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040NR by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.